The primary disadvantage of equity funding is that the firm’s owners relin- quish part of their ownership interest and may lose some control. The primary advantage is access to capital. In addition, because investors become partial owners of the firms in which they invest, they often try to help those firms by offering their expertise and assistance. Unlike a loan, the money received from an equity investor doesn’t have to be paid back. The investor receives a return on the investment through dividend payments and by selling the stock.

The three most common forms of equity funding are described next.

1. Business Angels

Business angels are individuals who invest their personal capital directly in start-ups. The term angel was first used in conjunction with finance to describe wealthy New Yorkers who invested in Broadway plays. The proto- typical business angel, who invests in entrepreneurial start-ups, is about 50 years old, has high income and wealth, is well educated, has succeeded as an entrepreneur, and invests in companies that are in the region where he or she lives.15 These investors generally invest between $10,000 and $500,000 in a single company and are looking for companies that have the potential to grow 30 to 40 percent per year before they are acquired or go public.16

Many well-known firms have received their initial funding from one or more business angels. For example, Apple received its initial investment capital from Mike Markkula, who obtained his wealth as an executive with Intel. In 1977, Markkula invested $91,000 in Apple and personally guaranteed an- other $250,000 in credit lines. When Apple went public in 1980, his stock in the company was worth more than $150 million.17 Similarly, in 1998, Google received its first investment from Sun Microsystems’s co-founder Andy Bechtolsheim, who gave Larry Page and Sergey Brin (Google’s co-founders) a check for $100,000 after they showed him an early version of Google’s search engine.18 Can you imagine what Bechtolsheim’s investment was worth when Google went public in 2005?

The number of angel investors in the United States, which is estimated to be around 298,800, has increased dramatically over the past decade.19 The rapid increase is due in part to the high returns that some angels report. In 2013, angels invested $24.8 billion, an increase of 8.3 percent over 2012. The average deal size was $350,830, which generally included more than one in- vestor.20 Software accounted for the largest share of angel investment in 2013, with 23 percent of total investment, followed by Media (16 percent), Healthcare Services/Medical Devices and Equipment (14 percent), Biotech (11 percent), Retail (7 percent), and Financial Services/Business Products and Services (7 percent). The average equity received was 12.5 percent with deal valuation at $2.8 million. According to the Center for Venture Research at the University of New Hampshire, in 2013, 21.6 percent of start-ups that were able to get in front of angel investors received investments. This is a relatively high percent- age. Historically, the number has been closer to 15 percent.21

Business angels are valuable because of their willingness to make rela- tively small investments. This gives access to equity funding to a start-up that needs just $75,000 rather than the $1 million minimum investment that most venture capitalists require. Many angels are also motivated by more than financial returns; they enjoy the process of mentoring a new firm. Most angels remain fairly anonymous and are matched up with en- trepreneurs through referrals. To find a business angel investor, an entre- preneur should discreetly work a network of acquaintances to see if anyone can make an appropriate introduction. An advantage that college students have in regard to finding business angels is that many angels judge col- lege- or university-sponsored business plan or business model competitions. The number of organized groups of angels continues to grow. Typically, each group consists of 10 to 150 angel investors in a local area that meet regularly to listen to business plan presentations. An example of an an- gel group is Ann Arbor Angels (www.annarborangels.org) located in Ann Arbor, Michigan. The group invests in early-stage technology companies in Southeast Michigan. Similar to most angel groups, a small committee of members screens investment applications and determines the start-ups that will pitch to the larger group. The group itself does not make investments. Instead, investment decisions are made independently by each member, of- ten in partnership with other members.22

According to Fundable, angel investors invest in approximately 61,900 com- panies per year, which is 16 times the number of investments made by venture capitalists.23

2. Venture capital

Venture capital is money that is invested by venture capital firms in start-ups and small businesses with exceptional growth potential.24 There are about 875 venture capital firms in existence, which have approximately $193 billion un- der management. In 2013, venture capital firms invested $29.6 billion in just over 4,041 deals.25 The peak year for venture capital investing was 2000, when $98.6 billion was invested at the height of the e-commerce craze. A distinct dif- ference between angel investors and venture capital firms is that angels tend to invest earlier in the life of a company, whereas venture capitalists come in later. The majority of venture capital money goes to follow-on funding for busi- nesses that were originally funded by angel investors, government programs (which are discussed later in the chapter), or by some other means.

Venture capital firms are limited partnerships of money managers who raise money in “funds” to invest in start-ups and growing firms. The funds, or pools of money, are raised from high-net-worth individuals, pension plans, university endowments, foreign investors, and similar sources. In 2013, the average fund size was $110.3 million.26 The investors who invest in venture capital funds are called limited partners. The venture capitalists, who man- age the fund, are called general partners. The venture capitalists who manage the fund receive an annual management fee in addition to 20 to 25 percent of the profits earned by the fund. The percentage of the profits the venture capi- talists get is called the carry. So if a venture capital firm raised a $100 million fund and the fund grew to $500 million, a 20 percent carry means that the firm would get, after repaying the original $100 million, 20 percent of the $400 million in profits, or $80 million. Some venture capital firms invest in specific areas. For example, Foundry Group invests in information technology start- ups.27 Similarly, BEV Capital invests exclusively in consumer-oriented busi- nesses, such as 1800diapers and Redfin.28

Because of the venture capital industry’s lucrative nature and because in the past venture capitalists have funded high-profile successes such as Google, Facebook, Dropbox, and Twitter, the industry receives a great deal of attention. But actually, venture capitalists fund very few entrepreneurial ventures in com- parison to business angels and relative to the number of firms seeking funding. According to the 2014 National Venture Capital Yearbook, for every 100 busi- ness plans that are submitted to venture capital firms for funding, only 10 get a serious look and only one is funded.29 As mentioned earlier in this chapter, many entrepreneurs become discouraged when they are repeatedly rejected for venture capital funding, even though they may have an excellent business plan. Venture capitalists are looking for the “home run.” The result is that the major- ity of business plans do not get funded.

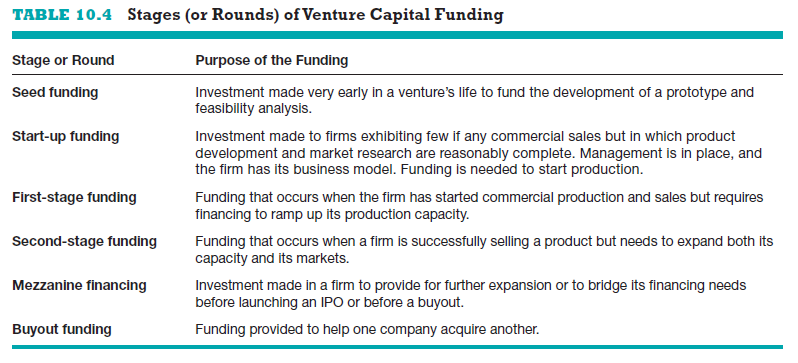

Still, for the firms that qualify, venture capital is a viable alternative to equity funding. An advantage to obtaining this funding is that venture capi- talists are extremely well connected in the business world (by this we mean that they have a large number of useful contacts with customers, suppliers, government representatives, and so forth) and can offer a firm considerable assistance beyond funding. Firms that qualify typically obtain their money in stages that correspond to their own stage of development. Once a venture capitalist makes an investment in a firm, subsequent investments are made in rounds (or stages) and are referred to as follow-on funding. Table 10.4 shows the various stages in the venture capital process, from the seed stage to buyout financing.

An important part of obtaining venture capital funding is going through the due diligence process, which refers to the process of investigating the merits of a potential venture and verifying the key claims made in the business plan. Firms that prove to be suitable for venture capital funding should conduct their own due diligence of the venture capitalists with whom they are working to ensure that they are a good fit. An entrepreneur should ask the following questions and scrutinize the answers to them before accepting funding from a venture capital firm:

■ Do the venture capitalists have experience in our industry?

■ Do they take a highly active or passive management role?

■ Are the personalities on both sides of the table compatible?

■ Does the firm have deep enough pockets or sufficient contacts within the venture capital industry to provide follow-on rounds of financing?

■ Is the firm negotiating in good faith in regard to the percentage of our firm they want in exchange for their investment?

Along with traditional venture capital, there is also corporate venture capital. This type of capital is similar to traditional venture capital except that the money comes from corporations that invest in start-ups related to their areas of interest. Corporate venture capital firms provide an estimated 10.5 percent of the venture capital invested by all venture groups. Examples of corporate venture capital firms include Intel Capital, Google Ventures, and Time Warner Investments.

Just because a firm receives venture capital funding doesn’t mean it’s a sure success. In fact, venture-funded firms are under extreme pressure to per- form to meet investors’ expectations. A firm that received venture capital fund- ing, DrawQuest, and regrettably failed is profiled in the “What Went Wrong?” feature. The feature includes a heartfelt statement by its founder, Chris Poole, which provides unique insight into how failing after taking money from ven- ture capitalists feels.

3. Initial public offering

Another source of equity funding is to sell stock to the public by staging an initial public offering (IPO). An IPO is the first sale of stock by a firm to the public. Any later public issuance of shares is referred to as a secondary market offering. When a company goes public, its stock is typically traded on one of the major stock exchanges. Most entrepreneurial firms that go public trade on the NASDAQ, which is weighted heavily toward technology, biotech, and small-company stocks.30 An IPO is an important milestone for a firm.31

Typically, a firm is not able to go public until it has demonstrated that it is vi- able and has a bright future.

Firms decide to go public for several reasons. First, it is a way to raise equity capital to fund current and future operations. Second, an IPO raises a firm’s public profile, making it easier to attract high-quality customers, alli- ance partners, and employees. Third, an IPO is a liquidity event that provides a mechanism for the company’s stockholders, including its investors, to cash out their investments. Finally, by going public, a firm creates another form of currency that can be used to grow the company. It is not uncommon for one firm to buy another company by paying for it with stock rather than with cash.32 The stock comes from “authorized but not yet issued stock,” which in essence means that the firm issues new shares of stock to make the purchase. Examples of well-known firms that have gone public in recent years include Facebook, Twitter, GrubHub, Alibaba, and King Digital Entertainment (maker of the popular mobile game Candy Crush Saga).

Although there are many advantages to going public, it is a complicated and expensive process and subjects firms to substantial costs related to SEC reporting requirements. Many of the most costly requirements were initiated by the Sarbanes-Oxley Act of 2002. The Sarbanes-Oxley Act is a federal law that was passed in response to corporate accounting scandals involving prominent corporations, such as Enron and WorldCom. This wide-ranging act established a number of new or enhanced reporting standards for public corporations.

The first step in initiating a public offering is for a firm to hire an invest- ment bank. An investment bank is an institution that acts as an underwriter or agent for a firm issuing securities.33 The investment bank acts as the firm’s advocate and adviser and walks it through the process of going public. The most important issues the firm and its investment bank must agree on are the amount of capital needed by the firm, the type of stock to be issued, the price of the stock when it goes public (e.g., $20 per share), and the cost to the firm to issue the securities.

There are a number of hoops the investment bank must jump through to assure the Securities and Exchange Commission (SEC) that the offer is legiti- mate. During the time the SEC is investigating the potential offering, the in- vestment bank issues a preliminary prospectus that describes the offering to the general public. The preliminary prospectus is also called the “red herring.” After the SEC has approved the offering, the investment bank issues the final prospectus, which sets a date and issuing price for the offering.

In addition to getting the offering approved, the investment bank is respon- sible for drumming up support for the offering. As part of this process, the in- vestment bank typically takes the top management team of the firm wanting to go public on a road show, which is a whirlwind tour that consists of meetings in key cities, where the firm presents its business plan to groups of investors.34

Until December 1, 2005, the presentations made during these road shows were seen only by the investors physically present in the various cities; an SEC regulation went into effect at that time requiring that road show presentations be taped and made available to the public. Road show presentations can be viewed online at www.retailroadshow.com. If enough interest in a potential public offering is created, the offering will take place on the date scheduled in the prospectus. If there isn’t, the offering will be delayed or canceled.

Timing and luck play a role in whether a public offering is successful. For example, a total of 332 IPOs raised about $50 billion in 1999, the height of the Internet bubble. When the bubble burst in early 2001, the IPO marketplace all but dried up, particularly for technology and telecom stocks. Since then, the market has recovered. There were 261 IPOs in 2013, which raised a total of $70.5 billion. The first half of 2014 saw 166 IPOs with a busy IPO calendar projected for the second half of the year.35 The vitality of the IPO market hinges largely on the state of the overall economy and the mood of professional inves- tors. However, even when facing a strong economy and a positive mood toward investing, an entrepreneurial venture should guard itself against becoming caught up in the euphoria and rushing its IPO.

A variation of the IPO is a private placement, which is the direct sale of an issue of securities to a large institutional investor. When a private placement is initiated, there is no public offering, and no prospectus is prepared.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

you are in reality a good webmaster. The web site loading velocity is amazing. It seems that you are doing any distinctive trick. Moreover, The contents are masterwork. you’ve done a fantastic process on this matter!