Along with helping a firm understand the dynamics of the industry it plans to enter, the five forces model can be used in two ways: (1) to help a firm deter- mine whether it should enter a particular industry and (2) whether it can carve out an attractive position in that industry. Let’s examine these two positive outcomes.

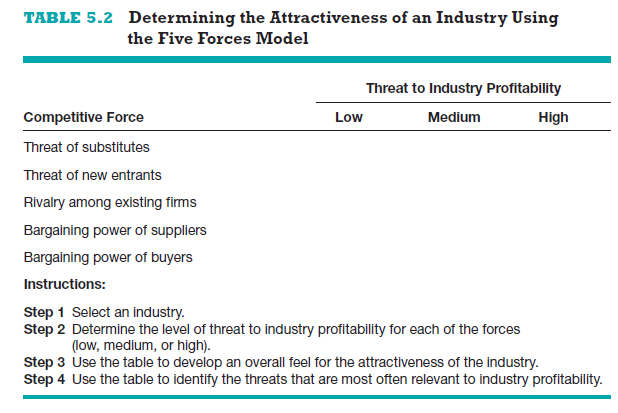

First, the five forces model can be used to assess the attractiveness of an industry or a specific position within an industry by determining the level of threat to industry profitability for each of the forces, as shown in Table 5.2. This analysis of industry attractiveness should be more in-depth than the less rigorous analysis conducted during feasibility analysis. For example, if a firm filled out the form shown in Table 5.2 and several of the threats to industry profitability were high, the firm may want to reconsider entering the industry or think carefully about the position it will occupy in the industry. In the res- taurant industry, for example, the threat of substitute products, the threat of new entrants, and the rivalry among existing firms are high. For certain res- taurants, such as fresh-seafood restaurants, the bargaining power of suppliers may also be high (the number of seafood suppliers is relatively small compared to the number of beef and chicken suppliers). Thus, a firm that enters the restaurant industry has several forces working against it simply because of the nature of the industry. To help sidestep or diminish these threats, it must establish a favorable position. One firm that has accomplished this is Panera Bread, as discussed in Case 5.1 at the end of this chapter. By studying the restaurant industry, Panera found that some consumers have tired of fast food but don’t always have the time to eat at a sit-down restaurant. To fill the gap, Panera helped to pioneer a new category called “fast casual,” which combines relatively fast service with high-quality food. Panera has been very successful in occupying this unique position in the restaurant industry. You’ll learn more about Panera Bread’s success while reading Case 5.1.

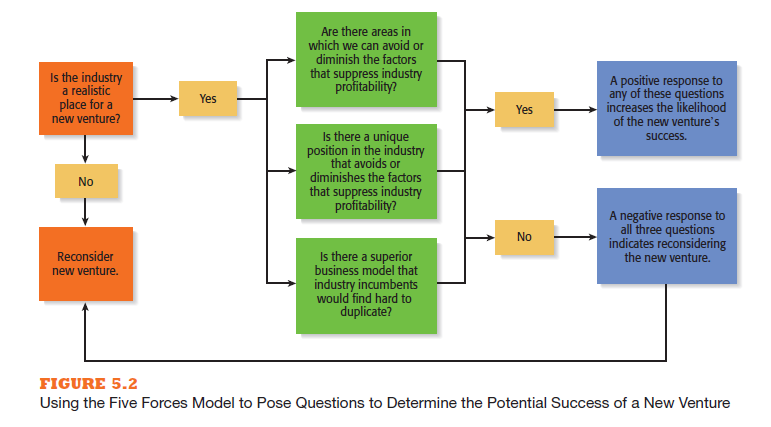

The second way a new firm can apply the five forces model to help determine whether it should enter an industry is by using the model pictured in Figure 5.2 to answer several key questions. By doing so, a new venture can assess the thresholds it may have to meet to be successful in a particular industry:

Question 1: Is the industry a realistic place for our new venture to enter? This question can be answered by looking at the overall attractiveness of an industry, as depicted in Table 5.2, and by assessing whether the window of opportunity is open. It’s up to the entrepreneur to determine if the window of opportunity for the industry is open or closed.

Question 2: If we do enter the industry, can our firm do a better job than the industry as a whole in avoiding or diminishing the impact of the forces that suppress industry profitability? Entering an industry with a fresh brand, innovative ideas, and a world-class manage- ment team and performing better than the industry incumbents increases the likelihood a new venture will be successful. This was the case when Google entered the Internet search engine industry and displaced Yahoo as the market leader. Outperforming industry incumbents can also be achieved if a new venture brings an attractive new product to market that is patented, preventing others from duplicating it for a period of time.

Question 3: Is there a unique position in the industry that avoids or diminishes the forces that suppress industry profitability? As we’ve described, this is the advantage that both Greenvelope and Panera Bread have captured.

Question 4: Is there a superior business model that can be put in place that would be hard for industry incumbents to dupli- cate? Keep in mind that the five forces model provides a picture of an industry “as is,” which isn’t necessarily the way a new venture has to approach it. Sometimes the largest firms in an industry are trapped by their own strategies and contractual obligations, providing an opening for a start-up to try something new. For example, when Dell started sell- ing computers directly to consumers, its largest rivals—Hewlett-Packard, Compaq, and IBM—were not able to respond quickly and effectively. They were locked into a strategy of selling through retailers. If they had tried to mimic Dell and sell directly to end users or customers, they would have alienated their most valuable partners—retailers such as Sears and Best Buy. However, with the passage of time, Dell’s competitors have learned how to effectively and efficiently sell directly to consumers, largely erasing Dell’s historic advantage in the process of doing so.

The steps involved in answering these questions are pictured in Figure 5.2. If the founders of a new firm believe that a particular industry is a realistic place for their new venture, a positive response to one or more of the questions posed in Figure 5.2 increases the likelihood that the new venture will be successful.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

Very nice layout and superb subject material, absolutely nothing else we need : D.

An attention-grabbing dialogue is price comment. I believe that you should write extra on this matter, it may not be a taboo topic however typically persons are not sufficient to talk on such topics. To the next. Cheers