This section illustrates merchandise transactions for NetSolutions after it becomes a retailer of computer hardware and software. During 2013, Chris Clark implemented the second phase of NetSolutions’ business plan. In doing so, Chris notified clients that beginning July 1, 2014, NetSolutions would no longer offer consulting services. Instead, it would become a retailer.

NetSolutions’ business strategy is to offer personalized service to individuals and small businesses that are upgrading or purchasing new computer systems. NetSolutions’ personal service includes a no-obligation, on-site assessment of the customer’s computer needs. By providing personalized service and follow-up, Chris feels that NetSolutions can compete effectively against such retailers as Best Buy, Office Max, Office Depot, and Dell.

Merchandise transactions are recorded in the accounts, using the rules of debit and credit that are described and illustrated in Chapter 2. However, the accounting system for merchandise businesses is often modified to more efficiently record transactions. For example, an accounting system should be designed to provide information on the amounts due from various customers (accounts receivable) and amounts owed to various creditors (accounts payable). A separate account for each customer and creditor could be added to the ledger. However, as the number of customers and creditors increased, the ledger would become large and awkward to use.

A large number of individual accounts with a common characteristic can be grouped together in a separate ledger, called a subsidiary ledger. The primary ledger, which contains all of the balance sheet and income statement accounts, is then called the general ledger. Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. The sum of the balances of the accounts in the subsidiary ledger must equal the balance of the related controlling account. Thus, a subsidiary ledger is a secondary ledger that supports a controlling account in the general ledger. Common subsidiary ledgers are:

- The accounts receivable subsidiary ledger, or customers ledger, lists the individual customer accounts in alphabetical order. The controlling account in the general ledger is Accounts Receivable.

- The accounts payable subsidiary ledger, or creditors ledger, lists individual creditor accounts in alphabetical order. The controlling account in the general ledger is Accounts Payable.

- The inventory subsidiary ledger, or inventory ledger, lists individual inventory by item (bar code) number. The controlling account in the general ledger is Inventory. An inventory subsidiary ledger is used in a perpetual inventory system.

Most merchandising companies also use computerized accounting systems that record similar transactions in separate journals, which generate purchase, sales, and inventory reports. These separate journals are called special journals. However, for simplicity, the journal entries in this chapter will be illustrated using a two-column general journal.1

1. Purchases Transactions

There are two systems for accounting for merchandise transactions: perpetual and periodic. In a perpetual inventory system, each purchase and sale of merchandise is recorded in the inventory account and related subsidiary ledger. In this way, the amount of merchandise available for sale and the amount sold are continuously (perpetually) updated in the inventory records. In a periodic inventory system, the inventory does not show the amount of merchandise available for sale and the amount sold. Instead, a listing of inventory on hand, called a physical inventory, is prepared at the end of the accounting period. This physical inventory is used to determine the cost of merchandise on hand at the end of the period and the cost of merchandise sold during the period.

Most merchandise companies use computerized perpetual inventory systems. Such systems use bar codes or radio frequency identification codes embedded in a product.

An optical scanner or radio frequency identification device is then used to read the product codes and track inventory on hand and sold.

Because computerized perpetual inventory systems are widely used, this chapter illustrates merchandise transactions using a perpetual inventory system. The periodic system is described and illustrated in an appendix at the end of this chapter.

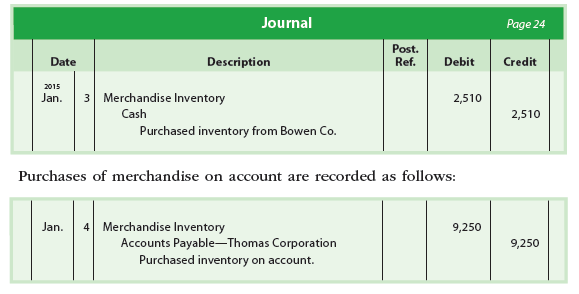

Under the perpetual inventory system, cash purchases of merchandise are recorded as follows:

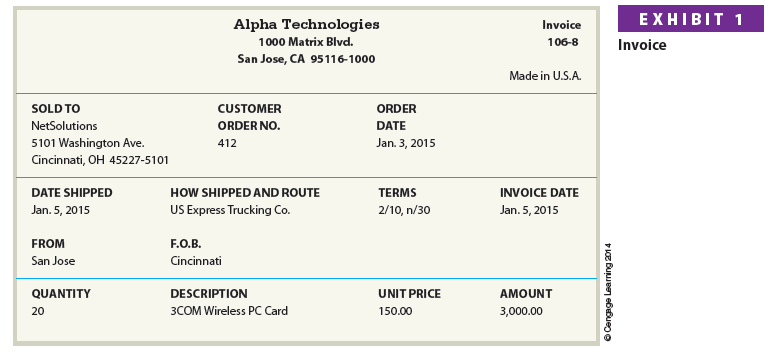

The terms of purchases on account are normally indicated on the invoice or bill that the seller sends the buyer. An example of an invoice sent to NetSolutions by Alpha Technologies is shown in Exhibit 1.

The terms for when payments for merchandise are to be made are called the credit terms. If payment is required on delivery, the terms are cash or net cash. Otherwise, the buyer is allowed an amount of time, known as the credit period, in which to pay. The credit period usually begins with the date of the sale as shown on the invoice.

If payment is due within a stated number of days after the invoice date, such as 30 days, the terms are net 30 days. These terms may be written as n/30.[1] If payment is due by the end of the month in which the sale was made, the terms are written as n/eom.

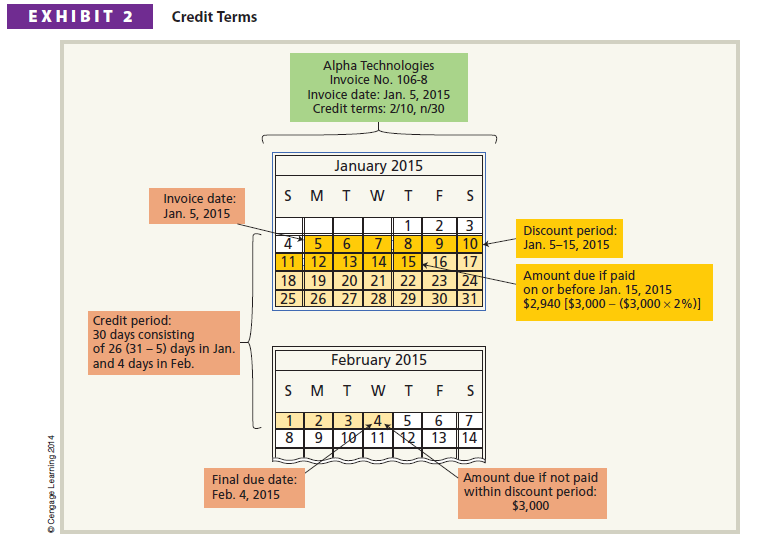

Purchases Discounts To encourage the buyer to pay before the end of the credit period, the seller may offer a discount. For example, a seller may offer a 2% discount if the buyer pays within 10 days of the invoice date. If the buyer does not take the discount, the total invoice amount is due within 30 days. These terms are expressed as 2/10, n/30 and are read as “2% discount if paid within 10 days, net amount due within 30 days.” The credit terms of 2/10, n/30 are summarized in Exhibit 2, using the invoice in Exhibit 1.

Discounts taken by the buyer for early payment of an invoice are called purchases discounts. Purchases discounts taken by a buyer reduce the cost of the merchandise purchased. Even if the buyer has to borrow to pay within a discount period, it is normally to the buyer’s advantage to do so. For this reason, accounting systems are normally designed so that all available discounts are taken.

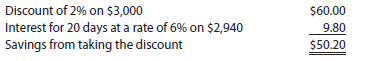

To illustrate, the invoice shown in Exhibit 1 is used. The last day of the discount period is January 15 (invoice date of January 5 plus 10 days). Assume that in order to pay the invoice on January 15, NetSolutions borrows $2,940, which is $3,000 less the discount of $60 ($3,000 x 2%). If an annual interest rate of 6% and a 360-day year is also assumed, the interest on the loan of $2,940 for the remaining 20 days of the credit period is $9.80 ($2,940 x 6% x 20/360).

The net savings to NetSolutions of taking the discount is $50.20, computed as follows:

The savings can also be seen by comparing the interest rate on the money saved by taking the discount and the interest rate on the money borrowed to take the discount. The interest rate on the money saved in the prior example is estimated by converting 2% for 20 days to a yearly rate, as follows:

![]()

NetSolutions borrowed $2,940 at 6% to take the discount. If NetSolutions does not take the discount, it pays an estimated interest rate of 36% for using the $2,940 for the remaining 20 days of the credit period. Thus, buyers should normally take all available purchase discounts.

Under the perpetual inventory system, the buyer initially debits Merchandise Inventory for the amount of the invoice. When paying the invoice within the discount period, the buyer credits Merchandise Inventory for the amount of the discount. In this way, Merchandise Inventory shows the net cost to the buyer.

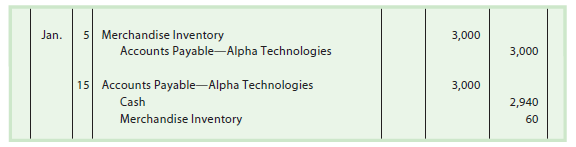

To illustrate, NetSolutions would record the Alpha Technologies invoice and its payment at the end of the discount period as follows:

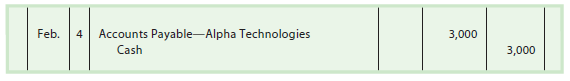

Assume that NetSolutions does not take the discount, but instead pays the invoice on February 4. In this case, NetSolutions would record the payment as follows:

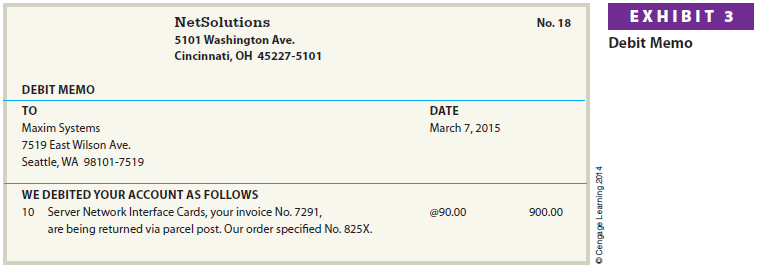

Purchases Returns and Allowances A buyer may request an allowance for merchandise that is returned (purchases return) or a price allowance (purchases allowance) for damaged or defective merchandise. From a buyer’s perspective, such returns and allowances are called purchases returns and allowances. In both cases, the buyer normally sends the seller a debit memorandum to notify the seller of reasons for the return (purchase return) or to request a price reduction (purchase allowance).

A debit memorandum, often called a debit memo, is shown in Exhibit 3. A debit memo informs the seller of the amount the buyer proposes to debit to the account payable due the seller. It also states the reasons for the return or the request for the price allowance.

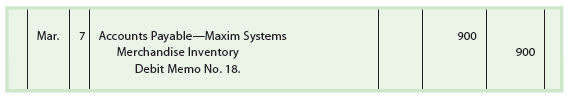

The buyer may use the debit memo as the basis for recording the return or allowance or wait for approval from the seller (creditor). In either case, the buyer debits Accounts Payable and credits Merchandise Inventory.

To illustrate, NetSolutions records the return of the merchandise indicated in the debit memo in Exhibit 3 as follows:

A buyer may return merchandise or be granted a price allowance before paying an invoice. In this case, the amount of the debit memo is deducted from the invoice. The amount is deducted before the purchase discount is computed.

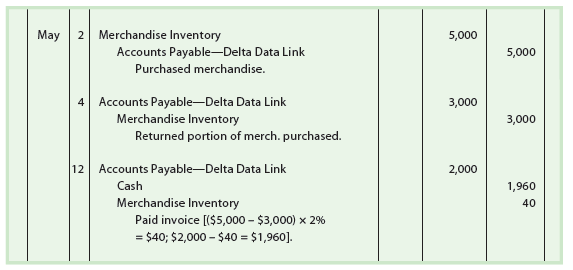

To illustrate, assume the following data concerning a purchase of merchandise by NetSolutions on May 2:

May 2. Purchased $5,000 of merchandise on account from Delta Data Link, terms 2/10, n/30.

- Returned $3,000 of the merchandise purchased on May 2.

- Paid for the purchase of May 2 less the return and discount.

NetSolutions would record these transactions as follows:

2. Sales Transactions

Revenue from merchandise sales is usually recorded as Sales. Sometimes a business may use the title Sales of Merchandise.

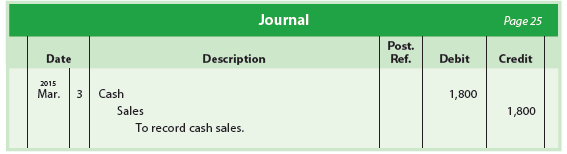

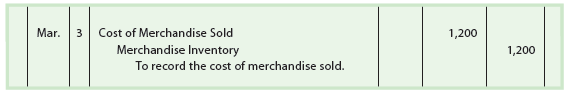

Cash Sales A business may sell merchandise for cash. Cash sales are normally entered on a cash register and recorded in the accounts. To illustrate, assume that on March 3, NetSolutions sells merchandise for $1,800. These cash sales are recorded as follows:

Using the perpetual inventory system, the cost of merchandise sold and the decrease in merchandise inventory are also recorded. In this way, the merchandise inventory account indicates the amount of merchandise on hand (not sold).

To illustrate, assume that the cost of merchandise sold on March 3 is $1,200. The entry to record the cost of merchandise sold and the decrease in the merchandise inventory is as follows:

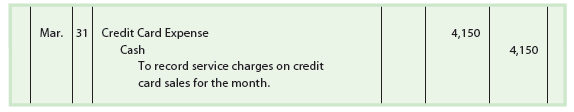

Sales may be made to customers using credit cards such as MasterCard or VISA. Such sales are recorded as cash sales. This is because these sales are normally processed by a clearinghouse that contacts the bank that issued the card. The issuing bank then electronically transfers cash directly to the retailer’s bank account.[2] Thus, the retailer normally receives cash within a few days of making the credit card sale.

If customers use MasterCards to pay for their purchases, the sales would be recorded exactly as shown in the March 3 entry at the top of the page. Any processing fees charged by the clearinghouse or issuing bank are periodically recorded as an expense. This expense is normally reported on the income statement as an administrative expense. To illustrate, assume that NetSolutions paid credit card processing fees of $4,150 on March 31. These fees would be recorded as follows:

Instead of using MasterCard or VISA, a customer may use a credit card that is not issued by a bank. For example, a customer might use an American Express card. If the seller uses a clearinghouse, the clearinghouse will collect the receivable and transfer the cash to the retailer’s bank account, similar to the way it would have if the customer had used MasterCard or VISA. Large businesses, however, may not use a clearinghouse. In such cases, nonbank credit card sales must first be reported to the card company before cash is received. Thus, a receivable is created with the nonbank credit card company. However, since most retailers use clearinghouses to process both bank and nonbank credit cards, all credit card sales will be recorded as cash sales.

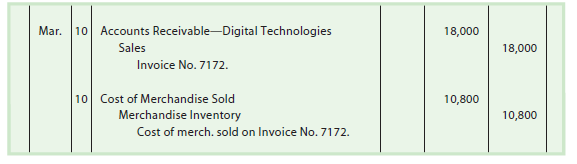

Sales on Account A business may sell merchandise on account. The seller records such sales as a debit to Accounts Receivable and a credit to Sales. An example of an entry for a NetSolutions sale on account of $18,000 follows. The cost of merchandise sold was $10,800.

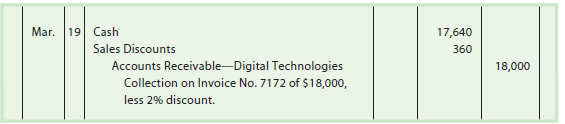

Sales Discounts As mentioned in the discussion of purchases transactions, a seller may offer the buyer credit terms that include a discount for early payment. The seller refers to such discounts as sales discounts.

Sales discounts reduce sales revenue. To reduce sales revenue, the sales account could be debited. However, managers usually want to know the amount of the sales discounts for a period. For this reason, sales discounts are recorded in a separate sales discounts account, which is a contra (or offsetting) account to Sales.

To illustrate, assume that NetSolutions sold $18,000 of merchandise to Digital Technologies on March 10 with credit terms 2/10, n/30. Under the credit terms, Digital Technologies has until March 20 (March 10 plus 10 days) to pay within the discount period. Assume that Digital Technologies pays the invoice on March 19. Since the invoice is paid within the discount period (10 days), Digital Technologies would deduct $360 ($18,000 x 2%) from the invoice amount of $18,000 and pay $17,640. NetSolutions would record the receipt of the cash as follows:

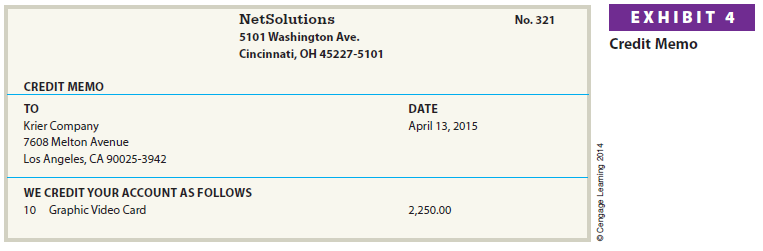

Sales Returns and Allowances Merchandise sold may be returned to the seller (sales return). In other cases, the seller may reduce the initial selling price (sales allowance). This might occur if the merchandise is defective, damaged during shipment, or does not meet the buyer’s expectations. From a seller’s perspective, such returns and allowances are called sales returns and allowances.

If the return or allowance is for a sale on account, the seller usually issues the buyer a credit memorandum, often called a credit memo. A credit memo authorizes a credit (decrease) to the buyer’s account receivable. A credit memo indicates the amount and reason for the credit. An example of a credit memo issued by NetSolutions is shown in Exhibit 4.

Like sales discounts, sales returns and allowances reduce sales revenue. Also, returns often result in additional shipping and handling expenses. Thus, managers usually want to know the amount of returns and allowances for a period. For this reason, sales returns and allowances are recorded in a separate sales returns and allowances account, which is a contra (or offsetting) account to Sales.

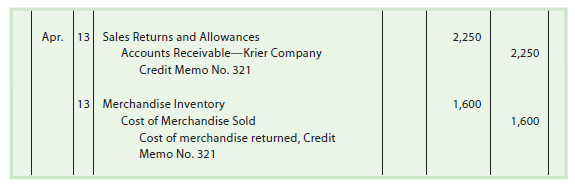

The seller debits Sales Returns and Allowances for the amount of the return or allowance. If the sale was on account, the seller credits Accounts Receivable. Using a perpetual inventory system, the seller must also debit (increase) Merchandise Inventory

and decrease (credit) Cost of Merchandise Sold for the cost of the returned merchandise.

To illustrate, the credit memo shown in Exhibit 4 is used. The selling price of the merchandise returned in Exhibit 4 is $2,250. Assuming that the cost of the merchandise returned is $1,600, the sales return and allowance would be recorded as follows:

A buyer may pay for merchandise and then later return it. In this case, the seller may do one of the following:

- Issue a credit that is applied against the buyer’s other receivables.

- Issue a cash refund.

If the credit is applied against the buyer’s other receivables, the seller records the credit with entries similar to those shown above. If cash is refunded, the seller debits Sales Returns and Allowances and credits Cash.

3. Freight

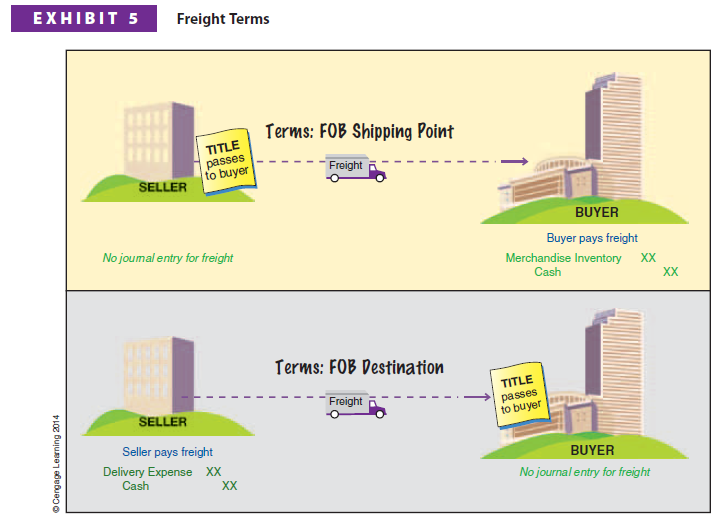

Purchases and sales of merchandise often involve freight. The terms of a sale indicate when ownership (title) of the merchandise passes from the seller to the buyer. This point determines whether the buyer or the seller pays the freight costs.[3]

The ownership of the merchandise may pass to the buyer when the seller delivers the merchandise to the freight carrier. In this case, the terms are said to be FOB (free on board) shipping point. This term means that the buyer pays the freight costs from the shipping point to the final destination. Such costs are part of the buyer’s total cost of purchasing inventory and are added to the cost of the inventory by debiting Merchandise Inventory.

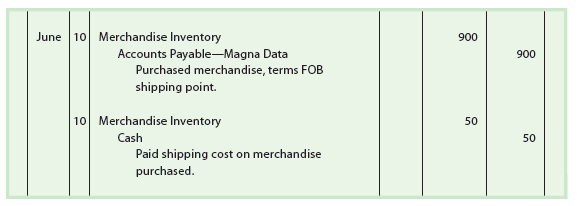

To illustrate, assume that on June 10, NetSolutions purchased merchandise as follows:

June 10. Purchased merchandise from Magna Data, $900, terms FOB shipping point.

- Paid freight of $50 on June 10 purchase from Magna Data.

NetSolutions would record these two transactions as follows:

The ownership of the merchandise may pass to the buyer when the buyer receives the merchandise. In this case, the terms are said to be FOB (free on board) destination. This term means that the seller pays the freight costs from the shipping point to the buyer’s final destination. When the seller pays the delivery charges, the seller debits Delivery Expense or Freight Out. Delivery Expense is reported on the seller’s income statement as a selling expense.

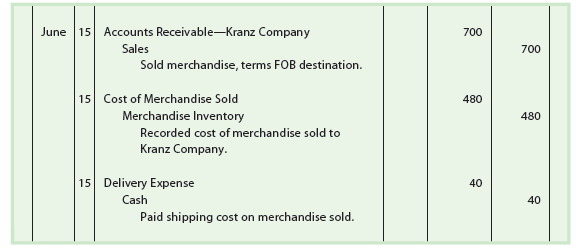

To illustrate, assume that NetSolutions sells merchandise as follows:

June 15. Sold merchandise to Kranz Company on account, $700, terms FOB destination. The cost of the merchandise sold is $480.

- NetSolutions pays freight of $40 on the sale of June 15.

NetSolutions records the sale, the cost of the sale, and the freight cost as follows:

The seller may prepay the freight, even though the terms are FOB shipping point. The seller will then add the freight to the invoice. The buyer debits Merchandise Inventory for the total amount of the invoice, including the freight. Any discount terms would not apply to the prepaid freight.

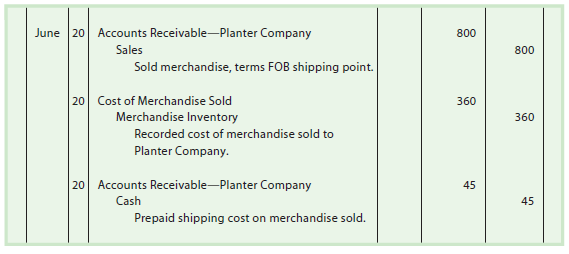

To illustrate, assume that NetSolutions sells merchandise as follows:

June 20. Sold merchandise to Planter Company on account, $800, terms FOB shipping point. NetSolutions paid freight of $45, which was added to the invoice. The cost of the merchandise sold is $360.

NetSolutions records the sale, the cost of the sale, and the freight as follows:

Shipping terms, the passage of title, and whether the buyer or seller is to pay the freight costs are summarized in Exhibit 5.

4. Summary: Recording Merchandise Inventory Transactions

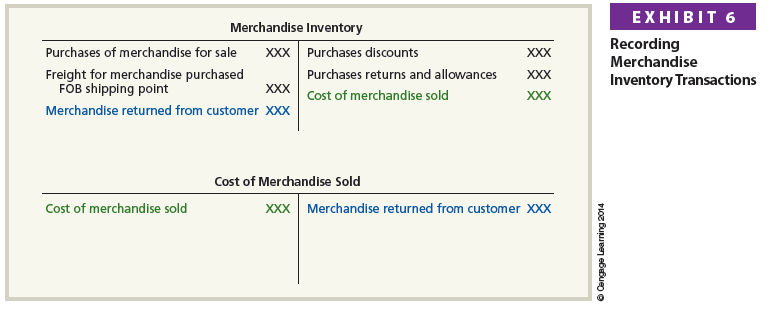

Recording merchandise inventory transactions under the perpetual inventory system has been described and illustrated in the preceding sections. These transactions involved purchases, purchases discounts, purchases returns and allowances, freight, sales, and sales returns from customers. Exhibit 6 summarizes how these transactions are recorded in T account form.

5. Dual Nature of Merchandise transactions

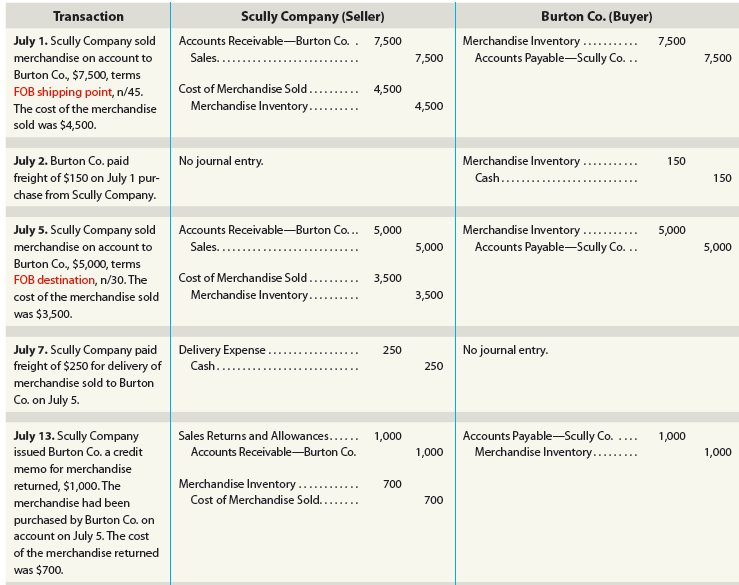

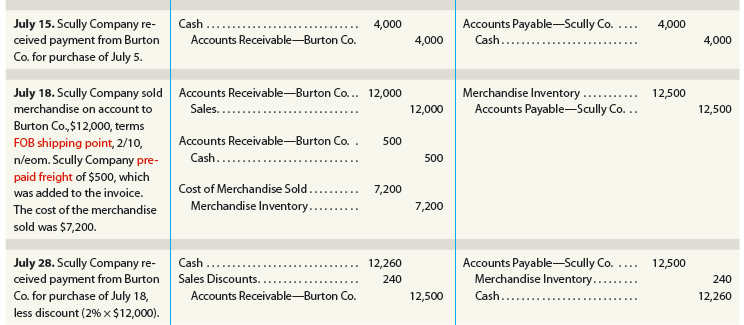

Each merchandising transaction affects a buyer and a seller. In the following illustration, the same transactions for a seller and buyer are recorded. In this example, the seller is Scully Company and the buyer is Burton Co.

6. Chart of Accounts for a Merchandising Business

The chart of accounts for a merchandising business should reflect the types of merchandise transactions described and illustrated earlier in this chapter. The chart of accounts for NetSolutions is shown in Exhibit 7. The accounts related to merchandising transactions are shown in color.

As shown in Exhibit 7, NetSolutions’ chart of accounts consists of three-digit account numbers. The first digit indicates the major financial statement classification (1 for assets, 2 for liabilities, and so on). The second digit indicates the subclassification (e.g., 11 for current assets, 12 for noncurrent assets, etc.). The third digit identifies the specific account (e.g., 110 for Cash, 123 for Store Equipment, etc.). Using a threedigit numbering system makes it easier to add new accounts as they are needed.

8. Sales Taxes and Trade Discounts

Sales of merchandise often involve sales taxes. Also, the seller may offer buyers trade discounts.

Sales Taxes Almost all states levy a tax on sales of merchandise.[4] The liability for the sales tax is incurred when the sale is made.

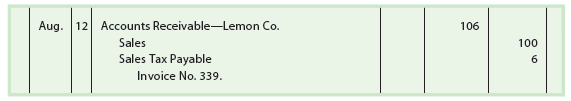

At the time of a cash sale, the seller collects the sales tax. When a sale is made on account, the seller charges the tax to the buyer by debiting Accounts Receivable. The seller credits the sales account for the amount of the sale and credits the tax to Sales Tax Payable. For example, the seller would record a sale of $100 on account, subject to a tax of 6%, as follows:

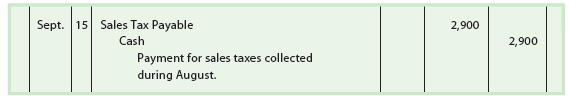

On a regular basis, the seller pays to the taxing authority (state) the amount of the sales tax collected. The seller records such a payment as follows:

Trade Discounts Wholesalers are companies that sell merchandise to other businesses rather than to the public. Many wholesalers publish sales catalogs. Rather than updating their catalogs, wholesalers may publish price updates. These updates may include large discounts from the catalog list prices. In addition, wholesalers often offer special discounts to government agencies or businesses that order large quantities. Such discounts are called trade discounts.

Sellers and buyers do not normally record the list prices of merchandise and trade discounts in their accounts. For example, assume that an item has a list price of $1,000 and a 40% trade discount. The seller records the sale of the item at $600 [$1,000 less the trade discount of $400 ($1,000 x 40%)]. Likewise, the buyer records the purchase at $600.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

You are a very clever person!

Thanks a lot for sharing this with all people you really recognize what you are talking approximately! Bookmarked. Please also seek advice from my website =). We will have a link alternate arrangement between us!