Research and development (R&D) personnel can play an integral part in strategy implementation. These individuals are generally charged with developing new products and improving old products effectively. R&D persons perform tasks that include transferring complex technology, adjusting processes to local raw materials, adapting processes to local markets, and altering products to particular tastes and specifications. Strategies such as product development, market penetration, and related diversification require that new products be successfully developed and that old products be significantly improved.

Technological improvements that affect consumer and industrial products and services shorten product life cycles. Companies in virtually every industry rely on the development of new products and services to fuel profitability and growth. Surveys suggest that the most successful organizations use an R&D strategy that ties external opportunities to internal strengths and is linked with objectives. Well-formulated R&D policies match market opportunities with internal capabilities. Strategic R&D issues include the following:

- To emphasize product or process improvements.

- To stress basic or applied research.

- To be a leader or follower in R&D.

- To develop robotics or use manual-type processes.

- To spend a high, average, or low amount of money on R&D.

- To perform R&D within the firm or contract R&D to outside firms.

- To use university researchers or private-sector researchers.

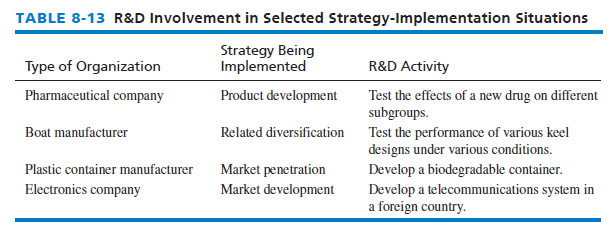

Research and development policy among rival firms often varies dramatically. Various pharmaceutical firms, for example, have a philosophical disagreement over the merits of heavy investment to discover new drugs, versus waiting for others to spend the money and then follow up with similar products. Table 8-13 gives some examples of R&D activities that could be required for successful implementation of various strategies. Many U.S. utility, energy, and automotive companies have charged their R&D departments with determining how the firm can effectively reduce its gas emissions.

Many firms wrestle with the decision to acquire R&D expertise from external firms or to develop R&D expertise internally. The following guidelines can be used to help make this decision:

- If the rate of technical progress is slow, the rate of market growth is moderate, and there are significant barriers to possible new entrants, then in-house R&D is the preferred solution. The reason is that R&D, if successful, will result in a temporary product or process monopoly that the company can exploit.

- If technology is changing rapidly and the market is growing slowly, then a major effort in R&D may be risky because it may lead to the development of an ultimately obsolete technology or one for which there is no market.

- If technology is changing slowly but the market is growing quickly, there generally is not enough time for in-house development. The prescribed approach is to obtain R&D expertise on an exclusive or nonexclusive basis from an outside firm.

- If both technical progress and market growth are fast, R&D expertise should be obtained through acquisition of a well-established firm in the industry.10

There are at least three major R&D approaches for implementing strategies, as discussed here:

- The first approach is to be the first firm to market new technological products. This is a glamorous and exciting strategy but also a dangerous one. Firms such as 3M, Apple, and General Electric have been successful with this method, but many other pioneering firms have fallen, with rival firms seizing the initiative.

- The second approach is to be an innovative imitator of successful products, thus minimizing the risks and costs of a “startup.” This approach entails allowing a pioneer firm to develop the first version of the new product and to demonstrate that a market exists. Then, laggard firms develop a similar product. This strategy requires excellent R&D and marketing personnel.

- The third approach is to be a low-cost producer by mass-producing products similar to but less expensive than products recently introduced. As a new product is accepted by customers, price becomes increasingly important in the buying decision. Also, mass marketing replaces personal selling as the dominant selling strategy. This approach requires substantial investment in plant and equipment, but fewer expenditures in R&D than the other two approaches. Dell and Lenovo have utilized this third approach to gain competitive advantage.

R&D spending in China increased to about $285 billion in 2014, up 22 percent from 2012. In contrast, R&D spending in the United States grew about 4 percent to $465 billion during the same period. Analysts expect R&D spending in China to surpass U.S. R&D spending by 2022.11 For example, Shenzhen-based Huawei Technologies, the second-largest telecom-equipment firm in the world behind Ericsson, spends almost $6 billion annually on R&D. Huawei’s R&D center in Shanghai employs more than 10,000 engineers, many of whom have computer science advanced degrees. Lenovo, another Chinese firm spending billions on R&D, just opened its huge new hub for R&D in the central Chinese city of Wuhan. China’s Fuzhou Rockchip Electronics and Allwinner Technology are rapidly trying to catch up in the mobile processor chips industry with the U.S. Qualcomm and Nvidia Corp. Generally speaking, Chinese firms are “on a mission” to eventually lead the world in technological advancements.

Perhaps the most current trend in R&D has been lifting the veil of secrecy whereby firms, even major competitors, join forces to develop new products. Collaboration is on the rise as a result of new competitive pressures, rising research costs, increasing regulatory issues, and accelerated product development schedules. Companies are also turning to consortia at universities for their R&D needs; more than 600 research consortia are now in operation in the United States.

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

17 May 2021

17 May 2021

18 May 2021

18 May 2021

18 May 2021

18 May 2021