Successful companies recognize and respond profitably to unmet needs and trends.

1. NEEDS AND TRENDS

Dockers was created to meet the needs of baby boomers who could no longer fit into their jeans and wanted a physically and psychologically comfortable pair of pants. Enterprising individuals and companies create new solutions to similarly unmet needs. Let’s distinguish among fads, trends, and megatrends.

- A fad is “unpredictable, short-lived, and without social, economic, and political significance.” A company can cash in on a fad such as Crocs clogs, Elmo TMX dolls, and Pokemon gifts and toys, but getting it right requires luck and good timing.19

- A direction or sequence of events with momentum and durability, a trend is more predictable and durable than a fad; trends reveal the shape of the future and can provide strategic direction. A trend toward health and nutrition awareness has brought increased government regulation and negative publicity for firms seen as peddling unhealthy food. Macaroni Grill revamped its menu to include more low-calorie and low-fat offerings after The Today Show called its chicken and artichoke sandwich “the calorie equivalent of 16 Fudgesicles” and Men’s Health declared its 1,630-calorie dessert ravioli the “worst dessert in America”20

- A megatrend is a “large social, economic, political, and technological change [that] is slow to form, and once in place, influences us for some time—between seven and ten years, or longer.”21

Several firms offer social-cultural forecasts. The Yankelovich Monitor has tracked 35 social value and lifestyle trends since 1971, such as “anti-bigness,” “mysticism,” and “living for today.” A new market opportunity doesn’t guarantee success, of course. Even if the new product is technically feasible, market research is necessary to determine profit potential.

2. IDENTIFYING THE MAJOR FORCES

The new century brought new challenges: the steep decline of the stock market, which affected savings, investment, and retirement funds; rising and long-lasting unemployment; corporate scandals; stronger indications of global warming and other signs of deterioration in the environment; and continued terrorism.

Firms must monitor six major forces in the broad environment: demographic, economic, social-cultural, natural, technological, and political-legal. We’ll describe them separately, but remember their interactions will lead to new opportunities and threats. For example, explosive population growth (demographic) leads to more resource depletion and pollution (natural), which leads consumers to call for more laws (political-legal), which stimulate new technological solutions and products (technological) that, if they are affordable (economic), may actually change attitudes and behavior (social-cultural).

3. THE DEMOGRAPHIC ENVIRONMENT

The main demographic factor marketers monitor is population, including the size and growth rate of population in cities, regions, and nations; age distribution and ethnic mix; educational levels; and household patterns.

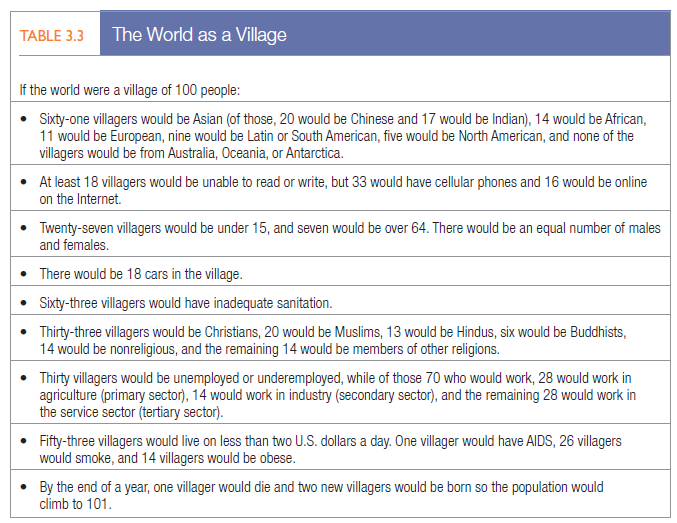

WORLDWIDE POPULATION GROWTH World population growth is explosive: The world’s population on July 1, 2012, was estimated at 7,027,349,193, forecasted to rise to 8.82 billion by 2040 and exceed 9 billion by 20 45.22 Table 3.3 offers an interesting perspective.23

Population growth is highest in countries and communities that can least afford it. Developing regions of the world house 84 percent of the world’s population and are growing at 1 percent to 2 percent per year; developed countries’ populations are growing at only 0.3 percent.24 In developing countries, modern medicine is lowering the death rate, but birthrates remain fairly stable.

A growing population does not mean growing markets unless there is sufficient purchasing power. Education can raise the standard of living but is difficult to accomplish in most developing countries. Nonetheless, companies that carefully analyze these markets can find major opportunities and sometimes lessons they can apply at home. See “Marketing Memo: Finding Gold at the Bottom of the Pyramid.”25

POPULATION AGE MIX Mexico has a very young population and rapid population growth. Italy, at the other extreme, has one of the world’s oldest populations. Milk, diapers, school supplies, and toys will be more important products in Mexico than in Italy.

There is a global trend toward an aging population. In 1950, there were only 131 million people 65 and older; in 1995, their number had almost tripled to 371 million. By 2050, one of 10 people worldwide will be 65 or older. In the United States, baby boomers—those born between 1946 and 1964—represent a market of some 36 million, about 12 percent of the population. By 2011, the 65-and-over population was growing faster than the population as a whole in each of the 50 states.26

Marketers generally divide the population into six age groups: preschool children, school-age children, teens, young adults age 20 to 40, middle-aged adults 40 to 65, and older adults 65 and older. Some marketers focus on cohorts, groups of individuals born during the same time period who travel through life together. The defining moments they experience as they come of age and become adults (roughly ages 17 through 24) can stay with them for a lifetime and influence their values, preferences, and buying behaviors.

ETHNIC AND OTHER MARKETS Ethnic and racial diversity varies across countries. At one extreme is Japan, where almost everyone is native Japanese; at the other extreme is the United States, 12 percent of whose people were born in another country. As of the 2010 Census, the U.S. population was: White (72 percent), Black or African American (13 percent), American Indian and Alaskan Native (0.9 percent), Asian (5 percent), Hispanic (16 percent). More than half the growth between 2000 and 2010 came from the increase in the Hispanic population, which grew by 43 percent, from 35.3 million to 50.5 million, representing a major shift in the nation’s ethnic center of gravity. Geographically, the 2010 Census revealed that Hispanics were moving to states like North Carolina where they had not been concentrated before and that they increasingly live in suburbs.27 From the food U.S. consumers eat to the clothing, music, and cars they buy, Hispanics are having a huge impact.

Companies are refining their products and marketing to reach this fastest-growing and most influential consumer group: Research by Hispanic media giant Univision suggests 70 percent of Spanish-language viewers are more likely to buy a product when it’s advertised in Spanish. Fisher-Price, recognizing that many Hispanic mothers did not grow up with its brand, shifted away from appeals to their heritage. Instead, its ads emphasized the joy of mother and child playing together with Fisher-Price toys.28 Hispanics are not the only fast-growing minority segment.

INDIAN-AMERICANS The U.S. Indian-American population has exploded over the past decade, according to the 2010 Census, surpassing Filipinos as the nation’s second-largest Asian population after Chinese. Affluent, well-educated, and consumer-oriented, Indian-Americans are attractive to marketers. Nationwide Insurance developed print and TV ads for them and other South Asians in the New York tristate area and San Francisco and Silicon Valley. Cadillac has run newspaper ads and local TV spots in Chicago and New York after seeing many Indian-Americans and South Asians in its showrooms. Zee TV was the first Hindi satellite channel and is the leading network serving the South Asian audience.

Yet marketers must not overgeneralize—within each group are consumers quite different from each other.30 Diversity also goes beyond ethnic and racial markets. More than 51 million U.S. consumers have disabilities, and they constitute a market for home delivery companies such as Internet grocer Peapod.

EDUCATIONAL GROUPS The population in any society falls into five educational groups: illiterates, high school dropouts, high school diplomas, college degrees, and professional degrees. More than two-thirds of the world’s 793 million illiterate adults are found in only eight countries (Bangladesh, China, Egypt, Ethiopia, India, Indonesia, Nigeria, and Pakistan); of all illiterate adults in the world, two-thirds are women; extremely low literacy rates are concentrated in three regions—the Arab states, South and West Asia, and Sub-Saharan Africa—where around one-third of the men and half of all women are illiterate (2005 est.).31

The United States has one of the world’s highest percentages of college-educated citizens.32 As of March 2011, just over 30 percent of U.S. adults held at least a bachelor’s degree, and 10.9 percent held a graduate degree, up from 26.2 percent and 8.7 percent 10 years earlier. Half of 18- and 19-year-olds were enrolled in college in 2009, but not all college students are young. About 16 percent are 35 and older; they also make up 37 percent of part-time students. The large number of educated people in the United States drives strong demand for high-quality books, magazines, and travel and creates a supply of skills.

HOUSEHOLD PATTERNS The traditional U.S. household included a husband, wife, and children under 18 (sometimes with grandparents). By 2010, only 20 percent of U.S. households met this definition, down from about 25 percent a decade before and 43 percent in 1950. Married couples have dropped below half of all U.S. households for the first time (48 percent), far below the 78 percent of 1950. The median age at first marriage has also never been higher: 26.5 for brides and 28.7 for grooms.33

The U.S. family has been steadily evolving toward less traditional forms. More people are divorcing, separating, choosing not to marry, or marrying later. Other types of households are single live-alones (27 percent), singleparent families (8 percent), childless married couples and empty nesters (32 percent), living with nonrelatives only (5 percent), and other family structures (8 percent).

The biggest change for the decade was the jump in households headed by women without husbands—up 18 percent. Nontraditional households are growing more rapidly than traditional households. Academics and marketing experts estimate the gay and lesbian population at 4 percent to 8 percent of the total U.S. population, higher in urban areas.34

Each type of household has distinctive needs and buying habits. The single, separated, widowed, and divorced may need smaller apartments; inexpensive and smaller appliances, furniture, and furnishings; and smaller-size food packages. Many non-traditional households feel advertising ignores families like theirs, suggesting an opportunity for advertisers.35

Even traditional households have changed. Boomer dads marry later than their fathers and grandfathers did, shop more, and are much more active in raising their kids. Bugaboo makes innovative baby strollers that speaks to modern parents. Bugaboo’s iconic functional strollers have unique designs and functionalities such as adjustable suspension and an extendable handle bar perfect for taller dads. And before Dyson, the high-end vacuum company, appealed to U.S. dads’ inner geek by focusing on the machine’s revolutionary technology, men weren’t even on the radar for vacuum cleaner sales. Now they make up 40 percent of Dyson’s customers.

4. MARKETING MEMO Finding Gold at the Bottom of the Pyramid

Business writer C. K. Prahalad believes much innovation can come from developments in emerging markets such as China and India. He estimates 5 billion unserved and underserved people make up the “bottom of the pyramid.” One study showed that 4 billion people live on $2 or less a day. Firms operating in those markets must learn how to do more with less.

In Bangalore, India, Narayana Hrudayalaya Hospital charges a flat fee of $1,500 for heart bypass surgery that costs 50 times as much in the United States. The hospital has low labor and operating expenses and an assembly-line view of care. The approach works—the hospital’s mortality rates are half those of U.S. hospitals. Narayana also operates on hundreds of infants for free and profitably insures 2.5 million poor Indians against serious illness for 11 cents a month.

Similarly, Arvind Eye Care System, established by Govindappa Venkatswamy in 1976 in India, has performed 4 million operations using an approach likened to “McDonald’s-style” high-volume assembly. Aravind also developed an intra-ocular lens, manufactured by its subsidiary, Aurolab, at a fraction of the cost of imports. SalaUno, a for-profit social enterprise based in San Francisco, replicated the Aravind model in Mexico, carrying out 133 cataract operations a month for a year—free of charge for those who could not afford the treatment.

The transfer of innovations from developing to developed markets is what Dartmouth professor Vijay Govindrajan calls reverse innovation. He sees opportunity in focusing on the needs and constraints of a developing market to create an inexpensive product that can succeed there and then introducing it as a cheaper alternative in developed markets. He also sees reverse innovation’s public policy benefits, which can transform industries through the successful development of ultra-low-cost transportation, renewable energy, clean water, micro finance, affordable heath care, and low-cost housing.

Among successful reverse innovators, Nestle repositioned its low-fat Maggi brand dried noodles—a popular, low-priced meal for rural Pakistan and India—as a budget-friendly health food in Australia and New Zealand. U.S.-based Harman International, known for high-end dashboard audio systems designed by German engineers, developed a radically simpler and cheaper way to create products for China, India, and emerging markets and is applying that method to its product-development centers in the West. It now can sell a range of products priced from low to high and is looking into infotainment systems for motorbikes, a popular form of transportation in emerging markets and around the world.

Sources: C. K. Prahalad, The Fortune at the Bottom of the Pyramid (Upper Saddle River, NJ: Wharton School Publishing, 2010); Bill Breen, “C. K. Prahalad: Pyramid Schemer,” Fast Company March 2007, p. 79; Reena Jane, “Inspiration from Emerging Economies,” BusinessWeek, March 23, 2009, pp. 38-41; Vijay Govindarajan and Chris Trimble, Reverse Innovation: Create Far from Home, Win Everywhere (Boston, MA: Harvard Business School Publishing, 2012); Jeffrey R. Immelt, Vijay Govindarajan, and Chris Trimble, “How GE Is Disrupting Itself,” Harvard Business Review, October 2009, pp. 56-65; Vijay Govindrajan, “A Reverse-Innovation Playbook,” Harvard Business Review, April 2012, pp.120-23; Felicity Carus, “Reverse Innovation Brings Social Solutions to Developed Countries,” The Guardian, August 29, 2012; Constantinos C. Markides, “How Disruptive Will Innovations from Emerging Markets Be?,” MIT Sloan Management Review, 54 (Fall 2012), pp. 23-25.

5. THE ECONOMIC ENVIRONMENT

Purchasing power depends on consumers’ income, savings, debt, and credit availability as well as the price level. As the recent economic downturn vividly demonstrated, fluctuating purchasing power strongly affects business, especially for products geared to high-income and price-sensitive consumers. Marketers must understand consumer psychology and levels and distribution of income, savings, debt, and credit.

CONSUMER PSYCHOLOGY The recession that began in 2008 initiated new consumer spending patterns. Were these temporary adjustments or permanent changes?37 The middle class—the bread and butter of many firms—was hit hard by record declines in both wages and net worth. Some experts believed the recession had fundamentally shaken consumers’ faith in the economy and their personal financial situations. “Mindless” spending would be out; willingness to comparison shop, haggle, and use discounts would become the norm.38

Consumers at the time certainly seemed to believe so. In one survey, almost two-thirds said the recession’s economic changes would be permanent; nearly one-third said they would spend less than before the recession. Others believed tighter spending was a short-term constraint and not a fundamental behavioral change; they predicted their spending would resume when the economy improved.39

Identifying the more likely long-term scenario—especially for the coveted 18- to 34-year-old group—would help marketers decide how to spend their money. Executives at Sainsbury, the third-largest UK chain of supermarkets, concluded that the recession had created a more risk-averse British consumer, saving more, paying off debts instead of borrowing, and shopping in more cost-conscious ways. Even wealthy UK consumers traded down some to lower-cost items. As one retail executive said,

“There’s nobody who can afford not to try to save.”40 iNCOME DiSTRiBUTiON There are four types of industrial structures: subsistence economies like Papua New Guinea, with few opportunities for marketers; raw-materialexporting economies like Democratic Republic of Congo (copper) and Saudi Arabia (oil), with good markets for equipment, tools, supplies, and luxury goods for the rich; industrializing economies like India, Egypt, and the Philippines, where a new rich class and a growing middle class demand new types of goods; and industrial economies like Western Europe, with rich markets for all sorts of goods.

Marketers often distinguish countries using five income-distribution patterns: (1) very low incomes; (2) mostly low incomes; (3) very low, very high incomes; (4) low, medium, high incomes; and (5) mostly medium incomes. Consider the market for the Lamborghini, an automobile costing more than $150,000. The market would be very small in countries with type 1 or 2 income patterns. One of the largest single markets for the ultra-expensive sports car Lamborghinis is Portugal (income pattern 3), one of the poorer countries in Western Europe, but with high enough income inequality that there are also wealthy families who can afford expensive cars.41

INCOME, SAVINGS, DEBT, AND CREDIT U.S. consumers have a high debt-to-income ratio, which slows expenditures on housing and large-ticket items. When credit became scarcer in the recession, especially for lower- income borrowers, consumer borrowing dropped for the first time in two decades. The financial meltdown that led to this contraction was due to overly liberal credit policies that allowed consumers to buy homes and other items they could not really afford. Marketers wanted every possible sale, banks wanted to earn interest on loans, and near financial ruin resulted.

An economic issue of increasing importance is the migration of manufacturers and service jobs offshore. From India, Infosys provides outsourcing services for Cisco, Nordstrom, Microsoft, and others. The 35,000 employees the fast-growing $4.2 billion company hires every year receive technical, team, and communication training in Infosys’s $120 million facility outside Bangalore.42

6. THE SOCIOCULTURAL ENVIRONMENT

From our sociocultural environment we absorb, almost unconsciously, a world view that defines our relationships to ourselves, others, organizations, society, nature, and the universe.

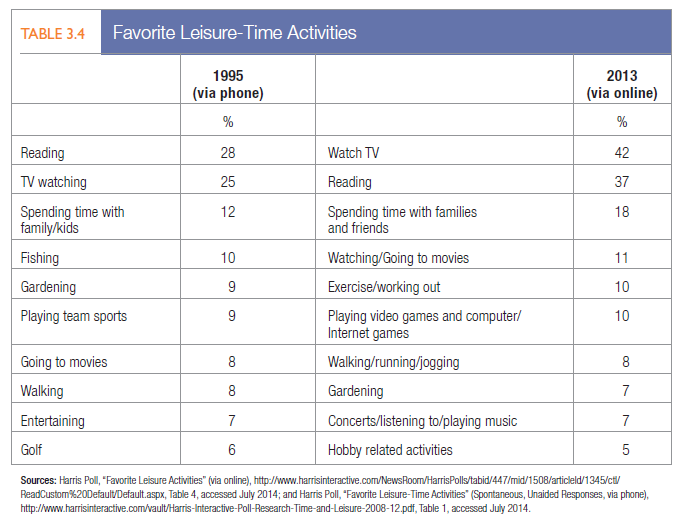

Views of ourselves. Some “pleasure seekers” chase fun, change, and escape; others seek “self-realization.” Some adopt more conservative behaviors and ambitions (see Table 3.4 for favorite consumer leisure-time activities and how they have changed, or not, in recent years).

- Views of others.People are concerned about the homeless, crime and victims, and other social problems. At the same time, they seek those like themselves for long-lasting relationships, suggesting a growing market for social-support products and services such as health clubs, cruises, and religious activity as well as “social surrogates” like television, video games, and social networking sites.

- Views of organizations.After a wave of layoffs and corporate scandals, organizational loyalty has declined. Companies need new ways to win back consumer and employee confidence. They need to ensure they are good corporate citizens and that their consumer messages are honest.

- Views of society.Some people defend society (preservers), some run it (makers), some take what they can from it (takers), some want to change it (changers), some are looking for something deeper (seekers), and still others want to leave it (escapers).43 Consumption patterns often reflect these social attitudes. Makers are high achievers who eat, dress, and live well. Changers usually live more frugally, drive smaller cars, and wear simpler clothes. Escapers and seekers are a major market for movies, music, surfing, and camping.

- Views of nature.Business has responded to increased awareness of nature’s fragility and finiteness by making more green products, seeking their own new energy sources, and reducing their environmental footprint. Companies are also literally tapping into nature more by producing wider varieties of camping, hiking, boating, and fishing gear such as boots, tents, backpacks, and accessories.

- Views of the universe.Most U.S. citizens are monotheistic, although religious conviction and practice have waned through the years or been redirected into an interest in evangelical movements or Eastern religions, mysticism, the occult, and the human potential movement.

Other cultural characteristics of interest to marketers are core cultural values and subcultures. Let’s look at both.

CORE CULTURAL VALUES Most people in the United States still believe in working, getting married, giving to charity, and being honest. Core beliefs and values are passed from parents to children and reinforced by social institutions—schools, churches, businesses, and governments. Secondary beliefs and values are more open to change. Believing in the institution of marriage is a core belief; believing people should marry early is a secondary belief.

Marketers have some chance of changing secondary values but little chance of changing core values. The nonprofit organization Mothers Against Drunk Drivers (MADD) does not try to stop the sale of alcohol but promotes lower legal blood-alcohol levels for driving and limited operating hours for businesses that sell alcohol.

Although core values are fairly persistent, cultural swings do take place. In the 1960s, hippies, the Beatles, Elvis Presley, and other cultural phenomena had a major impact on hairstyles, clothing, sexual norms, and life goals. Today’s young people are influenced by new heroes and activities: music entertainer and mogul Jay-Z, singer Lady Gaga, and snowboarder and skateboarder Shaun White.

SUBCULTURES Each society contains subcultures, groups with shared values, beliefs, preferences, and behaviors emerging from their special life experiences or circumstances. Marketers have always loved teenagers because they are trendsetters in fashion, music, entertainment, ideas, and attitudes. Attract someone as a teen, and you will likely keep the person as a customer later in life. Frito-Lay, which draws 15 percent of its sales from teens, noted a rise in chip snacking by grown-ups. “We think it’s because we brought them in as teenagers,” said Frito-Lay’s marketing director.44

7. THE NATURAL ENVIRONMENT

In Western Europe, “green” parties have pressed for public action to reduce industrial pollution. In the United States, experts have documented ecological deterioration, and watchdog groups such as the Sierra Club and Friends of the Earth commit to political and social action.

Steel companies and public utilities have invested billions of dollars in pollution-control equipment and environmentally friendly fuels, making hybrid cars, low-flow toilets and showers, organic foods, and green office buildings everyday realities. Opportunities await those who can reconcile prosperity with environmental protection. Consider these solutions to concerns about air quality:45

Corporate environmentalism recognizes the need to integrate environmental issues into the firm’s strategic plans. Trends for marketers to be aware of include the shortage of raw materials, especially water; the increased cost of energy; increased pollution levels; and the changing role of governments.46 (See also “Marketing Insight: The Green Marketing Revolution.”)

- The earth’s raw materials consist of the infinite, the finite renewable, and the finite nonrenewable. Firms whose products require finite nonrenewable resources—oil, coal, platinum, zinc, silver—face substantial cost increases as depletion approaches. Firms that can develop substitute materials have an excellent opportunity.

- One finite nonrenewable resource, oil, has created serious problems for the world economy. As oil prices soar, companies search for practical means to harness solar, nuclear, wind, and other alternative energies.

- Some industrial activity will inevitably damage the natural environment, creating a large market for pollution- control solutions such as scrubbers, recycling centers, and landfill systems as well as for alternative ways to produce and package goods.

- Many poor nations are doing little about pollution, lacking the funds or the political will. It is in the richer nations’ interest to help them control their pollution, but even richer nations today lack the necessary funds.

8. MARKETING INSIGHT The Green Marketing Revolution

Both consumers and companies are changing the way they view environmental issues, as the following descriptions illustrate.

Consumer Perspective

Consumers have put their very real environmental concerns into words and actions, focusing on green products, corporate sustainability, and other environmental issues. Here are highlights of some notable studies.

- WPP Green Brands Study. The WPP Green Brands Study surveys people in eight countries and evaluates 370 brands. In 2011 it found consumer interest in green products had expanded to auto, energy, and technology sectors in addition to personal care, food, and household products. Sixty percent of consumers stated they wanted to buy products from environmentally responsible companies. In developed countries such as the United States and United Kingdom, 20 percent were willing to spend more than 10 percent extra on a green product. Consumers in developing countries put even more value on green products: Ninety-five percent of Chinese consumers, for example, said they were willing to pay more for a green product.

- Greendex. A collaboration between National Geographic and environmental research consultants GlobeScan, Greendex is a sustainable consumption index of actual consumer behavior and material lifestyles across 17 countries. It defines environmentally friendly consumer behavior in terms of people’s transportation patterns, household energy, resource use, and consumption of food and everyday goods and how well consumers minimize their environmental impact. The 2012 survey found the top-scoring consumers in developing countries: India, China, and Brazil in descending order. Developed countries scored lower, with U.S. consumers lowest, followed by Canadians, Japanese, and the French.

- Gallup. Gallup has consistently found U.S. consumers are most concerned about pollution of drinking water, rivers, lakes, and reservoirs and maintenance of fresh water for household needs and least concerned about global warming. Overall, the 2012 survey showed all ratings at lower levels than their 2000 peak as more U.S. adults feel environmental conditions in the United States are improving.

- GfK Roper. The 2012 GfK Roper Green Gauge Study showed key aspects of “green” culture—from organic purchase to recyclability—have gone mainstream. U.S. consumers increasingly turn to digital devices to learn about the environment and share their green experiences. During slow economic recovery,however, paying significantly more to be environmentally friendly was becoming a barrier for many consumers.

Interestingly, although some marketers assume younger people are more concerned about the environment, some research suggests older consumers actually take their eco-responsibilities more seriously.

Company Perspectives

In the past, “green marketing” programs were not always entirely successful. Those that were persuaded consumers they were acting in their own and society’s long-run interest at the same time by buying, for instance, organic foods that were healthier, tastier, and safer and energy-efficient appliances that cost less to run.

Some green products have emphasized their natural benefits for years, like Tom’s of Maine, Burt’s Bees, Stonyfield Farm, and Seventh Generation. Products offering environmental benefits are becoming more mainstream. Part of the initial success of Clorox Green Works household cleaning products, launched in January 2008, was that it found the sweet spot where a target market wanting to take smaller steps toward a greener lifestyle met a green product with a very modest price premium and sold through a grassroots marketing program.

The recession took its toll on some newly launched green products, however, and Green Works and similar products from Arm & Hammer, Windex, Palmolive, and Hefty found sales stalling. Some consumers have also become more skeptical of green claims that are hard to verify. One challenge is the difficulty consumers have in experiencing or observing the environmental benefits of products, leading to accusations of “greenwashing” where products are not nearly so green or environmentally beneficial as their marketing might suggest.

Some experts recommend avoiding “green marketing myopia” by focusing on consumer value positioning, understanding what consumers know and should know, and credible product claims. During tough economic times especially, having the right value proposition and making sure green products are seen as effective and affordable are critical.

Sources: Jacquelyn A. Ottman, Edwin R. Stafford, and Cathy L. Hartman, “Avoiding Green Marketing Myopia,” Environment (June 2006), pp. 22-36; Jill Meredith Ginsberg and Paul N. Bloom, “Choosing the Right Green Marketing Strategy,” MIT Sloan Management Review (Fall 2004), pp. 79-84; Jacquelyn Ottman, Green Marketing: Opportunity for Innovation, 2nd ed. (New York: BookSurge Publishing, 2004); Jacquelyn Ottman, The New Rules of Green Marketing (San Francisco: Berrett-Koehler, 2012); Mark Dolliver, “Deflating a Myth,” Brandweek, May 12, 2008, pp. 30-31; Jeffrey M. Jones, “Worry about U.S. Water, Air Pollution at Historic Lows,” www.gallup.com, April 13, 2012; “The 2011 Green Brands Survey,” www .cohenwolfe.com, June 8, 2011; “Greendex 2012: Consumer Choice and the Environment—A Worldwide Tracking Survey,” www.nationalgeographic.com, July 2012; “Green Gets Real,” www.gfkamerica.com, accessed November 12, 2012; Stephanie Clifford and Andrew Martin, “As Consumers Cut Spending, ‘Green’ Products Lose Allure,” New York Times, April 21,2011; Tiffany Hsu, “Skepticism Grows over Products Touted as Eco-Friendly,” Los Angeles Times, May 21,2011.

9. THE TECHNOLOGICAL ENVIRONMENT

The essence of market capitalism is a dynamism that tolerates the creative destructiveness of technology as the price of progress. Transistors hurt the vacuum-tube industry; autos hurt the railroads. Television hurt newspapers; the Internet hurt them both. When old industries fight or ignore new technologies, they decline. Tower Records, Borders, and others had ample warning they would be hurt by Internet downloads; their failure to respond led to their liquidation.

In some cases, innovation’s long-run consequences are not fully foreseeable. Cell phones, video games, and the Internet allow people to stay in touch with each other and plugged in with current events but also reduce attention to traditional media as well as face-to-face social interaction as people listen to music or watch a movie on their cell phones.

Marketers should monitor the following technology trends: the accelerating pace of change, unlimited opportunities for innovation, varying R&D budgets, and increased regulation of technological change.

ACCELERATING PACE OF CHANGE More ideas than ever are in the works, and the time between idea and implementation is shrinking. In the first two-and-a-half years of the iPad’s existence, Apple sold a staggering 97 million units worldwide.47 In many markets, the next technological breakthrough seems right around the corner,

UNLIMITED OPPORTUNITIES FOR INNOVATION Consider just a few remarkable openings. Medical researchers hope to use stem cells for organ generation and hybrid positron emission tomography (PET) and magnetic resonance imaging (MRI) to dramatically improve diagnosis. Environmental researchers are exploring plasma arc waste disposal to harness lightning and turn garbage into glass or a gaseous energy source. They are

developing desalination methods to safely and economically remove salt from ocean water and make it drinkable. Neuroscientists are studying how to harness brain signals via electroencephalography (EEG) as well as how to construct a “thinking” DNA neural network that can answer questions correctly.48

VARYING R&D BUDGETS The United States is the world leader in R&D, spending $436 billion in 2012. Its advantage in innovation comes from all sectors—government-funded research from the National Aeronautics and Space Administration (NASA) and National Institutes of Health (NIH); top academic institutions such as Johns Hopkins University, University of Michigan, and the University of Wisconsin; and corporations such as Merck, Pfizer, Intel, and Microsoft.

A growing portion of U.S. R&D, however, goes to the development side, not research, raising concerns about whether the United States can maintain its lead in basic science. Too many companies seem to be putting their money into copying competitors’ products with minor improvements. Other countries are not standing still either. China, Israel, and Finland all are beginning to spend a larger percentage of their GDP on R&D than the United States.49

INCREASED REGULATION OF TECHNOLOGICAL CHANGE Government has expanded its agencies’ powers to investigate and ban potentially unsafe products. Safety and health regulations have increased for food, automobiles, clothing, electrical appliances, and construction. Consider the Food and Drug Administration (FDA).50

THE FDA The FDA plays a critical public health role, overseeing a wide range of products. Here is its specific charge:

FDA is responsible for protecting the public health by assuring the safety, efficacy and security of human and veterinary drugs, biological products, medical devices, our nation’s food supply, cosmetics, and products that emit radiation.

FDA is also responsible for advancing the public health by helping to speed innovations that make medicines more effective, safer, and more affordable and by helping the public get the accurate, science-based information they need to use medicines and foods to maintain and improve their health. FDA also has responsibility for regulating the manufacturing, marketing and distribution of tobacco products to protect the public health and to reduce tobacco use by minors.

Finally, FDA plays a significant role in the Nation’s counterterrorism capability. FDA fulfills this responsibility by ensuring the security of the food supply and by fostering development of medical products to respond to deliberate and naturally emerging public health threats.

The FDA’s level of enforcement has varied some through the years, in part depending on the political administration. It can also vary by product or industry. Congress recently empowered the FDA to place new restrictions on the prescribing, distribution, sale, and advertising of proposed new drugs. The FDA looks at the safety and efficacy of any proposed new drug, but also additional considerations such as the integrity of the global manufacturing chain that makes it, postmarketing studies as a condition of approval, and demonstrable superiority over existing therapies.

10. THE POLITICAL-LEGAL ENVIRONMENT

The political and legal environment consists of laws, government agencies, and pressure groups that influence organizations and individuals. Sometimes these create new business opportunities. Mandatory recycling laws boosted the recycling industry and launched dozens of new companies making products from recycled materials. On the other hand, overseas governments can impose laws or take actions that create uncertainty and even confusion for companies. Political instability in certain Middle Eastern and African nations has created much risk for oil firms and others. Two major trends are increased business legislation and the growth of special-interest groups.51

INCREASED BUSINESS LEGISLATION Business legislation is intended to protect companies from unfair competition, protect consumers from unfair business practices, protect society from unbridled business behavior,

Political unrest in the Middle East was a major cause for concern for many large multinational firms

and charge businesses with the social costs of their products or production processes. Each new law may also have the unintended effect of sapping initiative and slowing growth.

The European Commission has established new laws covering competitive behavior, product standards, product liability, and commercial transactions for the 28 member nations of the European Union. The United States has many consumer protection laws covering competition, product safety and liability, fair trade and credit practices, and packaging and labeling, but many countries’ laws are stronger.52

Norway bans several forms of sales promotion—trading stamps, contests, and premiums—as inappropriate or unfair. Many countries throughout the world ban or severely restrict comparative advertising. Thailand requires food processors selling national brands to also market low-price brands so low-income consumers will be served. In India, food companies need special approval to launch duplicate brands, such as another cola drink or brand of rice.

GROWTH OF SPECIAL-INTEREST GROUPS Political action committees (PACs) lobby government officials and pressure business executives to respect the rights of consumers, women, senior citizens, minorities, and gays and lesbians. Insurance companies directly or indirectly influence the design of smoke detectors; scientific groups affect the design of spray products. Many companies have established public affairs departments to deal with such special-interest groups.

The consumerist movement organized citizens and government to strengthen the rights and powers of buyers in relationship to sellers. Consumerists have won the right to know the real cost of a loan, the true cost per standard unit of competing brands (unit pricing), the basic ingredients and true benefits of a product, and the nutritional quality and freshness of food.

Privacy issues and identity theft will remain public policy hot buttons as long as consumers are willing to swap personal information for customized products—from marketers they trust.53 Consumers worry that they will be robbed or cheated; that private information will be used against them; that they will be bombarded by solicitations; and that children will be targeted by ads. Online privacy greatly concerns consumers and regulators alike. Technology now enables firms to collect all kinds of information.54

Make no mistake, your personal data isn’t your own. When you update your Facebook page, “Like” something on a website, apply for a credit card, click on an ad, listen to an MP3, or comment on a YouTube video, you are feeding a huge and growing beast with an insatiable appetite for your personal data, a beast that always craves more. Virtually every piece of personal information that you provide online (and much that you provide offline) will end up being bought and sold, segmented, packaged, analyzed, repackaged, and sold again.

“Marketing Insight: Watching Out for Big Brother” describes some of the data collection practices and privacy concerns that have arisen with widespread Internet adoption and use.

Views of ourselves. Some “pleasure seekers” chase fun, change, and escape; others seek “self-realization.” Some adopt more conservative behaviors and ambitions (see Table 3.4 for favorite consumer leisure-time activities and how they have changed, or not, in recent years).

- Views of others.People are concerned about the homeless, crime and victims, and other social problems. At the same time, they seek those like themselves for long-lasting relationships, suggesting a growing market for social-support products and services such as health clubs, cruises, and religious activity as well as “social surrogates” like television, video games, and social networking sites.

- Views of organizations.After a wave of layoffs and corporate scandals, organizational loyalty has declined. Companies need new ways to win back consumer and employee confidence. They need to ensure they are good corporate citizens and that their consumer messages are honest.

- Views of society.Some people defend society (preservers), some run it (makers), some take what they can from it (takers), some want to change it (changers), some are looking for something deeper (seekers), and still others want to leave it (escapers).43 Consumption patterns often reflect these social attitudes. Makers are high achievers who eat, dress, and live well. Changers usually live more frugally, drive smaller cars, and wear simpler clothes. Escapers and seekers are a major market for movies, music, surfing, and camping.

- Views of nature.Business has responded to increased awareness of nature’s fragility and finiteness by making more green products, seeking their own new energy sources, and reducing their environmental footprint. Companies are also literally tapping into nature more by producing wider varieties of camping, hiking, boating, and fishing gear such as boots, tents, backpacks, and accessories.

- Views of the universe.Most U.S. citizens are monotheistic, although religious conviction and practice have waned through the years or been redirected into an interest in evangelical movements or Eastern religions, mysticism, the occult, and the human potential movement.

Other cultural characteristics of interest to marketers are core cultural values and subcultures. Let’s look at both.

11. MARKETING INSIGHT Watching Out for Big Brother

The explosion of digital data created by individuals online can nearly all be collected, bought, and sold by the personal data economy, including “advertisers, marketers, ad networks, data brokers, website publishers, social networks, and online tracking and targeting companies.” Companies know or can find your age, race, gender, height, weight, marital status, education level, political affiliation, buying habits, hobbies, health, financial concerns, vacation dreams, and more.

The thought of such widespread transparency worries consumers. Research shows more people, especially older consumers, are refusing to reveal private information online. At the same time, consumers are accepting more privacy intrusions every day, perhaps because they don’t realize what information they are giving out, don’t feel they have a choice, or don’t think it will really matter. Many don’t realize, for example, that buried in the fine print of their agreement to buy a new smart phone may be authorization to allow third-party services to track their every move. One such firm, Carrier IQ, received permission from any purchaser of an EVO 3D HTC smart phone to see every call made and when, where text messages were sent, and which Web sites were visited. Unfortunately, once data have been collected online, they can end up in unexpected places, resulting in spam or worse.

Consumers increasingly want to know where, when, how, and why they are being watched online. Another data tracking firm is Acxion, which maintains a database on about 190 million U.S. i ndividuals and 126 million households. Its 23,000 servers process 50 trillion data transactions a year as it attempts to assemble “360-degree views” of consumers from offline, online, and mobile sources. Its customers have included banks like Wells Fargo and HSBC, investment services like E*TRADE, automakers like Toyota and Ford, and department stores like Macy’s.

Can online data profiling go too far? New parents are highly lucrative customers, but with birth records public, a slew of companies all discover them at the same time. To beat them to the punch, Target studied the buying histories of women who signed up for new-baby registries at the store and found many bought large amounts of vitamin supplements during their first trimester and unscented lotion around the start of their second trimester. Target then used these purchase markers to identify women of child-bearing age who were likely to be pregnant and sent them offers and coupons for baby products timed to the stages of pregnancy and later baby needs. When the practice became known, however, some criticized the company’s tactics, which had occasionally been the means of letting family members know someone in the house was expecting. Target responded by including the offers with others unrelated to pregnancy, and sales in the promoted pregnancy-related categories soared.

This episode vividly illustrates the power of database management in an Internet era, as well as the worries it can create among consumers. Politicians and government officials are discussing a “Do Not Track” option for consumers online (like the “Do Not Call” option for unsolicited phone calls). Although it is not clear how quickly legislation can be put into place, an online privacy bill that strengthens consumer rights seems inevitable. One member of the Federal Trade Commission, Julie Brill, feels data brokers should have to tell the public what data they collect, how they collect them, with whom they share them, and how they are used.

Sources: Avi Goldfarb and Catherine Tucker, “Shifts in Privacy Concerns,” American Economic Review: Papers & Proceedings 102, no. 3 (2012), pp. 349-53; Avi Goldfarb and Catherine Tucker, “Online Display Advertising: Targeting and Obtrusiveness,” Marketing Science 30 (May-June 2011), pp. 389-404, plus commentaries and rejoinder; Alessandro Acquisti, Leslie John, and George Loewenstein, “The Impact of Relative Judgments on Concern about Privacy,” Journal of Marketing Research 49 (April 2012), pp. 160-74; Mark Sullivan, “Data Snatchers! The Booming Market for Your Online Identity,” PC World, June 26, 2012; Charles Duhigg, “How Companies Learn Your Secrets,” New York Times, February 16, 2012; Joshue Topolsky, “Online Tracking Is Shady—but It Doesn’t Have to Be,” Washington Post, December 11,2011; Natasha Singer, “You for Sale: Mapping, and Sharing, the Consumer Genome,” New York Times, June 16, 2012; Natasha Singer, “Consumer Data, but Not for Consumers,” New York Times, July 21,2012; Doc Searls, “The Customer as a God,” Wall Street Journal, July 20, 2012.

Source: Kotler Philip T., Keller Kevin Lane (2015), Marketing Management, Pearson; 15th Edition.

Youre so cool! I dont suppose Ive read anything like this before. So good to seek out anyone with some original thoughts on this subject. realy thank you for starting this up. this web site is something that’s wanted on the internet, someone with a little bit originality. useful job for bringing something new to the internet!