The VICS Association has defined CPFR as “a business practice that combines the intelligence of multiple partners in the planning and fulfillment of customer demand.” In this section, we describe CPFR and some successful implementations. It is important to understand that successful CPFR can be built only on a foundation in which the two parties have synchronized their data and established standards for exchanging information.

Sellers and buyers in a supply chain may collaborate along any or all of the following four supply chain activities:

- Strategy and planning. The partners determine the scope of the collaboration and assign roles, responsibilities, and clear checkpoints. In a joint business plan, they then identify significant events such as promotions, new product introductions, store openings/closings, and changes in inventory policy that affect demand and supply.

- Demand and supply management. A collaborative sales forecast projects the partners’ best estimate of consumer demand at the point of sale. This is then converted to a collaborative order plan that determines future orders and delivery requirements based on sales forecasts, inventory positions, and replenishment lead times.

- Execution. As forecasts become firm, they are converted to actual orders. The fulfillment of these orders then involves production, shipping, receiving, and stocking of products.

- Analysis. The key analysis tasks focus on identifying exceptions and evaluating metrics that are used to assess performance or identify trends.

A fundamental aspect of successful collaboration is the identification and resolution of exceptions. Exceptions refer to a gap between forecasts made by the two sides or some other performance metric that is falling or is likely to fall outside acceptable bounds. These metrics may include inventories that exceed targets or product availability that falls below targets. For successful CPFR, it is important to have a process in place that allows the two parties to resolve exceptions. Detailed processes for identifying and resolving exceptions are discussed in the VICS CPFR Voluntary Guidelines version 2.0 (2002).

One successful CPFR implementation has involved Henkel, a German detergent manufacturer, and Eroski, a Spanish food retailer. Prior to CPFR, Eroski saw frequent stockouts of Henkel products, especially during promotions. At the inception of CPFR in December 1999, 70 percent of the sales forecasts had an average error of more than 50 percent, and only 5 percent of the forecasts had errors less than 20 percent. Within four months of the CPFR implementation, however, 70 percent of the sales forecasts had errors less than 20 percent and only 5 percent had errors of more than 50 percent. CPFR resulted in a customer service level of 98 percent and an average inventory of only five days. This was accomplished despite 15 to 20 products being promoted every month.

Another successful implementation involved Johnson & Johnson and Superdrug, a chain in the United Kingdom. Over the three-month trial period beginning April 2000, Superdrug saw inventory levels at its DCs drop by 13 percent, while product availability at its DCs increased by 1.6 percent. As reported by Steerman (2003), Sears also saw significant benefits from its CPFR initiative with Michelin in 2001. In-stock levels at Sears improved by 4.3 percent, DCs-to-stores fill rate improved by 10.7 percent, and overall inventory levels fell by 25 percent.

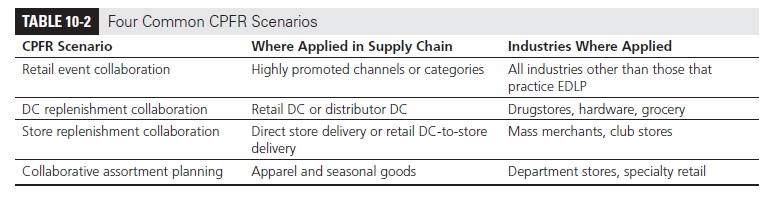

VICS has identified the four scenarios in Table 10-2 as the most common areas in which large-scale CPFR deployments have taken place between a retailer and a manufacturer. Next, we describe each of the four scenarios.

1. Retail Event Collaboration

In many retail environments, such as supermarkets, promotions and other retail events have a significant impact on demand. Stockouts, excess inventory, and unplanned logistics costs during these events affect financial performance for both the retailer and the manufacturer. In such a setting, collaboration between retailers and suppliers to plan, forecast, and replenish promotions is effective.

Retail event collaboration requires the two parties to identify brands and specific SKUs that are included in the collaboration. Details of the event—such as timing, duration, price point, advertising, and display tactics—are shared. It is important for the retailer to update this information as changes occur. Event-specific forecasts are then created and shared. These forecasts are then converted to planned orders and deliveries. As the event unfolds, sales are monitored to identify any changes or exceptions, which are resolved through an iterative process between the two parties.

P&G has implemented some form of retail event collaboration with a variety of partners, including Walmart.

2. DC Replenishment Collaboration

DC replenishment collaboration is perhaps the most common form of collaboration observed in practice and also the simplest to implement. In this scenario, the two trading partners collaborate on forecasting DC withdrawals or anticipated demand from the DC to the manufacturer. These forecasts are converted to a stream of orders from the DC to the manufacturer that are committed or locked over a specified time horizon. This information allows the manufacturer to include anticipated orders in future production plans and build the committed orders on demand. The result is a reduction in production cost at the manufacturer and a reduction of inventory and stockouts at the retailer.

DC replenishment collaboration is relatively easy to implement because it requires collaboration on aggregate data and does not require sharing of detailed POS data. As a result, it is often the best scenario with which to start collaboration. Over time, this form of collaboration can be extended to include all storage points in the supply chain, from retail shelves to raw material warehouses. According to Hammond (1994), Barilla implemented this form of collaboration with its distributors.

3. Store Replenishment Collaboration

In store replenishment collaboration, trading partners collaborate on store-level POS forecasts. These forecasts are then converted to a series of store-level orders, with orders committed over a specified time horizon. This form of collaboration is much harder to implement than a DC-level collaboration, especially if stores are small; it is easier for large stores such as Costco and Home Depot. The benefits of store-level collaboration include greater visibility of sales for the manufacturer, improved replenishment accuracy, improved product availability, and reduced inventories. Smith (2013) discusses how store level collaboration allowed suppliers to Canadian retailer West Marine, Inc. to improve “on-time shipments from a dismal 30 percent to over 90 percent.” This allowed West Marine to maintain product availability as high as 98 percent.

4. Collaborative Assortment Planning

Fashion apparel and other seasonal goods follow a seasonal pattern of demand. Thus, collaborative planning in these categories has a horizon of a single season and is performed at seasonal intervals. Given the seasonal nature, forecasts rely less on historical data and more on collaborative interpretation of industry trends, macroeconomic factors, and customer tastes. In this form of collaboration, the trading partners develop an assortment plan jointly. The output is a planned purchase order at the style/color/size level. The planned order is shared electronically in advance of a show, at which sample products are viewed and final merchandising decisions are made. The planned orders help the manufacturer purchase long-lead-time raw materials and plan capacity. This form of collaboration is most useful if capacity is flexible enough to accommodate a variety of product mix and raw materials have some commonality across end products.

5. Organizational and Technology Requirements for Successful CPFR

A successful CPFR implementation requires changes in the organizational structure and, to be scalable, requires the implementation of appropriate technology. Effective collaboration requires manufacturers to set up cross-functional, customer-specific teams that include sales, demand planning, and logistics, at least for large customers. Such a focus has become feasible with the consolidation in retailing. For smaller customers, such teams can be focused by geography or sales channel. Retailers should also attempt to organize merchandise planning, buying, and replenishment into teams around suppliers. This can be difficult, given the large number of suppliers that consolidated retailers have. They can then organize the teams by categories that include multiple suppliers. For retailers that have multiple levels of inventory, such as DCs and retail stores, it is important to combine the replenishment teams at the two levels. Without collaborative inventory management at the two levels, duplication of inventories is common. The proposed organizational structure is illustrated in Figure 10-4.

The CPFR process is not dependent on technology but requires technology to be scalable. CPFR technologies have been developed to facilitate sharing of forecasts and historical information, evaluating exception conditions, and enabling revisions. These solutions must be integrated with enterprise systems that record all supply chain transactions.

6. Risks and Hurdles for a cpFR Implementation

It is important to realize that there are risks and hurdles for a successful CPFR implementation. Given the large-scale sharing of information, there is a risk of information misuse. Often one or both of the CPFR partners have relationships with the partner’s competitors. Another risk is that if one of the partners changes its scale or technology, the other partner will be forced to follow suit or lose the collaborative relationship. Finally, the implementation of CPFR and the resolution of exceptions require close interactions between two entities whose cultures may be very

different. The inability to foster a collaborative culture across the partner organizations can be a major hurdle for the success of CPFR. One of the biggest hurdles to success is often that partners attempt store-level collaboration, which requires a higher organizational and technology investment. It is often best to start with an event- or DC-level collaboration, which is more focused and easier to collaborate on. Another major hurdle for successful CPFR is that demand information shared with partners is often not used within the organization in an integrated manner. It is important to have integrated demand, supply, logistics, and corporate planning within the organization to maximize the benefits of a CPFR effort with a partner.

Source: Chopra Sunil, Meindl Peter (2014), Supply Chain Management: Strategy, Planning, and Operation, Pearson; 6th edition.

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something.

I think that you could do with some pics to drive

the message home a bit, but instead of that,

this is great blog. A fantastic read. I’ll definitely be back.

Hi there, I enjoy reading all of your post. I wanted to write a little

comment to support you.

Very shortly this site will be famous among all blogging and site-building visitors,

due to it’s nice articles or reviews