Corporations often finance their operations by issuing bonds payable. As an alternative, corporations may issue installment notes. An installment note is a debt that requires the borrower to make equal periodic payments to the lender for the term of the note. Unlike bonds, each note payment includes the following:

- Payment of a portion of the amount initially borrowed, called the principal

- Payment of interest on the outstanding balance

At the end of the note’s term, the principal will have been repaid in full.

Installment notes are often used to purchase specific assets such as equipment, and are often secured by the purchased asset. When a note is secured by an asset, it is called a mortgage note. If the borrower fails to pay a mortgage note, the lender has the right to take possession of the pledged asset and sell it to pay off the debt. Mortgage notes are typically issued by an individual bank.

1. Issuing an Installment Note

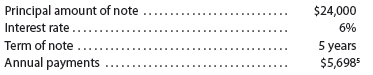

When an installment note is issued, an entry is recorded debiting Cash and crediting Notes Payable. To illustrate, assume that Lewis Company issues the following installment note to City National Bank on January 1, 2013.

2. Annual Payments

The preceding note payable requires Lewis Company to repay the principal and interest in equal payments of $5,698 beginning December 31, 2013, for each of the next five years. Unlike bonds, however, each installment note payment includes an interest and principal component.

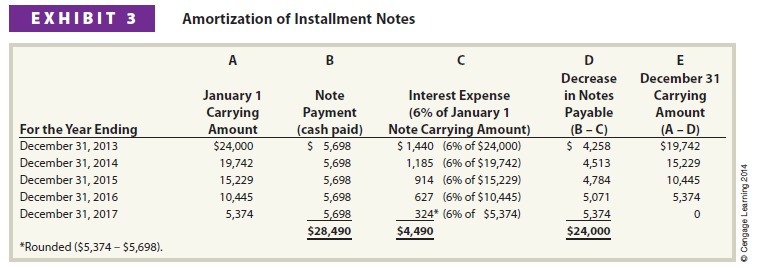

The interest portion of an installment note payment is computed by multiplying the interest rate by the carrying amount (book value) of the note at the beginning of the period. The principal portion of the payment is then computed as the difference between the total installment note payment (cash paid) and the interest component. These computations are illustrated in Exhibit 3 as shown on the following page.

- The January 1, 2013, carrying value (Column A) equals the amount borrowed from the bank. The January 1 balance in the following years equals the December 31 balance from the prior year.

- The note payment (Column B) remains constant at $5,698, the annual cash payment required by the bank.

- The interest expense (Column C) is computed at 6% of the installment note carrying amount at the beginning of each year. As a result, the interest expense decreases each year.

- Notes payable decreases each year by the amount of the principal repayment (Column D). The principal repayment is computed by subtracting the interest expense (Column C) from the total payment (Column B). The principal repayment (Column D) increases each year as the interest expense decreases (Column C).

- The carrying amount on December 31 (Column E) of the note decreases from $24,000, the initial amount borrowed, to $0 at the end of the five years.

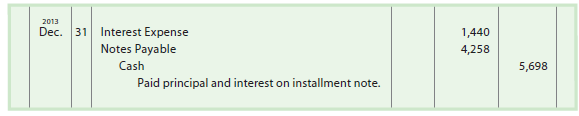

The entry to record the first payment on December 31, 2013, is as follows:

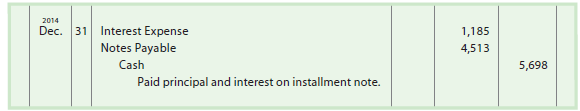

The entry to record the second payment on December 31, 2014, is as follows:

As the prior entries show, the cash payment is the same in each year. The interest and principal repayment, however, change each year. This is because the carrying amount (book value) of the note decreases each year as principal is repaid, which decreases the interest component the next period.

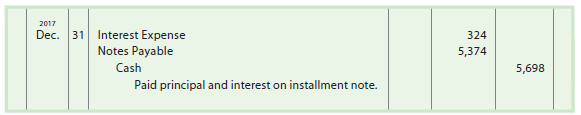

The entry to record the final payment on December 31, 2017, is as follows:

After the final payment, the carrying amount on the note is zero, indicating that the note has been paid in full. Any assets that secure the note would then be released by the bank.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Quality articles is the important to invite the visitors to pay a quick visit the

web page, that’s what this web page is providing.

Great article! That is the type of info that are supposed to be shared around the net.

Shame on the search engines for no longer positioning this

put up higher! Come on over and visit my site

. Thank you =)

Pretty nice post. I simply stumbled upon your blog and wanted to

say that I’ve really enjoyed surfing around your weblog posts.

After all I will be subscribing in your rss feed and I’m hoping you

write again soon!

Great article. I am facing some of these issues as well..

Very interesting information!Perfect just what I was searching for!