The fixed assets of some companies include timber, metal ores, minerals, or other natural resources. As these resources are harvested or mined and then sold, a portion of their cost is debited to an expense account. This process of transferring the cost of natural resources to an expense account is called depletion.

Depletion is determined as follows:

Step 1. Determine the depletion rate as:

![]()

Step 2. Multiply the depletion rate by the quantity extracted from the resource during the period.

Depletion Expense = Depletion Rate × Quantity Extracted

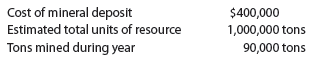

To illustrate, assume that Karst Company purchased mining rights as follows:

The depletion expense of $36,000 for the year is computed as shown below.

Step 1.

![]()

Step 2.

Depletion Expense = $0.40 per Ton × 90,000 Tons = $36,000

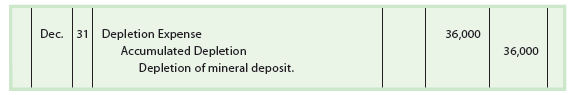

The adjusting entry to record the depletion is shown below.

Like the accumulated depreciation account, Accumulated Depletion is a contra asset account. It is reported on the balance sheet as a deduction from the cost of the mineral deposit.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Pretty! This has been an incredibly wonderful post.

Thank you for providing these details.

I could not refrain from commenting. Perfectly written!

Heya i’m for the first time here. I came across this board and I

find It really useful & it helped me out a lot.

I am hoping to present one thing again and help others

like you aided me.