In accounting, payroll refers to the amount paid to employees for services they provided during the period. A company’s payroll is important for the following reasons:

- Payroll and related payroll taxes significantly affect the net income of most companies.

- Payroll is subject to federal and state regulations.

- Good employee morale requires payroll to be paid timely and accurately.

1. Liability for Employee Earnings

Salary usually refers to payment for managerial and administrative services. Salary is normally expressed in terms of a month or a year. Wages usually refers to payment for employee manual labor. The rate of wages is normally stated on an hourly or a weekly basis. The salary or wage of an employee may be increased by bonuses, commissions, profit sharing, or cost-of-living adjustments.

Companies engaged in interstate commerce must follow the Fair Labor Standards Act. This act, sometimes called the Federal Wage and Hour Law, requires employers to pay a minimum rate of 1% times the regular rate for all hours worked in excess of 40 hours per week. Exemptions are provided for executive, administrative, and some supervisory positions. Increased rates for working overtime, nights, or holidays are common, even when not required by law. These rates may be as much as twice the regular rate.

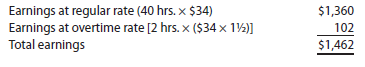

To illustrate computing an employee’s earnings, assume that John T. McGrath is a salesperson employed by McDermott Supply Co. McGrath’s regular rate is $34 per hour, and any hours worked in excess of 40 hours per week are paid at 1% times the regular rate. McGrath worked 42 hours for the week ended December 27. His earnings of $1,462 for the week are computed as follows:

2. Deductions from Employee Earnings

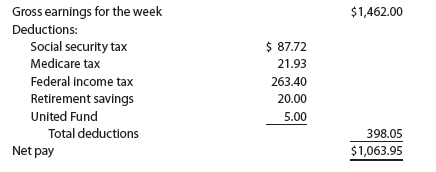

The total earnings of an employee for a payroll period, including any overtime pay, are called gross pay. From this amount is subtracted one or more deductions to arrive at the net pay. Net pay is the amount paid the employee. The deductions normally include federal, state, and local income taxes, medical insurance, and pension contributions.

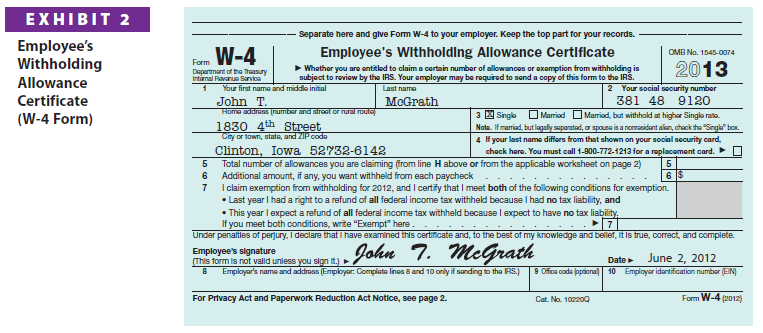

Income Taxes Employers normally withhold a portion of employee earnings for payment of the employees’ federal income tax. Each employee authorizes the amount to be withheld by completing an “Employee’s Withholding Allowance Certificate,” called a W-4. Exhibit 2 is the W-4 form submitted by John T. McGrath.

On the W-4, an employee indicates marital status and the number of withholding allowances. A single employee may claim one withholding allowance. A married employee may claim an additional allowance for a spouse. An employee may also claim an allowance for each dependent other than a spouse. Each allowance reduces the federal income tax withheld from the employee’s pay. Exhibit 2 indicates that John T. McGrath is single and, thus, claimed one withholding allowance.

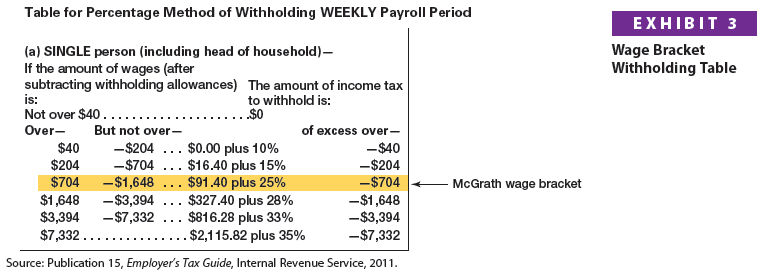

The federal income tax withheld depends on each employee’s gross pay and W-4 allowance. Withholding tables issued by the Internal Revenue Service (IRS) are used to determine amounts to withhold. Exhibit 3 is an example of an IRS wage withholding table for a single person who is paid weekly.

In Exhibit 3, each row is the employee’s wages after deducting the employee’s withholding allowances. Each year, the amount of the standard withholding allowance is determined by the IRS. For ease of computation and because this amount changes each year, we assume that the standard withholding allowance to be deducted in Exhibit 3 for a single person paid weekly is $70.4 Thus, if two withholding allowances are claimed, $140 ($70 x 2) is deducted.

To illustrate, John T. McGrath made $1,462 for the week ended December 27. McGrath’s W-4 claims one withholding allowance of $70. Thus, the wages used in determining McGrath’s withholding bracket in Exhibit 3 are $1,392 ($1,462 – $70).

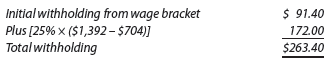

After the person’s withholding wage bracket has been computed, the federal income tax to be withheld is determined as follows:

Step 1. Locate the proper withholding wage bracket in Exhibit 3.

McGrath’s wages after deducting one standard IRS withholding allowance are $1,392 ($1,462 – $70). Therefore, the wage bracket for McGrath is $704-$1,648.

Step 2. Compute the withholding for the proper wage bracket using the directions in the two right-hand columns in Exhibit 3.

For McGrath’s wage bracket, the withholding is computed as “$91.40plus 25% of the excess over $704.” Hence, McGrath’s withholding is $263.40, as shown below.

Employers may also be required to withhold state or city income taxes. The amounts to be withheld are determined on state-by-state and city-by-city bases.

FICA Tax Employers are required by the Federal Insurance Contributions Act (FICA) to withhold a portion of the earnings of each employee. The FICA tax withheld contributes to the following two federal programs:

- Social security, which provides payments for retirees, survivors, and disability insurance.

- Medicare, which provides health insurance for senior citizens.

The amount withheld from each employee is based on the employee’s earnings paid in the calendar year. The withholding tax rates and maximum earnings subject to tax are often revised by Congress.[2] To simplify, this chapter assumes the following rates and earnings subject to tax:

- Social security: 6% on all earnings

- Medicare: 1.5% on all earnings

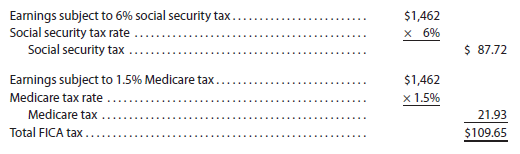

To illustrate, assume that John T. McGrath’s earnings for the week ending December 27 are $1,462 and the total FICA tax to be withheld is $109.65, as shown below.

Other Deductions Employees may choose to have additional amounts deducted from their gross pay. For example, an employee may authorize deductions for retirement savings, for charitable contributions, or life insurance. A union contract may also require the deduction of union dues.

3. Computing Employee Net Pay

Gross earnings less payroll deductions equals net pay, sometimes called take-home pay. Assuming that John T. McGrath authorized deductions for retirement savings and for a United Fund contribution, McGrath’s net pay for the week ended December 27 is $1,063.95, as shown below.

4. Liability for Employer’s Payroll Taxes

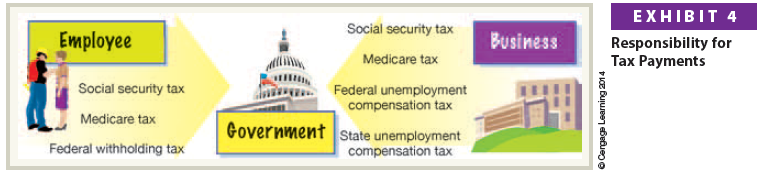

Employers are subject to the following payroll taxes for amounts paid their employees:

- FICA Tax: Employers must match the employee’s FICA tax contribution.

- Federal Unemployment Compensation Tax (FUTA): This employer tax provides for temporary payments to those who become unemployed. The tax collected by the federal government is allocated among the states for use in state programs rather than paid directly to employees. Congress often revises the FUTA tax rate and maximum earnings subject to tax.

- State Unemployment Compensation Tax (SUTA): This employer tax also provides temporary payments to those who become unemployed. The FUTA and SUTA programs are closely coordinated, with the states distributing the unemployment checks.[3] SUTA tax rates and earnings subject to tax vary by state.[4]

The preceding employer taxes are an operating expense of the company. Exhibit 4 summarizes the responsibility for employee and employer payroll taxes.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Excellent beat ! I wish to apprentice while you amend your site, how can i subscribe for a blog site? The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear idea

Very interesting info !Perfect just what I was looking for!