We have seen how firms value future cash flows and thereby decide whether to invest in long-lived capital. Consumers face similar decisions when they purchase durable goods, such as cars or major appliances. Unlike the decision to purchase food, entertainment, or clothing, the decision to buy a durable good involves comparing a flow of future benefits with the current purchase cost.

Suppose that you are deciding whether to buy a new car. If you keep the car for six or seven years, most of the benefits (and costs of operation) will occur in the future. You must therefore compare the future flow of net benefits from owning the car (the benefit of having transportation less the cost of insurance, maintenance, and gasoline) with the purchase price. Likewise, when deciding whether to buy a new air conditioner, you must compare its price with the present value of the flow of net benefits (the benefit of a cool room less the cost of electricity to operate the unit).

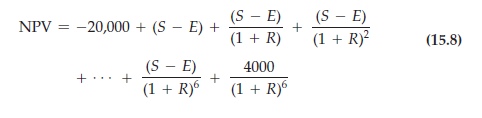

These problems are analogous to the problem of a firm that must compare a future flow of profits with the current cost of plant and equipment when making a capital investment decision. We can therefore analyze these problems just as we analyzed the firm’s investment problem. Let’s do this for a consumer’s decision to buy a car.The main benefit from owning a car is the flow of transportation services it provides. The value of those services differs from consumer to consumer. Let’s assume our consumer values the service at S dollars per year. Let’s also assume that the total operating expense (insurance, maintenance, and gasoline) is E dollars per year, that the car costs $20,000, and that after six years, its resale value will be $4000. The decision to buy the car can then be framed in terms of net present value:

What discount rate R should the consumer use? The consumer should apply the same principle that a firm does: The discount rate is the opportunity cost of money. If the consumer already has $20,000 and does not need a loan, the correct discount rate is the return that could be earned by investing the money in another asset—say, a savings account or a government bond. On the other hand, if the consumer is in debt, the discount rate would be the borrowing rate that he or she is already paying. Because this rate is likely to be much higher

than the interest rate on a bond or savings account, the NPV of the investment will be smaller.

Consumers must often make trade-offs between up-front versus future payments. An example is the decision of whether to buy or lease a new car. Suppose you can buy a new Toyota Corolla for $15,000 and, after six years, sell it for $6000. Alternatively, you could lease the car for $300 per month for three years, and at the end of the three years, return the car. Which is better—buying or leasing? The answer depends on the interest rate. If the interest rate is very low, buying the car is preferable because the present value of the future lease payments is high. If the interest rate is high, leasing is preferable because the present value of the future lease payments is low.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

26 Apr 2021

26 Apr 2021

19 Apr 2021

16 Apr 2021

19 Apr 2021

16 Apr 2021