As we have discussed, the assets of a company are subject to the (1) claims of creditors and (2) the rights of owners. As creditors, bondholders are primarily concerned with the company’s ability to make its periodic interest payments and repay the face amount of the bonds at maturity.

Analysts assess the risk that bondholders will not receive their interest payments by computing the number of times interest charges are earned during the year as follows:

![]()

This ratio computes the number of times interest payments could be paid out of current period earnings, measuring the company’s ability to make its interest payments. Because interest payments reduce income tax expense, the ratio is computed using income before tax.

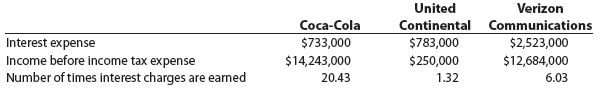

To illustrate, the following data were taken from a recent annual report of The Coca-Cola Company (in thousands):

The number of times interest charges are earned for The Coca-Cola Company is computed as follows:

![]()

Compare this to the number of times interest charges are earned for United Continental Holdings (an airline), and Verizon Communications (a telecommunications company) shown on the next page (in thousands):

Coca-Cola’s number of times interest charges are earned is 20.43, indicating that the company generates enough income before taxes to pay (cover) its interest payments 20.43 times. As a result, debtholders have extremely good protection in the event of an earnings decline. Compare this to United Continental, which only generates enough income before taxes to pay (cover) its interest payments 1.32 times. A small decrease in United Continental’s earnings could jeopardize the payment of interest. Verizon Communications falls in between, with a ratio of 6.03.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I have not checked in here for a while as I thought it was getting boring, but the last few posts are great quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂