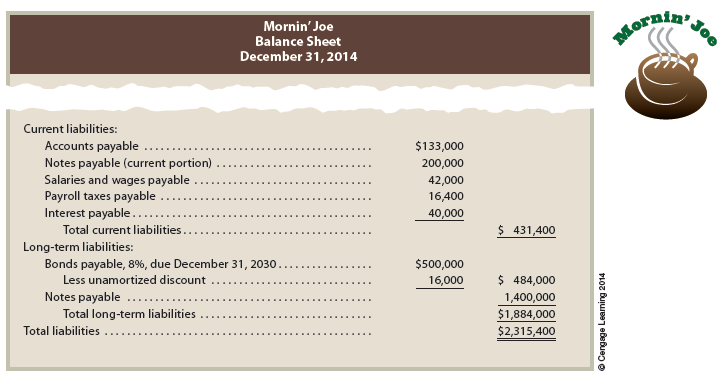

Bonds payable and notes payable are reported as liabilities on the balance sheet. Any portion of the bonds or notes that is due within one year is reported as a current liability. Any remaining bonds or notes are reported as a long-term liability.

Any unamortized premium is reported as an addition to the face amount of the bonds. Any unamortized discount is reported as a deduction from the face amount of the bonds. A description of the bonds and notes should also be reported either on the face of the financial statements or in the accompanying notes.

The reporting of bonds and notes payable for Mornin’ Joe is shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

WONDERFUL Post.thanks for share..extra wait .. …

Hello. Great job. I did not imagine this. This is a impressive story. Thanks!