A spreadsheet (work sheet) may be used in preparing the statement of cash flows. However, whether or not a spreadsheet (work sheet) is used, the concepts presented in this chapter are not affected.

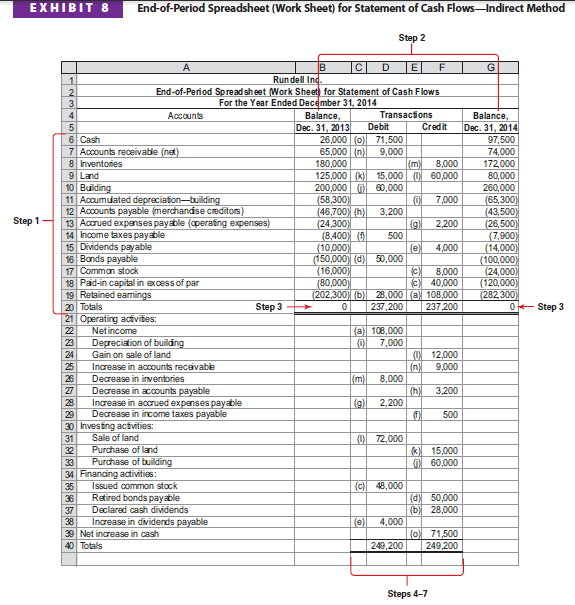

The data for Rundell Inc., presented in Exhibit 3 on pages 646-647, are used as a basis for illustrating the spreadsheet (work sheet) for the indirect method. The steps in preparing this spreadsheet (work sheet), shown in Exhibit 8, are as follows:

- Step 1. List the title of each balance sheet account in the Accounts column.

- Step 2. For each balance sheet account, enter its balance as of December 31, 2013, in the first column and its balance as of December 31, 2014, in the last column. Place the credit balances in parentheses.

- Step 3. Add the December 31, 2013 and 2014 column totals, which should total to zero.

- Step 4. Analyze the change during the year in each noncash account to determine its net increase (decrease) and classify the change as affecting cash flows from operating activities, investing activities, financing activities, or noncash investing and financing activities.

- Step 5. Indicate the effect of the change on cash flows by making entries in the Transactions columns.

- Step 6. After all noncash accounts have been analyzed, enter the net increase (decrease) in cash during the period.

- Step 7. Add the Debit and Credit Transactions columns. The totals should be equal.

1. Analyzing Accounts

In analyzing the noncash accounts (Step 4), try to determine the type of cash flow activity (operating, investing, or financing) that led to the change in the account. As each noncash account is analyzed, an entry (Step 5) is made on the spreadsheet (work sheet) for the type of cash flow activity that caused the change. After all noncash accounts have been analyzed, an entry (Step 6) is made for the increase (decrease) in cash during the period.

The entries made on the spreadsheet are not posted to the ledger. They are only used in preparing and summarizing the data on the spreadsheet.

The order in which the accounts are analyzed is not important. However, it is more efficient to begin with Retained Earnings and proceed upward in the account listing.

2. Retained Earnings

The spreadsheet (work sheet) shows a Retained Earnings balance of $202,300 at December 31, 2013, and $282,300 at December 31, 2014. Thus, Retained Earnings increased $80,000 during the year. This increase is from the following:

- Net income of $108,000

- Declaring cash dividends of $28,000

To identify the cash flows from these activities, two entries are made on the spreadsheet.

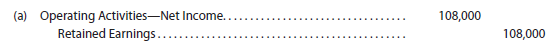

The $108,000 is reported on the statement of cash flows as part of “cash flows from operating activities.” Thus, an entry is made in the Transactions columns on the spreadsheet, as follows:

The preceding entry accounts for the net income portion of the change to Retained Earnings. It also identifies the cash flow in the bottom portion of the spreadsheet as related to operating activities.

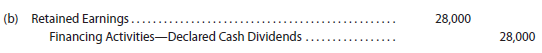

The $28,000 of dividends is reported as a financing activity on the statement of cash flows. Thus, an entry is made in the Transactions columns on the spreadsheet, as follows:

The preceding entry accounts for the dividends portion of the change to Retained Earnings. It also identifies the cash flow in the bottom portion of the spreadsheet as related to financing activities. The $28,000 of declared dividends will be adjusted later for the actual amount of cash dividends paid during the year.

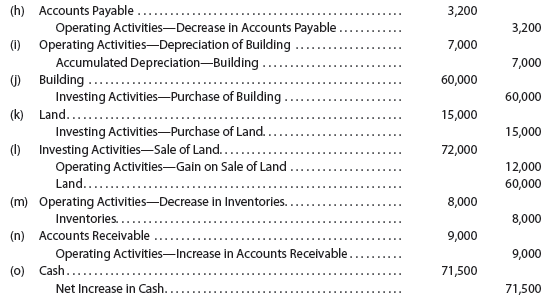

2. Other Accounts

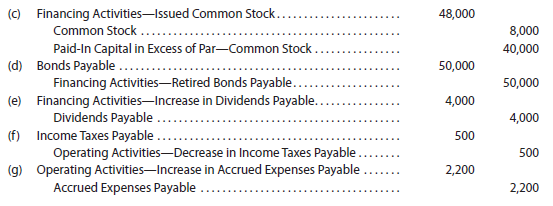

The entries for the other noncash accounts are made in the spreadsheet in a manner similar to entries (a) and (b). A summary of these entries is as follows:

After all the balance sheet accounts are analyzed and the entries made on the spreadsheet (work sheet), all the operating, investing, and financing activities are identified in the bottom portion of the spreadsheet. The accuracy of the entries is verified by totaling the Debit and Credit Transactions columns. The totals of the columns should be equal.

3. Preparing the Statement of Cash Flows

The statement of cash flows prepared from the spreadsheet is identical to the statement in Exhibit 6 on page 655. The data for the three sections of the statement are obtained from the bottom portion of the spreadsheet.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

What i do not realize is if truth be told how you’re not actually much more well-appreciated than you may be right now. You are very intelligent. You realize therefore significantly when it comes to this subject, produced me for my part imagine it from numerous numerous angles. Its like women and men are not interested except it is one thing to do with Girl gaga! Your own stuffs nice. At all times care for it up!