Financial distress occurs when promises to creditors are broken or honored with difficulty. Sometimes financial distress leads to bankruptcy. Sometimes it only means skating on thin ice.

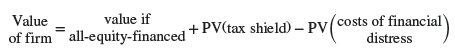

As we will see, financial distress is costly. Investors know that levered firms may fall into financial distress, and they worry about it. That worry is reflected in the current market value of the levered firm’s securities. Thus, the value of the firm can be broken down into three parts:

The costs of financial distress depend on the probability of distress and the magnitude of costs encountered if distress occurs.

Figure 18.2 shows how the trade-off between the tax benefits and the costs of distress could determine optimal capital structure. PV(tax shield) initially increases as the firm borrows more.

At low debt levels, the probability of financial distress should be trivial, and so PV(cost of financial distress) is small and tax advantages dominate. But at some point, the probability of financial distress increases rapidly with additional borrowing; the costs of distress begin to take a substantial bite out of firm value. Also, if the firm can’t be sure of profiting from the corporate tax shield, the tax advantage of additional debt is likely to dwindle and eventually disappear. (Once the firm hits the limit on interest deductions at 30% of EBITDA or EBIT, the tax shields from additional borrowing disappear completely.) The theoretical optimum is reached when the present value of tax savings due to further borrowing is just offset by increases in the present value of costs of distress. This is called the trade-off theory of capital structure.

Costs of financial distress cover several specific items. Now we identify these costs and try to understand what causes them.

1. Bankruptcy Costs

You rarely hear anything nice said about corporate bankruptcy. But there is some good in almost everything. Corporate bankruptcies occur when stockholders exercise their right to default. That right is valuable; when a firm gets into trouble, limited liability allows stockholders simply to walk away from it, leaving all its troubles to its creditors. The former creditors become the new stockholders, and the old stockholders are left with nothing.

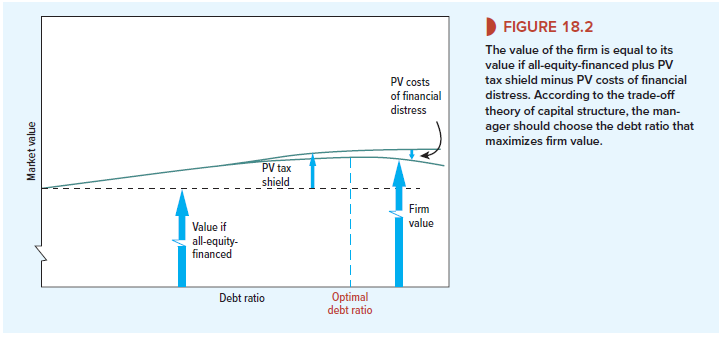

Stockholders in corporations automatically get limited liability. But suppose that this were not so. Suppose that there are two firms with identical assets and operations. Each firm has debt outstanding, and each has promised to repay $1,000 (principal and interest) next year. But only one of the firms, Ace Limited, enjoys limited liability. The other firm, Ace Unlimited, does not; its stockholders are personally liable for its debt.10

Figure 18.3 compares next year’s possible payoffs to the creditors and stockholders of these two firms. The only differences occur when next year’s asset value turns out to be less than $1,000. Suppose that next year, the assets of each company are worth only $500. In this case, Ace Limited defaults. Its stockholders walk away; their payoff is zero. Bondholders get the assets worth $500. But Ace Unlimited’s stockholders can’t walk away. They have to cough up $500, the difference between asset value and the bondholders’ claim. The debt is paid whatever happens.

Suppose that Ace Limited does go bankrupt. Of course, its stockholders are disappointed that their firm is worth so little, but that is an operating problem having nothing to do with financing. Given poor operating performance, the right to go bankrupt—the right to default— is a valuable privilege. As Figure 18.3 shows, Ace Limited’s stockholders are in better shape than Unlimited’s are.

The example illuminates a mistake people often make in thinking about the costs of bankruptcy. Bankruptcies are thought of as corporate funerals. The mourners (creditors and especially shareholders) look at their firm’s present sad state. They think of how valuable their securities used to be and how little is left. But they may also think of the lost value as a cost of bankruptcy. That is the mistake. The decline in the value of assets is what the mourning is really about. That has no necessary connection with financing. The bankruptcy is merely a legal mechanism for allowing creditors to take over when the decline in the value of assets triggers a default. Bankruptcy is not the cause of the decline in value. It is the result.

Be careful not to get cause and effect reversed. When a person dies, we do not cite the implementation of his or her will as the cause of death.

We said that bankruptcy is a legal mechanism allowing creditors to take over when a firm defaults. Bankruptcy costs are the costs of using this mechanism. There are no bankruptcy costs at all shown in Figure 18.3. Note that only Ace Limited can default and go bankrupt. But, regardless of what happens to asset value, the combined payoff to the bondholders and stockholders of Ace Limited is always the same as the combined payoff to the bondholders and stockholders of Ace Unlimited. Thus, the overall market values of the two firms now (this year) must be identical. Of course, Ace Limited’s stock is worth more than Ace Unlimited’s stock because of Ace Limited’s right to default. Ace Limited’s debt is worth correspondingly less.

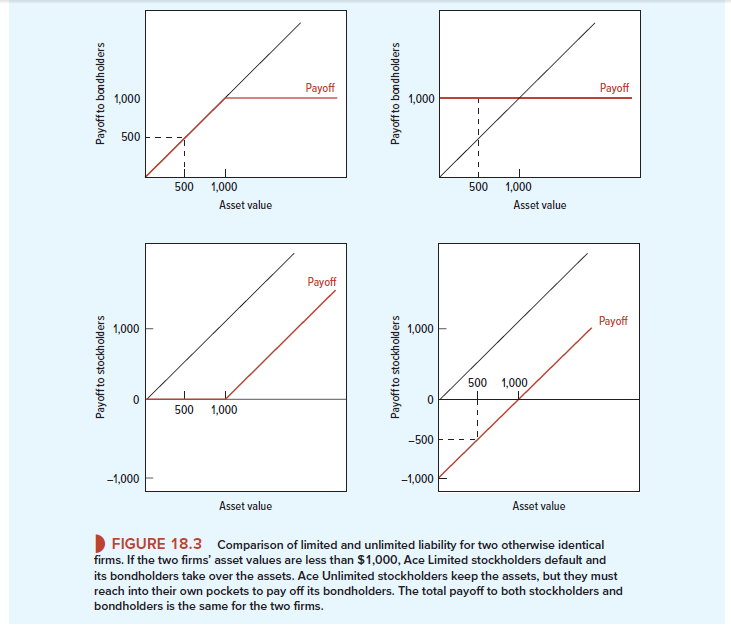

Our example was not intended to be strictly realistic. Anything involving courts and lawyers cannot be free. Suppose that court and legal fees are $200 if Ace Limited defaults. The fees are paid out of the remaining value of Ace’s assets. Thus, if asset value turns out to be $500, creditors end up with only $300. Figure 18.4 shows next year’s total payoff to bondholders and stockholders net of this bankruptcy cost. Ace Limited, by issuing risky debt, has given lawyers and the court system a claim on the firm if it defaults. The market value of the firm is reduced by the present value of this claim.

It is easy to see how increased leverage affects the present value of the costs of financial distress. If Ace Limited borrows more, it increases the probability of default and the value of the lawyers’ claim. It increases PV (costs of financial distress) and reduces Ace’s present market value.

The costs of bankruptcy come out of stockholders’ pockets. Creditors foresee the costs and foresee that they will pay them if default occurs. For this they demand compensation in advance in the form of higher payoffs when the firm does not default; that is, they demand a higher promised interest rate. This reduces the possible payoffs to stockholders and reduces the present market value of their shares.

2. Evidence on Bankruptcy Costs

Bankruptcy costs can add up fast. The failed energy giant Enron paid $757 million in legal, accounting, and other professional fees during the time that it spent in bankruptcy. The costs of sorting out the 65,000 claims on the assets of Lehman Brothers exceed $2 billion.

Daunting as such numbers may seem, they are not a large fraction of the companies’ asset values. Lawrence Weiss, who studied 31 firms that went bankrupt between 1980 and 1986, found average costs of about 3% of total book assets and 20% of the market value of equity in the year prior to bankruptcy. A study by Andrade and Kaplan of a sample of troubled and highly leveraged firms estimated costs of financial distress amounting to 10% to 20% of predistress market value, although they found it hard to decide whether these costs were caused by financial distress or by the business setbacks that led to distress.[1]

Bankruptcy eats up a larger fraction of asset value for small companies than for large ones. There are significant economies of scale in going bankrupt. For example, a study of smaller U.K. bankruptcies by Franks and Sussman found that fees (legal and accounting) and other costs soaked up roughly 20% to 40% of the proceeds from liquidation of the companies.[2]

3. Direct versus Indirect Costs of Bankruptcy

So far, we have discussed the direct (that is, legal and administrative) costs of bankruptcy. There are indirect costs too, which are nearly impossible to measure. But we have circumstantial evidence indicating their importance.

Managing a bankrupt firm is not easy. Consent of the bankruptcy court is required for many routine business decisions, such as the sale of assets or investment in new equipment. At best, this involves time and effort; at worst, proposals to reform and revive the firm are thwarted by impatient creditors, who stand first in line for cash from asset sales or liquidation of the entire firm.

Sometimes the problem is reversed: The bankruptcy court is so anxious to maintain the firm as a going concern that it allows the firm to engage in negative-NPV activities. When Eastern Airlines entered the “protection” of the bankruptcy court, it still had some valuable, profit-making routes and salable assets such as planes and terminal facilities. The creditors would have been best served by a prompt liquidation, which probably would have generated enough cash to pay off all debt and preferred stockholders. But the bankruptcy judge was keen to keep Eastern’s planes flying at all costs, so he allowed the company to sell many of its assets to fund hefty operating losses. When Eastern finally closed down after two years, it was not just bankrupt, but administratively insolvent: There was almost nothing for creditors, and the company was running out of cash to pay legal expenses.[3]

We do not know what the sum of direct and indirect costs of bankruptcy amounts to. We suspect it is a significant number, particularly for large firms for which proceedings would be lengthy and complex. Perhaps the best evidence is the reluctance of creditors to force bankruptcy. In principle, they would be better off to end the agony and seize the assets as soon as possible. Instead, creditors often overlook defaults in the hope of nursing the firm over a difficult period. They do this in part to avoid costs of bankruptcy. There is an old financial saying, “Borrow $1,000 and you’ve got a banker. Borrow $10,000,000 and you’ve got a partner.”

Creditors may also shy away from bankruptcy because they worry about violations of absolute priority. Absolute priority means that creditors are paid in full before stockholders receive a penny. But sometimes reorganizations provide something for everyone, including consolation prizes for stockholders. Sometimes other claimants move up in the queue. For example, after the Chrysler bankruptcy in 2009, the State of Indiana sued (unsuccessfully) on behalf of local pension funds that had invested in Chrysler bonds. The funds complained bitterly about the terms of sale of the bankrupt company’s assets to Fiat, arguing that they would get only $.29 on the dollar, while other, more junior claimants fared better. The Chrysler bankruptcy was a special case, however. One of the key players in the proceedings was the U.S. government, which was anxious to protect tens of thousands of jobs in the middle of a severe recession.

We cover bankruptcy procedures in more detail in Chapter 32.

4. Financial Distress without Bankruptcy

Not every firm that gets into trouble goes bankrupt. As long as the firm can scrape up enough cash to pay the interest on its debt, it may be able to postpone bankruptcy for many years. Eventually the firm may recover, pay off its debt, and escape bankruptcy altogether.

But the mere threat of financial distress can be costly to the threatened firm. Customers and suppliers are extra cautious about doing business with a firm that may not be around for long. Customers worry about resale value and the availability of service and replacement parts. (This was a serious drag on Chrysler’s sales before its bankruptcy in 2009.) Suppliers are disinclined to put effort into servicing the distressed firm’s account and may demand cash on the nail for their products. Potential employees are unwilling to sign on and existing staff keep slipping away from their desks for job interviews.

High debt, and thus high financial risk, also appears to reduce firms’ appetites for business risk. For example, Luigi Zingales looked at the fortunes of U.S. trucking companies after the trucking industry was deregulated in the late 1970s.14 The deregulation sparked a wave of competition and restructuring. Survival required new investment and improvements in operating efficiency. Zingales found that conservatively financed trucking companies were more likely to survive in the new competitive environment. High-debt firms were more likely to drop out of the game.

5. Debt and Incentives

When a firm is in trouble, both bondholders and stockholders want it to recover, but in other respects, their interests may be in conflict. In times of financial distress, the security holders are like many political parties—united on generalities but threatened by squabbling on any specific issue.

Financial distress is costly when these conflicts of interest get in the way of proper operating, investment, and financing decisions. Stockholders are tempted to forsake the usual objective of maximizing the overall market value of the firm and to pursue narrower self-interest instead. They are tempted to play games at the expense of their creditors. We now illustrate how such games can lead to costs of financial distress.

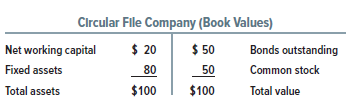

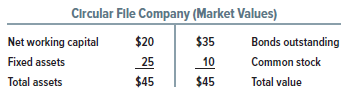

Here is the Circular File Company’s book balance sheet:

We will assume there is only one share and one bond outstanding. The stockholder is also the manager. The bondholder is somebody else.

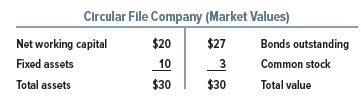

Here is its balance sheet in market values—a clear case of financial distress, since the face value of Circular’s debt ($50) exceeds the firm’s total market value ($30):

If the debt matured today, Circular’s owner would default, leaving the firm bankrupt. But suppose that the bond actually matures one year hence, that there is enough cash for Circular to limp along for this year, and that the bondholder cannot “call the question” and force bankruptcy before then.

The one-year grace period explains why the Circular share still has value. Its owner is betting on a stroke of luck that will rescue the firm, allowing it to pay off the debt with something left over. The bet is a long shot—the owner wins only if firm value increases from $30 to more than $50.[4] But the owner has a secret weapon: He controls investment and operating strategy.

6. Risk Shifting: The First Game

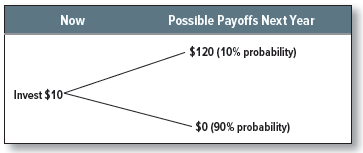

Suppose that Circular has $10 cash. The following investment opportunity comes up:

This is a wild gamble and probably a lousy project. But you can see why the owner would be tempted to take it anyway. Why not go for broke? Circular will probably go under anyway, so the owner is essentially betting with the bondholder’s money. But the owner gets most of the loot if the project pays off.

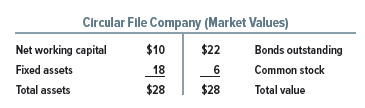

Suppose that the project’s NPV is -$2 but that it is undertaken anyway, thus depressing firm value by $2. Circular’s new balance sheet might look like this:

Firm value falls by $2, but the owner is $3 ahead because the bond’s value has fallen by $5.[5] The $10 cash that used to stand behind the bond has been replaced by a very risky asset worth only $8.

Thus, a game has been played at the expense of Circular’s bondholder. The game illustrates the following general point: Stockholders of levered firms gain when business risk increases. Financial managers who act strictly in their shareholders’ interests (and against the interests of creditors) will favor risky projects over safe ones. They may even take risky projects with negative NPVs.

This warped strategy for capital budgeting clearly is costly to the firm and to the economy as a whole. Why do we associate the costs with financial distress? Because the temptation to play is strongest when the odds of default are high. A blue-chip company like Exxon Mobil would never invest in our negative-NPV gamble. Its creditors are not vulnerable to one risky project.

7. Refusing to Contribute Equity Capital: The Second Game

We have seen how stockholders, acting in their immediate, narrow self-interest, may take projects that reduce the overall market value of their firm. These are errors of commission. Conflicts of interest may also lead to errors of omission.

Assume that Circular cannot scrape up any cash and, therefore, cannot take that wild gamble. Instead, a good opportunity comes up: a relatively safe asset costing $10 with a present value of $15 and NPV = +$5.

This project will not in itself rescue Circular, but it is a step in the right direction. We might therefore expect Circular to issue $10 of new stock and to go ahead with the investment. Suppose that two new shares are issued to the original owner for $10 cash. The project is taken. The new balance sheet might look like this:

The total value of the firm goes up by $15 ($10 of new capital and $5 NPV). Notice that the Circular bond is no longer worth $25, but $35. The bondholder receives a capital gain of $8 because the firm’s assets include a new, safe asset worth $15. The probability of default is less, and the payoff to the bondholder if default occurs is larger.

The stockholder loses what the bondholder gains. Equity value goes up not by $15 but by $15 – $8 = $7. The owner puts in $10 of fresh equity capital but gains only $7 in market value. Going ahead is in the firm’s interest but not the owner’s.

Again, our example illustrates a general point. If we hold business risk constant, any increase in firm value is shared among bondholders and stockholders. The value of any investment opportunity to the firm’s stockholders is reduced because project benefits must be shared with bondholders. Thus it may not be in the stockholders’ self-interest to contribute fresh equity capital even if that means forgoing positive-NPV investment opportunities.

This problem theoretically affects all levered firms, but it is most serious when firms land in financial distress. The greater the probability of default, the more bondholders have to gain from investments that increase firm value.

8. And Three More Games, Briefly

As with other games, the temptation to play the next three games is particularly strong in financial distress.

Cash In and Run Stockholders may be reluctant to put money into a firm in financial distress, but they are happy to take the money out—in the form of a cash dividend, for example. The market value of the firm’s stock goes down by less than the amount of the dividend paid, because the decline in firm value is shared with creditors. This game is just “refusing to contribute equity capital” run in reverse.17

Playing for Time When the firm is in financial distress, creditors would like to salvage what they can by forcing the firm to settle up. Naturally, stockholders want to delay this as long as they can. There are various devious ways of doing this—for example, through accounting changes designed to conceal the true extent of trouble; by encouraging false hopes of spontaneous recovery; or by cutting corners on maintenance, research and development, and so on—in order to make this year’s operating performance look better.

Bait and Switch This game is not always played in financial distress, but it is a quick way to get into distress. You start with a conservative policy, issuing a limited amount of relatively safe debt. Then you suddenly switch and issue a lot more. That makes all your debt risky, imposing a capital loss on the “old” bondholders. Their capital loss is the stockholders’ gain.

A dramatic example of bait and switch occurred in October 1988, when the management of RJR Nabisco announced its intention to acquire the company in a leveraged buyout (LBO). This put the company “in play” for a transaction in which existing shareholders would be bought out and the company would be “taken private.” The cost of the buyout would be almost entirely debt-financed. The new private company would start life with an extremely high debt ratio.

RJR Nabisco had debt outstanding with a market value of about $2.4 billion. The announcement of the coming LBO drove down this market value by $298 million.18

9. What the Games Cost

Why should anyone object to these games so long as they are played by consenting adults? Because playing them means poor decisions about investments and operations. These poor decisions are agency costs of borrowing.

The more the firm borrows, the greater is the temptation to play the games (assuming the financial manager acts in the stockholders’ interest). The increased odds of poor decisions in the future prompt investors to mark down the present market value of the firm. The fall in value comes out of the shareholders’ pockets. Therefore, it is ultimately in their interest to avoid temptation. The easiest way to do this is to limit borrowing to levels at which the firm’s debt is safe or close to it.

Banks and other corporate lenders are also not financial innocents. They realize that games may be played at their expense and so protect themselves by rationing the amount that they will lend or by imposing restrictions on the company’s actions.

EXAMPLE 18.1 ● Ms. Ketchup Faces Credit Rationing

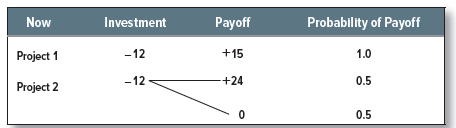

Consider the case of Henrietta Ketchup, a budding entrepreneur with two possible investment projects that offer the following payoffs:

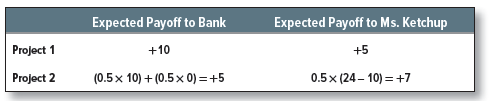

Project 1 is surefire and very profitable; project 2 is risky and a rotten project. Ms. Ketchup now approaches her bank and asks to borrow the present value of $10 (she will find the remaining money out of her own purse). The bank calculates that the payoff will be split as follows:

If Ms. Ketchup accepts project 1, the bank’s debt is certain to be paid in full; if she accepts project 2, there is only a 50% chance of payment and the expected payoff to the bank is only $5. Unfortunately, Ms. Ketchup will prefer to take project 2, for if things go well, she gets most of the profit, and if they go badly, the bank bears most of the loss. Unless Ms. Ketchup can convince the bank that she will not gamble with its money, the bank will limit the amount that it is prepared to lend.19

How can Ms. Ketchup in Example 18.1 reassure the bank of her intentions? The obvious answer is to give it veto power over potentially dangerous decisions. There we have the ultimate economic rationale for all that fine print backing up corporate debt. Debt contracts frequently limit dividends or equivalent transfers of wealth to stockholders; the firm may not be allowed to pay out more than it earns, for example. Additional borrowing is almost always limited. For example, many companies are prevented by existing bond indentures from issuing any additional long-term debt unless their ratio of earnings to interest charges exceeds 2.0.

Sometimes firms are restricted from selling assets or making major investment outlays except with the lenders’ consent. The risks of playing for time are reduced by specifying accounting procedures and by giving lenders access to the firm’s books and its financial forecasts.

Of course, fine print cannot be a complete solution for firms that insist on issuing risky debt. The fine print has its own costs; you have to spend money to save money. Obviously a complex debt contract costs more to negotiate than a simple one. Afterward it costs the lender more to monitor the firm’s performance. Lenders anticipate monitoring costs and demand compensation in the form of higher interest rates; thus the monitoring costs—another agency cost of debt—are ultimately paid by stockholders.

Perhaps the most severe costs of the fine print stem from the constraints it places on operating and investment decisions. For example, an attempt to prevent the risk-shifting game may also prevent the firm from pursuing good investment opportunities. At the minimum there are delays in clearing major investments with lenders. In some cases, lenders may veto high-risk investments even if net present value is positive. The lenders are tempted to play a game of their own, forcing the firm to stay in cash or low-risk assets even if good projects are forgone. [6] [7]

Debt contracts cannot cover every possible manifestation of the games we have just discussed. Any attempt to do so would be hopelessly expensive and doomed to failure in any event. Human imagination is insufficient to conceive of all the possible things that could go wrong. Therefore, contracts are always incomplete. We will always find surprises coming at us on dimensions we never thought to think about.

We hope we have not left the impression that managers and stockholders always succumb to temptation unless restrained. Usually, they refrain voluntarily, not only from a sense of fair play but also on pragmatic grounds: A firm or individual that makes a killing today at the expense of a creditor will be coldly received when the time comes to borrow again. Aggressive game playing is done only by out-and-out crooks and by firms in extreme financial distress. Firms limit borrowing precisely because they don’t wish to land in distress and be exposed to the temptation to play.

10. Costs of Distress Vary with Type of Asset

Suppose your firm’s only asset is a large downtown hotel, mortgaged to the hilt. The recession hits, occupancy rates fall, and the mortgage payments cannot be met. The lender takes over and sells the hotel to a new owner and operator. You use your firm’s stock certificates for wallpaper.

What is the cost of bankruptcy? In this example, probably very little. The value of the hotel is, of course, much less than you hoped, but that is due to the lack of guests, not to the bankruptcy. Bankruptcy doesn’t damage the hotel itself. The direct bankruptcy costs are restricted to items such as legal and court fees, real estate commissions, and the time the lender spends sorting things out.

Suppose we repeat the story of Heartbreak Hotel for Fledgling Electronics. Everything is the same, except for the underlying real assets—not real estate but a high-tech going concern, a growth company whose most valuable assets are technology, investment opportunities, and its employees’ human capital.

If Fledgling gets into trouble, the stockholders may be reluctant to put up money to cash in on its growth opportunities. Failure to invest is likely to be much more serious for Fledgling than for the Heartbreak Hotel.

If Fledgling finally defaults on its debt, the lender will find it much more difficult to cash in by selling off the assets. Many of them are intangibles that have value only as a part of a going concern.

Could Fledgling be kept as a going concern through default and reorganization? It may not be as hopeless as putting a wedding cake through a car wash, but there are a number of serious difficulties. First, the odds of defections by key employees are higher than they would be if the firm had never gotten into financial trouble. Special guarantees may have to be given to customers who have doubts about whether the firm will be around to service its products. Aggressive investment in new products and technology will be difficult; each class of creditors will have to be convinced that it is in its interest for the firm to invest new money in risky ventures.

Some assets, like good commercial real estate, can pass through bankruptcy and reorganization largely unscathed;[8] the values of other assets are likely to be considerably diminished. The losses are greatest for the intangible assets that are linked to the health of the firm as a going concern—for example, technology, human capital, and brand image. That may be why debt ratios are low in the pharmaceutical industry, where value depends on continued success in research and development, and in many service industries where value depends on human capital. We can also understand why highly profitable growth companies, such as Microsoft or Google, use mostly equity finance.

The moral of these examples is this: Do not think only about the probability that borrowing will bring trouble. Think also of the value that may be lost if trouble comes.

Heartbreak Hotel for Enron? Enron was one of the most glamorous, fast-growing, and (apparently) profitable companies of the 1990s. It played a lead role in the deregulation of electric power markets, both in the United States and internationally. It invested in electric power generation and distribution, gas pipelines, telecommunications networks, and various other ventures. It also built up an active energy trading business. At its peak, the aggregate market value of Enron’s common stock exceeded $60 billion. By the end of 2001, Enron was in bankruptcy and its shares were worthless.

With hindsight, we see that Enron was playing many of the games that we described earlier in this section. It was borrowing aggressively and hiding the debt in special-purpose entities (SPEs). The SPEs also allowed it to pump up its reported earnings, playing for time while making more and more risky investments. When the bubble burst, there was hardly any value left.

The collapse of Enron didn’t really destroy $60 billion in value because that $60 billion wasn’t there in the first place. But there were genuine costs of financial distress. Let’s focus on Enron’s energy trading business. That business was not as profitable as it appeared, but it was nevertheless a valuable asset. It provided an important service for wholesale energy customers and suppliers who wanted to buy or sell contracts that locked in the future prices and quantities of electricity, natural gas, and other commodities.

What happened to this business when it became clear that Enron was in financial distress and probably headed for bankruptcy? It disappeared. Trading volume went to zero immediately. None of its customers was willing to make a new trade with Enron because it was far from clear that Enron would be around to honor its side of the bargain. With no trading volume, there was no trading business. As it turned out, Enron’s trading business more resembled Fledgling Electronics than a tangible asset like Heartbreak Hotel.

The value of Enron’s trading business depended on Enron’s creditworthiness. The value should have been protected by conservative financing. Most of the lost value can be traced back to Enron’s aggressive borrowing. This loss of value was, therefore, a cost of financial distress.

11. The Trade-Off Theory of Capital Structure

Financial managers often think of the firm’s debt-equity decision as a trade-off between interest tax shields and the costs of financial distress. Of course, there is controversy about how valuable interest tax shields are and what kinds of financial trouble are most threatening, but these disagreements are only variations on a theme. Thus, Figure 18.2 illustrates the debt-equity trade-off.

This trade-off theory of capital structure recognizes that target debt ratios may vary from firm to firm. Companies with safe, tangible assets and plenty of taxable income to shield ought to have high target ratios. Unprofitable companies with risky, intangible assets ought to rely primarily on equity financing.

If there were no costs of adjusting capital structure, then each firm should always be at its target debt ratio. However, there are costs—and, therefore, delays—in adjusting to the optimum. Firms cannot immediately offset the random events that bump them away from their capital structure targets, so we should see random differences in actual debt ratios among firms having the same target debt ratio.

All in all, this trade-off theory of capital structure choice tells a comforting story. Unlike MM’s theory, which seemed to say that firms should take on as much debt as possible, it avoids extreme predictions and rationalizes moderate debt ratios. Also, if you ask financial managers whether their firms have target debt ratios, they will usually say yes—although the target is often specified not as a debt ratio but as a debt rating. For example, the firm might manage its capital structure to maintain a single-A bond rating. Ratio or rating, a target is consistent with the trade-off theory.[9]

But what are the facts? Can the trade-off theory of capital structure explain how companies actually behave?

The answer is “yes and no.” On the “yes” side, the trade-off theory successfully explains many industry differences in capital structure. High-tech growth companies, whose assets are risky and mostly intangible, normally use relatively little debt. Airlines can and do borrow heavily because their assets are tangible and relatively safe.[10]

On the “no” side, there are some things the trade-off theory cannot explain. It cannot explain why some of the most successful companies thrive with little debt. Think of Johnson & Johnson, which, as Table 18.4A shows, has little debt. Granted, Johnson & Johnson’s most valuable assets are intangible, the fruits of its research and development. We know that intangible assets and conservative capital structures go together. But Johnson & Johnson also has a very large corporate income tax bill (normally about $4 billion) and the highest possible credit rating. It could borrow enough to save tens of millions of dollars without raising a whisker of concern about possible financial distress.

Johnson & Johnson illustrates an odd fact about real-life capital structures: The most profitable companies commonly borrow the least.[11] Here the trade-off theory fails because it predicts exactly the reverse. Under the trade-off theory, high profits should mean more debt-servicing capacity and more taxable income to shield and so should give a higher target debt ratio.[12]

It will be interesting to see whether the Tax Cuts and Job Act of 2017 will lead U.S. corporations to rely less on debt. The trade-off theory predicts that the reduction of the tax rate from 35% to 21% will reduce target debt ratios. Corporations with interest payments exceeding 30% of EBITDA or EBIT will have an extra incentive to reduce debt if costs of financial distress are at all important.

On the other hand, it appears that public companies rarely make major shifts in capital structure just because of taxes,[13] and it is hard to detect the present value of interest tax shields in firms’ market values.[14] There are large, long-lived differences between average debt ratios of high- versus low-debt companies in the same industry, even after controlling for attributes

that the trade-off theory says should be important.[15] But DeAngelo and Roll find the debt ratios of individual companies have fluctuated dramatically when tracked over decades. For example, IBM’s book debt ratio peaked at about 40% in the mid-1950s, fell to nearly zero in the mid-1970s, and rose again to about 30% at the turn of the century. International Paper’s debt ratio fluctuated between 20% and 40% between 1909 and the end of World War II, then fell to zero until the mid-1960s, when it popped back into the 20% to 40% range. DeAngelo and Roll’s case studies suggest that increases in leverage often happened in periods of heavy capital investment and large requirements for external financing.[16]

Graham, Leary, and Roberts find that aggregate leverage for U.S. corporations increased steadily from about 10% in the mid-1940s to about 30% from the early 1970s through 2010.

But they were not able to explain the increase by changes in corporate tax rates.[17] Debt ratios in other industrialized countries are equal to or higher than those in the United States. Many of these countries have imputation tax systems, which should eliminate the value of the interest tax shields.[18]

None of this disproves the trade-off theory. As George Stigler emphasized, theories are not rejected by circumstantial evidence; it takes a theory to beat a theory. So we now turn to a completely different theory of financing.

24 Jun 2021

24 Jun 2021

24 Jun 2021

24 Jun 2021

23 Jun 2021

25 Jun 2021