As with other sections of the balance sheet, alternative terms and formats may be used in reporting stockholders’ equity. Also, changes in retained earnings and paid-in capital may be reported in separate statements or notes to the financial statements.

1. Stockholders’ Equity on the Balance Sheet

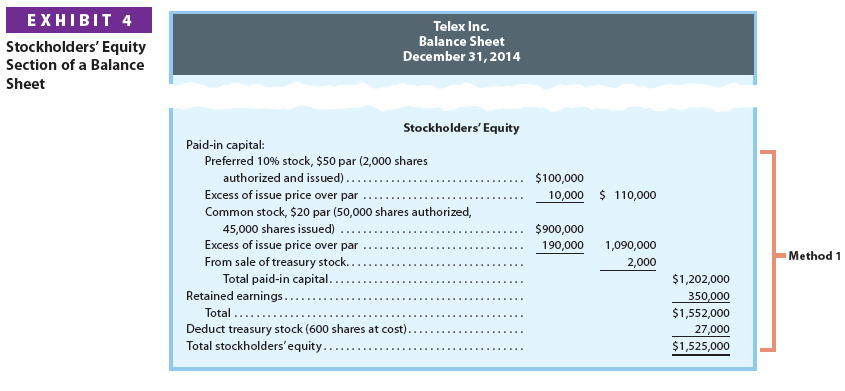

Exhibit 4 shows two methods for reporting stockholders’ equity for the December 31, 2014, balance sheet for Telex Inc.

Method 1. Each class of stock is reported, followed by its related paid-in capital accounts.

Retained earnings is then reported followed by a deduction for treasury stock.

Method 2. The stock accounts are reported, followed by the paid-in capital reported as a single item, Additional paid-in capital.

Retained earnings is then reported followed by a deduction for treasury stock.

Significant changes in stockholders’ equity during a period may also be presented in a statement of stockholders’ equity or in the notes to the financial statements. The statement of stockholders’ equity is illustrated later in this section.

Relevant rights and privileges of the various classes of stock outstanding should also be reported.9 Examples include dividend and liquidation preferences, conversion rights, and redemption rights. Such information may be disclosed on the face of the balance sheet or in the notes to the financial statements.

2. Reporting Retained Earnings

Changes in retained earnings may be reported using one of the following:

- Separate retained earnings statement

- Combined income and retained earnings statement

- Statement of stockholders’ equity

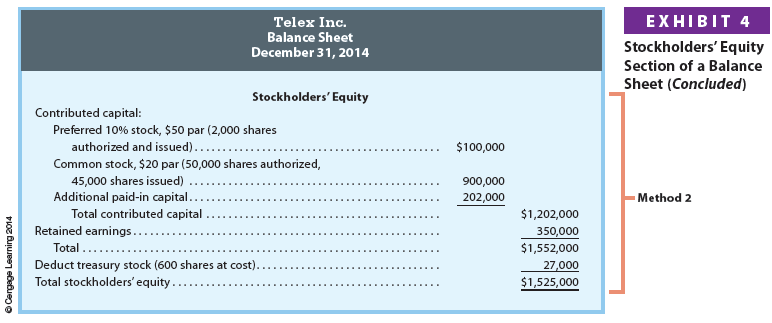

Changes in retained earnings may be reported in a separate retained earnings statement. When a separate retained earnings statement is prepared, the beginning balance of retained earnings is reported. The net income is then added (or net loss is subtracted) and any dividends are subtracted to arrive at the ending retained earnings for the period.

To illustrate, a retained earnings statement for Telex Inc. is shown in Exhibit 5.

Changes in retained earnings may also be reported in combination with the income statement. This format emphasizes net income as the connecting link between the income statement and ending retained earnings. Since this format is not often used, we do not illustrate it.

Changes in retained earnings may also be reported in a statement of stockholders’ equity. An example of reporting changes in retained earnings in a statement of stockholders’ equity for Telex Inc. is shown in Exhibit 6.

Restrictions The use of retained earnings for payment of dividends may be restricted by action of a corporation’s board of directors. Such restrictions, sometimes called appropriations, remain part of the retained earnings.

Restrictions of retained earnings are classified as:

- Legal. State laws may require a restriction of retained earnings.

Example: States may restrict retained earnings by the amount of treasury stock purchased. In this way, legal capital cannot be used for dividends.

- Contractual. A corporation may enter into contracts that require restrictions of retained earnings.

Example: A bank loan may restrict retained earnings so that money for repaying the loan cannot be used for dividends.

- Discretionary. A corporation’s board of directors may restrict retained earnings voluntarily.

Example: The board may restrict retained earnings and, thus, limit dividend distributions so that more money is available for expanding the business.

Restrictions of retained earnings must be disclosed in the financial statements. Such disclosures are usually included in the notes to the financial statements.

Prior Period Adjustments An error may arise from a mathematical mistake or from a mistake in applying accounting principles. Such errors may not be discovered within the same period in which they occur. In such cases, the effect of the error should not affect the current period’s net income. Instead, the correction of the error, called a prior period adjustment, is reported in the retained earnings statement. Such corrections are reported as an adjustment to the beginning balance of retained earnings.10

3. Statement of Stockholders’ Equity

When the only change in stockholders’ equity is due to net income or net loss and dividends, a retained earnings statement is sufficient. However, when a corporation also has changes in stock and paid-in capital accounts, a statement of stockholders’ equity is normally prepared.

A statement of stockholders’ equity is normally prepared in a columnar format. Each column is a major stockholders’ equity classification. Changes in each classification are then described in the left-hand column. Exhibit 6 illustrates a statement of stockholders’ equity for Telex Inc.

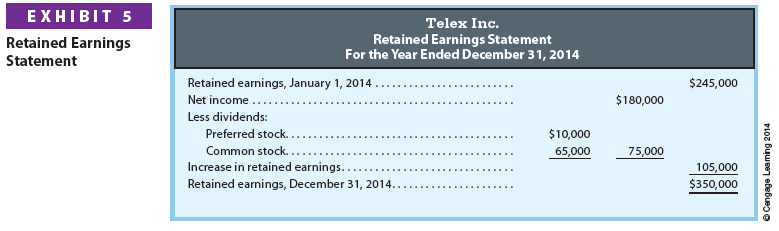

4. Reporting Stockholders’ Equity for Mornin’ Joe

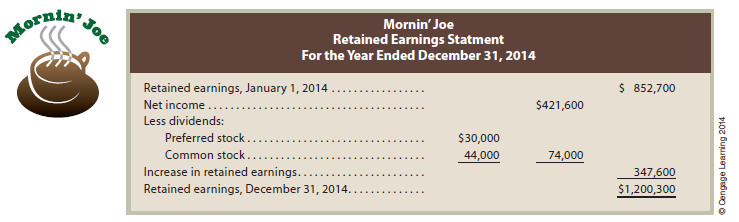

Mornin’ Joe reports stockholders’ equity in its balance sheet. Mornin’ Joe also includes a retained earnings statement and statement of stockholders’ equity in its financial statements.

The Stockholders’ Equity section of Mornin’ Joe’s balance sheet as of December 31, 2014, is shown below.

Mornin’ Joe’s retained earnings statement for the year ended December 31, 2014, is as follows:

The statement of stockholders’ equity for Mornin’ Joe is shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021