Old equipment is often traded in for new equipment having a similar use. In such cases, the seller allows the buyer an amount for the old equipment traded in. This amount, called the trade-in allowance, may be either greater or less than the book value of the old equipment. The remaining balance—the amount owed—is either paid in cash or recorded as a liability. It is normally called boot, which is its tax name.

Accounting for the exchange of similar assets depends on whether the transaction has commercial substance.[1] An exchange has commercial substance if future cash flows change as a result of the exchange. If an exchange of similar assets has commercial substance, a gain or loss is recognized. In such cases, the exchange is accounted for similar to that of a sale of a fixed asset. The gain or loss is determined as the difference between the fair market value (trade-in allowance) of the asset given up (exchanged) and its book value. Alternatively, the gain or loss can be determined as the difference between the fair market value of the new asset received and the assets given up in the exchange (cash and book value of the old asset).

1. Gain on Exchange

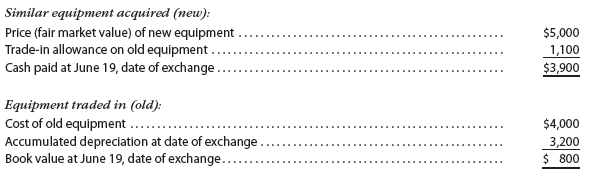

To illustrate a gain on an exchange of similar assets, assume the following:

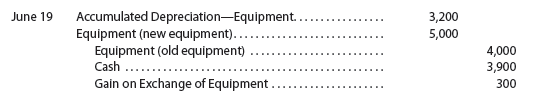

The entry to record this exchange and payment of cash is as follows:

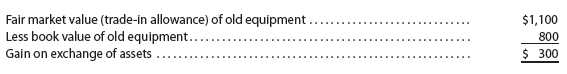

The gain on the exchange, $300, is the difference between the fair market value (trade-in allowance) of the asset given up (exchanged) of $1,100 and its book value of $800, as shown below.

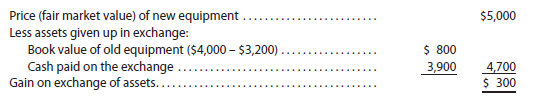

The gain on the exchange, $300, can also be determined as the difference between the fair market value of the new asset of $5,000 and the book value of the old asset traded in of $800 plus the cash paid of $3,900, as shown below.

2. Loss on Exchange

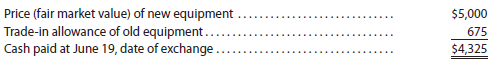

To illustrate a loss on an exchange of similar assets, assume that instead of a trade-in allowance of $1,100, a trade-in allowance of only $675 was allowed in the preceding example. In this case, the cash paid on the exchange is $4,325 as shown below.

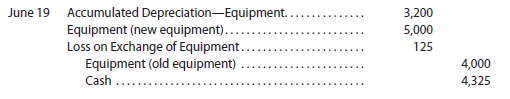

The entry to record this exchange and payment of cash is as follows:

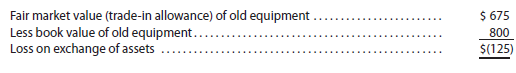

The loss on the exchange, $125, is the difference between the fair market value (trade-in allowance) of the asset given up (exchanged) of $675 and its book value of $800, as shown below.

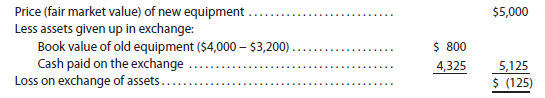

The loss on the exchange, $125, can also be determined as the difference between the fair market value of the new asset of $5,000 and the book value of the old asset traded in of $800 plus the cash paid of $4,325, as shown below.

In those cases where an asset exchange lacks commercial substance, no gain is recognized on the exchange. Instead, the cost of the new asset is adjusted for any gain. For example, in the first illustration, the gain of $300 would be subtracted from the purchase price of $5,000 and the new asset would be recorded at $4,700. Accounting for the exchange of assets that lack commercial substance is discussed in more advanced accounting texts.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Somebody essentially assist to make severely articles I’d state. This is the first time I frequented your web page and so far? I amazed with the analysis you made to make this particular submit incredible. Wonderful job!

There is clearly a bundle to know about this. I feel you made various nice points in features also.