In the income statement, depreciation and amortization expense should be reported separately or disclosed in a note. A description of the methods used in computing depreciation should also be reported.

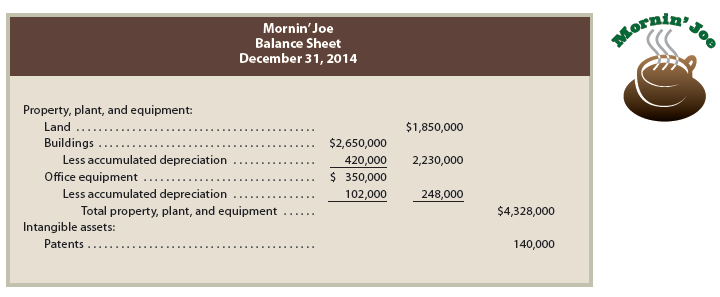

In the balance sheet, each class of fixed assets should be disclosed on the face of the statement or in the notes. The related accumulated depreciation should also be disclosed, either by class or in total. The fixed assets may be shown at their book value (cost less accumulated depreciation), which can also be described as their net amount.

If there are many classes of fixed assets, a single amount may be presented in the balance sheet, supported by a note with a separate listing. Fixed assets may be reported under the more descriptive caption of property, plant, and equipment.

Intangible assets are usually reported in the balance sheet in a separate section following fixed assets. The balance of each class of intangible assets should be disclosed net of any amortization.

The balance sheet presentation for Mornin’ Joe’s fixed and intangible assets is shown below.

The cost and related accumulated depletion of mineral rights are normally shown as part of the Fixed Assets section of the balance sheet. The mineral rights may be shown net of depletion on the face of the balance sheet. In such cases, a supporting note discloses the accumulated depletion.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I conceive this internet site has got very excellent written subject material posts.