Who owns the corporation? In the United States and United Kingdom, we just say “the stockholders.” There is usually just one class of common stock, and each share has one vote. Some stockholders may have more influence than others, but only because they own more shares. In other countries, ownership is not so simple, as we see later in this section.

What is the corporation’s financial objective? Normally we just say “to maximize stockholder value.” According to U.S. and UK corporation law, managers have a fiduciary duty to the shareholders. In other words, they are legally required to act in the interests of shareholders. Consider the classic illustration provided by an early case involving the Ford Motor Company. Henry Ford announced a special dividend, but then reneged, saying that the cash earmarked for the dividend would be spent for the benefit of employees. A shareholder sued on the grounds that corporations existed for the benefit of shareholders and the management did not have the right to improve the lot of workers at shareholders’ expense. Ford lost the case.6

The idea that the corporation should be run in the interests of the shareholders is thus embedded in the law in the United States and United Kingdom. The board of directors is supposed to represent shareholders’ interests. But laws and customs differ in other countries. Now we look at some of these differences. We start with Japan.

1. Ownership and Control in Japan

Traditionally the most notable feature of Japanese corporate finance has been the keiretsu. A keiretsu is a network of companies, usually organized around a major bank. Japan is said to have a main bank system, with long-standing relationships between banks and firms. There are also long-standing business relationships between a keiretsu’s companies. For example, a manufacturing company might buy most of its raw materials from group suppliers and in turn sell much of its output to other group companies.

The bank and other financial institutions at the keiretsu’s center own shares in most of the group companies (though a commercial bank in Japan is limited to 5% ownership of each company). Those companies may, in turn, hold the bank’s shares or each other’s shares. Because of the cross-holdings, the number of shares available for purchase by outside investors is much lower than the total number outstanding.

The keiretsu is tied together in other ways. Most debt financing comes from the keiretsu’s main bank or from affiliated financial institutions. Managers may sit on the boards of directors of other group companies, and a “presidents’ council” of the CEOs of the most important group companies meets regularly.

Think of the keiretsu as a system of corporate governance, where power is divided among the main bank, the group’s largest companies, and the group as a whole. This confers certain financial advantages. First, firms have access to additional “internal” financing—internal to the group, that is. Thus a company with a capital budget exceeding operating cash flows can turn to the main bank or other keiretsu companies for financing. This avoids the cost or possible bad-news signal of a public sale of securities. Second, when a keiretsu firm falls into financial distress, with insufficient cash to pay its bills or fund necessary capital investments, a workout can usually be arranged. New management can be brought in from elsewhere in the group, and financing can be obtained, again “internally.”

Hoshi, Kashyap, and Scharfstein tracked capital expenditure programs of a large sample of Japanese firms—many, but not all, members of keiretsus. The keiretsu companies’ investments were more stable and less exposed to the ups and downs of operating cash flows or to episodes of financial distress.7 It seems that the financial support of the keiretsus enabled members to invest for the long run, regardless of temporary setbacks.

Corporation law in Japan resembles that in the United States, but there are some important differences. For example, in Japan it is easier for shareholders to nominate and elect directors. Also, management remuneration must be approved at general meetings of shareholders.8 Nevertheless, ordinary shareholders do not, in fact, have much influence. Japanese boards traditionally had 40 or 50 members, with only a handful who are potentially independent of management. However, in recent years, many Japanese companies have changed to U.S.-style boards with fewer members and more independent directors. However, it is still the case that the CEO has tremendous influence. As long as the financial position of a Japanese corporation is sound, the CEO and senior management control the corporation. Outside stockholders have very little influence.

Given this control, plus the cross-holdings within industrial groups, it’s no surprise that hostile takeovers are exceedingly rare in Japan. Also, Japanese corporations have been stingy with dividends, which probably reflects the relative lack of influence of outside shareholders. On the other hand, Japanese CEOs do not use their power to generate large sums of personal wealth. They are not well paid, compared to CEOs in most other developed countries. (Look back to Figure 12.1 for average top-management compensation levels for Japan and other countries.)

Cross-holdings reached a peak around 1990 when about 50% of corporations’ shares were held by other Japanese companies and financial institutions. Starting in the mid-1990s, a banking crisis began to emerge in Japan. This led firms to sell off bank shares because they viewed them as bad investments. Banks and firms in financial distress, such as Nissan, sold off other companies’ shares to raise funds. By 2004, the level of cross-holdings had fallen to 20%. They rose again in the next few years as companies in the steel and other industries began to worry about hostile takeovers, which was the original motivation for acquisition of cross-holdings in the 1950s and 1960s.[1]

One of the most important changes in Japan in recent years has been the introduction of economic reforms by Prime Minister Shinzo Abe. These reforms are commonly known as Abenomics. Changes in corporate governance have been a major component of these. Their purpose is to make managers more responsible to shareholders and make companies more competitive, profitable, and transparent. The Tokyo Stock Exchange (TSE) and the government’s Financial Services Agency introduced a new, but legally nonbinding, Corporate Governance Code in 2015. The two most important suggestions are the appointment of two independent outside directors and the disclosure of the company’s policy regarding cross-shareholding in the hope that this will help reduce the amount of cross-shareholdings. It remains to be seen how effective the code will be in the long run, but the fact that foreign ownership of TSE-listed firms has been above 30% in recent years should increase companies’, willingness to adopt it.[2]

2. Ownership and Control in Germany

Traditionally, banks in Germany played a significant role in corporate governance. This involved providing loans, owning large amounts of equity directly, and the proxy voting of shares held on behalf of customers. Over time, this role has changed significantly. The relationship between the largest German bank, Deutsche Bank, and one of the largest German companies, Daimler AG, provides a good illustration.

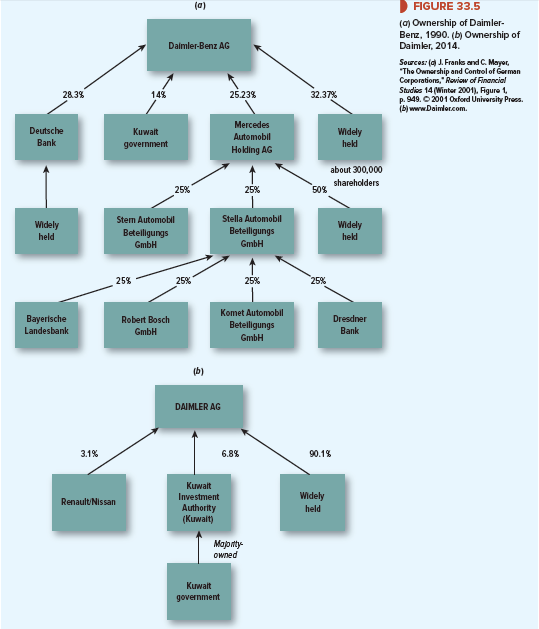

Panel a of Figure 33.5 shows the 1990 ownership structure of Daimler, or as it was known then, Daimler-Benz. The immediate owners were Deutsche Bank with 28%, Mercedes Auto- mobil Holding with 25%, and the Kuwait Government with 14%. The remaining 32% of the shares were widely held by about 300,000 individual and institutional investors. But this was only the top layer. Mercedes Automobil’s holding was half owned by holding companies “Stella” and “Stern,” for short. The rest of its shares were widely held. Stella’s shares were in turn split four ways: between two banks, Robert Bosch, an industrial company, and another holding company, “Komet.” Stern’s ownership was split five ways but we ran out of space.

Panel b shows the ownership structure in 2014. It is quite different. Deutsche Bank did not have a direct stake anymore. The Kuwait government still owned a substantial stake of 6.8%, but considerably less than the 14% it owned in 1990. In addition, Renault and Nissan each owned about 1.5%. In stark contrast to the situation in 1990, when only 32% of the stock was widely held, in 2014 90% was widely held. The ownership structure has moved a long way toward the U.S. ownership pattern, where many large companies are entirely widely held.

An important reason for this dramatic change in ownership structure was a tax change that took effect in 2002. This exempted capital gains on shares held for more than one year from corporate taxation. Prior to that, the corporate capital gains rate had been 52%, which made selling shares very costly for corporations.

Daimler was not the only company to experience a significant drop in bank ownership. Dittman, Maug, and Schneider point out that average bank ownership of equity fell from 4.1% in 1994 to .4% in 2005. Board seats held by bank representatives fell from 9.6% to 5.6% of the total. Dittman, Maug, and Schneider’s evidence suggests that banks are now primarily interested in using their board representation to promote their lending and investment banking activities. However, the companies on whose boards the bankers sit appear to perform worse than similar companies without such a presence.[4]

Other countries in continental Europe, such as France and Italy, also have complex corporate ownership structures. These countries have not had a dramatic tax change like that in Germany. However, there has been a steady stream of regulatory changes that have mostly had the effect of making the legal framework for corporate governance more like that in the United States.[5]

3. European Boards of Directors

Germany has a system of codetermination. Larger firms (generally firms with more than 2,000 employees) have two boards of directors: the supervisory board (Aufsichtsrat) and management board (Vorstand). Half of the supervisory board’s members are elected by employees, including management and staff as well as labor unions. The other half represents stockholders and often includes bank executives. There is also a chairman appointed by stockholders who can cast tie-breaking votes if necessary.

The supervisory board represents the interests of the company as a whole, not just the interests of employees or stockholders. It oversees strategy and elects and monitors the management board, which operates the company. Supervisory boards typically have about 20 members, more than typical U.S., UK, and Japanese boards. Management boards have about 10 members.

In France, firms can elect a single board of directors, as in the United States, United Kingdom, and Japan, or a two-tiered board, as in Germany. The single-tiered board, which is more common, consists mostly of outside directors, who are shareholders and representatives from financial institutions with which the firm has relationships. The two-board system has a conseil de surveillance, which resembles a German supervisory board, and a directoire, which is the management board. As far as employee representation is concerned, partially privatized firms and firms where employees own 3% or more of the shares are mandated to have employee-elected directors.

4. Shareholders versus Stakeholders

It is often suggested that companies should be managed on behalf of all stakeholders, not just shareholders. Other stakeholders include employees, customers, suppliers, and the communities where the firm’s plants and offices are located.

Different countries take very different views. In the United States, UK, and other “Anglo- Saxon” economies, the idea of maximizing shareholder value is widely accepted as the chief financial goal of the firm.

In other countries, workers’ interests are put forward much more strongly. In Germany, for example, as discussed previously, workers in large companies have the right to elect up to half of the directors to the companies’ supervisory boards. As a result they have a significant role in the governance of the firm and less attention is paid to the shareholders.[6] In Japan managers usually put the interests of employees and customers on a par with, or even ahead of, the interests of shareholders.

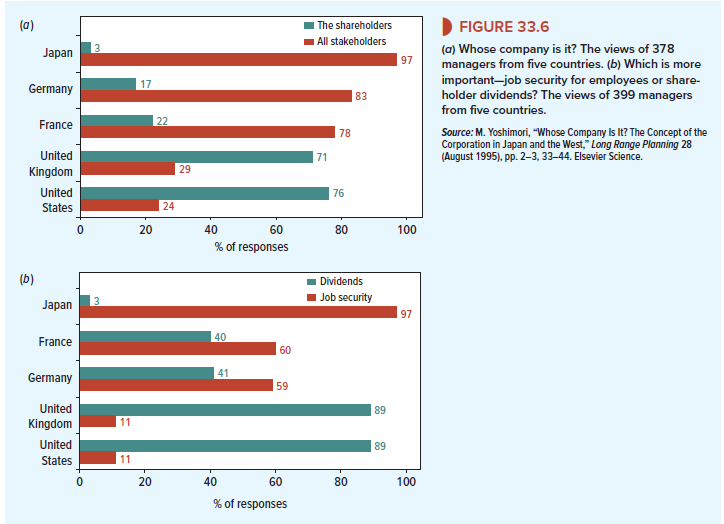

Figure 33.6 summarizes the results of interviews with executives from large companies in five countries. Japanese, German, and French executives think that their firms should be run for all stakeholders, while U.S. and UK executives say that shareholders must come first. When asked about the trade-off between job security and dividends, most U.S. and UK executives believe dividends should come first. By contrast, almost all Japanese executives and the majority of French and German executives believe that job security should come first.

As capital markets have become more global, companies in all countries face greater pressure to adopt wealth creation for shareholders as a primary goal. Some German companies, including Daimler and Deutsche Bank, have announced their primary goal as wealth creation for shareholders. In Japan, there has also been some movement in this direction as the proportion of foreign ownership of corporations has significantly increased in recent years.

Perhaps we should not make too much of these differences in objectives. Competitive forces alone oblige German and Japanese companies to run a tight ship. Likewise, a focus by U.S. companies on shareholder wealth does not mean that they can afford to rip off their customers or employees. As we pointed out in Chapter 1, corporations add value by establishing a reputation with all their stakeholders for fair dealing and integrity. That message is borne out in a study by Alex Edmans, which found that those U.S. companies with the most satisfied employees have also provided superior returns for their shareholders.15

5. Ownership and Control in Other Countries

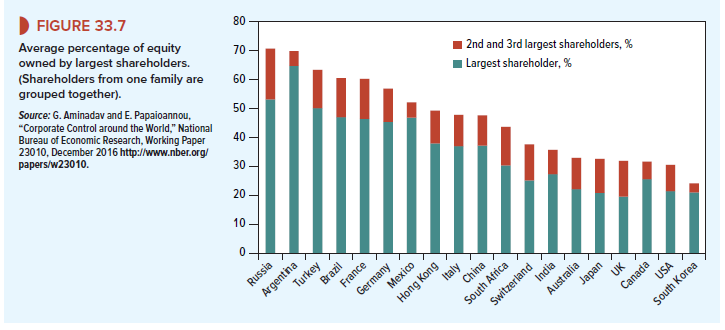

Figure 33.7 repeats Figure 14.5, and shows the concentration of ownership in different countries. In the United States, Canada, South Korea, and Japan ownership of listed companies tends to be relatively dispersed, but Figure 33.7 shows that this is not true everywhere. For example, in France and Germany, the largest shareholder owns, on average, nearly half of the outstanding stock. Ownership is even more concentrated in Russia and Argentina.

La Porta, Lopez-de-Silanes, and Shleifer surveyed corporate ownership in 27 developed economies.16 They found relatively few firms with actively traded shares and dispersed ownership. The pattern of significant ownership by banks and other financial institutions is also uncommon. Instead, firms are typically controlled by wealthy families or the state.

The ultimate controlling shareholders typically have secure voting control even when they do not have the majority stake in earnings, dividends, or asset values.

State involvement is particularly important in China, where the central and local government has a controlling interest in almost a quarter of listed firms. In Europe, family control is common in France, Germany, Greece, and Italy. It is also widespread in South America and in Asia, with the principal exception of Japan.

Family control does not usually mean a direct majority stake in the public firm. Control is usually exercised by cross-shareholdings, pyramids, and dual-class shares. We have already discussed cross-holdings. Pyramids and dual-class shares need further explanation.

Pyramids Pyramids are common in Asian countries as well as several European countries.[7] In a pyramid, control is exercised through a sequence of controlling positions in several layers of companies. The actual operating companies are at the bottom of the pyramid. Above each operating company is a first holding company, then a second one, then perhaps others still higher in the pyramid.[8] Look, for example, at Figure 33.8, which shows the principal shareholders of the French luxury goods company, LVMH. This company is controlled by Financiere Jean Goujon, whose only business is to hold a 57.5% stake in LVMH. Jean Goujon is wholly owned by Christian Dior, which in turn, is controlled by Semyrhamis, whose main purpose is to hold Christian Dior shares. This company is a wholly owned subsidiary of Financiere Agache, which also holds a direct 9.2% stake in Christian Dior. Financiere Agache is a 99% controlled subsidiary of the private company Groupe Arnault SAS, which is the holding company of Bernard Arnault and his family. Groupe Arnault SAS also controls 51% of the firm Le Peigne, which holds 1% of the shares of LVMH. In sum, LVMH is controlled by Bernard Arnault and his family, who indirectly hold about a 61.5% stake (57.5% via Financiere Jean Goujon, 2% via Financiere Agache, 1% via Groupe Arnault SAS, and 1% via Le Peigne).

Dual-Class Equity Another way to maintain control is to hold stock with extra voting rights. Extra votes can be attached to a special class of shares. For example, a firm’s Class A shares could have 10 votes and the Class B shares only 1. Dual-class equity occurs frequently in many countries, including Brazil, Canada, Denmark, Finland, Germany, Italy, Mexico, Norway, South Korea, Sweden, and Switzerland. Stocks with different voting rights also occur (but less frequently) in Australia, Chile, France, Hong Kong, South Africa, the United Kingdom, and the United States.19 For example, the Ford Motor Company is still controlled by the Ford family, who hold a special class of shares with 40% of the voting power. Many new technology companies, such as Google, Facebook, and LinkedIn, have dual-class shares that give the founders a considerable degree of control.

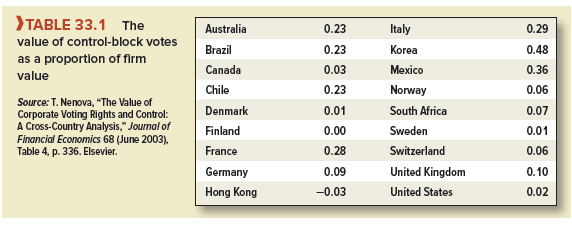

As we briefly discussed in Chapter 14, there is a wide variation in the value of votes across countries. Table 33.1 shows Tatiana Nenova’s estimates of the value of controlling blocks in different countries, calculated as a fraction of firms’ market values. These values are calculated from the differences in prices between ordinary shares and shares with extra votes. The range of values is large. For example, the Scandinavian countries have uniformly low premiums for control. South Korea and Mexico have very high control premiums.

Why is shareholder control valuable? For two reasons, one positive and one negative. The controlling shareholder may maximize value by monitoring management and making sure that the firm pursues the best operating and investment strategies. On the other hand, a controlling shareholder may be tempted to capture value by extracting private benefits at other shareholders’ expense. In this case the control premium is really a discount on the shares with inferior voting rights, a discount reflecting the value that these shareholders can not expect to receive.

6. Conglomerates Revisited

Of course, there are also examples of U.S. companies that are controlled by families or by investors holding large blocks of stock. But in these cases, control is exercised for a single firm, not a group of firms. Elsewhere in the world, and particularly in countries without fully developed financial markets, control extends to groups of firms in several different industries. These industrial groups are really conglomerates.

In Korea, for example, the 20 largest conglomerates own about 40% of the country’s total corporate assets. These chaebols are also strong exporters: Names like Samsung and Hyundai are recognized worldwide. Conglomerates are also common in Latin America. One of the more successful, the Chilean holding company Quinenco, is a dizzying variety of businesses, including hotels and brewing, mobile telephone services, banking, and the manufacture of copper cable. Widely diversified groups are also common in India. The largest, the Tata Group, spans 80 companies in various industries, including steel, electric power, real estate, telecommunications, and financial services. All of these companies are public, but control rests with the group and ultimately with the Tata family.

The United States had a conglomerate merger wave in the 1960s and 1970s, but diversification didn’t deliver value in the longer run, and most of the conglomerates of that era have dissolved. But conglomerates survive and grow in developing economies. Why?

Family ownership is part of the answer. A wealthy family can reduce risk while maintaining control and expanding the family business into new industries. Of course, the family could also diversify by buying shares of other companies. But where financial markets are limited and investor protection is poor, internal diversification can beat out financial diversification. Internal diversification means running an internal capital market, but if a country’s financial markets and institutions are substandard, an internal capital market may not be so bad after all.

“Substandard” does not just mean lack of scale or trading activity. It may mean government regulations limiting access to bank financing or requiring government approval before bonds or shares are issued.[9] It may mean poor information. If accounting standards are loose and companies are secretive, monitoring by outside investors becomes especially costly and difficult, and agency costs proliferate.

Internal diversification may also be the only practical way to grow. You can’t be big and focused in a small, closed economy, because the scale of one-industry companies is limited by the local market. Size can be an advantage if larger companies have easier access to international financial markets, which is important if local financial markets are inefficient. Size also means political power, which is especially important in managed economies or in countries where the government economic policy is unpredictable.

Many widely diversified business groups have been efficient and successful, particularly in countries like Korea that have grown rapidly. But there is also a dark side. Sometimes conglomerate business groups tunnel resources between the group companies at the expense of outside minority shareholders. Group company X can transfer value to Y by lending it money at a low interest rate, buying some of Y’s output at high prices or selling X’s assets to Y at low prices. Bertrand, Mehta, and Mullainathan found evidence of widespread tunneling in India.[10] Johnson, Boone, Breach, and Friedman note that the temptation to tunnel is stronger during a recession or financial crisis and argue that tunneling—and poor corporate governance in general—contributed to the Asian crisis of 1997-1998.

Very interesting topic, regards for posting.