Payroll systems should be designed to:

- Pay employees accurately and timely.

- Meet regulatory requirements of federal, state, and local agencies.

- Provide useful data for management decision-making needs.

Although payroll systems differ among companies, the major elements of most payroll systems are:

- Payroll register

- Employee’s earnings record

- Payroll checks

1. Payroll Register

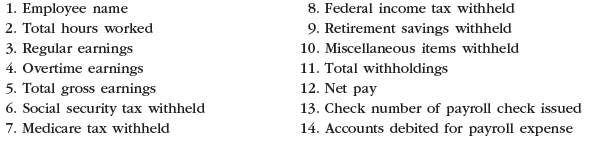

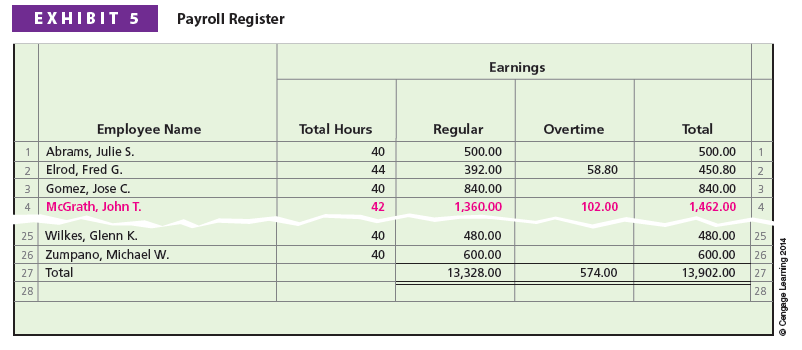

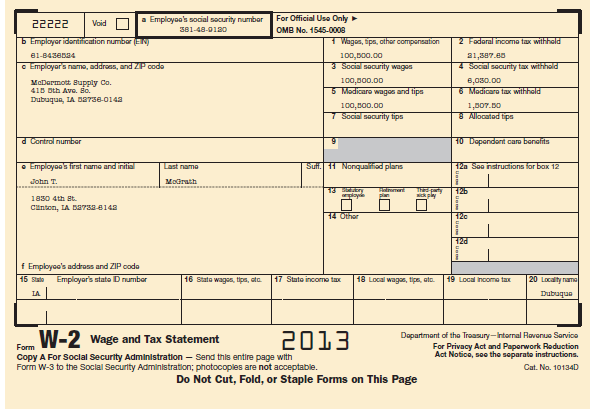

The payroll register is a multicolumn report used for summarizing the data for each payroll period. Although payroll registers vary by company, a payroll register normally includes the following columns:

Exhibit 5 on pages 460-461 illustrates a payroll register. The two right-hand columns of the payroll register indicate the accounts debited for the payroll expense. These columns are often referred to as the payroll distribution.

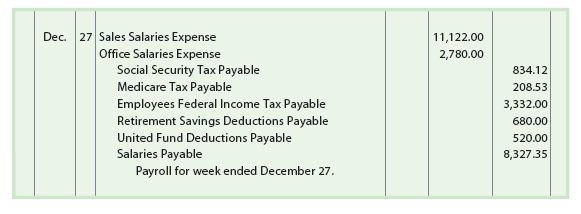

Recording Employees’ Earnings The column totals of the payroll register provide the basis for recording the journal entry for payroll. The entry based on the payroll register in Exhibit 5 is shown at the top of the next page.

Recording and Paying Payroll Taxes Payroll taxes are recorded as liabilities when the payroll is paid to employees. In addition, employers compute and report payroll taxes on a calendar-year basis, which may differ from the company’s fiscal year.

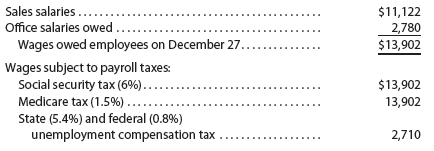

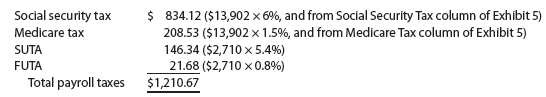

Employers must match the employees’ social security and Medicare tax contributions. In addition, the employer must pay state unemployment compensation tax (SUTA) of 5.4% and federal unemployment compensation tax (FUTA) of 0.8%. When payroll is paid on December 27, these payroll taxes are computed as follows:

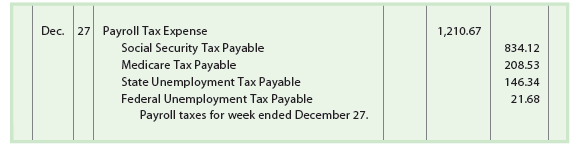

The entry to journalize the payroll tax expense for Exhibit 5 is shown below.

The preceding entry records a liability for each payroll tax. When the payroll taxes are paid, an entry is recorded debiting the payroll tax liability accounts and crediting Cash.

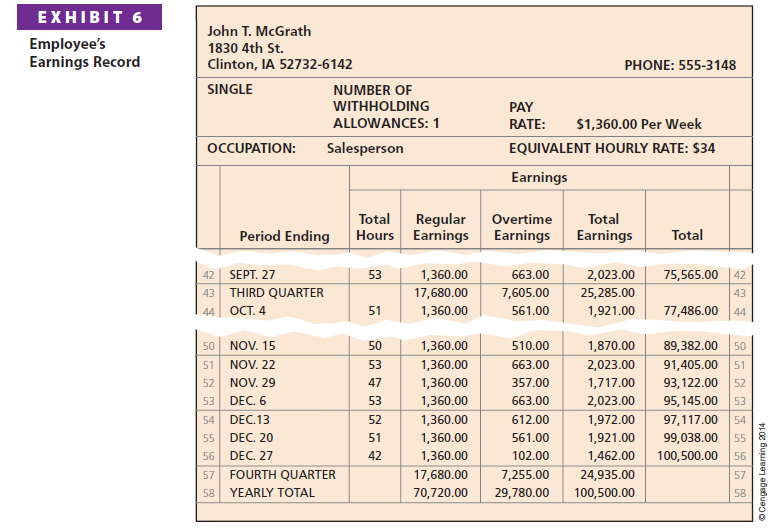

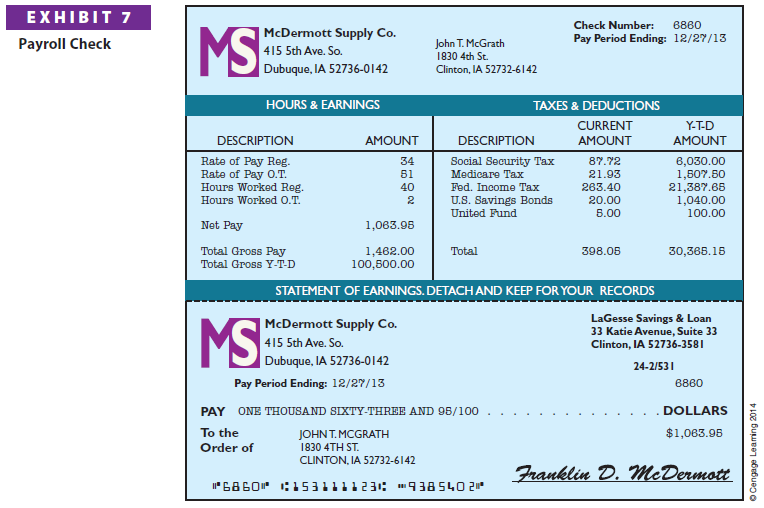

2. Employee’s Earnings Record

Each employee’s earnings to date must be determined at the end of each payroll period. This total is necessary for computing the employee’s social security tax withholding and the employer’s payroll taxes. Thus, detailed payroll records must be kept for each employee. This record is called an employee’s earnings record.

Exhibit 6, on pages 462-463, shows a portion of John T. McGrath’s employee’s earnings record. An employee’s earnings record and the payroll register are interrelated. For example, McGrath’s earnings record for December 27 can be traced to the fourth line of the payroll register in Exhibit 5.

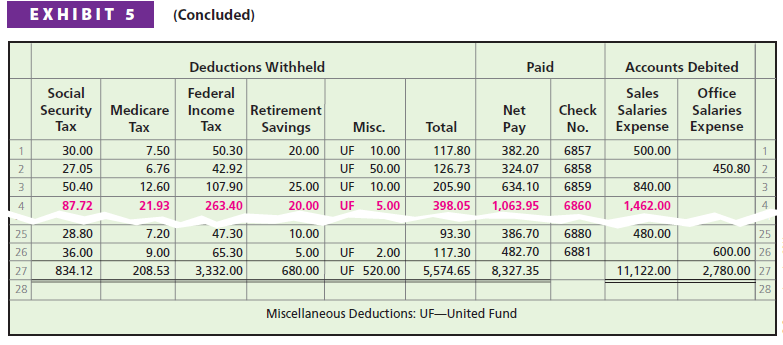

As shown in Exhibit 6, an employee’s earnings record has quarterly and yearly totals. These totals are used for tax, insurance, and other reports. For example, one such report is the Wage and Tax Statement, commonly called a W-2. This form is provided annually to each employee as well as to the Social Security Administration. The W-2 shown below is based on John T. McGrath’s employee’s earnings record shown in Exhibit 6, on pages 462-463.

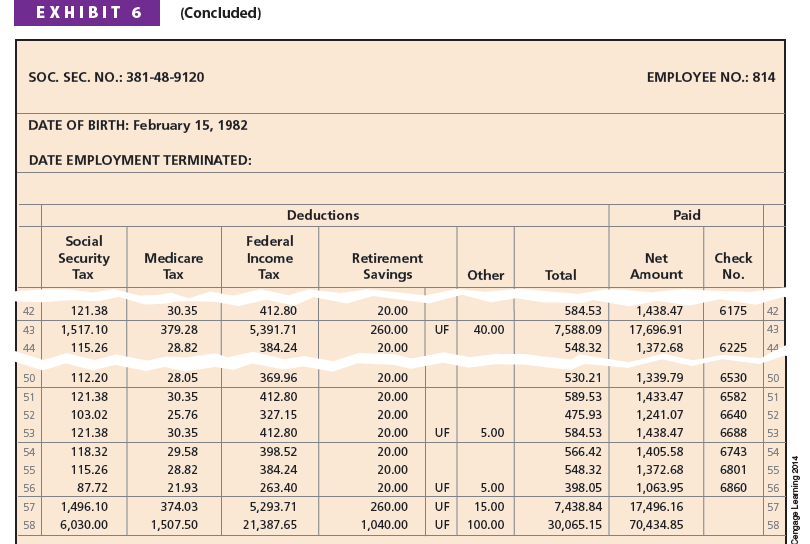

3. Payroll Checks

Companies may pay employees, especially part-time employees, by issuing payroll checks. Each check includes a detachable statement showing how the net pay was computed. Exhibit 7, on page 464, illustrates a payroll check for John T. McGrath.

Most companies issuing payroll checks use a special payroll bank account. In such cases, payroll is processed as follows:

- The total net pay for the period is determined from the payroll register.

- The company authorizes an electronic funds transfer (EFT) from its regular bank account to the special payroll bank account for the total net pay.

- Individual payroll checks are written from the payroll account.

- The numbers of the payroll checks are inserted in the payroll register.

An advantage of using a separate payroll bank account is that reconciling the bank statements is simplified. In addition, a payroll bank account establishes control over payroll checks and, thus, prevents their theft or misuse.

Many companies use electronic funds transfer to pay their employees. In such cases, each pay period an employee’s net pay is deposited directly into the employee checking account. Later, employees receive a payroll statement summarizing how the net pay was computed.

4. Computerized Payroll System

The inputs into a payroll system may be classified as:

- Constants, which are data that remain unchanged from payroll to payroll.

Examples: Employee names, social security numbers, marital status, number of income tax withholding allowances, rates of pay, tax rates, and withholding tables.

- Variables, which are data that change from payroll to payroll.

Examples: Number of hours or days worked for each employee, accrued days of sick leave, vacation credits, total earnings to date, and total taxes withheld.

In a computerized accounting system, constants are stored within a payroll file. The variables are input each pay period by a payroll clerk. In some systems, employees swipe their identification (ID) cards when they report for and leave from work. In such cases, the hours worked by each employee are automatically updated.

A computerized payroll system also maintains electronic versions of the payroll register and employee earnings records. Payroll system outputs, such as payroll checks, EFTs, and tax records, are automatically produced each pay period.

5. Internal Controls for Payroll Systems

The cash payment controls described in Chapter 7, Sarbanes-Oxley, Internal Control, and Cash, also apply to payrolls. Some examples of payroll controls include the following:

- If a check-signing machine is used, blank payroll checks and access to the machine should be restricted to prevent their theft or misuse.

- The hiring and firing of employees should be properly authorized and approved in writing.

- All changes in pay rates should be properly authorized and approved in writing.

- Employees should be observed when arriving for work to verify that employees are “checking in” for work only once and only for themselves. Employees may “check in” for work by using a time card or by swiping their employee ID card.

- Payroll checks should be distributed by someone other than employee supervisors.

- A special payroll bank account should be used.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I believe other website owners should take this web site as an example , very clean and good user genial design.