1. THE MANAGERIAL LABOUR MARKET

There are two different strands of thought in the literature on the managerial labour market, which are central to our discussion here. There is first the idea of the labour market as complementary to the internal incentive and monitoring systems of the firm. A second distinct theme is the labour market as a substitute for internal control by shareholders.

The first view of the managerial labour market links in with the incentive properties of labour markets generally discussed in Chapter 6. If acceptable monitoring gambles cannot be constructed internally, termination of an agreement will be the mechanism used for penalising poor performance. The penalty will take the form either of a downward revision in salary or of a period of job search. Again, empirical estimates suggest that wealth effects from ‘performance-related dismissal decisions’33 are not great for CEOs and that therefore they are unlikely to be an important determinant of senior managerial effort.

The second view of the managerial labour market is more far reaching. Attempts have been made to see it as a means of circumventing the moral hazard problem entirely. The difficulties, outlined in section 5, of monitoring management effort will obviously be much less significant if alternative methods exist of ensuring compliance with shareholders’ wishes. Not surprisingly, the argument relies on the repeated game and the economics of reputation. As we saw in Chapter 5, an agency game that is repeated into the indefinite future enables the principal to judge performance against the average that would be expected if the agent is providing a given level of effort. In reality, of course, agency situations are not repeated indefinitely and neither do the conditions of the game remain unaltered over time. However, the theoretical background does suggest the point that repetition changes the nature of the game substantially and permits contractors to achieve agreements that would not be possible in the single game setting.

The use of information on an agent’s past performance can also be used in the repeated game setting. Further, if this past performance is known publicly it can be used in contracts with new principals. It is this mechanism that forms the basis of Fama’s (1980) model of the managerial labour market. In this model, a manager’s wages fall if he or she is associated with failure and rise if associated with success. Fama argues that managerial labour markets may result in a form of ex post ‘settling up’ whereby shirking is punished by future losses of income equivalent to the resulting shortfall in performance. Managers will then have an incentive to maintain their value on the labour market and will not shirk. The argument is similar to that developed by Alchian (1969). Much of the effort of academics in the fields of publication and research, he pointed out, is not the result of a desire to enhance the prestige of the institutions which employ them, or to serve the interests of the taxpayer, but derives from attempts to increase the value of the individual in the academic labour market. Thus, taxpayers or shareholders do not need to exercise close monitoring but can rely on market incentives to induce effort.

For this ‘ex post settling-up’ mechanism to work, it has to be assumed that managers recontract period by period and that they are effectively always selling their services on an external market. The whole of Chapter 6, however, was dedicated to the proposition that incentives required longterm commitments and the formation of internal labour markets. Further, it was there argued that reputations and ‘brand name capital’ were more costly for individual managers to establish than for firms. Is it possible to reconcile these points of view? The answer is that incentives based upon hierarchies and internal labour markets will develop in conditions of information asymmetry and task idiosyncrasy, but that eventually all such arrangements confront the central problem of this chapter – who monitors the person at the top? To this question there are several possible responses. The first is that the person at the top, whether a dominant shareholder or a manager, has a personal interest in the residual great enough to induce effort and ensure the viability of the organisation. This is the answer explored in section 4. The second response is that the top managers are constrained by shareholders who have access to informative signals and present top managers with appropriately structured monitoring gambles. This is the answer explored in section 5. Finally, there is the argument that managers will be subject to impersonal ‘market pressures’. ‘The market’ will force a penalty for poor performance. This is the answer suggested by Alchian and Fama, and reported in this section. Essentially, an appeal is made to some external force to restrain the behaviour of senior managers; in the case considered above, the force of competition in the managerial labour market.

The mechanism by which competition influences behaviour is still somewhat mysterious, however. We are asked to imagine a world in which a group of elite senior managers take a succession of posts and build up reputations for high-quality service which then become a valuable component of ‘human capital’. Intuitively plausible though this may be, there is a difficulty. Assume for the purposes of this paragraph that shareholders find it too costly to monitor managers and that the mechanisms explored in sections 4 and 5 are not operating. Managers in a dispersed corporation will be appointed by other managers. If attention to shareholders’ interests cannot be assumed on the part of managers promoted internally to the top of the hierarchy, there seems no good reason to assume that in their screening of senior managers from outside they will be any more efficient. Good outside applicants might simply highlight the shortcomings of the established group. If, on the other hand, we assume that internally promoted managers at the top of the tree are by convention moved to positions where their ability to damage the firm is limited, and that all senior appointments are under the control of a mobile manager, it is still not clear that, in choosing a successor, such a manager would have an incentive to pick the best candidate. He or she might attempt to portray his or her ‘reign’ in the best light by picking a poor successor unless the managerial labour market is very sophisticated and penalises failure in this function as surely as failure in internal monitoring. Arguments which attempt to show the power of ‘impersonal market forces’ therefore appear incomplete. Ultimately, they seem to come down to the idea that a mobile manager who contracts on the labour market at frequent intervals will not shirk because s/he believes that other managers will penalise him/her later if s/he does. These other managers penalise him/her because they believe that if they do not do so they themselves will be penalised by other managers elsewhere who believe the same, and so on. The joint-stock enterprise survives through the power of shared beliefs, an institutional proof of the existence of collective levitation.

The power of shared beliefs is not to be underestimated, but we might expect these beliefs to be more durable if founded on something more substantial than thin air. Shareholders may not need to implement detailed monitoring to motivate managers but if they want managers to pursue shareholders’ objectives they will have to be powerful enough to influence senior appointments and thus to ensure that it is shareholders’ interests that are communicated through the managerial labour market rather than those of some other group.34 This influence of shareholders on senior appointments may be exercised in the ways covered in sections 4 and 5, although, once more, it is widely considered to be ineffective. Shleifer and Vishny (1988) chart what they see as the general weakness of internal controls on management and specifically draw attention to the fact that the Board does not even exercise choice of the CEO at the point of succession. If this is so, some other force is required to induce managers to consider shareholders’ interests. It is here that the role of the takeover mechanism enters the picture. General shareholder influence on appointments, it is argued, can be brought to bear through the threat of takeover by new shareholders rather than the direct influence of existing ones.

If senior managers are constrained by outside forces it is because they know that there are people outside the firm who are alert enough to spot a team operating short of its potential and with an incentive to act on that information. Competition is not an automatic impersonal force; it operates through the activities of the entrepreneur, and it is the entrepreneur with his/her accompanying threat of unexpected change who provides the managerial incentives. In Chapter 9, it is argued not simply that the takeover is an alternative to the managerial labour market as a device for encouraging profit-orientated behaviour, but that the effectiveness of that market can itself only be understood in conjunction with the possibility of entrepreneurial intervention and the restructuring of property rights which this can bring about. Before investigating the takeover, however, we look at competition in the product market as another constraint on managerial behaviour.

2. THE PRODUCT MARKET

Competition in the product market is widely considered an incentive to effort. Monopolists are popularly supposed to take much of their profit in the form of a quiet life, while competition is expected to reduce the capacity of managers to indulge in discretionary behaviour. In the case of perfect competition, elementary textbooks imply that all discretion disappears. We do what must be done and survive, or we do something else and perish. This has led many neoclassical economists to assume that, provided product markets are competitive, problems of the division of ownership from control can safely be ignored.35

Behavioural theorists, such as Leibenstein, who coined the term ‘X- inefficiency’ to describe the achievement of less than the maximum output technically possible from given inputs, and who has developed his own approach to the internal workings of the firm, also assign a prominent role to competition. In Leibenstein (1979), the incomplete nature of employment contracts and the necessity for monitoring are recognised. A theory of average production costs is then developed. As the effort of workers increases, money costs per unit of output fall. Effort depends on ‘pressure’, either from peers (horizontal pressure) or from superiors (vertical pressure).

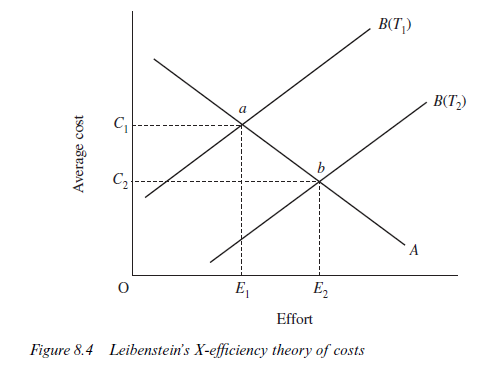

The degree of pressure is, in turn, a function of average costs. As costs rise, the survival of the firm is threatened and the pressure on the individual to ‘pull his weight’ is increased. Diagrammatically, Leibenstein’s approach is summarised in Figure 8.4. Curve A shows how costs depend on effort. Curve B(T1) shows how effort increases as costs rise (because of more intensive monitoring or ‘pressure’). The equilibrium is at point a with average costs C1 and effort E1.

Competition enters Leibenstein’s theory in the form of ‘environmental tightness’, which influences the position of curve B. For any given level of average costs, ‘pressure’ and hence ‘effort’ will be lower the more protected is the firm from competition. Conversely, as ‘environmental tightness’ increases, effort will increase at each level of costs. If ‘tightness’ increases from Tj to T2, the new position of equilibrium will be point b. If effort increases to E2, costs fall to C2 and the firm becomes more ‘X- efficient’. Leibenstein’s approach has been subjected to much criticism by neoclassical economists (Stigler, 1976, De Alessi, 1983). First, they object to the idea that failure to ‘maximise’ output is in any sense inefficient. As we have seen, the existence of agency costs is perfectly compatible with efficiency if it does not benefit anyone to reduce them.36 Second, they dislike Leibenstein’s behavioural insistence that individual people facing problems of bounded rationality cannot be regarded as rational ‘utility

maximisers’.37 Third, the ability of the theory to produce refutable predictions is questioned.38

For our present purposes, however, the relationship between ‘environmental tightness’ and monitoring ‘pressure’ is of central interest. The relationship has intuitive appeal but the mechanism is not clearly specified. If many firms in a particular market had dispersed shareholdings, for example, what would impel the managers to greater effort? Just because there are many firms, are we saying that property rights no longer matter, and that twenty nationalised firms in a market will behave like twenty joint- stock firms, or twenty closely held ones? Presumably this cannot be correct. As Jensen and Meckling (1976, p. 330) express it: ‘the existence of competition in product and factor markets will not eliminate the agency costs due to managerial control problems …Ifmy competitors all incur agency costs equal to or greater than mine I will not be eliminated from the market by their competition.’ The argument is therefore identical to that used in section 6 to question the role of competition in the managerial labour market.

Once more our basic difficulty is caused by attempting to talk about competition without the entrepreneur. Our instinctive feeling that competition does matter requires a more detailed look at the types of firm that are involved in a particular market, and the provisions of the contracts offered to managers. This is attempted in a paper by Hart (1983). Hart starts by assuming that managers are extremely risk averse. Their preferences are such that the indifference curves illustrated in Figure 5.2 would be L-shaped. From the analysis of Chapter 5, it is evident that we cannot offer such a manager incentives based upon sharing the risk. If effort is unobservable, the best that can be done is to pay the manager a fixed timerate conditional upon achieving some minimum level of performance (profit). Hart does not intend this to be realistic, but merely convenient for illustrating the working of his model. He then assumes that there are two types of firm: ‘entrepreneurial’39 and ‘managerial’. The only difference between these two types is that managerial effort can be monitored in the ‘entrepreneurial’ firm. Achieving this monitoring potential is not costless, however, and, again for simplicity, Hart assumes that there are additional fixed costs incurred in setting up an entrepreneurial firm relative to a managerial firm.

Where people are able to set up either managerial or entrepreneurial structures, Hart shows that if v is the proportion of entrepreneurial firms, there is a market equilibrium with v A 0. There will, in other words, be both entrepreneurial and managerial firms in the market. The intuition behind this result is as follows. Suppose that v = 0 and only managerial firms exist, then agency costs will be great and considerable managerial shirking will occur. If this is so, however, it may be profitable to set up an entrepreneurial firm and accept the additional fixed costs necessary to reduce managerial shirking. The argument is similar to that used to demonstrate the potential benefits from a takeover raid (see Chapter 9), but here we are allowing for the possibility that instead of changing an existing managerial firm into an entrepreneurial one via a raid, we can simply set up a new firm. As new entrepreneurial firms enter the market, however, industry output increases and the price of the product falls. This makes it more difficult for managers to achieve their minimum profit constraint and their effort level will rise. The rise in managerial effort which accompanies a fall in product price implies that the industry will not necessarily come to be composed entirely of entrepreneurial firms. To see this, consider the case of v = 1. Managerial shirking is at a minimum and product price is at its lowest. The entry of a managerial firm might now be profitable since the low market price will ensure high managerial effort and the fixed costs of instituting monitoring devices can be dispensed with. Thus, managerial firms will displace entrepreneurial ones until an equilibrium position is reached.

Hart’s model implies therefore that ‘entrepreneurial firms provide a source of discipline for managerial firms’.40 The market mechanism can indeed function as an incentive scheme but it does so through the medium of the entry of entrepreneurial firms which affect market price and induce greater effort from managers, who are assumed to have a rather special contract. As Hart points out, ‘if managerial tastes are less extreme, ordinary salary incentive schemes will become more effective in reducing managerial slack, and competition will become less important’ (p. 381). This possibility has already been discussed in sections 4 and 5.

Another mechanism by which competition might influence management behaviour is by providing comparators in the design of incentive contracts. Performance relative to other firms in an industry can be used as the basis of managerial remuneration. This sharpens incentives because general external ‘shocks’ which affect all firms in an industry similarly will no longer be attributable to managerial competence. Only relative performance will be rewarded or penalised. We have already observed that such contracts do not figure prominently in the remuneration of CEOs. However, in the absence of specific incentive contracts it is still possible that Fama’s ex post settling-up mechanism in the managerial labour market (discussed in section 6) is more effective when there is product-market competition than when there is no competition. The information about managerial competence available to this market is better when it comes out of an environment in which each manager has been pitted against other managers facing similar ‘general’ environmental difficulties.41 In a study of 670 UK companies, Nickell (1996, p. 741) found some support for the proposition that higher levels of competition (as measured by higher numbers of competitors or lower monopoly rents) were associated with higher rates of total factor productivity growth.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

You should take part in a contest for one of the best blogs on the web. I will suggest this website!

Some really interesting points you have written.Assisted me a lot, just what I was looking for : D.