1. Introduction to Financial Management

An entrepreneur’s ability to pursue an opportunity and turn the opportunity into a viable entrepreneurial firm hinges largely on the availability of money. Regardless of the quality of a product or service, a company can’t be viable in the long run unless it is successful financially. Money either comes from ex- ternal sources (such as investors or lenders) or is internally generated through earnings. It is important for a firm to have a solid grasp of how it is doing financially. One of the most common mistakes young entrepreneurial firms make is not emphasizing financial management and putting in place appropri- ate forms of financial controls.2

Entrepreneurs and those managing established companies must be aware of how much money they have in the bank and if that amount is sufficient to satisfy their firm’s financial obligations. Just because a firm is successful doesn’t mean that it doesn’t face financial challenges.3 For example, many of the small firms that sell their products to larger companies such as Apple, General Electric (GE), and The Home Depot aren’t paid for 30 to 60 days from the time they make a sale. Think about the difficulty this scenario creates. The small firm must buy parts, pay its employees, pay its routine bills, build and ship its products, and then wait for one to two months for payment. Unless a firm manages its money carefully, it is easy to run out of cash, even if its prod- ucts or services are selling like hotcakes.4 Similarly, as a company grows, its cash demands often increase to service a growing clientele. It is important for a firm to accurately anticipate whether it will be able to fund its growth through earnings or if it will need to look for investment capital or borrowing to raise needed cash.

The financial management of a firm deals with questions such as the fol- lowing on an ongoing basis:

■ How are we doing? Are we making or losing money?

■ How much cash do we have on hand?

■ Do we have enough cash to meet our short-term obligations?

■ How efficiently are we utilizing our assets?

■ How do our growth and net profits compare to those of our industry peers?

■ Where will the funds we need for capital improvements come from?

■ Are there ways we can partner with other firms to share risk and reduce the amount of cash we need?

■ Overall, are we in good shape financially?

A properly managed firm stays on top of the issues suggested by these ques- tions through the tools and techniques that we’ll discuss in this chapter.

2. Financial Objectives of a Firm

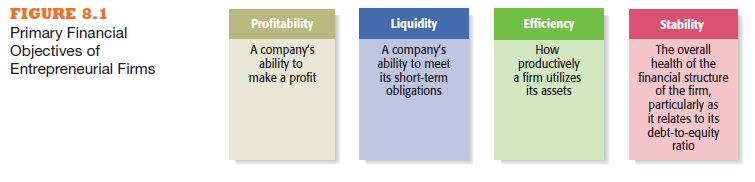

Most entrepreneurial firms—whether they have been in business for several years or they are start-ups—have four main financial objectives: profitability, liquidity, efficiency, and stability. Understanding these objectives sets a firm on the right financial course and helps it track the answers to the previously posed questions. Figure 8.1 describes each of these objectives.

Profitability is the ability to earn a profit. Many start-ups are not profit- able during their first one to three years, while they are training employees and building their brands, but a firm must become profitable to remain viable and provide a return to its owners.

Liquidity is a company’s ability to meet its short-term financial obliga- tions. Even if a firm is profitable, it is often a challenge to keep enough money in the bank to meet its routine obligations in a timely manner. To do so, a firm must keep a close watch on accounts receivable and inventories. A company’s accounts receivable is money owed to it by its customers. Its inventory is its merchandise, raw materials, and products waiting to be sold. If a firm allows the levels of either of these assets to get too high, it may not be able to keep sufficient cash on hand to meet its short-term obligations.5

Efficiency is how productively a firm utilizes its assets relative to its rev- enue and its profits. Southwest Airlines, for example, uses its assets very pro- ductively. Its turnaround time, or the time that its airplanes sit on the ground while they are being unloaded and reloaded, is the lowest in the airline industry. As Southwest officials are quick to point out, “Our planes don’t make any money sitting on the ground—we have to get them back into the air.”6

Stability is the strength and vigor of the firm’s overall financial posture. For a firm to be stable, it must not only earn a profit and remain liquid but also keep its debt in check. If a firm continues to borrow from its lenders and its debt-to-equity ratio, which is calculated by dividing its long-term debt by its shareholders’ equity, gets too high, it may have trouble meeting its obliga- tions and securing the level of financing needed to fuel its growth.

An increasingly common way that small companies improve their pros- pects across several of these areas is to join buying groups or co-ops, where businesses band together to attain volume discounts on products and services. Gaining access to products and services this way facilitates smaller firms’ ef- forts to compete on more of a “level playing field” with larger, more established companies. The way buying groups work, and how they’re able to help busi- nesses cut costs without adversely affecting their competitiveness, is described in this chapter’s “Partnering for Success” feature.

3. The process of Financial Management

To assess whether its financial objectives are being met, firms rely heavily on analyses of financial statements, forecasts, and budgets. A financial state- ment is a written report that quantitatively describes a firm’s financial health.

The income statement, the balance sheet, and the statement of cash flows are the financial statements entrepreneurs use most commonly. Forecasts are an estimate of a firm’s future income and expenses, based on its past performance, its current circumstances, and its future plans.7 New ventures typically base their forecasts on an estimate of sales and then on industry averages or the experiences of similar start-ups regarding the cost of goods sold (based on a percentage of sales) and on other expenses. Budgets are itemized forecasts of a company’s income, expenses, and capital needs and are also an important tool for financial planning and control.8

The process of a firm’s financial management is shown in Figure 8.2. It begins by tracking the company’s past financial performance through the preparation and analysis of financial statements. These statements organize and report the firm’s financial transactions. They tell a firm how much money it is making or losing (income statement), the structure of its assets and liabili- ties (balance sheet), and where its cash is coming from and going (statement of cash flows). The statements also help a firm discern how it stacks up against its competitors and industry norms. Most firms look at two to three years of past financial statements when preparing forecasts.

The next step is to prepare forecasts for two to three years in the future. In turn, forecasts are used to prepare a firm’s pro forma financial statements, which, along with its more fine-tuned budgets, constitute its financial plan.

The final step in the process is the ongoing analysis of a firm’s financial re- sults. Financial ratios, which depict relationships between items on a firm’s financial statements, are used to discern whether a firm is meeting its finan- cial objectives and how it stacks up against its industry peers. These ratios are also used to assess trends. Obviously, a completely new venture would start at step 2 in Figure 8.2. It is important that a new venture be familiar with the entire process, however. Typically, new ventures prepare financial statements quarterly so that as soon as the first quarter is completed, the new venture will have historic financial statements to help prepare forecasts and pro forma statements for future periods.

It is important for a firm to evaluate how it is faring relative to its industry. Sometimes raw financial ratios that are not viewed in context are deceiving. For example, a firm’s past three years’ income statements may show that it is increas- ing its sales at a rate of 15 percent per year. This number may seem impressive— until one learns that the industry in which the firm competes is growing at a rate of 30 percent per year, showing that the firm is steadily losing market share.

Many experienced entrepreneurs stress the importance of keeping on top of the financial management of a firm. In the competitive environments in which most firms exist, it’s simply not good enough to shoot from the hip when making financial decisions. Reinforcing this point, Bill Gates, the founder of Microsoft, said:

The business side of any company starts and ends with hard-core analysis of its numbers. Whatever else you do, if you don’t understand what’s happening in your business factually and you’re making business decisions based on anecdotal data or gut instinct, you’ll eventually pay a big price.9

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

I don’t even know the way I stopped up right here, however I assumed this post was once great. I don’t realize who you might be but definitely you are going to a well-known blogger for those who are not already 😉 Cheers!

It’s in reality a great and helpful piece of info. I’m happy that you simply shared this useful information with us. Please keep us informed like this. Thanks for sharing.