Throughout this chapter, the perpetual inventory system was used to record purchases and sales of merchandise. Not all merchandise businesses, however, use the perpetual inventory system. For example, small merchandise businesses, such as a local hardware store, may use a manual accounting system. A manual perpetual inventory system is time consuming and costly to maintain. In this case, the periodic inventory system may be used.

1. Cost of Merchandise Sold Using the Periodic Inventory System

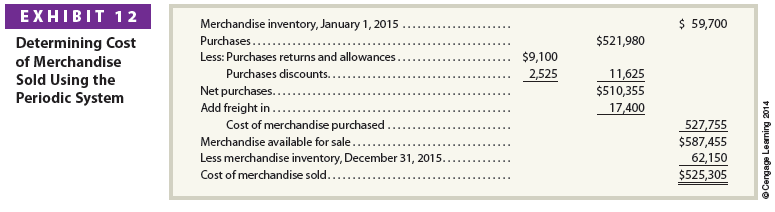

In the periodic inventory system, sales are recorded in the same manner as in the perpetual inventory system. However, the cost of merchandise sold is not recorded on the date of sale. Instead, the cost of merchandise sold is determined at the end of the period as shown in Exhibit 12 for NetSolutions.

2. Chart of Accounts under the Periodic Inventory System

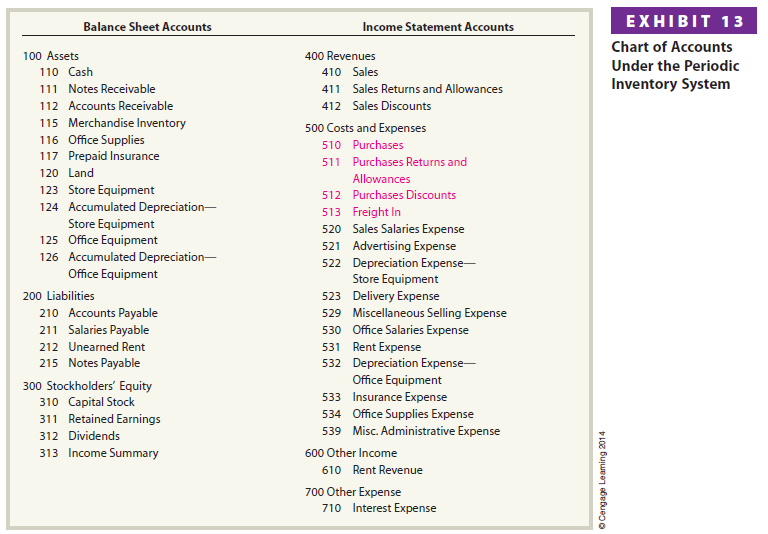

The chart of accounts under a periodic inventory system is shown in Exhibit 13. The accounts used to record transactions under the periodic inventory system are highlighted in Exhibit 13.

3. Recording Merchandise Transactions under the Periodic Inventory System

Using the periodic inventory system, purchases of inventory are not recorded in the merchandise inventory account. Instead, purchases, purchases discounts, and purchases returns and allowances accounts are used. In addition, the sales of merchandise are not recorded in the inventory account. Thus, there is no detailed record of the amount of inventory on hand at any given time. At the end of the period, a physical count of merchandise inventory on hand is taken. This physical count is used to determine the cost of merchandise sold as shown in Exhibit 12.

The use of purchases, purchases discounts, purchases returns and allowances, and freight in accounts are described below.

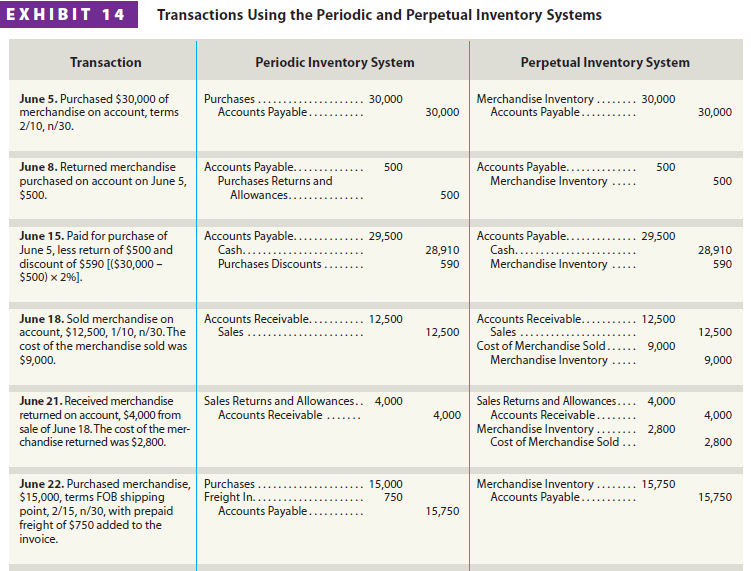

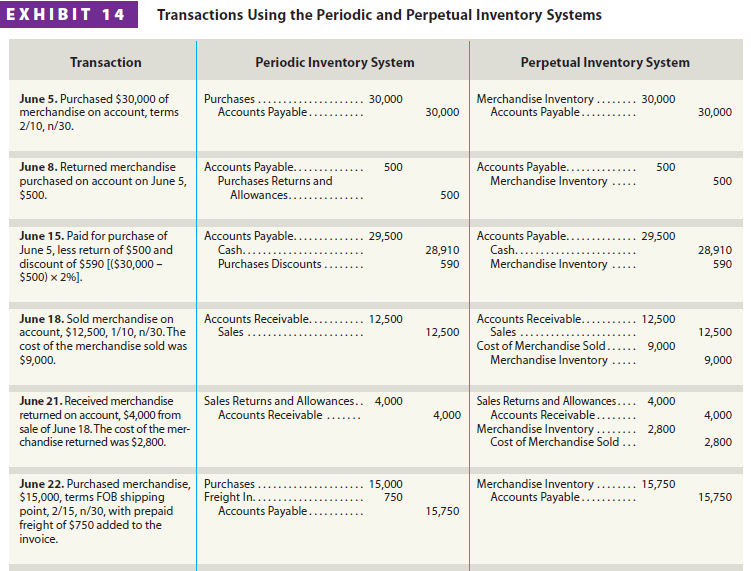

Purchases Purchases of inventory are recorded in a purchases account rather than in the merchandise inventory account. Purchases is debited for the invoice amount of a purchase.

Purchases Discounts Purchases discounts are normally recorded in a separate purchases discounts account. The balance of the purchases discounts account is reported as a deduction from Purchases for the period. Thus, Purchases Discounts is a contra (or offsetting) account to Purchases.

Purchases returns and Allowances Purchases returns and allowances are recorded in a similar manner as purchases discounts. A separate purchases returns and allowances account is used to record returns and allowances. Purchases returns and allowances are reported as a deduction from Purchases for the period. Thus, Purchases Returns and Allowances is a contra (or offsetting) account to Purchases.

Freight In When merchandise is purchased FOB shipping point, the buyer pays for the freight. Under the periodic inventory system, freight paid when purchasing merchandise FOB shipping point is debited to Freight In, Transportation In, or a similar account.

The preceding periodic inventory accounts and their effect on the cost of merchandise purchased are summarized below.

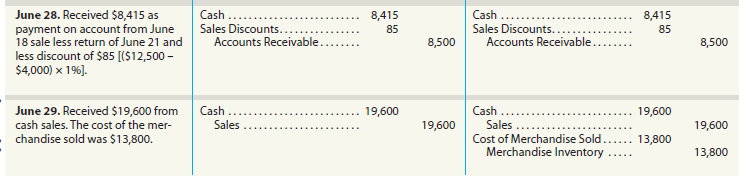

Exhibit 14 illustrates the recording of merchandise transactions using the periodic system. As a review, Exhibit 14 also illustrates how each transaction would have been recorded using the perpetual system.

4. Adjusting Process Under the Periodic Inventory System

The adjusting process is the same under the periodic and perpetual inventory systems except for the inventory shrinkage adjustment. The ending merchandise inventory is determined by a physical count under both systems.

Under the perpetual inventory system, the ending inventory physical count is compared to the balance of Merchandise Inventory. The difference is the amount of inventory shrinkage. The inventory shrinkage is then recorded as a debit to Cost of Merchandise Sold and a credit to Merchandise Inventory.

Under the periodic inventory system, the merchandise inventory account is not kept up to date for purchases and sales. As a result, the inventory shrinkage cannot be directly determined. Instead, any inventory shrinkage is included indirectly in the computation of the cost of merchandise sold as shown in Exhibit 12. This is a major disadvantage of the periodic inventory system. That is, under the periodic inventory system, inventory shrinkage is not separately determined.

5. Financial Statements under the Periodic Inventory System

The financial statements are similar under the perpetual and periodic inventory systems. When the multiple-step format of income statement is used, the cost of merchandise sold may be reported as shown in Exhibit 12.

6. Closing Entries under the Periodic Inventory System

The closing entries differ in the periodic inventory system in that there is no cost of merchandise sold account to close to Income Summary. Instead, the purchases, purchases discounts, purchases returns and allowances, and freight in accounts are closed to Income Summary. In addition, the merchandise inventory account is adjusted to the end-of-period physical inventory count during the closing process.

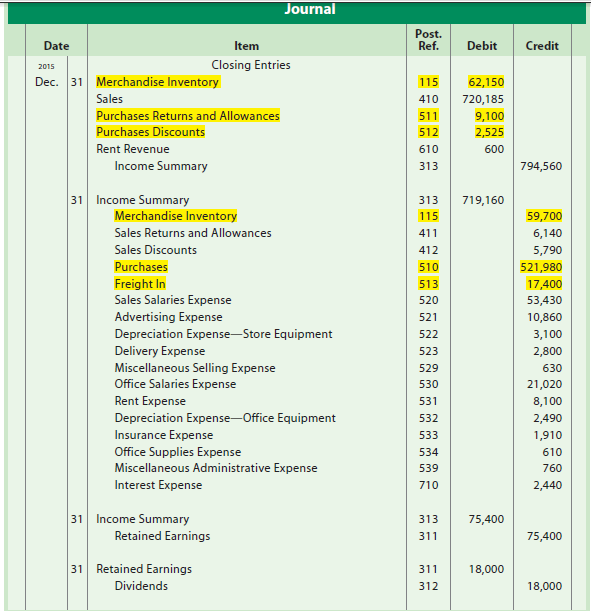

The four closing entries under the periodic inventory system are as follows:

- Debit each temporary account with a credit balance, such as Sales, for its balance and credit Income Summary. Since Purchases Discounts and Purchases Returns and Allowances are temporary accounts with credit balances, they are debited for their balances. In addition, Merchandise Inventory is debited for its end-of-period balance based on the end-of-period physical inventory.

- Credit each temporary account with a debit balance, such as the various expenses, and debit Income Summary. Since Sales Returns and Allowances, Sales Discounts, Purchases, and Freight In are temporary accounts with debit balances, they are credited for their balances. In addition, Merchandise Inventory is credited for its balance as of the beginning of the period.

- Debit Income Summary for the amount of its balance (net income) and credit the retained earnings account. The accounts debited and credited are reversed if there is a net loss.

- Debit the retained earnings account for the balance of the dividends account and credit the dividends account.

The four closing entries for NetSolutions under the periodic inventory system are shown on the next page.

In the first closing entry, Merchandise Inventory is debited for $62,150. This is the ending physical inventory count on December 31, 2015. In the second closing entry, Merchandise Inventory is credited for its January 1, 2015, balance of $59,700. In this way, the closing entries highlight the importance of the beginning and ending balances of Merchandise Inventory in determining the cost of merchandise sold, as shown in Exhibit 12. After the closing entries are posted, Merchandise Inventory will have a balance of $62,150. This is the amount reported on the December 31, 2015, balance sheet.

In the preceding closing entries, the periodic accounts are highlighted in color. Under the perpetual inventory system, the highlighted periodic inventory accounts are replaced by the cost of merchandise sold account.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Attractive section of content. I just stumbled upon your web site and in accession capital to assert that I acquire actually enjoyed account your blog posts. Any way I will be subscribing to your feeds and even I achievement you access consistently rapidly.