If a company’s management could record and report financial data as it saw fit, comparisons among companies would be difficult, if not impossible. Thus, financial accountants follow generally accepted accounting principles (GAAP) in preparing reports. These reports allow investors and other users to compare one company to another.

Accounting principles and concepts develop from research, accepted accounting practices, and pronouncements of regulators. Within the United States, the Financial Accounting Standards Board (FASB) has the primary responsibility for developing accounting principles. The FASB publishes Statements of Financial Accounting Standards as well as Interpretations of these Standards. In addition, the Securities and Exchange Commission (SEC), an agency of the U.S. government, has authority over the accounting and financial disclosures for companies whose shares of ownership (stock) are traded and sold to the public. The SEC normally accepts the accounting principles set forth by the FASB. However, the SEC may issue Staff Accounting Bulletins on accounting matters that may not have been addressed by the FASB.

Many countries outside the United States use generally accepted accounting principles adopted by the International Accounting Standards Board (IASB). The IASB issues International Financial Reporting Standards (IFRSs). Differences currently exist between FASB and IASB accounting principles. However, the FASB and IASB are working together to reduce and eliminate these differences into a single set of accounting principles. Such a set of worldwide accounting principles would help facilitate investment and business in an increasingly global economy.

In this chapter and text, accounting principles and concepts are emphasized. It is through this emphasis on the “why” as well as the “how” that you will gain an understanding of accounting.

1. Business Entity Concept

The business entity concept limits the economic data in an accounting system to data related directly to the activities of the business. In other words, the business is viewed as an entity separate from its owners, creditors, or other businesses. For example, the accountant for a business with one owner would record the activities of the business only and would not record the personal activities, property, or debts of the owner.

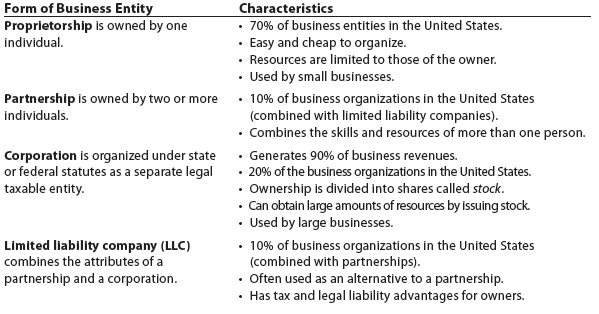

A business entity may take the form of a proprietorship, partnership, corporation, or limited liability company (LLC). Each of these forms and their major characteristics are listed below.

The three types of businesses discussed earlier—service, merchandising, and manufacturing—may be organized as proprietorships, partnerships, corporations, or limited liability companies. Because of the large amount of resources required to operate a manufacturing business, most manufacturers such as Ford Motor Company are corporations. Most large retailers such as Walmart and Home Depot are also corporations. Companies organized as corporations often include Inc. as part of their name to indicate that they are incorporated. For example, Apple’s legal name is Apple Inc.

2. Cost Concept

Under the cost concept, amounts are initially recorded in the accounting records at their cost or purchase price. To illustrate, assume that Aaron Publishers purchased the following building on February 20, 2012, for $150,000:

Price listed by seller on January 1, 2012 $160,000

Aaron Publishers’ initial offer to buy on January 31, 2012 140,000

Purchase price on February 20, 2012 150,000

Estimated selling price on December 31, 2014 220,000

Assessed value for property taxes, December 31,2014 190,000

Under the cost concept, Aaron Publishers records the purchase of the building on February 20, 2012, at the purchase price of $150,000. The other amounts listed above have no effect on the accounting records.

The fact that the building has an estimated selling price of $220,000 on December 31, 2014, indicates that the building has increased in value. However, to use the $220,000 in the accounting records would be to record an illusory or unrealized profit. If Aaron Publishers sells the building on January 9, 2016, for $240,000, a profit of $90,000 ($240,000 – $150,000) is then realized and recorded. The new owner would record $240,000 as its cost of the building.

The cost concept also involves the objectivity and unit of measure concepts. The objectivity concept requires that the amounts recorded in the accounting records be based on objective evidence. In exchanges between a buyer and a seller, both try to get the best price. Only the final agreed-upon amount is objective enough to be recorded in the accounting records. If amounts in the accounting records were constantly being revised upward or downward based on offers, appraisals, and opinions, accounting reports could become unstable and unreliable.

The unit of measure concept requires that economic data be recorded in dollars. Money is a common unit of measurement for reporting financial data and reports.

Example Exercise 1-1 Cost Concept

On August 25, Gallatin Repair Service extended an offer of $125,000 for land that had been priced for sale at $150,000. On September 3, Gallatin Repair Service accepted the seller’s counteroffer of $137,000. On October 20, the land was assessed at a value of $98,000 for property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a national retail chain. At what value should the land be recorded in Gallatin Repair Service’s records?

Follow My Example 1-1

$137,000. Under the cost concept, the land should be recorded at the cost to Gallatin Repair Service.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Keep on working, great job!