Remember our discussion of equivalent annual costs in Chapter 6? We defined the equivalent annual cost of, say, a machine as the annual rental payment sufficient to cover the present value of all the costs of owning and operating it.

In Chapter 6’s examples, the rental payments were hypothetical—just a way of converting a present value to an annual cost. But in the leasing business the payments are real. Suppose you decide to lease a machine tool for one year. What will the rental payment be in a competitive leasing industry? The lessor’s equivalent annual cost, of course.

1. Example of an Operating Lease

The boyfriend of the daughter of the CEO of Establishment Industries takes her to the senior prom in a pearly white stretch limo. The CEO is impressed. He decides Establishment Industries ought to have one for VIP transportation. Establishment’s CFO prudently suggests a one- year operating lease instead and approaches Acme Limolease for a quote.

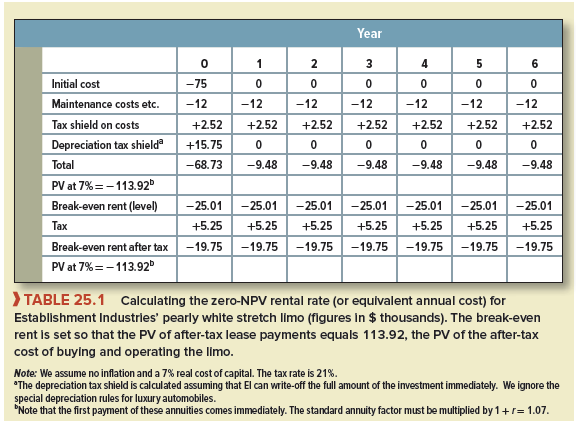

Table 25.1 shows Acme’s analysis. Suppose it buys a new limo for $75,000 that it plans to lease out for seven years (years 0 through 6). The table gives Acme’s forecasts of operating, maintenance, and administrative costs, the latter including the costs of negotiating the lease, keeping track of payments and paperwork, and finding a replacement lessee when Establishment’s year is up. For simplicity, we assume zero inflation and use a 7% real cost of capital.

We also assume that the limo will have zero salvage value at the end of year 6. The present value of all costs, partially offset by the value of depreciation tax shields,6 is $113,920. Now, how much does Acme have to charge to break even?

Acme can afford to buy and lease out the limo only if the rental payments forecasted over six years have a present value of at least $113,920. We follow common leasing practice and assume rental payments in advance.7 The problem, then, is to calculate a six-year annuity due with a present value of $113,920.

As Table 25.1 shows, the required annuity is $19,750.8 This annuity’s present value (after taxes) exactly equals the present value of the after-tax costs of owning and operating the limo. The annuity provides Acme with a competitive expected rate of return (7%) on its investment. Acme could try to charge Establishment Industries more than $19,750, but if the CFO is smart enough to ask for bids from Acme’s competitors, the winning lessor will end up receiving this amount.

Remember that Establishment Industries is not compelled to use the limo for more than one year. Acme may have to find several new lessees over the limo’s economic life. Even if Establishment continues, it can renegotiate a new lease at whatever rates prevail in the future. Thus Acme does not know what it can charge in year 1 or afterward. If pearly white falls out of favor with teenagers and CEOs, Acme is probably out of luck.

In real life, Acme would have several further things to worry about. For example, how long will the limo stand idle when it is returned at year 1? If idle time is likely before a new lessee is found, then lease rates have to be higher to compensate.9

In an operating lease, the lessor absorbs these risks, not the lessee. The discount rate used by the lessor must include a premium sufficient to compensate its shareholders for the risks of buying and holding the leased asset. In other words, Acme’s 7% real discount rate must cover the risks of investing in stretch limos. (As we see in the next section, risk bearing in financial leases is fundamentally different.)

2. Lease or Buy?

If you need a car or limo for only a day or a week you will surely rent it; if you need one for five years you will probably buy it. In between, there is a gray region in which the choice of lease or buy is not obvious. The decision rule should be clear in concept, however: If you need an asset for your business, buy it if the equivalent annual cost of ownership and operation is less than the best lease rate you can get from an outsider. In other words, buy if you can rent to yourself cheaper than you can rent from others. (Again we stress that this rule applies to operating leases.)

If you plan to use the asset for an extended period, your equivalent annual cost of owning the asset will usually be less than the operating lease rate. The lessor has to mark up the lease rate to cover the costs of negotiating and administering the lease, the foregone revenues when the asset is off-lease and idle, and so on. These costs are avoided when the company buys and rents to itself.

There are two cases in which operating leases may make sense even when the company plans to use an asset for an extended period. First, the lessor may be able to buy and manage the asset at less expense than the lessee. For example, the major truck leasing companies buy thousands of new vehicles every year. That puts them in an excellent bargaining position with truck manufacturers. These companies also run very efficient service operations, and they know how to extract the most salvage value when trucks wear out and it is time to sell them. A small business, or a small division of a larger one, cannot achieve these economies and often finds it cheaper to lease trucks than to buy them.

Second, operating leases often contain useful options. Suppose Acme offers Establishment Industries the following two leases:

- A one-year lease for $26,000.

- A six-year lease for $28,000, with the option to cancel the lease at any time from year 1 on.[1] [2]

The second lease has obvious attractions. Suppose Establishment’s CEO becomes fond of the limo and wants to use it for a second year. If rates increase, lease 2 allows Establishment to continue at the old rate. If rates decrease, Establishment can cancel lease 2 and negotiate a lower rate with Acme or one of its competitors.

Of course, lease 2 is a more costly proposition for Acme: In effect it gives Establishment an insurance policy protecting it from increases in future lease rates. The difference between the costs of leases 1 and 2 is the annual insurance premium. But lessees may happily pay for insurance if they have no special knowledge of future asset values or lease rates. A leasing company acquires such knowledge in the course of its business and can generally sell such insurance at a profit.

Airlines face fluctuating demand for their services and the mix of planes that they need is constantly changing. Most airlines, therefore, lease a proportion of their fleet on a short-term, cancelable basis and are willing to pay a premium to lessors for bearing the cancelation risk. Specialist aircraft lessors are prepared to bear this risk because they are well-placed to find new customers for any aircraft that are returned to them. Aircraft owned by specialist lessors spend less time parked and more time flying than aircraft owned by airlines.11

Be sure to check out the options before you sign (or reject) an operating lease.

24 Jun 2021

25 Jun 2021

25 Jun 2021

24 Jun 2021

24 Jun 2021

25 Jun 2021