Fixed assets that are no longer useful may be discarded or sold.6 In such cases, the disposal of fixed assets– fixed asset is removed from the accounts. Just because a fixed asset is fully depreciated, however, does not mean that it should be removed from the accounts.

If a fixed asset is still being used, its cost and accumulated depreciation should remain in the ledger even if the asset is fully depreciated. This maintains accountability for the asset in the ledger. If the asset was removed from the ledger, the accounts would contain no evidence of the continued existence of the asset. In addition, cost and accumulated depreciation data on such assets are often needed for property tax and income tax reports.

1. Discarding Fixed Assets

If a fixed asset is no longer used and has no residual value, it is discarded. For example, assume that a fixed asset that is fully depreciated and has no residual value is discarded. The entry to record the discarding removes the asset and its related accumulated depreciation from the ledger.

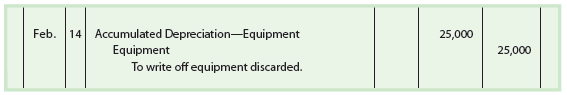

To illustrate, assume that equipment acquired at a cost of $25,000 is fully depreciated at December 31, 2013. On February 14, 2014, the equipment is discarded. The entry to record the discard is as follows:

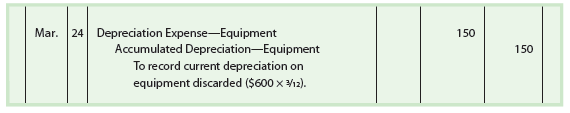

If an asset has not been fully depreciated, depreciation should be recorded before removing the asset from the accounting records. To illustrate, assume that equipment costing $6,000 with no estimated residual value is depreciated at a straight-line rate of 10%. On December 31, 2013, the accumulated depreciation balance, after adjusting entries, is $4,650. On March 24, 2014, the asset is removed from service and discarded. The entry to record the depreciation for the three months of 2014 before the asset is discarded is as follows:

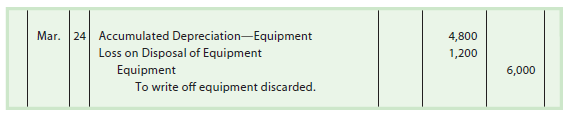

The discarding of the equipment is then recorded as follows:

The loss of $1,200 is recorded because the balance of the accumulated depreciation account ($4,800) is less than the balance in the equipment account ($6,000). Losses on the discarding of fixed assets are reported in the income statement.

2. Selling Fixed Assets

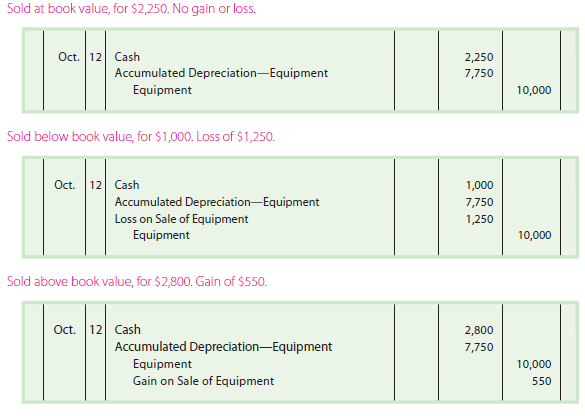

The entry to record the sale of a fixed asset is similar to the entry for discarding an asset. The only difference is that the receipt of cash is also recorded. If the selling price is more than the book value of the asset, a gain is recorded. If the selling price is less than the book value, a loss is recorded.

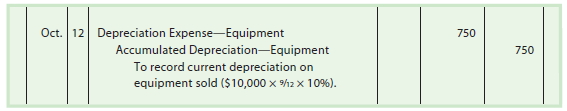

To illustrate, assume that equipment is purchased at a cost of $10,000 with no estimated residual value and is depreciated at a straight-line rate of 10%. The equipment is sold for cash on October 12 of the eighth year of its use. The balance of the accumulated depreciation account as of the preceding December 31 is $7,000. The entry to update the depreciation for the nine months of the current year is as follows:

After the current depreciation is recorded, the book value of the asset is $2,250 ($10,000 − $7,750). The entries to record the sale, assuming three different selling prices, are as follows:

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I am glad to be one of the visitors on this great internet site (:, thanks for posting.