We have seen that externalities, including common-property resources, create mar- ket inefficiencies that sometimes warrant government regulation. When, if ever, should governments replace private firms as a producer of goods and services? In this section we describe a set of conditions under which the private market either may not provide a good at all or may not price it properly once it is available.

NONRIVAL GOODS As we saw in Chapter 16, public goods have two charac- teristics: They are nonrival and nonexclusive. A good is nonrival if for any given level of production, the marginal cost of providing it to an additional consumer is zero. For most goods that are provided privately, the marginal cost of pro- ducing more of the good is positive. But for some goods, additional consumers do not add to cost. Consider the use of a highway during a period of low traf- fic volume. Because the highway already exists and there is no congestion, the additional cost of driving on it is zero. Or consider the use of a lighthouse by a ship. Once the lighthouse is built and functioning, its use by an additional ship adds nothing to its running costs. Finally, consider public television. Clearly, the cost of one more viewer is zero.

Most goods are rival in consumption. For example, when you buy furniture, you have ruled out the possibility that someone else can buy it. Goods that are rival must be allocated among individuals. Goods that are nonrival can be made available to everyone without affecting any individual’s opportunity for consuming them.

NONEXCLUSIVE GOODS A good is nonexclusive if people cannot be excluded from consuming it. As a consequence, it is difficult or impossible to charge peo- ple for using nonexclusive goods; the goods can be enjoyed without direct pay- ment. One example of a nonexclusive good is national defense. Once a nation has provided for its national defense, all citizens enjoy its benefits. A lighthouse and public television are also examples of nonexclusive goods.

Nonexclusive goods need not be national in character. If a state or city eradi- cates an agricultural pest, all farmers and consumers benefit. It would be virtu- ally impossible to exclude a particular farmer from the benefits of the program. Automobiles are exclusive (as well as rival). If a dealer sells a new car to one consumer, then the dealer has excluded other individuals from buying it.

Some goods are exclusive but nonrival. For example, in periods of low traffic, travel on a bridge is nonrival because an additional car on the bridge does not lower the speed of other cars. But bridge travel is exclusive because bridge author- ities can keep people from using it. A television signal is another example. Once a signal is broadcast, the marginal cost of making the broadcast available to another user is zero; thus the good is nonrival. But broadcast signals can be made exclusive by scrambling the signals and charging for the codes that unscramble them.

Some goods are nonexclusive but rival. An ocean or large lake is nonexclu- sive, but fishing is rival because it imposes costs on others: the more fish caught, the fewer fish available to others. Air is nonexclusive and often nonrival; but it can be rival if the emissions of one firm adversely affect the quality of the air and the ability of others to enjoy it.

Public goods, which are both nonrival and nonexclusive, provide benefits to people at zero marginal cost, and no one can be excluded from enjoying them. The classic example of a public good is national defense. Defense is nonexclu- sive, as we have seen, but it is also nonrival because the marginal cost of provid- ing defense to an additional person is zero. The lighthouse is also a public good because it is nonrival and nonexclusive; in other words, it would be difficult to charge ships for the benefits they receive from it.23

The list of public goods is much smaller than the list of goods that govern- ments provide. Many publicly provided goods are either rival in consumption, exclusive, or both. For example, high school education is rival in consumption. Because other children get less attention as class sizes increase, there is a posi- tive marginal cost of providing education to one more child. Likewise, charging tuition can exclude some children from enjoying education. Public education is provided by local government because it entails positive externalities, not because it is a public good.

Finally, consider the management of a national park. Part of the public can be excluded from using the park by raising entrance and camping fees. Use of the park is also rival: because of crowded conditions, the entrance of an additional car into a park can reduce the benefits that others receive from it.

1. Efficiency and Public Goods

The efficient level of provision of a private good is determined by comparing the marginal benefit of an additional unit to the marginal cost of producing it. Efficiency is achieved when the marginal benefit and the marginal cost are equal. The same principle applies to public goods, but the analysis is different. With private goods, the marginal benefit is measured by the benefit that the consumer receives. With a public good, we must ask how much each person values an additional unit of output. The marginal benefit is obtained by adding these values for all people who enjoy the good. To determine the efficient level of provision of a public good, we must then equate the sum of these marginal benefits to the marginal cost of production.

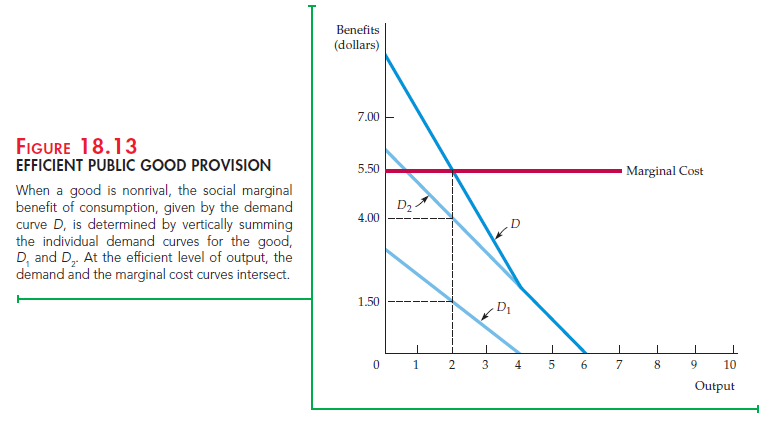

Figure 18.13 illustrates the efficient level of producing a public good. D1 rep- resents the demand for the public good by one consumer and D2 the demand by a second consumer. Each demand curve tells us the marginal benefit that the consumer gets from consuming every level of output. For example, when there are 2 units of the public good, the first consumer is willing to pay $1.50 for the good, and $1.50 is the marginal benefit. Similarly, the second consumer has a marginal benefit of $4.00.

To calculate the sum of the marginal benefits to both people, we must add each of the demand curves vertically. For example, when the output is 2 units, we add the marginal benefit of $1.50 to the marginal benefit of $4.00 to obtain a marginal social benefit of $5.50. When this sum is calculated for every level of public output, we obtain the aggregate demand curve for the public good D.

The efficient amount of output is the one at which the marginal benefit to society is equal to the marginal cost. This occurs at the intersection of the demand and the marginal cost curves. In our example, because the marginal cost of production is $5.50, 2 is the efficient output level.

To see why 2 is efficient, note what happens if only 1 unit of output is provided: Although the marginal cost remains at $5.50, the marginal benefit is approximately $7.00. Because the marginal benefit is greater than the marginal cost, too little of the good has been provided. Similarly, suppose 3 units of the public good have been produced. Now the marginal benefit of approximately

$4.00 is less than the marginal cost of $5.50; too much of the good has been provided. Only when the marginal social benefit is equal to the marginal cost is the public good provided efficiently.24

2. Public Goods and Market Failure

Suppose you want to offer a mosquito abatement program for your community. You know that the program is worth more to the community than the $50,000 it will cost. Can you make a profit by providing the program privately? You would break even if you assessed a $5.00 fee to each of the 10,000 households in your community. But you cannot force them to pay the fee, let alone devise a system in which those households that value mosquito abatement most highly pay the highest fees.

Unfortunately, mosquito abatement is nonexclusive: There is no way to pro- vide the service without benefiting everyone. As a result, households have no incentive to pay what the program really is worth to them. People can act as free riders, who understate the value of the program so that they can enjoy the benefit of the good without paying for it.

With public goods, the presence of free riders makes it difficult or impossible for markets to provide goods efficiently. Perhaps if few people were involved and the program were relatively inexpensive, all households might agree volun- tarily to share costs. However, when many households are involved, voluntary private arrangements are usually ineffective. The public good must therefore be subsidized or provided by governments if it is to be produced efficiently.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

faultless post, i like it

I like the helpful information you provide in your articles. I will bookmark your weblog and check again here regularly. I’m quite certain I will learn lots of new stuff right here! Good luck for the next!