The allowance method estimates the uncollectible accounts receivable at the end of the accounting period. Based on this estimate, Bad Debt Expense is recorded by an adjusting entry.

To illustrate, assume that ExTone Company began operations August 1. As of the end of its accounting period on December 31, 2013, ExTone has an accounts receivable balance of $200,000. This balance includes some past due accounts. Based on industry averages, ExTone estimates that $30,000 of the December 31 accounts receivable will be uncollectible. However, on December 31, ExTone doesn’t know which customer accounts will be uncollectible. Thus, specific customer accounts cannot be decreased or credited. Instead, a contra asset account, Allowance for Doubtful Accounts, is credited for the estimated bad debts.

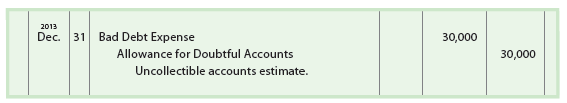

Using the $30,000 estimate, the following adjusting entry is made on December 31:

The preceding adjusting entry affects the income statement and balance sheet. On the income statement, the $30,000 of Bad Debt Expense will be matched against the related revenues of the period. On the balance sheet, the value of the receivables is reduced to the amount that is expected to be collected or realized. This amount, $170,000 ($200,000 – $30,000), is called the net realizable value of the receivables.

After the preceding adjusting entry is recorded, Accounts Receivable still has a debit balance of $200,000. This balance is the total amount owed by customers on account on December 31 as supported by the accounts receivable subsidiary ledger. The accounts receivable contra account, Allowance for Doubtful Accounts, has a credit balance of $30,000.

1. Write-Offs to the Allowance Account

When a customer’s account is identified as uncollectible, it is written off against the allowance account. This requires the company to remove the specific accounts receivable and an equal amount from the allowance account.

To illustrate, on January 21, 2014, John Parker’s account of $6,000 with ExTone Company is written off as follows:

At the end of a period, Allowance for Doubtful Accounts will normally have a balance. This is because Allowance for Doubtful Accounts is based on an estimate. As a result, the total write-offs to the allowance account during the period will rarely equal the balance of the account at the beginning of the period. The allowance account will have a credit balance at the end of the period if the write-offs during the period are less than the beginning balance. It will have a debit balance if the writeoffs exceed the beginning balance.

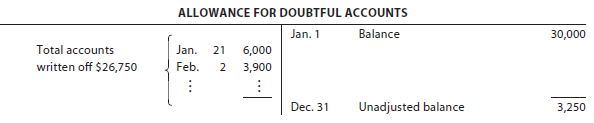

To illustrate, assume that during 2014 ExTone Company writes off $26,750 of uncollectible accounts, including the $6,000 account of John Parker recorded on January 21. Allowance for Doubtful Accounts will have a credit balance of $3,250 ($30,000 – $26,750), as shown below.

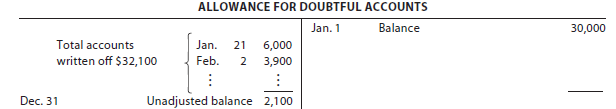

If ExTone Company had written off $32,100 in accounts receivable during 2014, Allowance for Doubtful Accounts would have a debit balance of $2,100, as shown below.

The allowance account balances (credit balance of $3,250 and debit balance of $2,100) in the preceding illustrations are before the end-of-period adjusting entry. After the end-of-period adjusting entry is recorded, Allowance for Doubtful Accounts should always have a credit balance.

An account receivable that has been written off against the allowance account may be collected later. Like the direct write-off method, the account is reinstated by an entry that reverses the write-off entry. The cash received in payment is then recorded as a receipt on account.

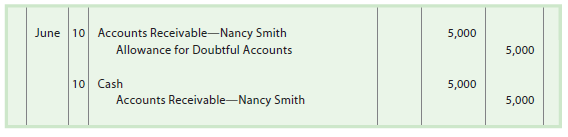

To illustrate, assume that Nancy Smith’s account of $5,000 which was written off on April 2 is collected later on June 10. ExTone Company records the reinstatement and the collection as follows:

2. Estimating Uncollectibles

The allowance method requires an estimate of uncollectible accounts at the end of the period. This estimate is normally based on past experience, industry averages, and forecasts of the future.

The two methods used to estimate uncollectible accounts are as follows:

- Percent of sales method.

- Analysis of receivables method.

Percent of Sales Method Since accounts receivable are created by credit sales, uncollectible accounts can be estimated as a percent of credit sales. If the portion of credit sales to sales is relatively constant, the percent may be applied to total sales or net sales.

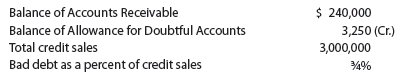

To illustrate, assume the following data for ExTone Company on December 31, 2014, before any adjustments:

Bad debt as a percent of credit sales Bad Debt Expense of $22,500 is estimated as follows:

![]()

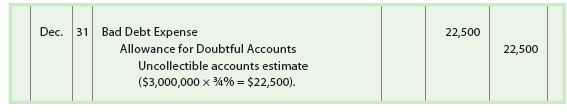

The adjusting entry for uncollectible accounts on December 31, 2014, is as follows:

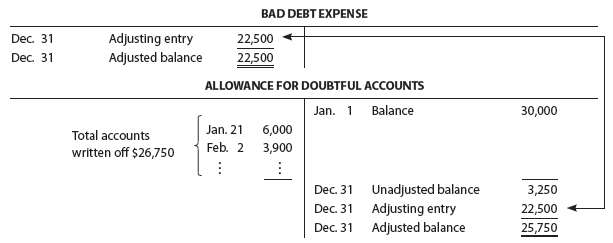

After the adjusting entry is posted to the ledger, Bad Debt Expense will have an adjusted balance of $22,500. Allowance for Doubtful Accounts will have an adjusted balance of $25,750 ($3,250 + $22,500). Both T accounts are shown below.

Under the percent of sales method, the amount of the adjusting entry is the amount estimated for Bad Debt Expense. This estimate is credited to whatever the unadjusted balance is for Allowance for Doubtful Accounts.

To illustrate, assume that in the preceding example the unadjusted balance of Allowance for Doubtful Accounts on December 31, 2014, had been a $2,100 debit balance instead of a $3,250 credit balance. The adjustment would still have been $22,500. However, the December 31, 2014, ending adjusted balance of Allowance for Doubtful Accounts would have been $20,400 ($22,500 – $2,100).

Analysis of Receivables Method The assumption that the longer an account receivable is outstanding, the less likely that it will be collected. The analysis of receivables method is applied as follows:

- The due date of each account receivable is determined.

- The number of days each account is past due is determined. This is the number of days between the due date of the account and the date of the analysis.

- Each account is placed in an aged class according to its days past due. Typical aged classes include the following:

Not past due

1-30 days past due

31-60 days past due

61-90 days past due

91-180 days past due

181-365 days past due

Over 365 days past due

- The totals for each aged class are determined.

- The total for each aged class is multiplied by an estimated collectible accounts for that class.

- The estimated total of uncollectible accounts is determined uncollectible accounts for each aged class.

The preceding steps are summarized in an aging schedule, and this overall process is called aging the receivables.

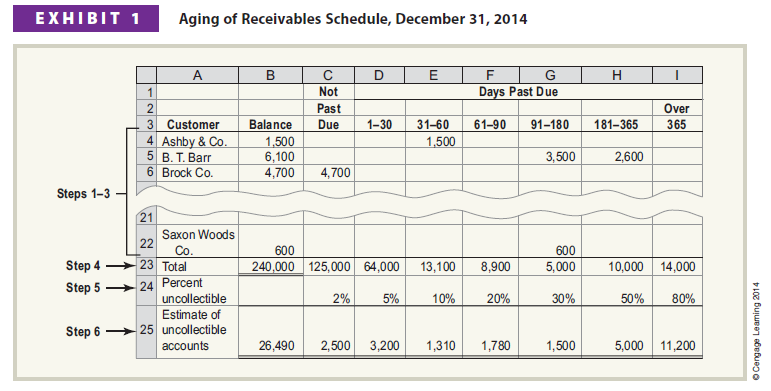

To illustrate, assume that ExTone Company uses the analysis of receivables method instead of the percent of sales method. ExTone prepared an aging schedule for its accounts receivable of $240,000 as of December 31, 2014, as shown in Exhibit 1.

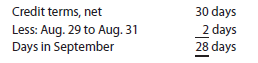

Assume that ExTone Company sold merchandise to Saxon Woods Co. on August 29 with terms 2/10, n/30. Thus, the due date (Step 1) of Saxon Woods’ account is September 28, as shown below.

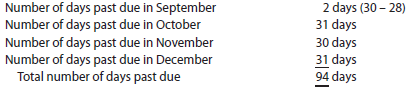

As of December 31, Saxon Woods’ account is 94 days past due (Step 2), as shown below.

Exhibit 1 shows that the $600 account receivable for Saxon Woods Co. was placed in the 91-180 days past due class (Step 3).

The total for each of the aged classes is determined (Step 4). Exhibit 1 shows that $125,000 of the accounts receivable are not past due, while $64,000 are 1-30 days past due. ExTone Company applies a different estimated percentage of uncollectible accounts to the totals of each of the aged classes (Step 5). As shown in Exhibit 1, the percent is 2% for accounts not past due, while the percent is 80% for accounts over 365 days past due.

The sum of the estimated uncollectible accounts for each aged class (Step 6) is the estimated uncollectible accounts on December 31, 2014. This is the desired adjusted balance for Allowance for Doubtful Accounts. For ExTone Company, this amount is $26,490, as shown in Exhibit 1.

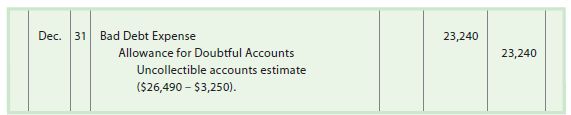

Comparing the estimate of $26,490 with the unadjusted balance of the allowance account determines the amount of the adjustment for Bad Debt Expense. For ExTone, the unadjusted balance of the allowance account is a credit balance of $3,250. The amount to be added to this balance is therefore $23,240 ($26,490 – $3,250). The adjusting entry is as follows:

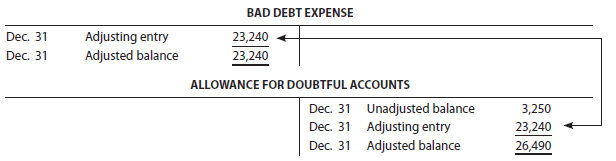

After the preceding adjusting entry is posted to the ledger, Bad Debt Expense will have an adjusted balance of $23,240. Allowance for Doubtful Accounts will have an adjusted balance of $26,490, and the net realizable value of the receivables is $213,510 ($240,000 – $26,490). Both T accounts are shown below.

Under the analysis of receivables method, the amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts equal to that estimated by the aging schedule.

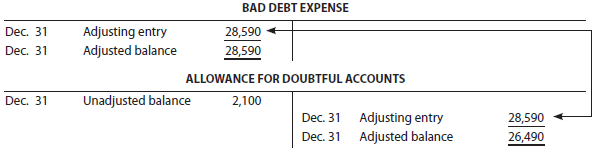

To illustrate, if the unadjusted balance of the allowance account had been a debit balance of $2,100, the amount of the adjustment would have been $28,590 ($26,490 + $2,100). In this case, Bad Debt Expense would have an adjusted balance of $28,590. However, the adjusted balance of Allowance for Doubtful Accounts would still have been $26,490. After the adjusting entry is posted, both T accounts are shown below.

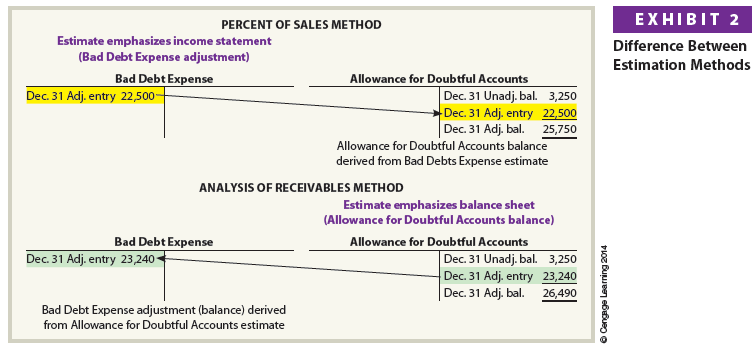

Comparing Estimation Methods Both the percent of sales and analysis of receivables methods estimate uncollectible accounts. However, each method has a slightly different focus and financial statement emphasis.

Under the percent of sales method, Bad Debt Expense is the focus of the estimation process. The percent of sales method places more emphasis on matching revenues and expenses and, thus, emphasizes the income statement. That is, the amount of the adjusting entry is based on the estimate of Bad Debt Expense for the period. Allowance for Doubtful Accounts is then credited for this amount.

Under the analysis of receivables method, Allowance for Doubtful Accounts is the focus of the estimation process. The analysis of receivables method places more emphasis on the net realizable value of the receivables and, thus, emphasizes the balance sheet. That is, the amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts equal to that estimated by the aging schedule. Bad Debt Expense is then debited for this amount.

Exhibit 2 summarizes these differences between the percent of sales and the analysis of receivables methods. Exhibit 2 also shows the results of the ExTone Company illustration for the percent of sales and analysis of receivables methods. The amounts shown in Exhibit 2 assume an unadjusted credit balance of $3,250 for Allowance for Doubtful Accounts. While the methods normally yield different amounts for any one period, over several periods the amounts should be similar.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Super-Duper site! I am loving it!! Will be back later to read some more. I am taking your feeds also

As a Newbie, I am permanently browsing online for articles that can benefit me. Thank you