The effective interest rate method of amortization provides for a constant rate of interest over the life of the bonds. As the discount or premium is amortized, the carrying amount of the bonds changes. As a result, interest expense also changes each period. This is in contrast to the straight-line method, which provides for a constant amount of interest expense each period.

The interest rate used in the effective interest rate method of amortization, sometimes called the interest method, is the market rate on the date the bonds are issued. The carrying amount of the bonds is multiplied by this interest rate to determine the interest expense for the period. The difference between the interest expense and the interest payment is the amount of discount or premium to be amortized for the period.

1. Amortization of Discount by the Interest Method

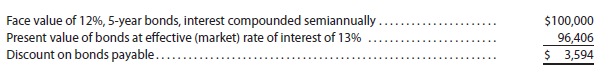

To illustrate, the following data taken from the chapter illustration of issuing bonds at a discount are used:

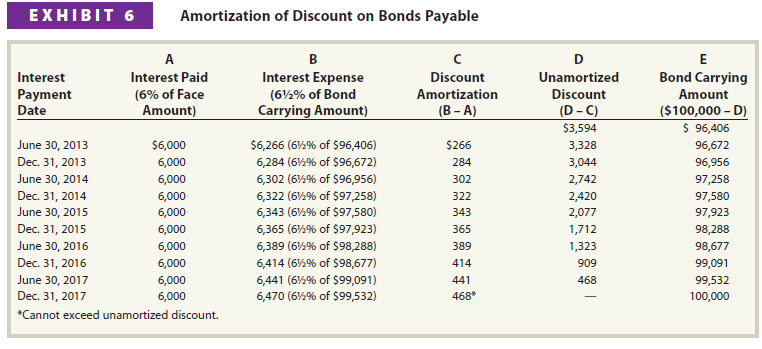

Exhibit 6 illustrates the interest method for the preceding bonds. Exhibit 6 begins with six columns. The first column is not lettered. The remaining columns are lettered A through E. The exhibit was then prepared as follows:

- Step 1. List the interest payments dates in the first column, which for the preceding bond are 10 interest payment dates (semiannual interest over five years). Also, list on the first line the initial amount of discount in Column D and the initial carrying amount (selling price) of the bonds in Column E.

- Step 2. List in Column A the semiannual interest payments, which for the preceding bond are $6,000 ($100,000 x 6%).

- Step 3. Compute the interest expense in Column B by multiplying the bond carrying amount at the beginning of each period times 6½%,, which is the semiannual effective interest (market) rate (13% ÷ 2).

- Step 4. In Column C, compute the discount to be amortized each period by subtracting the interest payment in Column A ($6,000) from the interest expense for the period shown in Column B.

- Step 5. Compute the remaining unamortized discount by subtracting the amortized discount in Column C for the period from the unamortized discount at the beginning of the period in Column D.

- Step 6. Compute the bond carrying amount at the end of the period by subtracting the unamortized discount at the end of the period in Column D from the face amount of the bonds ($100,000).

Steps 3-6 are repeated for each interest payment.

As shown in Exhibit 6, the interest expense increases each period as the carrying amount of the bond increases. Also, the unamortized discount decreases each period to zero at the maturity date. Finally, the carrying amount of the bonds increases from $96,406 to $100,000 (the face amount) at maturity.

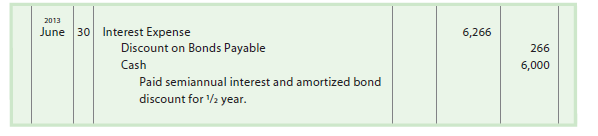

The entry to record the first interest payment on June 30, 2013, and the related discount amortization is as follows:

If the amortization is recorded only at the end of the year, the amount of the discount amortized on December 31, 2013, would be $550. This is the sum of the first two semiannual amortization amounts ($266 and $284) from Exhibit 6.

2. Amortization of Premium by the Interest Method

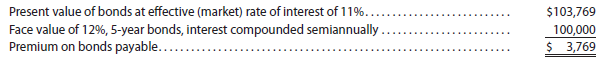

To illustrate, the following data taken from the chapter illustration of issuing bonds at a premium are used:

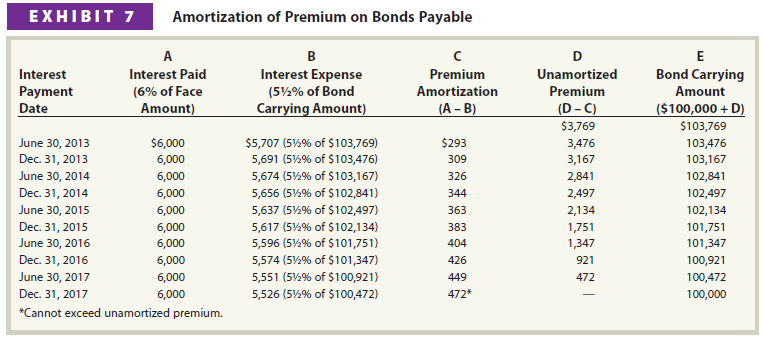

Exhibit 7 illustrates the interest method for the preceding bonds. Exhibit 7 begins with six columns. The first column is not lettered. The remaining columns are lettered A through E. The exhibit was then prepared as follows:

- Step 1. List the number of interest payments in the first column, which for the preceding bond are 10 interest payments (semiannual interest over 5 years). Also, list on the first line the initial amount of premium in Column D and the initial carrying amount of the bonds in Column E.

- Step 2. List in Column A the semiannual interest payments, which for the preceding bond are $6,000 ($100,000 x 6%).

- Step 3. Compute the interest expense in Column B by multiplying the bond carrying amount at the beginning of each period times 5½%, which is the semiannual effective interest (market) rate (11% ÷ 2).

- Step 4. In Column C, compute the premium to be amortized each period by subtracting the interest expense for the period shown in Column B from the interest payment in Column A ($6,000).

- Step 5. Compute the remaining unamortized premium by subtracting the amortized premium in Column C for the period from the unamortized premium at the beginning of the period in Column D.

- Step 6. Compute the bond carrying amount at the end of the period by adding the unamortized premium at the end of the period in Column D to the face amount of the bonds ($100,000).

Steps 3-6 are repeated for each interest payment.

As shown in Exhibit 7, the interest expense decreases each period as the carrying amount of the bond decreases. Also, the unamortized premium decreases each period to zero at the maturity date. Finally, the carrying amount of the bonds decreases from $103,769 to $100,000 (the face amount) at maturity.

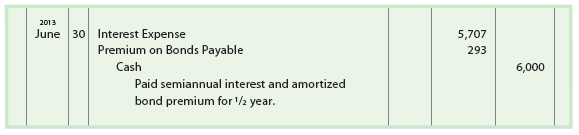

The entry to record the first interest payment on June 30, 2013, and the related premium amortization is as follows:

If the amortization is recorded only at the end of the year, the amount of the premium amortized on December 31, 2013, would be $602. This is the sum of the first two semiannual amortization amounts ($293 and $309) from Exhibit 7.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I every time emailed this web site post page to all my

contacts, as if like to read it then my contacts will too.

I could not resist commenting. Very well written!