There is a consistent set of challenges that affect all stages of a firm’s growth. The challenges typically become more acute as a business grows, but a busi- ness’s founder or founders and managers also become more savvy and experi- enced with the passage of time. The challenges illustrate that no firm grows in a competitive vacuum.29 As a business grows and takes market share away from rival firms, there will be a certain amount of retaliation that takes place. This is an aspect of competition that a business owner needs to be aware of and plan for. Competitive retaliation normally increases as a business grows and becomes a larger threat to its rivals.

This section is divided into two parts. The first part focuses on the mana- gerial capacity problem, which is a framework for thinking about the overall challenge of growing a firm. The second part focuses on the four most common day-to-day challenges of growing a business.

1. Managerial capacity

In her thoughtful and seminal book The Theory of the Growth of the Firm, Edith T. Penrose argues that firms are collections of productive resources that are organized in an administrative framework.30 As an administrative frame- work, the primary purpose of a firm is to package its resources together with resources acquired outside the firm as a foundation for being able to produce products and services at a profit. As a firm goes about its routine activities, the management team becomes better acquainted with the firm’s resources and its markets. This knowledge leads to the expansion of a firm’s productive opportunity set, which is the set of opportunities the firm feels it’s capable of pursuing. The opportunities might include the introduction of new products, geographic expansion, licensing products to other firms, exporting, and so on. The pursuit of these new opportunities causes a firm to grow.

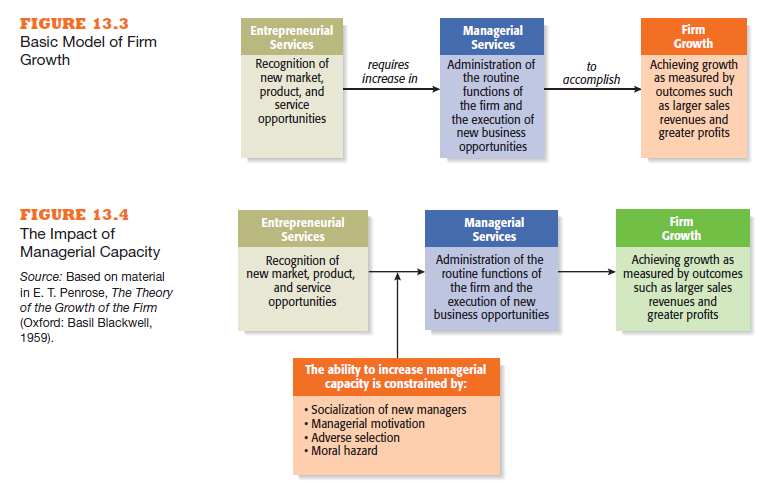

Penrose points out, however, that there is a problem with the execution of this simple logic. The firm’s administrative framework consists of two kinds of services that are important to a firm’s growth—entrepreneurial services and managerial services. Entrepreneurial services generate new market, product, and service ideas, while managerial services administer the routine functions of the firm and facilitate the profitable execution of new opportunities. However, the introduction of new product and service ideas requires substantial manage- rial services (or managerial “capacity”) to be properly implemented and super- vised. This is a complex problem because if a firm has insufficient managerial services to properly implement its entrepreneurial ideas, it can’t quickly hire new managers to remedy the shortfall. It is expensive to hire new employees, and it takes time for new managers to be socialized into the firm’s culture, ac- quire firm-specific skills and knowledge, and establish trusting relationships with other members of their firms.31 When a firm’s managerial resources are insufficient to take advantage of its new product and services opportunities, the subsequent bottleneck is referred to as the managerial capacity problem.

As the entrepreneurial venture grows, it encounters the dual challenges of adverse selection and moral hazard. Adverse selection means that as the number of employees a firm needs increases, it becomes increasingly difficult for it to find the right employees, place them in appropriate positions, and pro- vide adequate supervision.32 The faster a firm grows, the less time managers have to evaluate the suitability of job candidates and the higher the chances are that an unsuitable candidate will be chosen. Selecting “ineffective” or “un- suitable” employees increases the venture’s costs. Moral hazard means that as a firm grows and adds personnel, the new hires typically do not have the same ownership incentives as the original founders, so the new hires may not be as motivated as the founders to put in long hours or may even try to avoid hard work.33 To make sure the new hires are doing what they are employed to do, the firm will typically hire monitors (i.e., managers) to supervise the employees. This practice creates a hierarchy that is costly and isolates the top management team from its rank-and-file employees.

The basic model of firm growth articulated by Penrose is shown in Figure 13.3 while Figure 13.4 shows the essence of the growth-limiting managerial capacity problem.34 Figure 13.4 indicates that the ability to increase managerial services is not friction free. It is constrained or limited by (1) the time required to socialize new managers, (2) how motivated entrepreneurs and/or managers are to grow their firms, (3) adverse selection, and (4) moral hazard.

Wesabe, the focus of this chapter’s “What Went Wrong?” feature, suffered as a result of trying to build out its own capabilities or managerial capacity in a key area rather than partnering with a company that was willing to license it the capability. A competitor licensed the technology and sped ahead of Wesabe. Wesabe’s own attempt to build out the capability took longer than it thought it would, and it never recovered.

The reality of the managerial capacity problem is one of the main reasons that entrepreneurs and managers worry so much about growth. Growth is a generally positive thing, but it is easy for a firm to overshoot its capacity to man- age growth in ways that will diminish the venture’s sales revenues and profits.

2. Day-to-Day challenges of growing a Firm

Along with the overarching challenges imposed by the managerial capacity problem, there are a number of day-to-day challenges involved with growing a firm. The following is a discussion of the four most common challenges.

Cash Flow Management As discussed in Chapters 8 and 10, as a firm grows, it requires an increasing amount of cash to service its customers. In addition, a firm must carefully manage its cash on hand to make sure it main- tains sufficient liquidity to meet its payroll and cover its other short-term obli- gations. There are many colorful anecdotes about business founders who have had to rush to a bank and get a second mortgage on their houses to cover their business’s payroll. This usually occurs when a business takes on too much work, and its customers are slow to pay. A business can literally have $1 mil- lion in accounts receivable but not be able to meet a $25,000 payroll. This is why almost any book you pick up about growing a business stresses the im- portance of properly managing a firm’s cash flow.

Growth usually increases rather than decreases the challenges involved with cash flow management because an increase in sales means that more cash will be flowing into and out of the firm. Growth is also expensive, in that it often involves investing more money in operations, marketing, administra- tive processes (to better track accounts payable and receivable), and personnel. This point is made by Vinny Antonio, president of Victory Marketing Agency:

“Cash flow management for a rapidly growing, bootstrapped company can be harder than the world’s most difficult Sudoku puzzle. It’s almost a full-time job staying on top of who owes you what and who you owe, and then priortizing those payments. All the while, you’re pushing for more growth, but with that comes additional ex- penses—most notably, your executive team. Good talent doesn’t come cheap, and you often have to find creative ways to lure the right personnel to your team.”35

Some firms raise the cash needed to fund growth via investors or a line of credit at a bank. Other firms deliberately restrict the pace of their growth to avoid cash flow challenges.

Price Stability If firm growth comes at the expense of a competitor’s market share, price competition can set in. For example, if an entrepreneur opened a fast-casual restaurant near a Panera Bread that started eroding the Panera Bread’s market share, Panera Bread would probably fight back by running pro- motions or lowering prices. This type of scenario places a new firm in a difficult predicament and illustrates why it’s important to start a business by selling a differentiated product to a clearly defined target market. There is no good way for a small firm to compete head-to-head against a much larger rival on price. The best thing for a small firm to do is to avoid price competition by serving a different market and by serving that market particularly well.

Quality Control One of the most difficult challenges that businesses en- counter as they grow is maintaining high levels of quality and customer ser- vice. As a firm grows, it handles more service requests and paperwork and contends with an increasing number of prospects, customers, vendors, and other stakeholders. If a business can’t build its infrastructure fast enough to handle the increased activity, quality and customer service will usually suffer. What happens to many businesses is that they run into the classic chicken- or-egg quandary. It’s hard to justify hiring additional employees or leasing more office space until the need is present, but if the business waits until the need is present, it usually won’t have enough employees or office space to properly service new customers.

There is no easy way to resolve this type of quandary other than to recog- nize that it may take place and to plan for it in the best way possible. Many businesses find innovative ways to expand their capacity to try to avoid short- falls in quality control or customer service.

Capital Constraints Although many businesses are started fairly inexpen- sively, the need for capital is typically the most prevalent in the early growth and continuous growth stages of the organizational life cycle. The amount of capital required varies widely among businesses. Some businesses, like restaurant chains, might need considerable capital to hire employees, construct buildings, and purchase equipment. If they can’t raise the capital they need, their growth will be stymied.

Most businesses, regardless of their industry, need capital from time to time to invest in growth-enabling projects. Their ability to raise capital, whether it’s through internally generated funds, through a bank, or from investors, will determine in part whether their growth plans proceed.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

I feel this is among the most vital information for me. And i’m satisfied studying your article. However want to commentary on few basic things, The web site style is great, the articles is in reality great : D. Just right job, cheers