Patents, copyrights, trademarks, and goodwill are long-lived assets that are used in the operations of a business and are not held for sale. These assets are called intangible assets because they do not exist physically.

The accounting for intangible assets is similar to that for fixed assets. The major issues are:

Determining the initial cost.

Determining the amortization, which is the amount of cost to transfer to expense.

Amortization results from the passage of time or a decline in the usefulness of the intangible asset.

1. Patents

Manufacturers may acquire exclusive rights to produce and sell goods with one or more unique features. Such rights are granted by patents, which the federal government issues to inventors. These rights continue in effect for 20 years. A business may purchase patent rights from others, or it may obtain patents developed by its own research and development.

The initial cost of a purchased patent, including any legal fees, is debited to an asset account. This cost is written off, or amortized, over the years of the patent’s expected useful life. The expected useful life of a patent may be less than its legal life. For example, a patent may become worthless due to changing technology or consumer tastes.

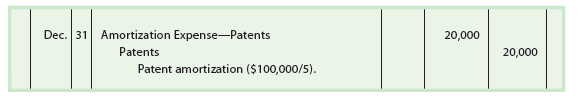

Patent amortization is normally computed using the straight-line method. The amortization is recorded by debiting an amortization expense account and crediting the patents account. A separate contra asset account is usually not used for intangible assets.

To illustrate, assume that at the beginning of its fiscal year, a company acquires patent rights for $100,000. Although the patent will not expire for 14 years, its remaining useful life is estimated as five years. The adjusting entry to amortize the patent at the end of the year is as follows:

Some companies develop their own patents through research and development. In such cases, any research and development costs are usually recorded as current operating expenses in the period in which they are incurred. This accounting for research and development costs is justified on the basis that any future benefits from research and development are highly uncertain.

2. Copyrights and Trademarks

The exclusive right to publish and sell a literary, artistic, or musical composition is granted by a copyright. Copyrights are issued by the federal government and extend for 70 years beyond the author’s death. The costs of a copyright include all costs of creating the work plus any other costs of obtaining the copyright. A copyright that is purchased is recorded at the price paid for it. Copyrights are amortized over their estimated useful lives.

A trademark is a name, term, or symbol used to identify a business and its products. Most businesses identify their trademarks with ® in their advertisements and on their products.

Under federal law, businesses can protect their trademarks by registering them for 10 years and renewing the registration for 10-year periods. Like a copyright, the legal costs of registering a trademark are recorded as an asset.

If a trademark is purchased from another business, its cost is recorded as an asset. In such cases, the cost of the trademark is considered to have an indefinite useful life. Thus, trademarks are not amortized. Instead, trademarks are reviewed periodically for impaired value. When a trademark is impaired, the trademark should be written down and a loss recognized.

3. Goodwill

Goodwill refers to an intangible asset of a business that is created from such favorable factors as location, product quality, reputation, and managerial skill. Goodwill allows a business to earn a greater rate of return than normal.

Generally accepted accounting principles (GAAP) allow goodwill to be recorded only if it is objectively determined by a transaction. An example of such a transaction is the purchase of an entity at a price in excess of the fair value of its net assets (assets – liabilities). The excess is recorded as goodwill and reported as an intangible asset.

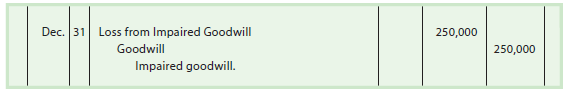

Unlike patents and copyrights, goodwill is not amortized. However, a loss should be recorded if the future prospects of the purchased entity become impaired. This loss would normally be disclosed in the Other Expense section of the income statement.

To illustrate, assume that on December 31 FaceCard Company has determined that $250,000 of the goodwill created from the purchase of Electronic Systems is impaired. The entry to record the impairment is as follows:

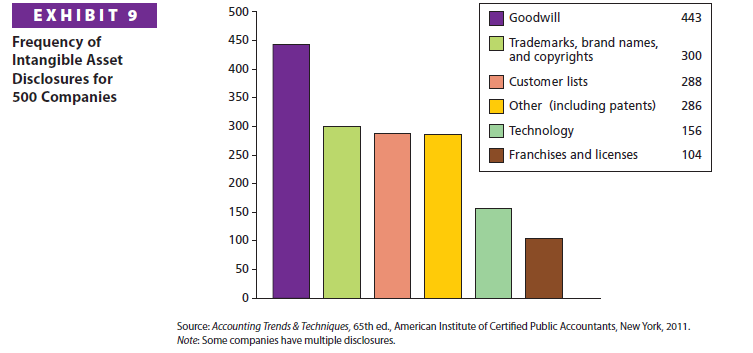

Exhibit 9 shows intangible asset disclosures for 500 large companies. Goodwill is the most often reported intangible asset. This is because goodwill arises from merger transactions, which are common.

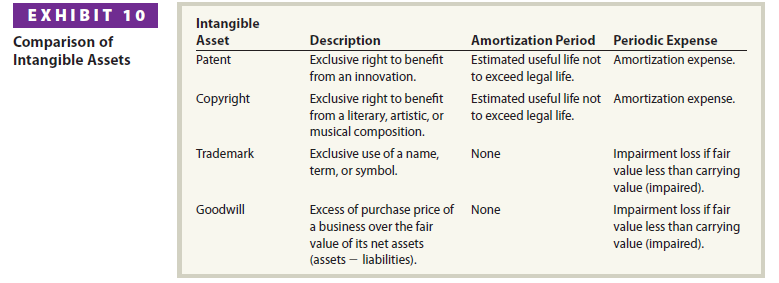

Exhibit 10 summarizes the characteristics of intangible assets.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Thanks a lot for sharing this with all of us you really know what you’re talking about! Bookmarked. Kindly also visit my site =). We could have a link exchange arrangement between us!