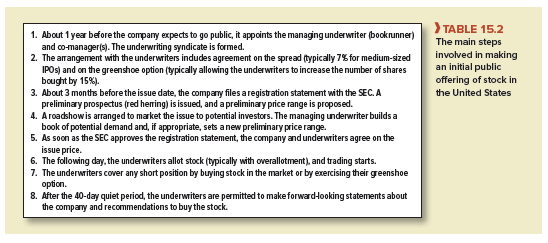

Table 15.2 summarizes the main steps involved in making an initial public offering of stock in the United States. You can see that Marvin’s new issue was a typical IPO in almost every respect. In particular, most IPOs in the United States use the bookbuilding method in which the underwriter builds a book of likely orders and uses this information to set the issue price.

The bookbuilding method is, in some ways, like an auction since potential buyers indicate how many shares they are prepared to buy at given prices. However, these indications are not binding and are used only as a guide to fix the price of the issue. The advantage of the bookbuilding method is that it allows underwriters to give preference to those investors whose bids are most helpful in setting the issue price and to offer them a reward in the shape of underpric- ing.[1] Critics of bookbuilding point to the abuses of the 1990s and emphasize the dangers of allowing the underwriter to decide who is allotted stock.

Bookbuilding has rapidly gained popularity throughout the world, but it is not the only way to sell new stock. One alternative is to conduct an open auction. In this case, investors are invited to submit their bids, stating how many shares they wish to buy and the price. The securities are then sold to the highest bidders. Most governments, including the U.S. Treasury, sell their bonds by auction. In the United States, auctions of common stock are rare. However, in 2004, Google simultaneously raised eyebrows and $1.7 billion in the world’s largest initial public offering to be sold by auction.[2]

Fans of auctions often point to countries such as France, Israel, and Japan, where auctions were once commonly used to sell new issues of stock. Japan is a particularly interesting case because the bookbuilding method was widely used until it was revealed that investment banks had been allocating shares in hot IPOs to government officials. In 1989, the finance ministry responded to this scandal by ruling that in the future all IPOs were to be auctioned.

This resulted in a sharp fall in underpricing. However, in 1997, the restrictions were lifted, bookbuilding returned to favor, and the level of underpricing increased.36

Types of Auction: A Digression

Suppose that a government wishes to auction 4 million bonds and three would-be buyers submit bids. Investor A bids $1,020 each for 1 million bonds, B bids $1,000 for 3 million bonds, and C bids $980 for 2 million bonds. The bids of the two highest bidders (A and B) absorb all the bonds on offer and C is left empty-handed. What price do the winning bidders, A and B, pay?

The answer depends on whether the sale is a discriminatory auction or a uniform-price auction. In a discriminatory auction, every winner is required to pay the price that he or she bid. In this case, A would pay $1,020 and B would pay $1,000. In a uniform-price auction, both would pay $1,000, which is the price of the lowest winning bidder (investor B).

It might seem from our example that the proceeds from a uniform-price auction would be lower than from a discriminatory auction. But this ignores the fact that the uniform-price auction provides better protection against the winner’s curse. Wise bidders know that there is little cost to overbidding in a uniform-price auction, but there is potentially a very high cost to doing so in a discriminatory auction.37 Economists therefore often argue that the uniform- price auction should result in higher proceeds.38

Sales of bonds by the U.S. Treasury used to take the form of discriminatory auctions so that successful buyers paid their bid. However, in 1998, the government switched to a uniform-price auction.

outstanding content, i like it