Thus far, the recording of transactions, chart of accounts, and financial statements for a merchandising business (NetSolutions) have been described and illustrated. In the remainder of this chapter, the adjusting and closing process for a merchandising business will be described. In this discussion, the focus will be on the elements of the accounting cycle that differ from those of a service business.

1. Adjusting Entry for Inventory Shrinkage

Under the perpetual inventory system, the merchandise inventory account is continually updated for purchase and sales transactions. As a result, the balance of the merchandise inventory account is the amount of merchandise available for sale at that point in time. However, retailers normally experience some loss of inventory due to shoplifting, employee theft, or errors. Thus, the physical i nventory on hand at the end of the accounting period is usually less than the balance of Merchandise Inventory. This difference is called inventory shrinkage or inventory shortage.

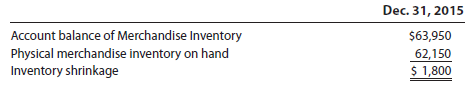

To illustrate, NetSolutions’ inventory records indicate the following on December 31, 2015:

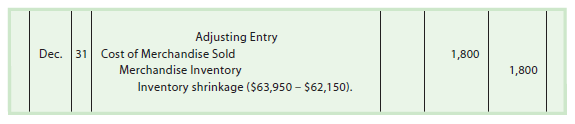

At the end of the accounting period, inventory shrinkage is recorded by the following adjusting entry:

After the preceding entry is recorded, the balance of Merchandise Inventory agrees with the physical inventory on hand at the end of the period. Since inventory shrinkage cannot be totally eliminated, it is considered a normal cost of operations. If, however, the amount of the shrinkage is unusually large, it may be disclosed separately on the income statement. In such cases, the shrinkage may be recorded in a separate account, such as Loss from Merchandise Inventory Shrinkage.[1]

2. Closing Entries

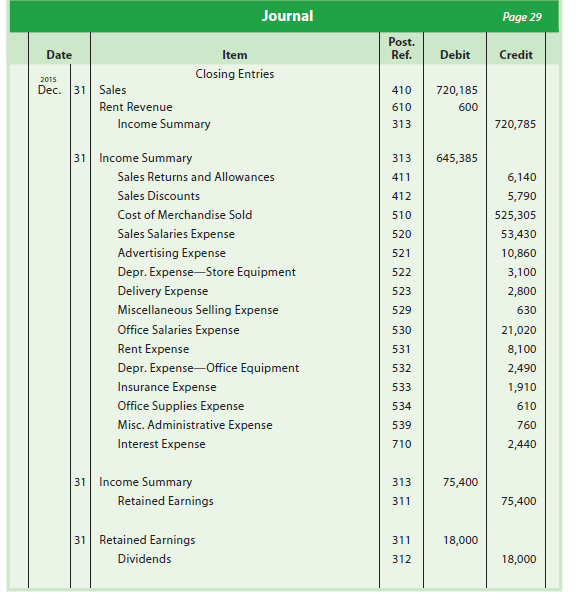

The closing entries for a merchandising business are similar to those for a service business. The four closing entries for a merchandising business are as follows:

- Debit each temporary account with a credit balance, such as Sales, for its balance and credit Income Summary.

- Credit each temporary account with a debit balance, such as the various expenses, and debit Income Summary. Since Sales Returns and Allowances, Sales Discounts, and Cost of Merchandise Sold are temporary accounts with debit balances, they are credited for their balances.

- Debit Income Summary for the amount of its balance (net income) and credit the retained earnings account. The accounts debited and credited are reversed if there is a net loss.

- Debit the retained earnings account for the balance of the dividends account and credit the dividends account.

The four closing entries for NetSolutions are shown at the top of the next page.

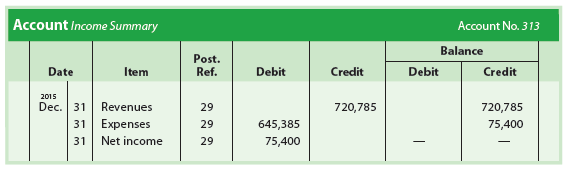

NetSolutions’ income summary account after the closing entries have been posted is as follows:

After the closing entries are posted to the accounts, a post-closing trial balance is prepared. The only accounts that should appear on the post-closing trial balance are the asset, contra asset, liability, and stockholders’ equity accounts with balances. These are the same accounts that appear on the end-of-period balance sheet. If the two totals of the trial balance columns are not equal, an error has occurred that must be found and corrected.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021