When a company or a bank advances credit, it is making a loan. The company or bank is called a creditor (or lender). The individuals or companies receiving the loan are called debtors (or borrowers).

Debt is recorded as a liability by the debtor. Long-term liabilities are debts due beyond one year. Thus, a 30-year mortgage used to purchase property is a long-term liability. Current liabilities are debts that will be paid out of current assets and are due within one year.

Three types of current liabilities are discussed in this section—accounts payable, the current portion of long-term debt, and short-term notes payable.

1. Accounts Payable

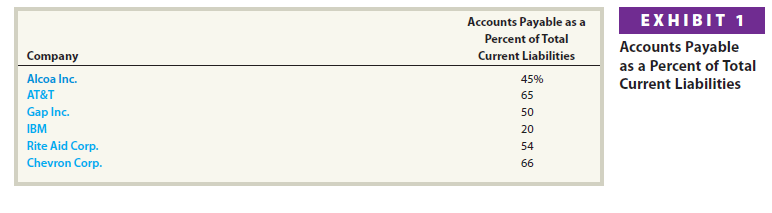

Accounts payable transactions have been described and illustrated in earlier chapters. These transactions involved a variety of purchases on account, including the purchase of merchandise and supplies. For most companies, accounts payable is the largest current liability. Exhibit 1 shows the accounts payable balance as a percent of total current liabilities for a number of companies.

2. Current Portion of Long-Term Debt

Long-term liabilities are often paid back in periodic payments, called installments. Such installments that are due within the coming year are classified as a current liability. The installments due after the coming year are classified as a long-term liability.

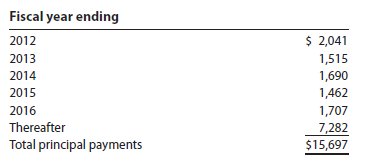

To illustrate, The Coca-Cola Company reported the following debt payments schedule in its December 31, 2011, annual report to shareholders (in millions):

The debt of $2,041 due in 2012 would be reported as a current liability on the December 31 balance sheet for the preceding year. The remaining debt of $13,656 ($15,697 – $2,041) would be reported as a long-term liability on the balance sheet.

3. Short-Term Notes Payable

Notes may be issued to purchase merchandise or other assets. Notes may also be issued to creditors to satisfy an account payable created earlier.1

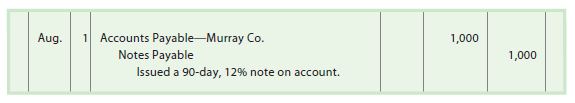

To illustrate, assume that Nature’s Sunshine Company issued a 90-day, 12% note for $1,000, dated August 1, 2013, to Murray Co. for a $1,000 overdue account. The entry to record the issuance of the note is as follows:

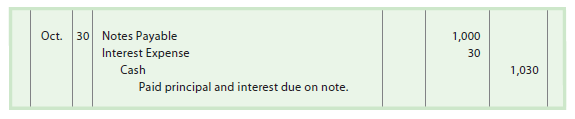

When the note matures, the entry to record the payment of $1,000 plus $30 interest ($1,000 x 12% x 90/360) is as follows:

The interest expense is reported in the Other Expense section of the income statement for the year ended December 31, 2013. The interest expense account is closed at December 31.

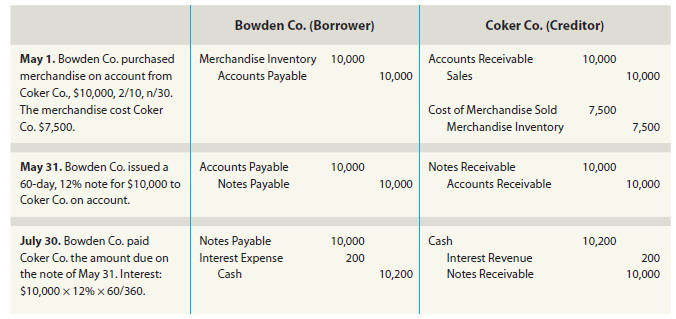

Each note transaction affects a debtor (borrower) and creditor (lender). The following illustration shows how the same transactions are recorded by the debtor and creditor. In this illustration, the debtor (borrower) is Bowden Co., and the creditor (lender) is Coker Co.

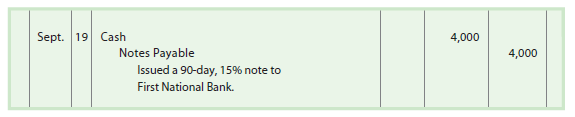

A company may also borrow from a bank by issuing a note. To illustrate, assume that on September 19 Iceburg Company borrowed cash from First National Bank by issuing a $4,000, 90-day, 15% note to the bank. The entry to record the issuance of the note and the cash proceeds is as follows:

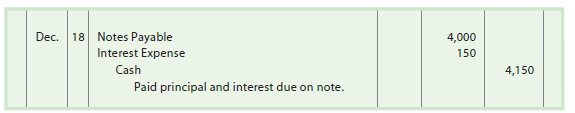

On the due date of the note (December 18), Iceburg Company owes First National Bank $4,000 plus interest of $150 ($4,000 x 15% x 90/360). The entry to record the payment of the note is as follows:

In some cases, a discounted note may be issued rather than an interest-bearing note. A discounted note has the following characteristics:

- The interest rate on the note is called the discount rate.

- The amount of interest on the note, called the discount, is computed by multiplying the discount rate times the face amount of the note.

- The debtor (borrower) receives the face amount of the note less the discount, called the

- The debtor must repay the face amount of the note on the due date.

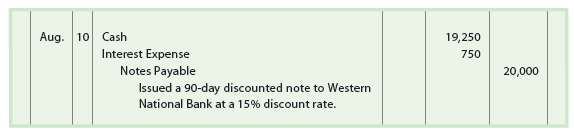

To illustrate, assume that on August 10, Cary Company issues a $20,000, 90-day discounted note to Western National Bank. The discount rate is 15%, and the amount of the discount is $750 ($20,000 x 15% x 90/360). Thus, the proceeds received by Cary Company are $19,250. The entry by Cary Company is as follows:

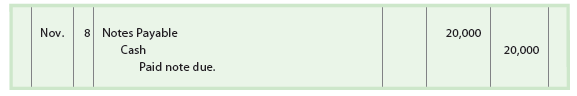

The entry when Cary Company pays the discounted note on November 8 is as follows:

Other current liabilities that have been discussed in earlier chapters include accrued expenses, unearned revenue, and interest payable. The accounting for wages and salaries, termed payroll accounting, is discussed next.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I really like your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to create my own blog and would like to know where u got this from. thanks a lot