Many companies provide their employees benefits in addition to salary and wages earned. Such fringe benefits may include vacation, medical, and retirement benefits.

The cost of employee fringe benefits is recorded as an expense by the employer. To match revenues and expenses, the estimated cost of fringe benefits is recorded as an expense during the period in which the employees earn the benefits.

1. Vacation Pay

Most employers provide employees vacations, sometimes called compensated absences. The liability to pay for employee vacations could be accrued as a liability at the end of each pay period. However, many companies wait and record an adjusting entry for accrued vacation at the end of the year.

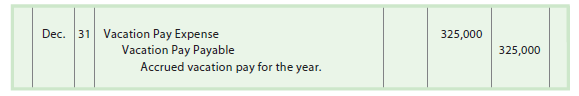

To illustrate, assume that employees earn one day of vacation for each month worked. The estimated vacation pay for the year ending December 31 is $325,000. The adjusting entry for the accrued vacation is shown below.

Employees may be required to take all their vacation time within one year. In such cases, any accrued vacation pay will be paid within one year. Thus, the vacation pay payable is reported as a current liability on the balance sheet. If employees are allowed to accumulate their vacation pay, the estimated vacation pay payable that will not be taken within a year is reported as a long-term liability.

When employees take vacations, the liability for vacation pay is decreased by debiting Vacation Pay Payable. Salaries or Wages Payable and the other related payroll accounts for taxes and withholdings are credited.

2. Pensions

A pension is a cash payment to retired employees. Pension rights are accrued by employees as they work, based on the employer’s pension plan. Two basic types of pension plans are:

- Defined contribution

- Defined benefit

In a defined contribution plan, the company invests contributions on behalf of the employee during the employee’s working years. Normally, the employee and employer contribute to the plan. The employee’s pension depends on the total contributions and the investment returns earned on those contributions.

One of the more popular defined contribution plans is the 401k plan. Under this plan, employees contribute a portion of their gross pay to investments, such as mutual funds. A 401k plan offers employees two advantages.

- The employee contribution is deducted before taxes.

- The contributions and related earnings are not taxed until withdrawn at retirement.

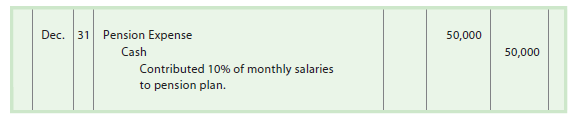

In most cases, the employer matches some portion of the employee’s contribution. The employer’s cost is debited to Pension Expense. To illustrate, assume that Heaven Scent Perfumes Company contributes 10% of employee monthly salaries to an employee 401k plan. Assuming $500,000 of monthly salaries, the journal entry to record the monthly contribution is shown below.

In a defined benefit plan, the company pays the employee a fixed annual pension based on a formula. The formula is normally based on such factors as the employee’s years of service, age, and past salary.

In a defined benefit plan, the employer is obligated to pay for (fund) the employee’s future pension benefits. As a result, many companies are replacing their defined benefit plans with defined contribution plans.

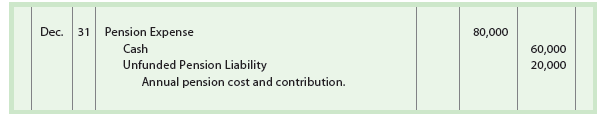

The pension cost of a defined benefit plan is debited to Pension Expense. Cash is credited for the amount contributed (funded) by the employer. Any unfunded amount is credited to Unfunded Pension Liability.

To illustrate, assume that the defined benefit plan of Hinkle Co. requires an annual pension cost of $80,000. This annual contribution is based on estimates of Hinkle’s future pension liabilities. On December 31, Hinkle Co. pays $60,000 to the pension fund. The entry to record the payment and the unfunded liability is shown on the next page.

If the unfunded pension liability is to be paid within one year, it is reported as a current liability on the balance sheet. Any portion of the unfunded pension liability that will be paid beyond one year is a long-term liability.

The accounting for pensions is complex due to the uncertainties of estimating future pension liabilities. These estimates depend on such factors as employee life expectancies, employee turnover, expected employee compensation levels, and investment income on pension contributions. Additional accounting and disclosures related to pensions are covered in advanced accounting courses.

3. Postretirement Benefits Other than Pensions

Employees may earn rights to other postretirement benefits from their employer. Such benefits may include dental care, eye care, medical care, life insurance, tuition assistance, tax services, and legal services.

The accounting for other postretirement benefits is similar to that of defined benefit pension plans. The estimate of the annual benefits expense is recorded by debiting Postretirement Benefits Expense. If the benefits are fully funded, Cash is credited for the same amount. If the benefits are not fully funded, a postretirement benefits plan liability account is also credited.

The financial statements should disclose the nature of the postretirement benefit liabilities. These disclosures are usually included as notes to the financial statements. Additional accounting and disclosures for postretirement benefits are covered in advanced accounting courses.

4. Current Liabilities on the Balance Sheet

Accounts payable, the current portion of long-term debt, notes payable, and any other debts that are due within one year are reported as current liabilities on the balance sheet. The balance sheet presentation of current liabilities for Mornin’ Joe is as shown on the next page.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I am constantly browsing online for posts that can facilitate me. Thank you!

Hello.This article was extremely interesting, particularly since I was browsing for thoughts on this subject last Thursday.