1. Launching a New Business Concept and the Role of the Founding Entrepreneur

The foundation of Delivery Hero goes back to initial brainstorming ideas developed during a student summer project in 2005 in Sweden. Just a couple of years later, in 2008, one of the students who had participated in the project, named Niklas Ostberg, started the company’s first online food delivery services in Sweden and expanded its business to Poland and Austria in 2009. Using its personal relationships with other entrepreneurs who were joining a startup incubator project named Team Europe, Niklas Ostberg established Delivery Hero in 2011 in Berlin. Colleagues and employees describe Niklas Ostberg as a passionate entrepreneur who is an ideal mixture between visionary and operative, with a strong international mindset that makes him able to understand and to solve complex business-related challenges. In parallel, Delivery Hero’s employees at Berlin headquarters portray him as a modest person who stays grounded in reality.

Delivery Hero seeks to revolutionize global food delivery service, claiming that everything which is available on the street is available on Delivery Hero’s mobile application (app) platform. Introducing digital-based and truly new value propositions to the food delivery industry, Delivery Hero holds an intermediary position, bridging restaurants with ‘hungry and busy customers’ through advanced digital technologies. The clients, through their app – which connects their mobile devices with Delivery Hero’s web platform – can order various kinds of meals which are prepared by participating restaurants. The food is delivered either directly by the restaurant to any location indicated by the client or through Delivery Hero’s mobile distribution network (e.g., bicycle, motorcycle). For each digitally ordered meal, Delivery Hero receives a commission from the restaurant. Delivery Hero seeks its firm specific-advantage through the highest possible customer satisfaction levels which are reached, first, when the app (technology) operates comfortably, safely, and reliably without software clashes. Second, the food, prepared in the restaurant for the clients, has to be tasty and affordable and should be delivered on time. Thus appropriate restaurant selection is of vital importance for Delivery Hero.

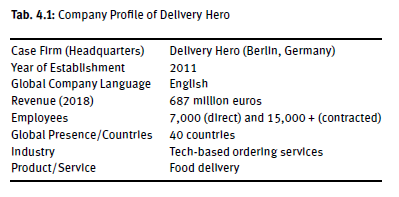

Initially developed to launch the global digital food delivery business, just seven years after its foundation Delivery Hero’s employs around 22,000 people of 70 different nationalities (compare Table 4.1). The company owns 26 brands and operates 145 foreign subsidiaries. Listed on the stock exchange since 2017 Delivery Hero has contracted 250,000 restaurant partners in 41 countries. Delivery Hero holds a market leader position in the digital food delivery service in 36 countries. As per end of 2019,1,389 meals were delivered every minute.

For the fiscal year 2018, Delivery Hero generated revenues of 687 million euros (2017:544 million euros, 2016: 341 million euros) and an EBITDA of -123 million euros in 2018 (2017: -94 million euros, 2016: -116 million euros) (Delivery Hero, 2018). Around 90 percent of sales are generated outside Germany. Fifteen percent of the revenues are generated through contractual agreements with larger restaurants chains such as Burger King, Subway, Dunkin’ Donuts, KFC and Starbucks (Manager Delivery Hero). Delivery Hero is organized as a holding of globally spread subsidiaries, each representing well-known local brands such as Pedidos Ya (Argentina), Yemeksepeti (Turkey), Talabat (Kuweit) and Yogiyo (Korea).

Local branding indicates an opposite strategy to the US-based logistics service provider Uber, which recently diversified its business to enter food delivery with ‘Uber Eats.’ Uber Eats offers similar food delivery services to Delivery Hero. In recent years they have acquired various food delivery service providers. However, instead of running subsidiaries with well-known local brands with the most flexible entrepreneurial freedom, Uber Eats offers its service in a standardized managerial form, making use of its globally uniform brand name, regardless of its international target markets.

According to Delivery Hero’s financial records (status as of the first quarter of 2019), the Middle East and North Africa (MENA) accounted for almost half of its revenues, at 316.4 million euros, growing more than twofold compared to 2017. Operations in Asia generated 192.5 million euros; in Europe 115.9 million euros; and in North and South America 62.1 million euros. All the markets indicate yearly growth (Delivery Hero 2018).

2. Digital Technologies and International Expansion

Digital communication technologies have made international market entry easier for Delivery Hero, even in geographically rather distant markets relative to the headquarters in Berlin. Before entering a new market, Delivery Hero studies the foreign target market environment in light of demographics (aging), political stability, intensity of competition, food buying behavior (which is, for example, very different in Korea or Thailand compared to Western Europe), economic indicators such as gross domestic product and purchasing power, and last but not least, the acceptance of digital technology applications by the citizens.

In the course of their international expansion, Delivery Hero recognized that the food ordering behavior of the clients differs between foreign regions. For example, in countries such as Turkey, Argentina, Korea, Kuwait, Dubai and Oman, clients spend considerably more money for app-based food deliveries than in Europe. In the Middle East, due to relatively high temperature during the day-time, people prefer ordering food to their offices and homes at lunchtime. In comparison, Europe has rather less dynamic market growth rates for app- based food ordering. The tech-based communication behavior of customers also differs between regions and countries. For example, in Germany most clients tend to get nervous and may even delete the app if they receive an invitation a couple of times per day to participate in a promotional campaign, whereas in Korea customers start feeling uncomfortable if they do not receive frequent daily advertisements such as ‘special offers.’

During the first years after the firm’s foundation in 2011 Delivery Hero grew mainly through foreign greenfield investments, making use of its truly novel business concept built on digital app algorithm architecture. Algorithm programming needs to acknowledge diversified suppliers all around the globe who are delivering different food ingredients of mixed quality, as well as the different service delivery performance of the participating restaurants. Further variables to be considered in these algorithms are average order volumes, purchasing power, and order forecasts which also include potential traffic jams and changing climate and weather conditions. This generates major firm-specific advantages for Delivery Hero because the app algorithm programming at headquarters in Berlin is used as a standardized platform which can be easily modified according to the specific foreign target market’s requirements. Running the technology platform, including the data management, contributes around seventy percent of the value added and thus allows significant economies of scale effects within Delivery Hero’s global business network compared to smaller individual competitors offering similar delivery services (Delivery Hero 2018).

Over time Delivery Hero decided to change its market strategy towards equity participations and acquisitions. What are the reasons? Delivery Hero recognized in the course of internationalization that it is of vital importance to hold a market leadership positioning in the foreign target market. Because food usually is perceived as a very personal, region- and country-specific product, brand reputation is of extreme importance. However, building up ‘Delivery Hero’ as a new brand in the foreign target markets through greenfield investment is time-consuming and costly. Being ranked as second or third in the market makes generating economies of scale effects impossible. Cost efficiency is important in the digital food delivery market which experiences fast technological changes but has rather low margins.

Therefore, current takeover candidates of Delivery Hero are usually firms with strong local brands which are recording a minimum of tens of thousands, and up to one million, orders a month and hold the number one market position. Among other reasons, the tremendous growth of Delivery Hero through acquisitions in recent years was possible due to relatively large engagements by international financial investors. The largest investor is the South-African based Naspers, which held a stake in Delivery Hero of 23.6 percent at the end of 2018. Naspers is one of the largest internet investors in the world, holding minority stakes in digital players such as Tencent, Mail.Ru and Flipkart (McIntyre 2017).

Delivery Hero’s international expansion has not followed a positive, linear path. For example in 2012, the tech firm entered the Chinese market, but left China already in 2016, even though the business was successful in the beginning. The main reason for divestment was mainly due to local competition where ‘food has been offered for free to clients for a couple of months and restaurants were not obliged to pay commission fees for months,’ according to a manager at Delivery Hero. In China, e-commerce giant Alibaba copied Delivery Hero’s business concept and aggressively launched a food delivery business in 2015 investing USD 1.25 billion in the digital food delivery service company called “Ele.me” (von Braunmuhl 2016).

In 2018, Delivery Hero sold further foreign subsidiaries in Australia, Italy, the Netherlands and France (Smyth 2018). Major reasons for the divestment were limited economies of scale due to a market position that was much to far from the local market leader. Delivery Hero refocused its strategy on more promising markets indicating higher growth rates with less local competition.

3. Firm Organization and Culture

In 2019, Delivery Hero is led by Niklas Ostberg (CEO) and Emmanuel Thomassin (CFO). Both belong to the Management Board which is supported by The General meeting of Shareholders and the Supervisory board (compare Figure 4.17).

During their internationalization process, Delivery Hero recognized that local entrepreneurs know better than headquarters about their markets and food ordering behavior of their customers. However, acquisitions always come along with the risk of losing qualified and motivated people of the acquired entity, whether they are entrepreneurs, managers or operating staff. Therefore, during the post-acquisition phase Delivery Hero pays attention that the local entrepreneurs of the acquired firm do not leave Delivery Hero. Instead, they should become closely integrated into the organization. According to Niklas Ostberg, ‘locals take benefit of the last decisional rights relative to headquarters because they know bestwhat is going on in their local markets.’ Such firm policy requires a culturally open mindset at headquarters, aiming to share ‘the ways of thinking with locals,’ according to the CEO of Delivery Hero.

In order implement such a firm culture, Delivery Hero takes advantage of the seventy different nationalities of the employees working at the company. Sixty-five percent have an international background and thirty- five percent a German one. The firm offers various cross-cultural training courses for its employees either provided by in-house employees or external experts.

That is why Berlin was selected as the headquarters’ location in 2011 because of its strong international community, which is important for human resource recruitment of global startups like Delivery Hero. Moreover, Berlin has reasonable rent costs for headquartering the facilities there, educated and open-minded citizens, and a potential market for the digital food delivery business.

A diverse cultural mindset allows for much better understanding of foreign operations. Trust between headquarters and its foreign operations is developed when the company’s mission, goals and objectives are actively communicated and shared. Therefore, the Berlin headquarters describes itself as a ‘center of excellence of a united nations of food delivery’, leaving the most possible entrepreneurial freedom to its foreign subsidiaries, according to a manager at Delivery Hero. The headquarters ensures that foreign entrepreneurs and restaurants are aware that they perform much better when they are an integrated part of Delivery Hero’s global network instead of doing food delivery business independently and alone.

The challenges of a decentralized organization, such as implemented by Delivery Hero which requires permanent information exchange, should not be underestimated. Delivery Hero’s foreign subsidiaries are guided and monitored from its headquarters in Berlin through updated digital reporting channels and weekly videophone conferences where, among other topics, sales targets and business performance are discussed and evaluated. Delivery Hero employs five people at its headquarters who permanently monitor the global business network and make sure that knowledge is spread without delay among all operations in the organizational network. According to Niklas Ostberg, headquarters has implemented an electronic reporting system but at the same time also has launched ‘principles’ in terms of reporting days and contents, where ‘we try to get certain things out of the market being a little bit unique and valuable to us.’ As a result firm-specific advantages are further developed through digitalized communication technologies which means the best practice cases in one market can be instantly applied to other foreign subsidiaries of Delivery Hero’s global business network. As a result, the firm’s dynamic capabilities are continuously being improved through digital communication technologies securing that best practice cases in one market can be instantly applied to other foreign subsidiaries of Delivery Hero.

Source: Glowik Mario (2020), Market entry strategies: Internationalization theories, concepts and cases, De Gruyter Oldenbourg; 3rd edition.

Good info. Lucky me I reach on your website by accident, I bookmarked it.