The Allied Board and Carton Company manufactured and distributed cardboard boxes, cartons, and other packaging materials. The sales force of twenty-five persons, assigned to territories thoughout the United States, made calls directly on purchasing agents of manufacturers of industrial and consumer products. During the previous eighteen months, operating losses had been experienced, and a firm of management consultants had been retained to investigate the situation. The findings of the consulting firm indicated that the losses did not stem from manufacturing inefficiency, as previously believed, but rather from the fact that selling costs per order were significantly higher than for comparable companies in the industry. The problem, then, was to find ways to step up selling efficiency; management began its task by reviewing the methods used for compensating sales personnel, with a view toward uncovering a possible solution.

Salespeople were paid a base salary of $1,200 per month and a commission of 3 percent on sales over quota. The monthly quota was determined by adding the individual salesperson’s expenses for the previous month to the $ 1,000 base salary and multiplying the result by 20. Since management was of the opinion that sales personnel would keep their expenses down to gain from the next month’s lower quotas and increased expenses, this system of quota determination was designed to minimize selling expenses. Sales-persons drove their own automobiles, but their expenses of operation were reimbursed at the rate of 25 cents per mile for the first 100 miles, 20 cents per mile for the next 100 miles, and 16 cents per mile for all miles over 200 travelled in any one month. Salespeople were not required to submit bills and receipts for expenditures made for rooms, meals, and incidentals. Reimbursements were made at the end of each month. Salespeople were allowed to draw monthly on anticipated commissions, and overdrawals were automatically wiped off the books at the close of the fiscal year.

At the close of each month, sales personnel submitted a report detailing the number of calls made, the number of presentations, and the number of orders written. At the same time, the monthly report of expenses was submitted. The credit department was responsible for approving all orders, but commissions were charged back against the salespersons when customers failed to pay their accounts.

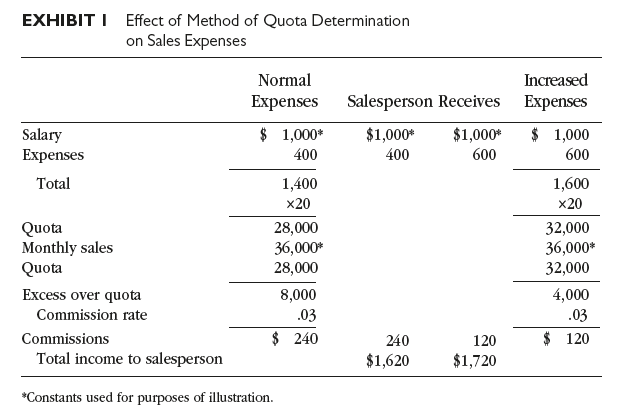

Upon completing the review of the method of quota determination, management concluded that its effect was to increase, rather than decrease, selling expenses. As shown in Exhibit 1, a salesperson who managed to reduce his expenses by $200 in one month received an increase of only $120 in commissions the next month. Thus, sales personnel could make more money by increasing their expenses and quotas than they could by reducing expenses and working with lower quotas. Consequently, a new method of quota determination was adopted. The base for the new monthly quota was the previous year’s sales for the corresponding month; this was adjusted to reflect changes in territorial potential, degree of competition relative to the previous year, and the salesperson’s past performance.

At the same time, the expense-reimbursement procedure was changed. Now, before salespeople could receive reimbursements, they were required to substantiate their expenses by producing all bills and receipts. In addition, each salesperson was provided with a predetermined amount each month, to be used for incidental expenses. Finally, the method of paying commissions was changed, with the objective of avoiding large fluctuations in the size of monthly paychecks. Salespeople were paid the same amount each month, based on the previous average monthly earnings of the individual. At the close of the year, total payments to sales staff were compared to the amounts actually earned through salary and commission. If actual earnings were in excess of the total paid to the salesperson, a check was made out for the difference. In the event that actual earnings were less than the amount paid, the salesperson was not required to make up the difference; his or her monthly check, however, was adjusted to reflect the new earning rate.

Source: Richard R. Still, Edward W. Cundliff, Normal A. P Govoni, Sandeep Puri (2017), Sales and Distribution Management: Decisions, Strategies, and Cases, Pearson; Sixth edition.

24 May 2021

25 May 2021

24 May 2021

25 May 2021

25 May 2021

24 May 2021