We now consider pricing schedules that encourage buyers to purchase in large lots. There are many instances in business-to-business transactions in which the pricing schedule displays economies of scale, with prices decreasing as lot size increases. A discount is lot-size based if the pricing schedule offers discounts based on the quantity ordered in a single lot. A discount is volume based if the discount is based on the total quantity purchased over a given period, regardless of the number of lots purchased over that period. In this section, we will see that lot-size- based quantity discounts tend to increase the lot size and cycle inventory in a supply chain. Two commonly used lot-size-based discount schemes are:

- All unit quantity discounts

- Marginal unit quantity discount or multi-block tariffs

To investigate the impact of such quantity discounts on the supply chain, we must answer the following two basic questions:

- Given a pricing schedule with quantity discounts, what is the optimal purchasing decision for a buyer seeking to maximize profits? How does this decision affect the supply chain in terms of lot sizes, cycle inventories, and flow times?

- Under what conditions should a supplier offer quantity discounts? What are appropriate pricing schedules that a supplier seeking to maximize profits should offer?

We start by studying the optimal response of a retailer (the buyer) when faced with either of the two lot-size-based discount schemes offered by a manufacturer (the supplier). The retailer’s objective is to select lot sizes to minimize the total annual material, order, and holding costs. Next, we evaluate the optimal lot size in the case of all unit quantity discounts.

1. All Unit Quantity Discounts

In all unit quantity discounts, the pricing schedule contains specified break points q0, q1, … , qr, where q0 = 0. If an order placed is at least as large as qi but smaller than qi+1, each unit is obtained at a cost of Ci. In general, the unit cost decreases as the quantity ordered increases; that is, C0 > Q > g > Cr. For all unit discounts, the average unit cost varies with the quantity ordered, as shown in Figure 11-3. The retailer’s objective is to decide on lot sizes to maximize profits or, equivalently, to minimize the sum of material, order, and holding costs. The solution procedure evaluates the optimal lot size for each price and picks the lot size that minimizes the overall cost.

Step 1: Evaluate the economic order quantity for each price Ci,0 < i < r as follows:

Step 2: We next select the order quantity Q* for each price Ci. There are three possible cases for Qi:

Case 3 can be ignored for Qi because it is considered for Qi+1. Thus, we need to consider only the first two cases. If qi < Qi < qi + b then set Q* = Qi. If Qi < qi, then a lot size of Qi does not result in a discount. In this case, set Q* = qi to qualify for the discounted price of Ci per unit.

Step 3: For each i, calculate the total annual cost of ordering Q* units (this includes order cost, holding cost, and material cost) as follows:

Step 4: Over all i select order quantity Q* with the lowest total cost TCi.

Goyal (1995) has shown that this procedure can be shortened further by identifying a cutoff price C* above which the optimal solution cannot occur. Recall that Cr is the lowest unit cost above the final threshold quantity qr. The cutoff is obtained as follows:

In Example 11-7, we evaluate the optimal lot size given an all unit quantity discount (see worksheets Example 11-7 and Example 11-7 check in spreadsheet Chapter11-examples7-8).

EXAMPLE 11-7 All Unit Quantity Discounts

Drugs Online (DO) is an online retailer of prescription drugs and health supplements. Vitamins represent a significant percentage of its sales. Demand for vitamins is 10,000 bottles per month. DO incurs a fixed order placement, transportation, and receiving cost of $100 each time an order for vitamins is placed with the manufacturer. DO incurs a holding cost of 20 percent. The manufacturer uses the following all unit discount pricing schedule. Evaluate the number of bottles that the DO manager should order in each lot.

Analysis:

In this case, the manager has the following inputs:

q0 = 0, q1 = 5,000, q2 = 10,000

C0 = $3.00, C1 = $2.96, C2 = $2.92

D = 120,000/year, S = $100/lot, h = 0.2

Using Step 1 and Equation 11.10 we obtain

![]()

In Step 2, we ignore i = 0 because Q0 = 6,325 > q1 = 5,000. For i = 1, 2, we obtain

Q*1 = Q1 = 6,367; Q*2 = q2 = 10,000

In Step 3, we obtain the total costs using Equation 11.11 as follows:

Observe that the lowest total cost is for i = 2. Thus, it is optimal for DO to order Q* = 10,000 bottles per lot and obtain the discount price of $2.92 per bottle.

If the manufacturer in Example 11-7 sold all bottles for $3, it would be optimal for DO to order in lots of 6,325 bottles. The quantity discount is an incentive for DO to order in larger lots of 10,000 bottles, raising both the cycle inventory and the flow time. The impact of the discount is further magnified if DO works hard to reduce its fixed ordering cost to S = $4 (from the current $100). Then, the optimal lot size in the absence of a discount is 1,265 bottles. In the presence of the all unit quantity discount, the optimal lot size is still 10,000 bottles. In this case, the presence of quantity discounts leads to an eightfold increase in average inventory and flow time at DO.

Given that all unit quantity discounts increase the average inventory and flow time in a supply chain, it is important to identify how these discounts add value in a supply chain. Before we consider this question, we discuss marginal unit quantity discounts.

2. Marginal Unit Quantity Discounts

Marginal (or incremental) unit quantity discounts are also referred to as multi-block tariffs. In this case, the pricing schedule contains specified break points q0, q1, … , qr. It is not the average cost of a unit but the marginal cost of a unit that decreases at a breakpoint (in contrast to the all unit discount scheme). If an order of size q is placed, the first q1 – q0 units are priced at C0, the next q2 – q1 are priced at C1, and, in general, qi+1 – qi units are priced at Ci. The marginal cost per unit varies with the quantity purchased, as shown in Figure 11-4.

Faced with such a pricing schedule, the retailer’s objective is to decide on a lot size that maximizes profits or, equivalently, minimizes material, order, and holding costs.

The solution procedure discussed here evaluates the optimal lot size for each marginal price Ci (this forces a lot size between q{ and qi+1) and then settles on the lot size that minimizes the overall cost. A more streamlined procedure has been provided by Hu and Munson (2002).

For each value of i, 0 < i < r, let Vi be the cost of ordering q{ units. Define V0 = 0 and Vi for 0 < i < r as follows:

![]()

For each value of i, 0 < i < r – 1, consider an order of size Q in the range qi to qi+1 units; that is, q +1 > Q > q;. The material cost of each order of size Q is given by Vi + (Q – q)Ci. The various costs associated with such an order are as follows:

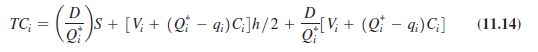

The total annual cost is the sum of the three costs and is given by

![]()

The optimal lot size for price Ci is obtained by taking the first derivative of the total cost with respect to the lot size and setting it equal to 0. This results in the following optimal lot size:

![]()

Observe that the optimal lot size is obtained using a formula very much like the EOQ formula (Equation 11.5), except that the presence of the quantity discount has the effect of raising the fixed cost per order by Vi – qiCi (from S to S + Vi – qC). The overall optimal lot size is obtained as follows:

Step 1: Evaluate the optimal lot size using Equation 11.13 for each price Ci.

Step 2: We next select the order quantity Q* for each price Ci. There are three possible cases for Qi:

- If q < Qi < qi+1 then set Q* = Qi

- If Qi < qi then set Q* = qi

- If Qi > qi +1 then set Q* = qi +1

Step 3: Calculate the total annual cost of ordering Q* units as follows:

Step 4: Over all i, select order size Q* with the lowest cost TCi.

In Example 11-8, we evaluate the optimal lot size given a marginal unit quantity discount (see worksheets Example 11-8 and Example 11-8 check in spreadsheet Chapter11-examples7-8).

EXAMPLE 11-8 Marginal Unit Quantity Discounts

Let us return to DO from Example 11-7. Assume that the manufacturer uses the following marginal unit discount pricing schedule:

This implies that if an order is placed for 7,000 bottles, the first 5,000 are at a unit cost of $3.00, with the remaining 2,000 at a unit cost of $2.96. Evaluate the number of bottles that DO should order in each lot.

Analysis:

In this case, we have

q0 = O, q1 = 5,000, q2 = 10,000

C0 = $3.00, C1 = $2.96, C2 = $2.92

D = 120,000/ year, S = $100 / lot, h = 0.2

Using Equation 11.12, we obtain

V0 = 0; Vi = 3 X (5,000 – 0) = $15,000

V2 = 3 X (5,000 – 0) + 2.96 X (10,000 – 5,000) = $29,800

Using Step 1 and Equation 11.13, we obtain

In Step 2, we set Q0 = q1 = 5,000 because Q0 = 6,325 > q1 = 5,000. Similarly, we obtain Qi = q2 = 10,000 (because Q1 = 11,028 > q2 = 10,000) and Q* =Q2= 16,961.

In Step 3, we obtain the total cost for i = 0, 1, 2 using Equation 11.14 to be

Observe that the lowest cost is for i = 2. Thus, it is optimal for DO to order in lots of Q* = 16,961 bottles. This is much larger than the optimal lot size of 6,325 when the manufacturer does not offer any discount.

If the fixed cost of ordering is $4, the optimal lot size for DO is 15,755 with the discount compared to a lot size of 1,265 without the discount. This discussion demonstrates that there can be significant order sizes—and, thus, significant cycle inventory—in the absence of any formal fixed ordering costs as long as quantity discounts are offered. Thus, quantity discounts lead to a significant buildup of cycle inventory in a supply chain. In many supply chains, quantity discounts contribute more to cycle inventory than fixed ordering costs. This forces us once again to question the value of quantity discounts in a supply chain.

3. Why Do Suppliers Offer Quantity Discounts?

We have seen that the presence of lot-size-based quantity discounts tends to increase the level of cycle inventory in the supply chain. We now develop reasons why suppliers may offer lot-size- based quantity discounts in a supply chain. In each case, we look for circumstances under which a lot-size-based quantity discount increases supply chain profits. Quantity discounts can increase the supply chain profit for the following two main reasons:

- Improved coordination to increase total supply chain profits

- Extraction of surplus by supplier through price discrimination

Munson and Rosenblatt (1998) also provide other factors, such as marketing, that motivate sellers to offer quantity discounts. We now discuss each of the two situations in greater detail.

COORDINATION TO INCREASE TOTAL SUPPLY CHAIN PROFITS A supply chain is coordinated if the decisions the retailer and supplier make maximize total supply chain profits. In reality, each stage in a supply chain may have a separate owner and thus attempt to maximize its own profits. For example, each stage of a supply chain is likely to make lot-sizing decisions with an objective of minimizing its own overall costs. The result of this independent decision making can be a lack of coordination in a supply chain because actions that maximize retailer profits may not maximize supply chain profits. In this section, we discuss how a manufacturer may use appropriate quantity discounts to ensure that total supply chain profits are maximized even if the retailer is acting to maximize its own profits.

Quantity discounts for commodity products. Economists have argued that for commodity products such as milk, a competitive market exists and prices are driven down to the products’ marginal cost. In this case, the market sets the price and the firm’s objective is to lower costs in order to increase profits. Consider, for example, the online retailer DO, discussed earlier. It can be argued that it sells a commodity product. In this supply chain, both the manufacturer and DO incur costs related to each order placed by DO. Assume that the manufacturer has a fixed cost SM, a unit cost CM, and a holding cost hM. The manufacturer incurs fixed costs related to order setup and fulfillment (SM) and holding costs (hMCM) as it builds up inventory to replenish the order. Assume that the retailer has a fixed cost SR, a unit cost CR, and a holding cost hR. Thus, DO incurs fixed costs (SR) for each order it places and holding costs (hRCR) for the inventory it holds as it slowly sells an order. Even though both parties incur costs associated with the lotsizing decision made by DO, the retailer makes its lot-sizing decisions based solely on minimizing its local costs. This results in lot-sizing decisions that are locally optimal but do not maximize the supply chain surplus. We illustrate this idea in Example 11-9 (see spreadsheet Chapterll- quantity discounts worksheet Example 11-9).

EXAMPLE 11-9 The Impact of Locally Optimal Lot Sizes on a Supply Chain

Demand for vitamins is 10,000 bottles per month. DO incurs a fixed order placement, transportation, and receiving cost of $100 each time it places an order for vitamins with the manufacturer. DO incurs a holding cost of 20 percent. The manufacturer charges $3 for each bottle of vitamins purchased. Evaluate the optimal lot size for DO.

Each time DO places an order, the manufacturer must process, pack, and ship the order. The manufacturer has a line packing bottles at a steady rate that matches demand. The manufacturer incurs a fixed-order filling cost of $250, production cost of $2 per bottle, and a holding cost of 20 percent. What is the annual fulfillment and holding cost incurred by the manufacturer as a result of DO’s ordering policy?

Analysis:

In this case, we have

D = 120,000/ year, SR = $100/ lot, hR = 0.2, CR = $3

SM = $250/ lot, hM = 0.2, CM = $2

Using the EOQ formula (Equation 11.5), we obtain the optimal lot size and annual cost for DO to be:

If DO orders in lots sizes of QR = 6,325, the annual cost incurred by the manufacturer is obtained to be:

The annual supply chain cost (manufacturer + DO) is thus $6,008 + $3,795 = $9,803.

In Example 11-9, DO picks the lot size of 6,325 with an objective of minimizing only its own costs. From a supply chain perspective, the optimal lot size should account for the fact that both DO and the manufacturer incur costs associated with each replenishment lot. If we assume that the manufacturer produces at a rate that matches demand (as assumed in Example 11-9), the total supply chain cost of using a lot size Q is obtained as follows:

![]()

The optimal lot size (Q*) for the supply chain is obtained by taking the first derivative of the total cost with respect to Q and setting it equal to 0 as follows (see worksheet Example 11-9):

If DO orders in lots of Q* = 9,165 units, the total costs for DO and the manufacturer are as follows:

Observe that if DO orders a lot size of 9,165 units, the supply chain cost decreases to $9,165 (from $9,803 when DO ordered its own optimal lot size of 6,325). There is thus an opportunity for the supply chain to save $638. The challenge, however, is that ordering in lots of 9,165 bottles raises the cost for DO by $264 per year from $3,795 to $4,059 (even though it reduces overall supply chain costs). The manufacturer’s costs, in contrast, go down by $902 from $6,008 to $5,106 per year. Thus, the manufacturer must offer DO a suitable incentive for DO to raise its lot size. A lot-size–based quantity discount is an appropriate incentive in this case. Example 11-10 (see worksheet Example 11-10) provides details of how the manufacturer can design a suitable quantity discount that gets DO to order in lots of 9,165 units even though DO is optimizing its own profits (and not total supply chain profits).

Observe that offering a lot-size–based discount in this case decreases total supply chain cost. It does, however, increase the lot size the retailer purchases and thus increases cycle inventory in the supply chain.

Our discussion on coordination for commodity products highlights the important link between the lot-size-based quantity discount offered and the order costs incurred by the manufacturer. As the manufacturer works on lowering order or setup cost, the discount it offers to retailers should change. For a low enough setup or order cost, the manufacturer gains little from using a lot-size-based quantity discount. In Example 11-9, discussed earlier, if the manufacturer lowers its fixed cost per order from $250 to $100, the total supply chain costs are close to the minimum without quantity discounts even if DO is trying to minimize its cost. Thus, if its fixed order costs are lowered to $100, it makes sense for the manufacturer to eliminate all quantity discounts. In most companies, however, marketing and sales design quantity discounts, whereas operations works on reducing setup or order cost. As a result, changes in pricing do not always occur in response to setup cost reduction in manufacturing. It is important that the two functions coordinate these activities.

Quantity discounts for products for which the firm has market power. Now, consider the scenario in which the manufacturer has invented a new vitamin pill, Vitaherb, which is derived from herbal ingredients and has other properties highly valued in the market. Few competitors have a similar product, so it can be argued that the price at which the retailer DO sells Vitaherb influences demand. Assume that the annual demand faced by DO is given by the demand curve 360,000 – 60,000p, where p is the price at which DO sells Vitaherb. The manufacturer incurs a production cost of CM = $2 per bottle of Vitaherb sold. The manufacturer must decide on the price CR to charge DO, and DO in turn must decide on the price p to charge the customer. The profit at DO (ProfR) and the manufacturer (ProfM) as a result of this policy is given by

ProfR = (p – CR)( 360,000 – 60,000 p); ProfM = (CR – CM)(360,000 – 60,000 p)

DO picks the price p to maximize ProfR. Taking the first derivative with respect to p and setting it to 0, we obtain the following relationship between p and CR

![]()

Given that the manufacturer is aware that DO is aiming to optimize its own profits, the manufacturer is able to use the relationship between p and CR to obtains its own profits to be

ProfM = (CR – CM)a360,000 – 60,000^3 + C)) = (CR – 2)(180,000 – 30,000 CR)

The manufacturer picks its price CR to maximize ProfM. Taking the first derivative of ProfM with respect CR to and setting it to 0 we obtain CR = $4. Substituting back into Equation 11.15, we obtain p = $5. Thus, when DO and the manufacturer make their pricing decisions independently, it is optimal for the manufacturer to charge a wholesale price of CR = $4 and for DO to charge a retail price of p = $5. The total market demand in this case is 360,000 – 60,000p =60,000 bottles. DO makes a profit of ProfR = (5 – 4)(360,000 – [60,000 X 5]) = $60,000 and the manufacturer makes a profit of ProfM = (4 – 2)(360,000 – [60,000 X 5]) = $120,000 (see worksheet 2-stage).

Now, consider the case in which the two stages coordinate their pricing decisions with a goal of maximizing the supply chain profit ProfSC, which is given by

ProfSC = (p – CM)( 360,000 – 60,000p)

The optimal retail price is obtained by setting the first derivative of ProfSC with respect to p to 0. We thus obtain the coordinated retail price to be

![]()

If the two stages coordinate pricing and DO prices at p = $4, market demand is 360,000 – 60,000p = 120,000 bottles. The total supply chain profit if the two stages coordinate is ProfSC = ($4 – $2) X 120,000 = $240,000. As a result of each stage settings its price independently, the supply chain thus loses $60,000 in profit. This phenomenon is referred to as double marginalization. Double marginalization leads to a loss in profit because the supply chain margin is divided between two stages, but each stage makes its pricing decision considering only its own local profits.

Given that independent pricing decisions lower supply chain profits, it is important to consider pricing schemes that may help recover some of these profits even when each stage of the supply chain continues to act independently. We propose two pricing schemes that the manufacturer may use to achieve the coordinated solution and maximize supply chain profits even though DO acts in a way that maximizes its own profit.

- Two-part tariff: In this case, the manufacturer charges its entire profit as an up-front franchise fee ff (which could be anywhere between the noncoordinated manufacturer profit ProfM and the difference between the coordinated supply chain profit and the noncoordinated retailer profit, ProfSC – ProfR) and then sells to the retailer at cost; that is, the manufacturer sets its wholesale price CR = CM. This pricing scheme is referred to as a two-part tariff because the manufacturer sets both the franchise fee and the wholesale price. The retail pricing decision is thus based on maximizing its profits (p – CM)(360,000 – 60,000p) – ff. Under the two-part tariff, the franchise fee ff is paid up front and is thus a fixed cost that does not change with the retail price p. The retailer DO is thus effectively maximizing the coordinated supply chain profits ProfSC = (p – CM)(360,000 – 60,000p). Taking the first derivative with respect to p and setting it equal to 0, the optimal coordinated retail price p is evaluated to be

![]()

In the case of DO, recall that total supply chain profit when the two stages coordinate is ProfSC = $240,000 with DO charging the customer $4 per bottle of Vitaherb. The profit made by DO when the two stages do not coordinate is ProfR = $60,000. One option available to the manufacturer is to construct a two-part tariff by which DO is charged an upfront fee of ff = ProfSC – ProfR = $180,000 (see worksheet 2-part-tariff) and material cost of CR = CM = $2 per bottle. DO maximizes its profit if it prices the vitamins at p = 3 + CM / 2 = 3 + 2 / 2 = $4 per bottle. It has annual sales of 360,000 – 60,000p = 120,000 and profits of $60,000. The manufacturer makes a profit of $180,000, which it charges up front. Observe that the use of a two-part tariff has increased supply chain profits from $180,000 to $240,000 even though the retailer DO has made a locally optimal pricing decision given the two-part tariff. A similar result can be obtained as long as the manufacturer sets the up-front fee ff to be any value between $120,000 and $180,000 with a wholesale price of CR = CM = 2.

- Volume-based quantity discount: Observe that the two-part tariff is really a volume-based quantity discount whereby the retailer DO pays a lower average unit cost as it purchases larger quantities each year (the franchise fee ff is amortized over more units). This observation can be made explicit by designing a volume-based discount scheme that gets the retailer DO to purchase and sell the quantity sold when the two stages coordinate their actions.

Recall that the coordinated solution results in a retail price of p = 3 + CM/2 = 3 + 2/2 = 4. This retail price results in total demand of dcoord = 360,000 – (60,000 X 4) = 120,000. The objective of the manufacturer is to design a volume-based discounting scheme that gets the retailer DO to buy (and sell) dcoord = 120,000 units each year. The pricing scheme must be such that retailer gets a profit of at least $60,000, and the manufacturer gets a profit of at least $120,000 (these are the profits that DO and the manufacturer made when their actions were not coordinated).

Several such pricing schemes can be designed. One such scheme is for the manufacturer to charge a wholesale price of CR = $4 per bottle (this is the same wholesale price that is optimal when the two stages are not coordinated) for annual sales below dcoord =120,000 units, and to charge CR = $3.50 (any value between $3.00 and $3.50 will work) if sales reach 120,000 or more (see worksheet Volume Discount). It is then optimal for DO to order 120,000 units in the year and price them at p = $4 per bottle to the customers (to ensure that they are all sold). The total profit earned by DO (360,000 – 60,000p) X (p – CR) = $60,000. The total profit earned by the manufacturer is 120,000 X (CR – $2) = 180,000 when CR = $3.50. The total supply chain profit is $240,000, which is higher than the $180,000 that the supply chain earned when actions were not coordinated.

If the manufacturer charges $3.00 (instead of $3.50) for sales of 120,000 units or more, it is still optimal for DO to order 120,000 units in the year and price them at p = $4 per bottle. The only difference is that the total profit earned by DO now increases to $120,000, whereas that for the manufacturer now drops to $120,000. The total supply chain profits remain at $240,000. The price that the manufacturer is able to charge (between $3.00 and $3.50) for sales of 120,000 or more will depend on the relative bargaining power of the two parties.

At this stage, we have seen that even in the absence of inventory-related costs, quantity discounts play a role in supply chain coordination and improved supply chain profits. Unless the manufacturer has large fixed costs associated with each lot, the discount schemes that are optimal are volume based and not lot-size based. It can be shown that even in the presence of large fixed costs for the manufacturer, a two-part tariff or volume-based discount, with the manufacturer passing on some of the fixed cost to the retailer, optimally coordinates the supply chain and maximizes profits given the assumption that customer demand decreases when the retailer increases price.

A key distinction between lot-size-based and volume discounts is that lot-size discounts are based on the quantity purchased per lot, not the rate of purchase. Volume discounts, in contrast, are based on the rate of purchase or volume purchased on average per specified time period (say, a month, quarter, or year). Lot-size-based discounts tend to raise the cycle inventory in the supply chain by encouraging retailers to increase the size of each lot. Volume-based discounts, in contrast, are compatible with small lots that reduce cycle inventory. Lot-size-based discounts make sense only when the manufacturer incurs high fixed cost per order. In all other instances, it is better to have volume-based discounts.

One can make the point that even with volume-based discounts, retailers will tend to increase the size of the lot toward the end of the evaluation period. For example, assume that the manufacturer offers DO a 2 percent discount if the number of bottles of Vitaherb purchased over a quarter exceeds 40,000. This policy will not affect the lot sizes DO orders early during the quarter, and DO will order in small lots to match the quantity ordered with demand. Consider a situation, however, in which DO has sold only 30,000 bottles with a week left before the end of the quarter. To get the quantity discount, DO may order 10,000 bottles over the last week even though it expects to sell only 3,000. In this case, cycle inventory in the supply chain goes up in spite of the fact that there is no lot-size-based quantity discount. The situation in which orders peak toward the end of a financial horizon is referred to as the hockey stick phenomenon because demand increases dramatically toward the end of a period, similar to the way a hockey stick bends upward toward its end. This phenomenon has been observed in many industries. One possible solution is to base the volume discounts on a rolling horizon. For example, each week the manufacturer may offer DO the volume discount based on sales over the past 12 weeks. Such a rolling horizon dampens the hockey stick phenomenon by making each week the last week in some 12-week horizon.

Thus far, we have discussed only the scenario in which the supply chain has a single retailer. One may ask whether our insights are robust and also apply if the supply chain has multiple retailers, each with different demand curves, all supplied by a single manufacturer. As one would expect, the form of the discount scheme to be offered becomes more complicated in these settings (typically, instead of having only one breakpoint at which the volume-based discount is offered, there are multiple breakpoints). The basic form of the optimal pricing scheme, however, does not change. The optimal discount continues to be volume based, with the average price charged to the retailers decreasing as the rate of purchase (volume purchased per unit time) increases.

PRICE DISCRIMINATION TO MAXIMIZE SUPPLIER PROFITS Price discrimination is the practice in which a firm charges different prices to maximize profits. An example of price discrimination is airlines: Passengers traveling on the same plane often pay different prices for their seats.

As discussed in Chapter 16, setting a fixed price for all units does not maximize profits for the manufacturer. In principle, the manufacturer can obtain the entire area under the demand curve above its marginal cost by pricing each unit differently based on customers’ marginal willingness to pay at each quantity. Quantity discounts are one mechanism for price discrimination because customers pay different prices based on the quantity purchased.

Next we discuss trade promotions and their impact on lot sizes and cycle inventory in the supply chain.

Source: Chopra Sunil, Meindl Peter (2014), Supply Chain Management: Strategy, Planning, and Operation, Pearson; 6th edition.

I have been browsing online more than 3 hours nowadays, but I by no means found any attention-grabbing article like yours. It is lovely worth enough for me. In my view, if all web owners and bloggers made good content as you did, the net might be much more useful than ever before. “No nation was ever ruined by trade.” by Benjamin Franklin.