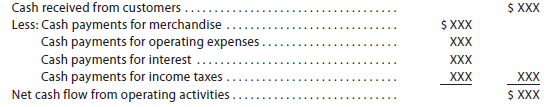

The direct method reports cash flows from operating activities as follows:

Cash flows from operating activities:

The Cash Flows from Investing and Financing Activities sections of the statement of cash flows are exactly the same under both the direct and indirect methods. The amount of net cash flow from operating activities is also the same, but the manner in which it is reported is different.

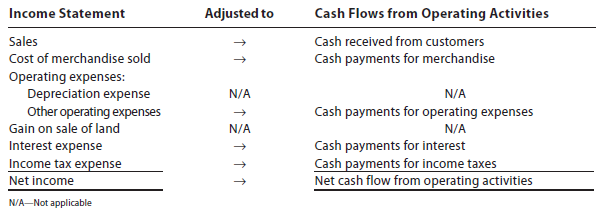

Under the direct method, the income statement is adjusted to cash flows from operating activities as follows:

As shown above, depreciation expense is not adjusted or reported as part of cash flows from operating activities. This is because deprecation expense does not involve a cash outflow. The gain on the sale of the land is also not adjusted and is not reported as part of cash flows from operating activities. This is because the cash flow from operating activities is determined directly, rather than by reconciling net income. The cash proceeds from the sale of the land are reported as an investing activity.

To illustrate the direct method, the income statement and comparative balance sheet for Rundell Inc., shown in Exhibit 3 on pages 646–647, are used.

1. Cash Received from Customers

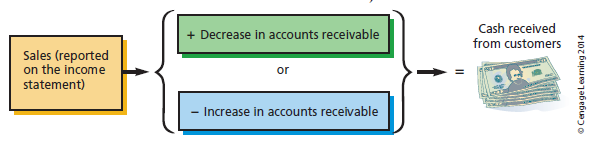

The income statement (shown in Exhibit 3) of Rundell Inc. reports sales of $1,180,000. To determine the cash received from customers, the $1,180,000 is adjusted for any increase or decrease in accounts receivable. The adjustment is summarized below.

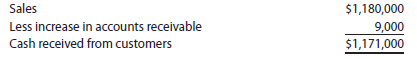

The cash received from customers is $1,171,000, computed as follows:

The increase of $9,000 in accounts receivable (shown in Exhibit 3) during 2014 indicates that sales on account exceeded cash received from customers by $9,000. In other words, sales include $9,000 that did not result in a cash inflow during the year. Thus, $9,000 is deducted from sales to determine the cash received from customers.

2. Cash Payments for Merchandise

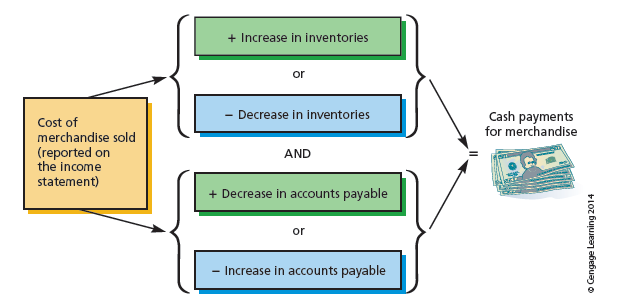

The income statement (shown in Exhibit 3) for Rundell Inc. reports cost of merchandise sold of $790,000. To determine the cash payments for merchandise, the $790,000 is adjusted for any increases or decreases in inventories and accounts payable. Assuming the accounts payable are owed to merchandise suppliers, the adjustment is summarized below.

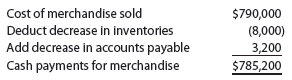

The cash payments for merchandise are $785,200, computed as follows:

The $8,000 decrease in inventories (from Exhibit 3) indicates that the merchandise sold exceeded the cost of the merchandise purchased by $8,000. In other words, the cost of merchandise sold includes $8,000 of goods sold from inventory that did not require a cash outflow during the year. Thus, $8,000 is deducted from the cost of merchandise sold in determining the cash payments for merchandise.

The $3,200 decrease in accounts payable (from Exhibit 3) indicates that cash payments for merchandise were $3,200 more than the purchases on account during 2014. Therefore, $3,200 is added to the cost of merchandise sold in determining the cash payments for merchandise.

3. Cash Payments for Operating Expenses

The income statement (from Exhibit 3) for Rundell Inc. reports total operating expenses of $203,000, which includes depreciation expense of $7,000. Since depreciation expense does not require a cash outflow, it is omitted from cash payments for operating expenses.

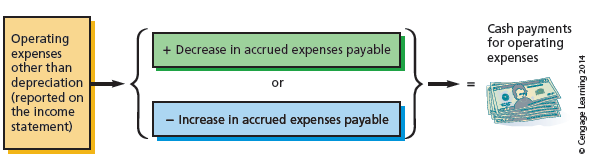

To determine the cash payments for operating expenses, the other operating expenses (excluding depreciation) of $196,000 ($203,000 – $7,000) are adjusted for any increase or decrease in accrued expenses payable. Assuming that the accrued expenses payable are all operating expenses, this adjustment is summarized below.

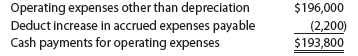

The cash payments for operating expenses are $193,800, computed as follows:

The increase in accrued expenses payable (from Exhibit 3) indicates that the cash payments for operating expenses were $2,200 less than the amount reported for operating expenses during the year. Thus, $2,200 is deducted from the operating expenses in determining the cash payments for operating expenses.

4. Gain on Sale of Land

The income statement for Rundell Inc. (from Exhibit 3) reports a gain of $12,000 on the sale of land. The sale of land is an investing activity. Thus, the proceeds from the sale, which include the gain, are reported as part of the cash flows from investing activities.

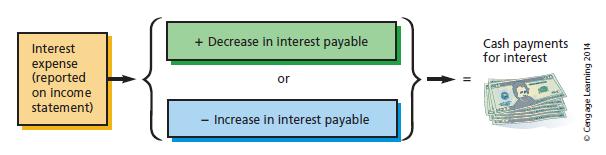

5. Interest Expense

The income statement (from Exhibit 3) for Rundell Inc. reports interest expense of $8,000. To determine the cash payments for interest, the $8,000 is adjusted for any increases or decreases in interest payable. The adjustment is summarized as follows:

The comparative balance sheet of Rundell Inc. in Exhibit 3 indicates no interest payable. This is because the interest expense on the bonds payable is paid on June 1 and December 31. Since there is no interest payable, no adjustment of the interest expense of $8,000 is necessary.

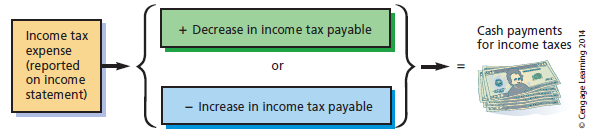

6. Cash Payments for Income Taxes

The income statement (from Exhibit 3) for Rundell Inc. reports income tax expense of $83,000. To determine the cash payments for income taxes, the $83,000 is adjusted for any increases or decreases in income taxes payable. The adjustment is summarized below.

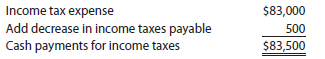

The cash payments for income taxes are $83,500, computed as follows:

The $500 decrease in income taxes payable (from Exhibit 3) indicates that the cash payments for income taxes were $500 more than the amount reported for income tax expense during 2014. Thus, $500 is added to the income tax expense in determining the cash payments for income taxes.

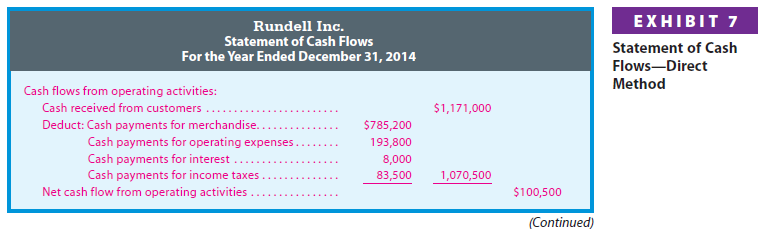

7. Reporting Cash Flows from Operating Activities—Direct Method

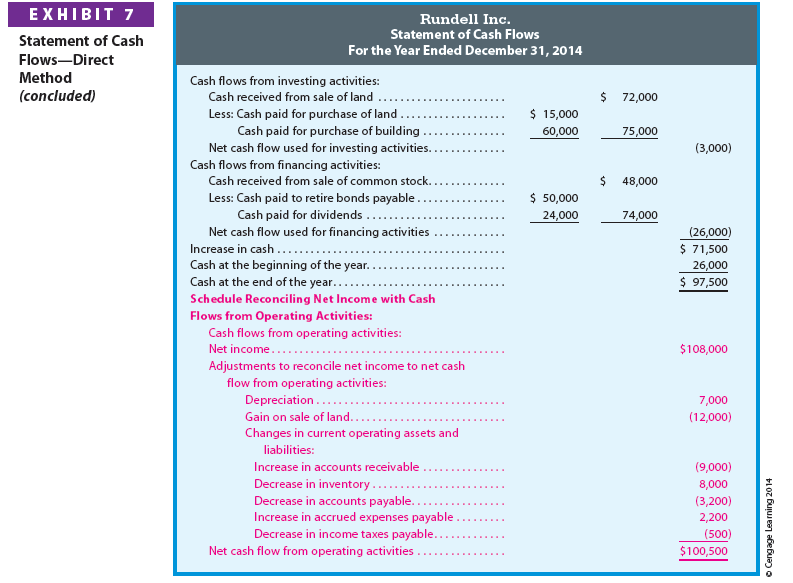

The statement of cash flows for Rundell Inc., using the direct method for reporting cash flows from operating activities, is shown in Exhibit 7. The portions of the statement that differ from those prepared under the indirect method are highlighted in color.

Exhibit 7 also includes the separate schedule reconciling net income and net cash flow from operating activities. This schedule is included in the statement of cash flows when the direct method is used. This schedule is similar to the Cash Flows from Operating Activities section prepared under the indirect method.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I have not checked in here for some time since I thought it was getting boring, but the last several posts are good quality so I guess I?¦ll add you back to my everyday bloglist. You deserve it my friend 🙂