A business1 is an organization in which basic resources (inputs), such as materials and labor, are assembled and processed to provide goods or services (outputs) to customers. Businesses come in all sizes, from a local coffee house to Starbucks, which sells over $10 billion of coffee and related products each year.

The objective of most businesses is to earn a profit. Profit is the difference between the amounts received from customers for goods or services and the amounts paid for the inputs used to provide the goods or services. This text focuses on businesses operating to earn a profit. However, many of the same concepts and principles also apply to not-for-profit organizations such as hospitals, churches, and government agencies.

1. Types of Businesses

Three types of businesses operating for profit include service, merchandising, and manufacturing businesses. Some examples of each type of business are given below.

Service businesses provide services rather than products to customers.

Delta Air Lines (transportation services)

The Walt Disney Company (entertainment services)

Merchandising businesses sell products they purchase from other businesses to customers.

Walmart (general merchandise)

Amazon.com (Internet books, music, videos)

Manufacturing businesses change basic inputs into products that are sold to customers.

Ford Motor Co. (cars, trucks, vans)

Dell, Inc. (personal computers)

2. Role of Accounting in Business

The role of accounting in business is to provide information for managers to use in operating the business. In addition, accounting provides information to other users in assessing the economic performance and condition of the business.

Thus, accounting can be defined as an information system that provides reports to users about the economic activities and condition of a business. You could think of accounting as the “language of business.” This is because accounting is the means by which businesses’ financial information is communicated to users.

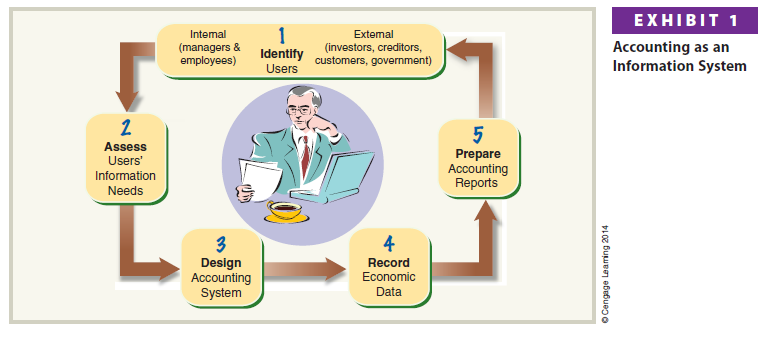

The process by which accounting provides information to users is as follows:

- Identify users.

- Assess users’ information needs.

- Design the accounting information system to meet users’ needs.

- Record economic data about business activities and events.

- Prepare accounting reports for users.

As illustrated in Exhibit 1, users of accounting information can be divided into two groups: internal users and external users.

Internal users of accounting information include managers and employees. These users are directly involved in managing and operating the business. The area of accounting that provides internal users with information is called managerial accounting, or management accounting.

The objective of managerial accounting is to provide relevant and timely information for managers’ and employees’ decision-making needs. Oftentimes, such information is sensitive and is not distributed outside the business. Examples of sensitive information might include information about customers, prices, and plans to expand the business. Managerial accountants employed by a business are employed in private accounting.

External users of accounting information include investors, creditors, customers, and the government. These users are not directly involved in managing and operating the business. The area of accounting that provides external users with information is called financial accounting.

The objective of financial accounting is to provide relevant and timely information for the decision-making needs of users outside of the business. For example, financial reports on the operations and condition of the business are useful for banks and other creditors in deciding whether to lend money to the business. General-purpose financial statements are one type of financial accounting report that is distributed to external users. The term general-purpose refers to the wide range of decision-making needs that these reports are designed to serve. Later in this chapter, general-purpose financial statements are described and illustrated.

3. Role of Ethics in Accounting and Business

The objective of accounting is to provide relevant, timely information for user decision making. Accountants must behave in an ethical manner so that the information they provide users will be trustworthy and, thus, useful for decision making. Managers and employees must also behave in an ethical manner in managing and operating a business. Otherwise, no one will be willing to invest in or loan money to the business.

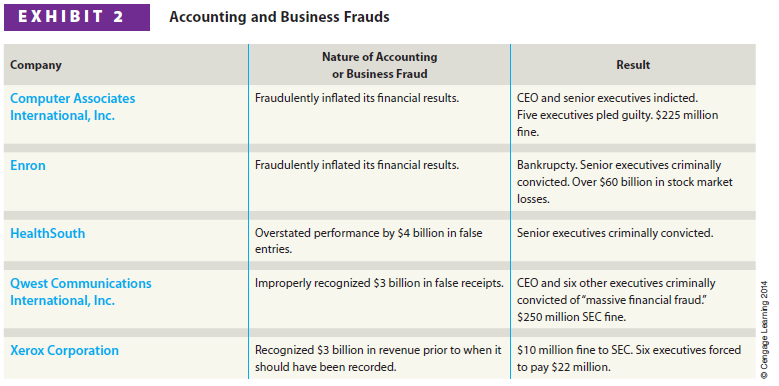

Ethics are moral principles that guide the conduct of individuals. Unfortunately, business managers and accountants sometimes behave in an unethical manner. Many of the managers of the companies listed in Exhibit 2 engaged in accounting or business fraud. These ethical violations led to fines, firings, and lawsuits. In some cases, managers were criminally prosecuted, convicted, and sent to prison.

What went wrong for the managers and companies listed in Exhibit 2? The answer normally involved one or both of the following two factors:

Failure of Individual Character. An ethical manager and accountant is honest and fair. However, managers and accountants often face pressures from supervisors to meet company and investor expectations. In many of the cases in Exhibit 2, managers and accountants justified small ethical violations to avoid such pressures. However, these small violations became big violations as the company’s financial problems became worse.

Culture of Greed and Ethical Indifference. By their behavior and attitude, senior managers set the company culture. In most of the companies listed in Exhibit 2, the senior managers created a culture of greed and indifference to the truth.

As a result of the accounting and business frauds shown in Exhibit 2, Congress passed new laws to monitor the behavior of accounting and business. For example, the Sarbanes-Oxley Act of 2002 (SOX) was enacted. SOX established a new oversight body for the accounting profession called the Public Company Accounting Oversight Board (PCAOB). In addition, SOX established standards for independence, corporate responsibility, and disclosure.

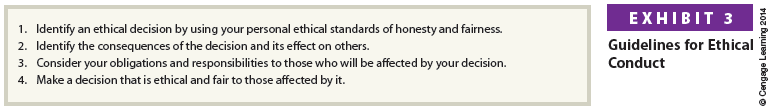

How does one behave ethically when faced with financial or other types of pressure? Guidelines for behaving ethically are shown in Exhibit 3.

4. Opportunities for Accountants

Numerous career opportunities are available for students majoring in accounting. Currently, the demand for accountants exceeds the number of new graduates entering the job market. This is partly due to the increased regulation of business caused by the accounting and business frauds shown in Exhibit 2. Also, more and more businesses have come to recognize the importance and value of accounting information.

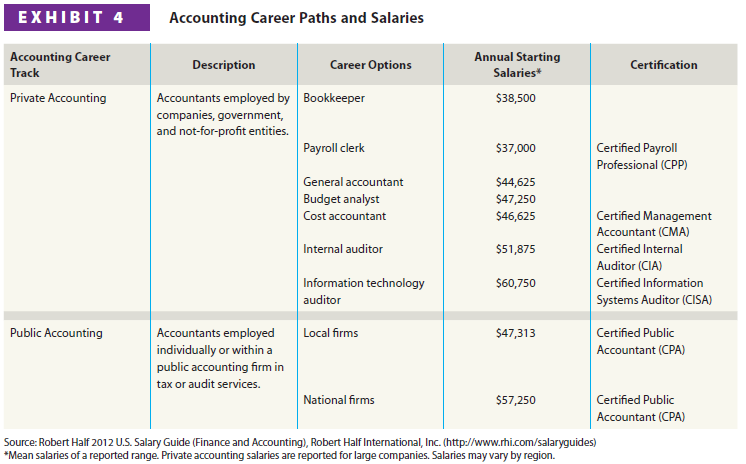

As indicated earlier, accountants employed by a business are employed in private accounting. Private accountants have a variety of possible career options within a company. Some of these career options are shown in Exhibit 4 along with their starting salaries. Accountants who provide audit services, called auditors, verify the accuracy of financial records, accounts, and systems. As shown in Exhibit 4, several private accounting careers have certification options.

Accountants and their staff who provide services on a fee basis are said to be employed in public accounting. In public accounting, an accountant may practice as an individual or as a member of a public accounting firm. Public accountants who have met a state’s education, experience, and examination requirements may become Certified Public Accountants (CPAs). CPAs typically perform general accounting, audit, or tax services. As can be seen in Exhibit 4, CPAs have slightly better starting salaries than private accountants. Career statistics indicate, however, that these salary differences tend to disappear over time.

Because all functions within a business use accounting information, experience in private or public accounting provides a solid foundation for a career. Many positions in industry and in government agencies are held by individuals with accounting backgrounds.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Generally I don’t learn post on blogs, however I wish to say that this write-up very forced me to take a look at and do it! Your writing taste has been amazed me. Thank you, very great post.

Excellent site. Lots of useful information here. I am sending it to a few buddies ans additionally sharing in delicious. And certainly, thank you to your effort!

Rattling informative and wonderful body structure of subject material, now that’s user friendly (:.