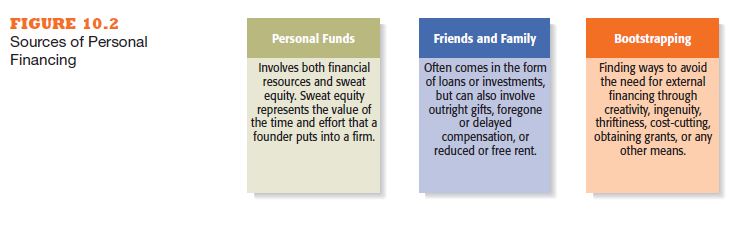

Typically, the seed money that gets a company off the ground comes from the founders’ own pockets. There are three categories of sources of money in this area: personal funds, friends and family, and bootstrapping. These sources are depicted in Figure 10.2 and are explained next.

1. Personal funds

The vast majority of founders contribute personal funds along with sweat equity to their ventures.5 In fact, according to data complied by Fundable, 57 percent of start-ups are funded by the entrepreneurs’ personal savings and credit. The average amount invested is $48,000.6 Sweat equity, which represents the value of the time and effort that a founder puts into a new venture, is also important. Because many founders do not have a substan- tial amount of cash to put into their ventures, it is often the sweat equity that makes the most difference.

2. Friends and family

Friends and family are the second source of funds for many new ventures. According to the same Fundable data, 38 percent of start-ups are funded by friends and family, with an average investment of $23,000.7 This type of con- tribution often comes in the form of loans or investments, but can also involve outright gifts, foregone or delayed compensation (if a friend or family member works for the new venture), or reduced or free rent. For example, Cisco Systems, the giant producer of Internet routers and switches, started in the house of one of its co-founder’s parents.

There are three rules of thumb that entrepreneurs should follow when asking friends and family members for money. First, the request should be presented in a businesslike manner, just like one would deal with a banker or investor. The potential of the business along with the risks involved should be carefully and fully described. Second, if the help the entrepreneur receives is in the form of a loan, a promissory note should be prepared, with a repayment schedule, and the note should be signed by both parties. Stipulating the terms of the loan in writing reduces the potential of a misunderstanding and protects both the entrepreneur and the friend or family member providing the funding. Third, financial help should be requested only from those who are in a legiti- mate position to offer assistance. It’s not a good idea to ask certain friends or family members, regardless of how much they may have expressed a willing- ness to help, for assistance if losing the money would cripple them financially. Entrepreneurs who are unable to repay a loan to a friend or family member risk not only damaging their business relationship with them, but their per- sonal relationship as well.8

LendingKarma (www.lendingkarma.com) helps people involved with friends and family develop loan documents and then track the loans. Following a sim- ple set of online commands, a user can select a loan amount, designate if he or she is the borrower or lender, and set various options such as interest rate, payment frequency, and length of loan. A promissory note, in PDF format, can then be created, along with an amortization schedule. Two tiers of service are available. The premium service, which costs $59.95 per loan, includes all of the above plus online payment tracking and end-of-year reporting, and it al- lows the parties involved to modify loan documents during repayment. A more basic-service alternative costs $29.95 per loan.9 For people who only need documents prepared, online document preparation and filing services such as LegalZoom.com and RocketLawyer.com are available. Accountants, attorneys, and bankers can also help individuals structure their loan agreements.

3. Bootstrapping

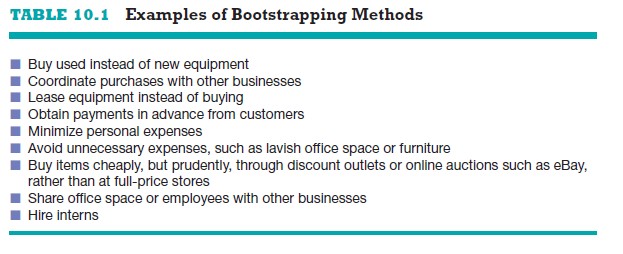

Bootstrapping is a third source of seed money for new ventures. Bootstrapping is finding ways to avoid the need for external financing or funding through creativity, ingenuity, thriftiness, cost-cutting, or any means necessary.10 (The term comes from the adage “pull yourself up by your bootstraps.”) It is the term attached to the general philosophy of minimizing start-up expenses by aggressively pursuing cost-cutting techniques and money-saving tactics. There are many well-known examples of entrepreneurs who bootstrapped to get their companies started. Legend has it that Steve Jobs and partner Steve Wozniak sold a Volkswagen van and a Hewlett-Packard programmable calculator to raise $1,350, which was the initial seed capital for Apple Computer.

There are many ways entrepreneurs bootstrap to raise money or cut costs. Some of the more common examples of bootstrapping are provided in Table 10.1. A simple example of bootstrapping is that fax machines are no longer an absolute necessity, in most cases. There are several Web-based services that allow busi- nesses to fax documents for free or for a small monthly fee, as long as they have a scanner and are able to scan the document into a word processing program. The document can then be sent to the recipient’s fax machine and it will print out as a normal fax. Examples of companies that offer variations of this service are eFax, MyFax, and OnlineFaxes. The overarching point is that a little ingenu- ity (learning how to fax for free, for example) can save an entrepreneur the cost of purchasing a fax machine.

While bootstrapping and using personal funds are highly recommended actions in almost all start-up situations, there are subtle downsides. Cost- cutting and saving money are admirable practices, but pushing these practices too far can hold a business back from reaching its full potential. For example, renting space in a community incubator or building where other start-ups are located, rather than working from home, may be worth it if it provides entre- preneurs access to a network of people who can be relied on to provide social support and business advice.11

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

Keep functioning ,remarkable job!