Table 29.3 showed why Dynamic’s cash balance rose in 2018. But its financial manager also needs to forecast the company’s cash needs in 2019 and ensure that the company will be able to pay its upcoming bills. These forecasts are set out in the firm’s cash budget and are then used to draw up a plan for investing any cash surpluses or financing any deficit.

There are three steps to preparing a cash budget:

Step 1 Forecast the sources of cash. The largest inflow of cash usually comes from payments by the firm’s customers.

Step 2 Forecast the uses of cash.

Step 3 Calculate whether the firm is facing a cash shortage or surplus. The company then uses these forecasts to draw up a plan for raising or investing cash.

We will illustrate these steps by continuing with the example of Dynamic Mattress.

Step 1. Forecast the Sources of Cash Most of Dynamic’s cash inflow comes from the sales of mattresses. Therefore, we start with a sales forecast by quarter for 2019:[1]

But unless customers pay cash on delivery, these sales will become accounts receivable before they become cash. Cash flow comes from collections on accounts receivable.

Most firms keep track of the average time it takes customers to pay their bills. From this, they can forecast what proportion of a quarter’s sales is likely to be converted into cash in that quarter and what proportion is likely to be carried over to the next quarter as accounts receivable.

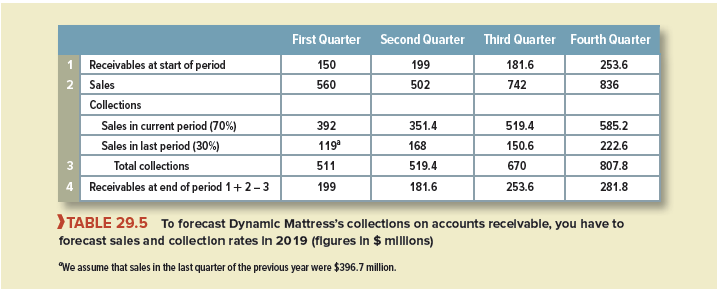

Suppose that 70% of Dynamic’s sales are paid for in the immediate quarter and the remaining 30% in the next. Table 29.5 shows forecast collections under this assumption. For example, you can see that in the first quarter, collections from current sales are 70% of $560, or $392 million. But the firm also collects 30% of the previous quarter’s sales, or .3 X $396.7 = $119.0 million. Therefore, total collections are $392 + $119.0 = $511.0 million.

Dynamic started the first quarter with $150.0 million of accounts receivable. The quarter’s sales of $560 million were added to accounts receivable, but $511.0 million of collections were subtracted. Therefore, as Table 29.5 shows, Dynamic ended the quarter with accounts receivable of 150 + 560 – 511 = $199 million. The general formula is

Ending accounts receivable = beginning accounts receivable + sales – collections

Step 2: Forecast the Uses of Cash So much for the incoming cash. Now for the outgoing. There always seem to be many more uses for cash than there are sources. The second section of Table 29.6 shows how Dynamic expects to use cash. For simplicity, we have condensed the uses into five categories:

- Payments of accounts payable. Dynamic has to pay its bills for raw materials, parts, electricity, and so on. The cash-flow forecast assumes all these bills are paid on time, although Dynamic could probably delay payment to some extent. Delayed payment is sometimes called stretching payables. Stretching is one source of short-term financing, but for most firms, it is an expensive source because, by stretching, they lose discounts given to firms that pay promptly. (This is discussed in more detail in Chapter 30.)

- Increase in inventories. The expected increase in sales in 2019 requires additional investment in inventories.

- Labor, administrative, and other expenses. This category includes all other regular business expenses.

- Capital expenditures. Note that Dynamic Mattress plans a major outlay of cash in the first quarter to pay for a long-lived asset.

- Taxes, interest, and dividend payments. This includes dividend payments to stockholders and interest on currently outstanding long-term debt. It does not include interest on any additional borrowing to meet cash requirements in 2019. At this stage in the analysis, Dynamic does not know how much it will have to borrow, or whether it will have to borrow at all.

Step 3: Calculate the Cash Balance The forecasted net inflow of cash (sources minus uses) is shown by the shaded line in Table 29.6. Note the large negative figure for the first quarter: a $141.0 million forecast outflow. There is a smaller forecast outflow in the second quarter and then substantial cash inflows in the second half of the year.

The bottom part of Table 29.6 calculates how much financing Dynamic will have to raise if its cash-flow forecasts are right. It starts the year with $30.4 million in cash. There is a $141.0 million cash outflow in the first quarter, so Dynamic will have to obtain at least $141.0 − 30.4 = $110.6 million of additional financing. This would leave the firm with a forecasted cash balance of exactly zero at the start of the second quarter.

Most financial managers regard a planned cash balance of zero as driving too close to the edge of the cliff. They establish a minimum operating cash balance to absorb unexpected cash inflows and outflows. We assume that Dynamic’s minimum operating cash balance is $25 million. This means it will have to raise $110.6 + $25 = $135.6 million in the first quarter and $72.6 million more in the second quarter. Thus, its cumulative financing requirement is $208.2 million by the second quarter. Fortunately, this is the peak: The cumulative requirement declines in the third quarter by $120 million to $88.2 million. In the final quarter, Dynamic is out of the woods: Its cash balance is $107.1 million, well above its minimum operating balance.

I’m still learning from you, while I’m trying to achieve my goals. I absolutely liked reading all that is posted on your website.Keep the stories coming. I liked it!