Awareness of the organizational and managerial dimensions of information systems can help us understand why some firms achieve better results from their information systems than others. Studies of returns from information technology investments show that there is considerable variation in the returns firms receive (see Figure 1.8). Some firms invest a great deal and receive a great deal (quadrant 2); others invest an equal amount and receive few returns (quadrant 4). Still other firms invest little and receive much (quadrant 1), whereas others invest little and receive little (quadrant 3). This suggests that investing in information technology does not by itself guarantee good returns. What accounts for this variation among firms?

The answer lies in the concept of complementary assets. Information technology investments alone cannot make organizations and managers more effective unless they are accompanied by supportive values, structures, and behavior patterns in the organization and other complementary assets. Business firms need to change how they do business before they can really reap the advantages of new information technologies.

Complementary assets are those assets required to derive value from a primary investment (Teece, 1998). For instance, to realize value from automobiles requires substantial complementary investments in highways, roads, gasoline stations, repair facilities, and a legal regulatory structure to set standards and control drivers.

Research indicates that firms that support their technology investments with investments in complementary assets, such as new business models, new business processes, management behavior, organizational culture, or training, receive superior returns, whereas those firms failing to make these complementary investments receive less or no returns on their information technology investments (Brynjolfsson, 2005; Brynjolfsson and Hitt, 2000; Laudon, 1974). These investments in organization and management are also known as organizational and management capital.

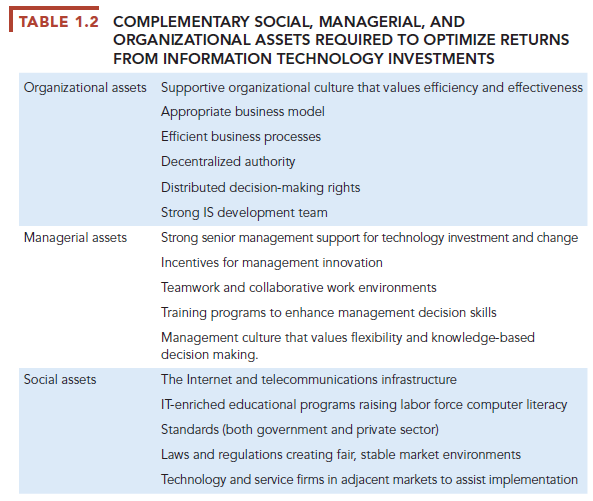

Table 1.2 lists the major complementary investments that firms need to make to realize value from their information technology investments. Some of this investment involves tangible assets, such as buildings, machinery, and tools. However, the value of investments in information technology depends to a large extent on complementary investments in management and organization.

Key organizational complementary investments are a supportive business culture that values efficiency and effectiveness, an appropriate business model, efficient business processes, decentralization of authority, highly distributed decision rights, and a strong information system (IS) development team.

Important managerial complementary assets are strong senior management support for change, incentive systems that monitor and reward individual innovation, an emphasis on teamwork and collaboration, training programs, and a management culture that values flexibility and knowledge.

Important social investments (not made by the firm but by the society at large, other firms, governments, and other key market actors) are the Internet and the supporting Internet culture, educational systems, network and computing standards, regulations and laws, and the presence of technology and service firms.

Throughout the book, we emphasize a framework of analysis that considers technology, management, and organizational assets and their interactions. Perhaps the single most important theme in the book, reflected in case studies and exercises, is that managers need to consider the broader organization and management dimensions of information systems to understand current problems as well as to derive substantial above-average returns from their information technology investments. As you will see throughout the text, firms that

can address these related dimensions of the IT investment are, on average, richly rewarded.

Source: Laudon Kenneth C., Laudon Jane Price (2020), Management Information Systems: Managing the Digital Firm, Pearson; 16th edition.

It’s in reality a nice and helpful piece of information. I

am satisfied that you simply shared this helpful info with us.

Please keep us up to date like this. Thanks for sharing.

What’s up, just wanted to tell you, I liked this blog post.

It was helpful. Keep on posting!

It is in reality a nice and helpful piece of information.

I’m happy that you just shared this useful information with us.

Please keep us up to date like this. Thanks for sharing.

Well I really liked reading it. This post offered by you is very effective for accurate planning.

You produced some decent points there. I looked on the net for that issue and located most individuals will go in conjunction with with your site.

Howdy! I just want to give an enormous thumbs up for the great information you might have here on this post. I will likely be coming back to your weblog for more soon.

It’s really a cool and helpful piece of info. I’m glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.