The World Bank and the International Finance Corporation annually rank 189 countries in terms of their respective ease of doing business (http://www.doingbusiness.org/rankings). The index ranks nations from 1 (best) to 189 (worst). For each nation, the ranking is calculated as the simple average of the percentile rankings on how easy is it to (1) start a business, (2) deal with construction permits, (3) register property, (4) get credit, (5) protect investors, (6) pay taxes, (7) trade across borders, (8) enforce contracts, (9) resolve insolvency, and (10) get electricity.

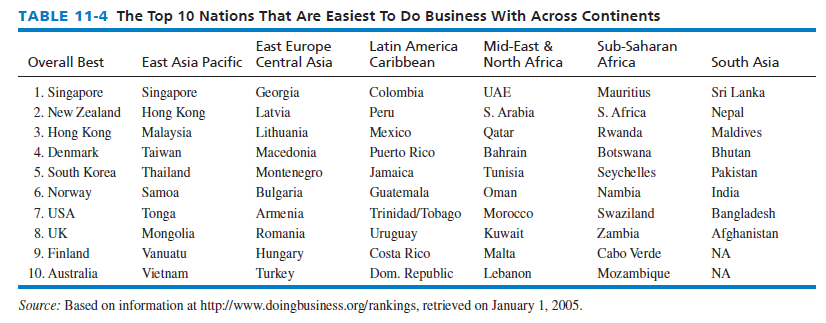

Table 11-4 reveals the 2014 “Ease of Doing Business” rankings for the top 10 nations in six regions of the world. Note, for example, that Norway is rated the sixth best country on the planet for doing business, the United States is ranked seventh, and Colombia is the best country in South America. This information can be helpful for strategists (and students) deciding where to locate new operations, and where to focus new efforts.

1. Africa’s Business Climate

Recently, 25 African countries held democratic elections, whereas two decades ago only 3 African countries were considered democracies. Currencies in Africa are stabilizing and many countries are fund-raising to build modern highways, ports, and power grids. Many African and non-African companies are launching operations in Africa due to the rapidly growing middle class and an average GDP growth of 5 percent for the continent through 2017. Also, the World Bank says food demand across Africa will double between 2012 and 2020.

Morocco has the highest Internet penetration among all countries in Africa, with 51 percent, followed by Egypt (36%), Kenya (tied with Nigeria at 28%), Senegal (18%), South Africa (17%), Angola (15%), Algeria (14%), Ghana (14%), and Tanzania (12%).9 All other African countries have less than 6 percent Internet penetration among their residents. The article was based on research published by the consulting firm McKinsey, which estimates that only 16 percent of Africans have access to the Internet. McKinsey predicts that by 2025, 50 percent of Africans will be online.

Nigeria (GDP = $510B) recently surpassed South Africa (GDP = $320B) as having the continent’s largest gross domestic product.10 In 2014, Nissan Motor assembled thousands of cars in Nigeria, General Electric began building $10 billion worth of new turbines for power plants, and Procter & Gamble opened a second diaper factory. Nigeria’s population will be seven times larger than South Africa by 2050, even though the country still has problems with infrastructure, unemployment, crime, and poverty.

A recent article in the Wall Street Journal (7-13-15, p. B1) reported that Ethiopia is the newest country where garment companies are shifting manufacturing work; Kenya also is receiving numerous new “clothing” factories. VF Corporation that makes such brands as Lee, Wrangler, and Timberland, as well as Calvin Klein and PVH Corporation that makes Tommy Hilfiger, are all mentioned in the article as increasingly shifting their production operations to Africa. Such companies are shifting work to Africa from China, Bangladesh, Vietnam, Cambodia, India, Sri Lanka, and Turkey, primarily due to exceptionally low wages. For example, the article reports that Chinese garment workers earn between $155 to $297 a month, compared to workers in Bangladesh and Ethiopia that earn about $67 and $21 a month respectively. Many African countries also grow cotton and that is a plus for textile companies, but the lowest wages on the planet, coupled with improving infrastructure and stability, is the real draw.

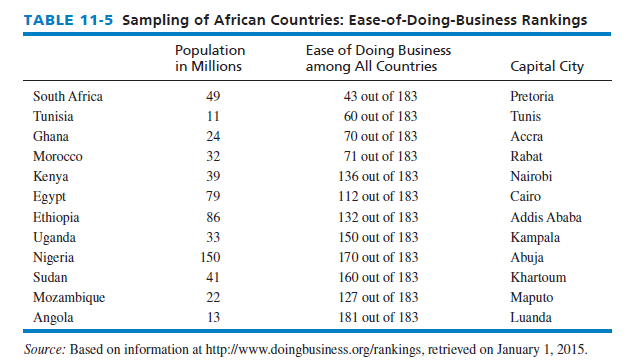

Table 11-5 provides a summary of the economic situation in 12 African countries. Note that Angola is rated lowest in terms of doing business, whereas South Africa is rated highest. Recent regime changes in Egypt, Tunisia, Libya, and Algeria may spur further investment in Africa as democracy and capitalism strengthens. Many multinational companies are now gaining first mover advantages by engaging Africa at all levels. Today, 40 percent of Africans live in the cities—a proportion close to China and India. The general stereotype of Africa is rapidly changing from subsistence farmers avoiding lions to millions of smartphone-carrying consumers in cities purchasing products.

Africa has the world’s largest deposits of platinum, chrome, and diamonds—and many Chinese companies in particular are investing there. Africa’s largest food retailer, Shoprite Holdings, has more than 1,000 stores in 17 countries. Shoprite is a potential acquisition target being considered by European retailers Carrefour and Tesco. Diageo PLC sells Guinness beer, Smirnoff vodka, Baileys liqueur, and Johnnie Walker whiskey in more than 40 countries across Africa. Nestle SA now has more than 25 factories in Africa.

All of Africa is coming online, representing huge opportunities for countless companies. McKinsey & Co. estimates that within 5 years another 220 million Africans that today can meet only basic needs will join the middle class as consumers.11 There are more than 950 million people who live in Africa.

2. China’s Business Climate

The International Monetary Fund (IMF) recently reported that China, the world’s most populous country, has overtaken the United States as the world’s number-one economic powerhouse. China’s economic output in 2014 reached $17.6 trillion, compared to the USA’s $17.4 trillion. China now accounts for 16.5 percent of the world economy, compared to the 6.3 percent recorded by the United States. Experts have predicted this monumental shift in economic power for years, but it has come much faster than expected. Hundreds of companies are scurrying to set up business in China.

China’s economic growth has slowed to 6.8 percent, led especially by a domestic-property slump that has dented construction activity and demand for materials such as steel and cement. Ruling Communist Party leaders are calling the situation the “new normal” of slower growth as the government tries to reduce widespread pollution and conserve energy. Fixed-asset investment in China is poised to fall to 12.8 percent in 2015, down from 15.5 percent the prior year. Cantonese-speaking demonstrators in Hong Kong, supported by millions of Mandarin-speaking main land Chinese, still hold out for democracy. More than 40 million Chinese visit Hong Kong (population 7 million) annually.”12

For many decades, low wage rates in China helped keep world prices low on hundreds of products—but that is changing, because all 31 Chinese provinces and regions recently boosted their minimum wage for the third consecutive year. Demand for workers in China now outstrips supply, and this is contributing to rapidly rising wage rates and worldwide inflation. Commercial and industrial development in China’s west has turned interior cities such as Chongqing into production centers that compete for labor with coastal factories. In fact, Chinese labor laws limiting student interns to 8 work hours a day and no night shifts are widely disregarded by factories.13 Many of China’s vocational schools “dump students for long internships (up to one year) at factories.” Intern students are generally paid about the same as regular workers, about $212 a month before overtime, but students often have to pay most of their base wages to their school.

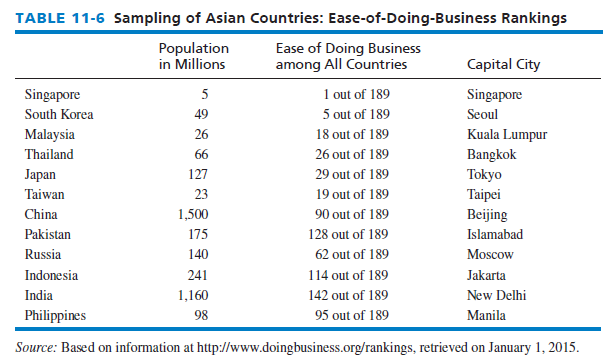

As indicated in Table 11-6, China ranks 90 out of 189 countries in terms of doing business. That ranking is relatively low for a variety of reasons, ranging from human rights issues to substantial disregard for copyright, patent, and trademark rules of law. Best Buy and Home Depot are examples of companies that are closing stores in China. In contrast, luxury handbag maker Coach Inc. has made China the cornerstone of its international strategy, adding more products for men and opening men’s stores in China. However, Coach is struggling to compete with Hong Kong-based Michael Kors. Note also in Table 11-6 that Singapore is rated the best country on the planet for doing business.

3. Brazil’s Business Climate

Brazil’s biggest trading partner is China, but as China’s economy has slowed, Brazil’s economy has deteriorated. In August 2015, consumer confidence in Brazil is at a record low, unemployment has increased to 8.3 percent, inflation is nearing 10 percent, and corruption scandals have left President Dilma Rouseseff with approval ratings below 10 percent. Demand for Brazil’s commodities, especially soybeans and iron ore, has declined sharply, so Brazilian businesses are laying off workers and cutting spending. Lower commodity prices cost Brazil $12 billion in foreign sales through the first half of 2015 alone. Brazil’s currency, the real, declined 30 percent versus the US dollar in the last twelve months; Brazil’s stock market is down 22 percent in the last twelve months; Brazil’s economy is shrinking at about 1.7 percent annually. Economists now predict prolonged stagnation for Brazil. Marcos Troyjo, a former Brazilian diplomat who now is at Columbia University, says: “We went from Brazil mania to Brazil nausea; we are now looking at a lost decade.” Instead of negative growth, Brazil reported 7+ percent annual GDP growth in 2010-2012 making it a BRIC (Brazil, Russia, India, China) high performer. But that was then. Also hurting Brazil now has been the fall in oil prices since that country is (or was) a big exporter of oil.

4. Indonesia’s Business Climate

A Pacific archipelago comprised of thousands of islands, Indonesia’s stock market was the top performer in 2014 among all Asian countries, and was also the top performer in five out of the last seven years in Asia. Indonesia’s currency is the rupiah and its economy is one of the fastest growing in Asia, behind China and the Philippines. Indonesia’s GDP is expected to grow 5.7 percent in 2015 As Southeast Asia’s largest economy, Indonesia elected a new legislature and president in 2014. Despite its large population and densely populated regions, Indonesia has the world’s second-highest level of biodiversity, with vast areas of wilderness and abundant natural resources.

5. India’s Business Climate

The GDP of India in 2015 is expected to reach 8.3 percent, making it the world’s fastest-growing large economy, and the first time that India’s growth rate has exceeded that of China since the 1990s. China’s GDP for 2015 is expected to slow to 6.8 percent.

By a landslide, India elected a new prime minister in May 2014, Narendra Modi. Modi has introduced excellent policies to jump-start India’s economy, boosting profits at companies ranging from banks to cement makers. In support of Modi and India’s future, money managers worldwide poured more than $17 billion into Indian stocks in 2014—the most of any developing country tracked by the Institute of International Finance. India’s S&P Index grew nearly 40 percent in 2014. The country is the world’s tenth-largest economy, but its economy pre-Modi was stagnant due to cumbersome bureaucracy and poor infrastructure. India grew faster (5.6%) in 2014 than any BRIC (Brazil, Russia, India, and China) country. India’s economy is expected to grow 6.4 percent in 2015. Modi’s political party has the ruling majority in the India legislature for the first time in 30 years. India is benefiting greatly from low prices for oil and gas, India’s biggest import.

India’s state Parliament of Rajasthan recently overhauled its local labor laws by making it easier for companies with as many as 300 employees to fire workers and avoid other contentious provisions of strict labor-protection laws. Modi is using various Indian states where his Bharatiya Janata Party has control to test his greater economic openness policies. He believes, for example, that manufacturers will now relocate to Rajasthan, and the neighboring state of Haryana has suggested it may follow Rajasthan. Modi is trying to revitalize India’s manufacturing sector by taking the following steps immediately: reducing the powers of labor inspectors, replacing onerous paperwork with digital submissions, removing restrictions on women working at night, improving factory conditions for workers, easing regulations on hiring apprentices, and facilitating overtime.

Foreign firms may now own 100 percent of some Indian retail ventures, up from a previous 51 percent a few years ago. One company taking advantage of this change in the law is IKEA, which recently opened 25 new stores in India. India has also greatly reduced the expensive government subsidies on diesel fuel. Indian banks are lowering interest rates to spur growth. The country is implementing a 5-year road map to improve its finances, aiming to narrow its budget deficit of 5.3 percent of GDP to 3 percent by 2017. Complicating matters in India are high interest rates and budget deficits. The Indian Parliament recently approved higher overseas ownership in their insurance and pension investments sectors of the economy.

The Indian government is slowly improving the country’s education system, but an enormous amount of work remains. Only 74 percent of Indian men and 48 percent of Indian women are literate, compared to 96 percent of men and 88 percent of women in China. India’s “knowledge economy” employs only about 2.23 million people out of 750 million available.

At present, only 15 percent of India’s citizens enter higher education, and the government hopes to increase this to 21 percent by 2017. The Indian Institutes of Technology—a group of universities focused on engineering and technology—are world renowned, but offer only a miniscule 7,000 places to students each year. There is elaborate red tape required to establish and operate any business in India. Also, the country’s tax code is archaic and many new sectors are not even open to foreign direct investment. However, India will surpass China as the most populated country in 2030. Its highest density growth and population is in the northwest and east-central areas of the country. India has a literacy rate now of 74 percent, up from 65 percent a decade ago.

6. Japan’s Business Climate

Japan’s new Prime Minister Shinzo Abe was reelected on a mandate to revive the economy. Hopes for Abe’s “Three Arrows” of hyper-easy monetary policy, government spending, and reforms such as deregulation were tarnished after Japan’s economy slipped into a recession in Q3 2014, following a national sales tax increase from 5 to 8 percent aimed primarily at reducing Japan’s huge public debt, the worst among advanced nations. But the sales tax increase hurt ordinary Japanese citizens. However, the falling yen has hurt small businesses and consumers by raising the cost of imported goods. Abe is pushing hard now for Japanese companies to raise wages of their employees, because company stock prices and profits are up and ordinary citizens are suffering. Abe says if wages do not rise as quickly as prices, households will cut back on spending, endangering a desired economic recovery in Japan.

Prime Minister Abe wants to restart nuclear reactors that were taken offline after the 2011 Fukushima disaster. As of 2015, all 48 of Japan’s reactors are offline. Abe likely will stay in power in Japan through 2018, becoming one of Japan’s rare long-term leaders. His historically pro-business Liberal Democratic Party (LBD), together with its junior coalition partner, the Komeito party, now controls more than two thirds of the lower house. Abe also wants to revitalize Japan’s military to help confront growing aggression from China and North Korea, and to be able to respond to incidents such as the recent ISIS beheading of two Japanese journalists.

7. Mexico’s Business Climate

South Korea’s Kia Motors is building a $1 billion assembly near Monterrey, Mexico, joining Mazda Motors, Honda Motors, Audi AG, BMW AG, Renault SA, Nissan Motors, and Daimler AG, all of which are shifting automobile assembly operations to Mexico. The country of Mexico is now (2015) the fourth-largest auto exporter in the world, behind Japan, Germany, and South Korea. Mexico’s auto industry now employs one of every six Mexican factor workers and comprises one third of all exports from Mexico.

No country was hurt more in the last decade by the rise of China than Mexico, but Chinese policy today is to boost wages and therefore boost consumer spending. The Boston Consulting Group estimates that “China’s average manufacturing wage exceeded Mexico’s in 2012 for the first time, when accounting for differences in productivity; Mexican workers typically produce more per hour than Chinese workers.”14 The average wage plus benefits across Mexico is $3.50 an hour. This fact, coupled with China’s rising wages and slowing growth and Mexico’s close proximity to the United States, represents a great opportunity for Mexico to recoup much of the manufacturing prowess it lost in the last decade to China.

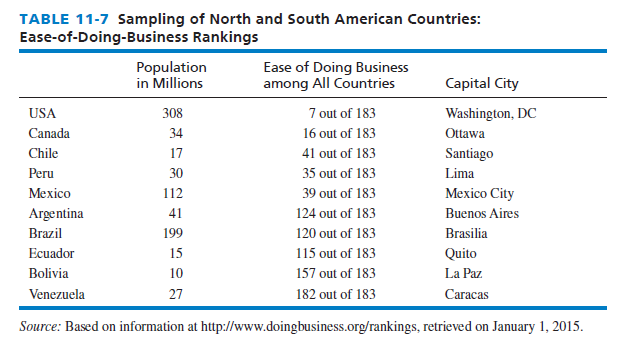

Foreign direct investment (FDI) in Mexico has surged to exceed $30 billion annually, led by automobile manufacturers such as Volkswagen AG building new factories, and auto-parts suppliers such as Delphi Automotive PLC following. Home Depot will soon have 150 stores in Mexico. The FDI surge is expected to last at least through 2018, spurred by low wages, government policies that allow foreign companies to import raw materials without paying duties or tariffs, a 30 percent corporate tax rate, and rising wages in China. Note in Table 11-7 that Mexico rose to 39th place (from 53rd place) in the last two years among all nations in terms of ease of doing business.

Mexico is especially attractive for manufacturing products that are bulky or costly to transport, such as automobiles. However, a key variable hurting Mexico is drug-related violence. Mexico’s homicide rate exceeds 15 people per 100,000, compared with a per capita rate of about 5.0 in the United States and 1.1 in China. If Mexico can improve its security situation as it intends, then hundreds of additional firms may consider returning to Mexico from China (and India).

8. Vietnam’s Business Climate

Internet penetration has grown to 44 percent among Vietnam’s 90 million people, up from 12 percent a decade ago.15 Unlike another communist country, North Korea, Vietnam is booming for business. The market for e-commerce in Vietnam generates $4 billion in revenue annually and is growing dramatically. Telecommunications companies in Vietnam, such as Viettel Mobile and Vietnam Mobile Telecom Services, provide the lowest data prices in the world at just over $3 per gigabyte. The Vietnamese are among the most prevalent watchers of videos on smartphones in the world. The number of active mobile social-media accounts in Vietnam rose 41 percent from January 2014 to January 2015—a higher growth rate than China, India, or Brazil. Facebook has over 30 million active users in Vietnam, up from 8.5 million in 2012. Even the smallest businesses in the United States (and elsewhere) can easily reach and sell to consumers in Vietnam, who yearn for new products and services. (Interestingly, the most recent foreign translation of this textbook, Strategic Management, has been translated into Vietnamese.)

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

17 May 2021

17 May 2021

18 May 2021

18 May 2021

18 May 2021

18 May 2021