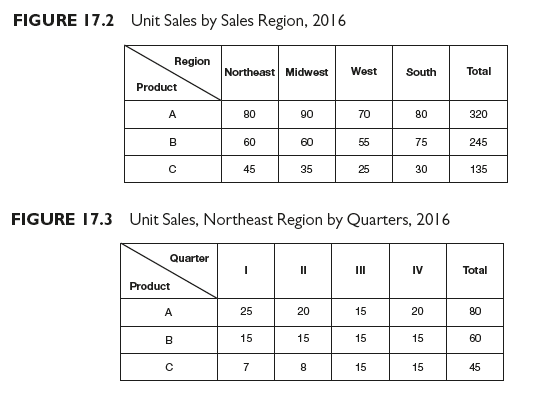

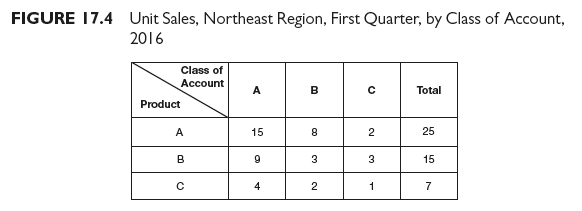

The completed sales budget is a statement of projected sales revenues and selling expenses. The so-called “summary” of the sales volume section of the sales budget is both in dollars and product units, so that budgeted figures are readily adjustable for price changes. The budget section on planned sales volume is presented in considerable detail. Not only are total unit sales shown but so are unit sales of each product, unit sales by sales territory (and/or region), unit sales by quarters or months, and unit sales by class of account (or type of marketing channel). For instance, Figure 17.2 shows unit sales of products A, B, and C by sales regions for 2016. Figure 17.3 take the breakdown one step farther and shows unit sales of the three products in the northeast region by quarters. Figure 17.4 carries the breakdown another step farther and shows unit sales of the three products in the northeast region for the first quarter by class of account. Not every company uses the same breakdowns; each selects those appropriate to its own planning, directing, and controlling of sales efforts.

Estimating Budgeted Selling Expenses

The sales budget is drafted with a view toward obtaining an optimum net profit for the forecast sales volume. Note that it is the optimum—not the maximum—net profit that is the short-run profit objective. Profit maximization is the objective over the long run, but other considerations, including the necessity for providing “business building” customer services, and for scheduling calls on prospective new accounts, make profit optimization the short-run goal. In other words, some selling expenses would not be incurred if management did not look beyond the current budgetary period. A forward-looking management considers these expenditures as investments that return sales and net profit dollars during succeeding budgetary periods. Management reasons that certain expenditures made during the period just ahead permit future savings in similar expenditures.

Thus, both immediate- and long-run sales plans are taken into account in arriving at estimates for the selling expense items included in the sales budget. Indeed, the immediate sales plan is an integral part of the plan covering a longer period. However, sales plans for the period just ahead are drafted in sharper outline than are those for longer periods, such as those covering five, ten, or twenty-five years. For the immediate budgeting period, plans cover the types and amounts of personal-selling efforts required to attain the sales and profit objectives. If the sales volume goal for the coming budget period calls for an additional $10 million in sales, sales management identifies the activities needed for reaching this goal. In turn, these activities, which may be stated in such terms as the numbers of new dealers needed in various classifications, are translated into estimates of the expenses incurred in performing them.

Therefore, after sales management expresses its plan for the forthcoming budgetary period in terms of required activities, the next step is to convert these into dollar estimates for the various items of selling expense. If the plan calls for sales personnel to travel a total of 150,000 miles in the year ahead, and the company pays a straight mileage allowance of 50 cents per mile, $75,000 to cover mileage allowances is included in the selling expense section of the sales budget. The paying of 50 cents a mile for sales travel, a previously established practice, aids in estimating the costs of reimbursing sales personnel for travel, but management determines the total number of miles sales personnel are to travel. In budgeting items of selling expense, then, management (1) estimates the volume of performance of the activity and (2) multiplies that volume by the cost of performing a measurable unit of the activity.

Using standard costs. When the total cost of performing a specific activity is analyzed and the cost of performing one measurable unit of the activity is determined, the first step has been taken towards establishing a standard cost. The second step is to compare the historical cost of performing one unit of the activity with what the cost should be, assuming standard performance, and considering the effect of changed conditions on costs. A standard cost, in marketing as well as in manufacturing, is a predetermined cost for having a standard employee perform under standard conditions one measurable unit of the activity.

The techniques for determining standard costs of distribution are less refined than are those for standard costs of production. Some companies have developed standard distribution costs accurate enough to provide a means for appraising the relative efficiency of performance of personal-selling activities. The executive compares current costs against known yardsticks. Standard costs of distribution simplify the estimating of individual items in the selling expense portion of the budget. Any predicted volume of sales, or any division of sales among the various products, classes of customers, or territories, are convertible into selling expense estimates through the application of standard costs.

Other estimating methods. Some companies that do not have usable standard distribution cost systems employ other methods for estimating selling expenses. Some simply add up selling expenses over a recent period and divide by the number of units of product sold, thus arriving at an average cost per unit sold. This figure is then multiplied by the forecast for unit sales volume, to obtain an estimate for the total budgeted selling expenses. Some adjust the average cost per unit sold for changes in the strength of competition, general business conditions, the inflation rate, and the like. Other companies calculate for past periods the percentage relationship of total selling expense to sales volume. This percentage, which may or may not be adjusted for changes in conditions, is applied to the dollar sales forecast to estimate budgeted selling expenses.

Finally, some companies build up their estimates for total selling expenses by applying historical unit cost figures to individual selling expense items. This is not a true standard distribution cost method, but it does focus upon individual expense rather than upon the total. Consequently, the expense estimates in the budget possess greater accuracy than if total selling expense percentages or total selling expenses per unit of product are used.

Source: Richard R. Still, Edward W. Cundliff, Normal A. P Govoni, Sandeep Puri (2017), Sales and Distribution Management: Decisions, Strategies, and Cases, Pearson; Sixth edition.

great post, very informative. I wonder why the other specialists of this sector do not notice this. You should continue your writing. I am confident, you have a great readers’ base already!

Hi my family member! I want to say that this post is awesome, nice written and include almost all important infos. I would like to see more posts like this.