Once a start-up’s financial needs exceed what personal funds, friends and fam- ily, and bootstrapping can provide, debt and equity are the two most common sources of funds. The most important thing an entrepreneur must do at this point is determine precisely what the company needs and the most appropriate source to use to obtain those funds. A carefully planned approach to raising money increases a firm’s chance of success and can save an entrepreneur con- siderable time.

The steps involved in properly preparing to raise debt or equity financing are shown in Figure 10.3 and are discussed next.

Step 1 Determine precisely how much money the company needs.

Constructing and analyzing documented cash flow statements and projections for needed capital expenditures are actions taken to complete this step. This information should already be in the busi- ness plan, as described in Chapter 6. Knowing exactly how much money to ask for is important for at least two reasons. First, a com- pany doesn’t want to get caught short, yet it doesn’t want to pay for capital it doesn’t need. Second, entrepreneurs talking to a potential lender or investor make a poor impression when they appear uncer- tain about the amount of money required to support their venture.

Step 2 Determine the most appropriate type of financing or funding.

Equity and debt financing are the two most common alternatives for raising money. Equity financing (or funding) means exchanging partial ownership of a firm, usually in the form of stock, in return for funding. Angel investors, private placement, venture capital, and initial public offerings are the most common sources of equity fund- ing (we discuss all these sources later in the chapter). Equity funding is not a loan—the money that is received is not paid back. Instead, equity investors become partial owners of the firm. Some equity in- vestors invest “for the long haul” and are content to receive a return on their investment through dividend payments on their stock. More commonly, equity investors have a three- to five-year investment horizon and expect to get their money back, along with a substan- tial capital gain, through the sale of their stock. The stock is typi- cally sold following a liquidity event, which is an occurrence that converts some or all of a company’s stock into cash. The three most common liquidity events for a new venture are when it goes public, finds a buyer, or merges with another company.

Because of the risks involved, equity investors are very demand- ing and fund only a small percentage of the business plans they consider.12 An equity investor considers a firm that has a unique business opportunity, high growth potential, a clearly defined niche market, and proven management to be an ideal candidate. In con- trast, businesses that don’t fit these criteria have a hard time get- ting equity funding. Many entrepreneurs are not familiar with the standards that equity investors apply and get discouraged when they are repeatedly turned down by venture capitalists and angel investors. Often, the reason they don’t qualify for venture capital or angel investment isn’t because their business proposal is poor, but because they don’t meet the exacting standards equity investors usually apply.13

Debt financing is getting a loan. The most common sources of debt financing are commercial banks and Small Business Administration (SBA) guaranteed loans. The types of bank loans and SBA guaranteed loans available to entrepreneurs are discussed later in this chapter. In general, banks lend money that must be repaid with interest. Banks are not investors. As a result, bankers are interested in minimizing risk, properly collateralizing loans, and repayment, as opposed to re- turn on investment and capital gains. The ideal candidate for a bank loan is a firm with a strong cash flow, low leverage, audited financial statements, good management, and a healthy balance sheet. A care- ful review of these criteria demonstrates why it’s difficult for start-ups to receive bank loans. Most start-ups are simply too early in their life cycle to have the set of characteristics bankers want.

Table 10.2 provides an overview of three common profiles of new ventures and the type of financing or funding that is appropriate for each one. This table illustrates why most start-ups must rely on per- sonal funds, friends and family, and bootstrapping at the outset and must wait until later to obtain equity or debt financing. Indeed, most new ventures do not have the characteristics required by bankers or investors until they have proven their product or service idea and have achieved a certain measure of success in the marketplace.

Step 3 Developing a strategy for engaging potential investors or bankers.

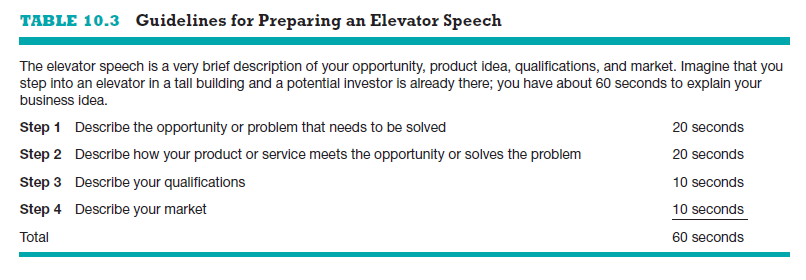

There are three steps to developing a strategy for engaging potential investors or bankers. First, the lead entrepreneurs in a new venture should prepare an elevator speech (or pitch)—a brief, carefully con- structed statement that outlines the merits of a business opportunity. Why is it called an elevator speech? If an entrepreneur stepped into an elevator on the 25th floor of a building and found that by a stroke of luck a potential investor was in the same elevator, the entrepreneur would have the time it takes to get from the 25th floor to the ground floor to try to get the investor interested in the business opportunity. Most elevator speeches are 45 seconds to 2 minutes long.14

There are many occasions when a carefully constructed elevator speech might come in handy. For example, many university-sponsored centers for entrepreneurship hold events that bring investors and entrepreneurs together. Often, these events include social hours and refreshment breaks designed spe- cifically for the purpose of allowing entrepreneurs looking for funding to mingle with potential investors. An outline for a 60-second elevator speech is provided in Table 10.3.

The second step in developing a strategy for engaging potential investors or bankers is more deliberate and requires identifying and contacting the best prospects. First, the new venture should carefully assess the type of financing or funding it is likely to qualify for, as depicted in Table 10.2. Then, a list of potential bankers or investors should be compiled. If venture capital funding is felt to be appropriate, for example, a little legwork can go a long way in pin- pointing likely investors. A new venture should identify the venture funds that are investing money in the industry in which it intends to compete and target those firms first. To do this, look to the venture capital firms’ websites. These reveal the industries in which the firms have an interest. Sometimes, these sites also provide a list of the companies the firm has funded. For an example, access the website of Sequoia Capital (www.sequoiacap.com), a well-known venture capital firm.

A cardinal rule for approaching a banker or an investor is to get a personal introduction. Bankers and investors receive many business plans, and most of them end up in what often becomes an unread stack of paper in a corner in their offices. To have your business plan noticed, find someone who knows the banker or the investor and ask for an introduction.

The third step in engaging potential investors or bankers is to be prepared to provide the investor or banker a completed business plan and make a pre- sentation of the plan if requested. We looked at how to present a business plan in Chapter 6. The presentation should be as polished as possible and should demonstrate why the new venture represents an attractive endeavor for the lender or investor.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

6 May 2021

10 May 2021

10 May 2021

8 May 2021

6 May 2021

10 May 2021