Marketing tactics to implement strategies and objectives are traditionally based around the elements of the marketing mix. There are other methods for approaching tactics that are detailed in further sections. One approach is to use customer-driven tactics that affect both the design and services provided by an e-commerce site. A further approach to structure e-marketing tactics is that of customer relationship management described in Chapter 9.

The marketing mix – the 4 Ps of Product, Price, Place and Promotion originally proposed by Jerome McCarthy (1960) – is used as an essential part of implementing marketing strategy by many practitioners. The 4 Ps have been extended to the 7 Ps by including three further elements that better reflect service delivery: People, Processes and Physical evidence (Booms and Bitner, 1981), although others argue that these are subsumed within the 4 Ps. The marketing mix is applied frequently when developing marketing strategies since it provides a simple framework for varying different elements of the product offering to influence the demand for products within target markets. For example, to increase sales of a product the price can be decreased or the amount or type of promotion changed, or there can be some combination of these elements. E-commerce provides new opportunities for the marketer to vary the marketing mix, so it is worthwhile outlining these. However, it should be noted that many marketers now consider it as only one tool for developing tactics and other approaches such as branding (see Focus on online branding below) or a customer relationship management perspective (Chapter 9 can be used to develop tactics, particularly for marketing communications). One difficulty is that the marketing mix is symptomatic of a push approach to marketing and does not recognize the needs of customers. For this reason it is important that mix be backed up by detailed knowledge of buyer behaviour collected through market research. Furthermore, the mix should be adjusted according to different target markets or segments to better meet the needs of customers.

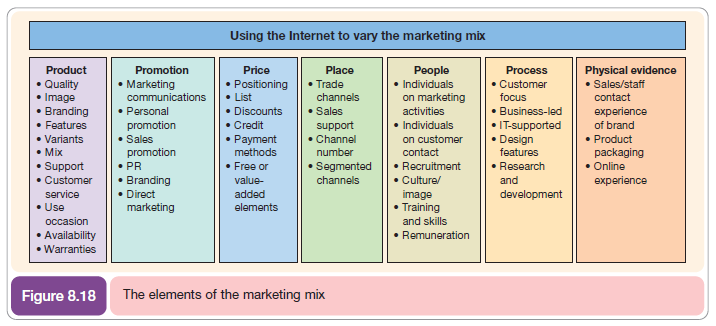

Figure 8.18 summarizes the different sub-elements of the 7 Ps. We will now consider how each element of the marketing mix can be varied or how we ‘mix the mix’ in more detail. You can also refer to Allen and Fjermestad (2001) for a more detailed assessment.

Before embarking on a review of the role of the Internet on each of the 7 Ps, it is worth briefly restating some of the well-known criticisms of applying the marketing mix as a solitary tool for marketing strategy. First, and perhaps most importantly, the marketing mix, because of its origins in the 1960s, is symptomatic of a push approach to marketing and does not explicitly acknowledge the needs of customers. As a consequence, the marketing mix tends to lead to a product rather than a customer orientation – a key concept of market orientation and indeed a key Internet marketing concept. To mitigate this effect, Lautenborn (1990) suggested the 4 Cs framework which considers the 4 Ps from a customer perspective. In an e-commerce context the 4 Cs can be interpreted as follows:

- Customer needs and wants (from the product) – the web site is a mechanism for explaining how the product proposition meets these needs and wants.

- Cost to the customer (price) – online the customer is likely to be comparing prices to other web sites and traditional purchasing sources.

- Convenience (relative to place) – online this is the quality of customer experience in terms of the ordering process and fulfilment.

- Communication (promotion) – the web site itself coupled with the methods of driving traffic to the site, such as search-engine marketing and e-mail marketing as described in Chapter 9.

It follows that the selection of the marketing mix is based on detailed knowledge of buyer behaviour collected through market research. Furthermore, it should be remembered that the mix is often adjusted according to different target markets or segments to better meet the needs of these customer groupings. An increased focus on ‘one-to-one marketing’ which means tailoring of the offer for specific customers also sits uncomfortably within the 7 Ps framework.

1. Product

There are many alternatives for varying the Product when a company is developing its online strategy. Internet-related product decisions can be usefully divided into decisions affecting the core product and the extended product. For some companies, there may be options for new digital products which will typically be information products that can be delivered over the web. In some cases, the core product offering has been replaced by information about the product. For example, a company providing oil-drilling equipment focusing instead on analysis and dissemination of information about drilling. In some cases, an online version of the product may be more valuable to customers in that it can be updated more regularly. The advertising directory BRAD (www.brad.co.uk) has been changed from a large paper-based document to an online version with searching facilities that were not available in the paper-based version. The Internet also introduces options for mass customization of products. Levi’s provided a truly personal service that dates back to 1994, when Levi Strauss initiated its ‘Personal Pair’ programme. Women who were prepared to pay up to $15 more than the standard price and wait for delivery could go to Levi’s stores and have themselves digitized – that is, have their measurements taken and a pair of custom jeans made and then have their measurements stored on a database for future purchases.

Companies can also consider how the Internet can be used to change the range or combination of products offered. Some companies only offer a subset of products online – for example, WH Smith interactive TV service only offered bestsellers at a discount. Alternatively, a company may have a fuller catalogue available online than is available through offline brochures. Bundling is a further alternative. For example, easyJet has developed a range of complementary travel-related services including flights, packages and car hire.

For many companies, using the Internet to vary the extended product is most practical. Chaffey and Smith (2008) suggest these examples of how the Internet can be used to vary the extended product:

- Endorsements

- Awards

- Testimonies

- Customer lists

- Customer comments

- Warranties

- Guarantees

- Money-back offers

- Customer service (see People, Process and Physical evidence)

- Incorporating tools to help users during their use of the product. A good example of this is the Citroen Exceed software which Citroen provides to fleet car managers. Options for digital products.

Companies such as publishers, TV companies and other media owners who can offer digital products such as published content, music or videos now have great flexibility to offer a range of product purchase options at different price points including:

- Subscription. This is a traditional publisher revenue model, but subscription can potentially be offered for different periods at different price points, e.g. 3 months, 12 months or 2 years.

- Pay-per-view. A fee for a single download or viewing session at a higher relative price than the subscription service. Music service Napster offers vouchers for download in a similar way to a mobile company ‘pay as you go’ model. Travel publisher Lonely Planet enables visitors to a destination to download an introduction for a fraction of the price of a full printed guide. Technology publisher O’Reilly now offers ‘Digital Shorts’ which are concise guides about a particular product.

- Bundling. Different channels or content can be offered as individual products or grouped at a reduced price compared to pay per view.

- Ad-supported content. There is no direct price set here; instead, the publisher’s main revenue source is through adverts on the site (CPM display advertising on site using banners ads and skyscrapers, a fixed sponsorship arrangement or CPC which stands for ‘cost per click’ more typical when using search ad network publishing such as Google Adsense (google.com/adsense.com) which accounts for around a third of Google’s revenue). Other options include affiliate revenue from sales on third-party sites or offering access to subscriber lists. The UK’s most popular newspaper site, The Guardian (www.guardian.co.uk) once trialled an ad free subscription service, but it, like many online publishers, has reverted to ad-supported content.

Also related to the product element of the mix is how the Internet can be used to assist in new product development by assessing product needs from web-site logs (Chapter 12), testing new concepts, online surveys and focus groups.

Quelch and Klein (1996) also noted that the implication of the Internet and globalization is that to remain competitive, organizations will have to roll out new products more rapidly to international markets. More recently, Malcolm Gladwell in his book The Tipping Point (2000) has shown how word-of-mouth communication has a tremendous impact on the rate of adoption of new products and we can suggest this effect is often enhanced or facilitated through the Internet.

2. Price

The Price element of the marketing mix refers to an organization’s pricing policies which are used to define pricing models and, of course, to set prices for products and services. The Internet has dramatic implications for pricing in many sectors and there is a lot of literature in this area. Baker et al. (2001) and more recently Xing et al. (2006) have noted two approaches that have been commonly adopted for pricing on the Internet. Start-up companies have tended to use low prices to gain a customer base, while many existing companies have transferred their existing prices to the web. However, Case Study 8.1 showed how easy- Jet discounted online prices in an effort to meet its objectives of online revenue contribution. In this case, price reduction was possible because of the lower overhead of processing a customer transaction online in comparison with on the phone. Similarly, to acquire customers online booksellers may decide to offer a discount of 50 per cent on the top 25 best-selling books in each category, for which no profit is made, but offer a relatively small discount on the less popular books of the long tail to give a profit margin.

The main implications of the Internet for the Price aspect of the mix are as follows.

2.1. Increased price transparency and its implications on differential pricing

Quelch and Klein (1996) describe two contradictory effects of the Internet on price that are related to price transparency. First, a supplier can use the technology for differential pricing, for example customers in different countries. However, if precautions are not taken about price, the customers maybe able to quickly find out about the price discrimination and they

will object to it. So, customer knowledge of pricing is enhanced through the Internet. This is particularly the case for standardized goods sold through online retailers. Not only can customers visit sites of rival suppliers, they can visit sites of price-comparison engines provided by intermediaries such as Kelkoo (www.kelkoo.com), or Pricerunner (www.pricerunner.com). These sites will list the best price from suppliers for a particular product ranked from highest to lowest. It is difficult to retain price differentials if all customers are aware of these differences. Currently, this is probably not the case. However, research quoted by Baker et al. (2001) suggests that only around 8% of active online consumers are ‘aggressive price shoppers’. Furthermore, they note that Internet price brands have remained quite broad. Online booksellers’ prices varied by an average of 33% and CD sellers’ by 25%.

There appear to be two main reasons for this: first, pricing is only one variable – consumers also decide on suppliers according to other aspects about the brand such as familiarity, trust and perceived service levels. Secondly, consumers often display satisficing behaviour. The term ‘satisfice’ was coined by Herbert Simon in 1957 when he said that people are only ‘rational enough’ and that they suspend or relax their rationality if they feel it is no longer required. This is called ‘bounded rationality’ by cognitive psychologists. In other words, although consumers may seek to minimize some variable (such as price) when making a product or supplier selection, most may not try too hard. Online, this is supported by research by Johnson et al. (2004) who showed that by analysing panel data from over 10,000 Internet households and three commodity-like products (books, compact discs (CDs) and air travel services) the amount of online search is actually quite limited. On average, households visit only 1.2 book sites, 1.3 CD sites and 1.8 travel sites during a typical active month in each category. Of course, these averages will reflect a range of behaviour.

A compromise approach used by many companies is to use differential pricing with lower prices or Internet offers for some of their products online. This has been the approach followed by online electrical retailers such as Comet (www.comet.co.uk), travel companies such as Thomson (www.thomson.co.uk) and companies with e-savings products.

Pricing online has to take into account the concept of price elasticity of demand. This is a measure of consumer behaviour based on economic theory that indicates the change in demand for a product or service in response to changes in price. Price elasticity of demand is determined by the price of the product, availability of alternative goods from alternative suppliers (which tends to increase online) and consumer income. A product is said to be ‘elastic’ (or responsive to price changes) if a small change in price increases or reduces the demand substantially. A product is ‘inelastic’ if a large change in price is accompanied by a small amount of change in demand.

2.2. Downward pressure on price (including commoditization)

For business commodities, auctions on business-to-business exchanges (e.g. Emiliani, 2001) can also have a similar effect of driving down price. Many companies, such as GlaxoSmithKline (pharmaceuticals), Whitbread (entertainment and leisure) and DaimlerChrysler (automotive) have reported that price has been decreased by 10% or more using reverse auctions (see Case Study 2.1). Purchase of some products that have not traditionally been thought of as commodities, may become more price-sensitive. This process is known as ‘commoditization’. Goods that are becoming commoditized include electrical goods and cars.

2.3. New pricing approaches (including dynamic pricing and auctions)

In addition to the auctions described above, the Internet introduces new opportunities for dynamic pricing, for example new customers could be automatically given discounted purchases for the first three items. Care has to be taken with differential pricing since established customers will be unhappy if significant discounts are given to new customers. Amazon trialled such a discounting scheme in 2000 and it received negative press and had to be withdrawn when people found out that their friends or colleagues had paid less. If the scheme had been a clear introductory promotion this problem may not have arisen.

A further approach is aggregated buying. This approach was promoted by LetsBuyit.com, but the business model did not prove viable – the cost of creating awareness for the brand and explaining the concept was not offset by the revenue from each transaction.

Baye et al. (2007) reported that European electronics online retailer Pixmania (www.pixmania.com) used price experimentation to learn about its customers’ price sensitivity. They noted that for a PDA, Pixmania adjusted its product price 11 times in a 14 week period, from a low of £268 to a high of £283 as part of a series of small experiments that enabled it to learn about the price sensitivities of its customers. This pricing strategy also provides an additional strategic benefit – unpredictability.

Baye et al. (2007) recommend that online retailers should ask the following questions when reviewing pricing online:

- How many competitors are there at a point in time? They suggest a product’s markup should be increased when the number of rivals falls and decreased when the number of rivals increases. They also recommend that since the identity of competitors online will differ from traditional offline rivals it is important to include key online competitors.

- What is the position in the product lifecycle. A product’s markup should be decreased over its lifecycle or when new versions are introduced.

- What is the price sensitivity or elasticity of a product? They suggest continuously experimenting to learn changes in the price sensitivity of a product

- At what level is pricing set? The optimal markup factor should be applied at the product rather than category or firm level based on price testing at the product level. They also note the variation of conversion rates and clickthrough fees from paid search engines and aggregators at the category or product level, which makes it important to have micro-management of pricing.

- Are rivals monitoring my price? Be unpredictable if rivals are watching. Exploit ‘blind spots’ if rivals are not watching.

- Are we stuck in the middle? A middle pricing point is sub-optimal particularly if prices can be set to target the lowest point in the market.

2.4. Alternative pricing structure or policies

Different types of pricing may be possible on the Internet, particularly for digital, downloadable products. Software and music have traditionally been sold for a continuous right to use. The Internet offers new options such as payment per use, rental at a fixed cost per month or a lease arrangement. Bundling options may also be more possible. The use of software-as-a-service (SaaS) (Chapter 3) providers to deliver services such as web-site traffic monitoring also gives new methods of volume pricing. Web analytics companies such as Omniture (www.omniture.com) and Clicktracks (www.ciicktracks.com) charge in price bands based on the number of visitors to the purchaser’s site.

Further pricing options which could be varied online include:

- Basic price

- Discounts

- Add-ons and extra products and services

- Guarantees and warranties

- Refund policies

- Order cancellation terms.

3. Place

Allen and Fjermestad (2001) argue that the Internet has the greatest implications for Place in the marketing mix since the Internet has a global reach. However, due to cost and time of international fulfilment together with issues of trust in the local country and the availability of phone support, most products are still sourced locally. The exception to this is digital products where there is no physical limitation on fulfilment, so for example Apple iTunes has proved successful in offering this service worldwide. The main implications of the Internet for the Place aspect of the mix, which we will review in this section, are:

3.1. Place of purchase

In a B2B context, e-commerce is conducted on the manufacturer’s own site, at an intermediary or is procured on a customer’s site (Chapter 2, p. 67).

3.2. New channel structures

New channel structures such as changes introduced by disintermediation, reintermediation and countermediation referred to in Chapter 2 (pp. 65-6) and Chapter 5 (p. 308).

3.3. Channel conflicts

A significant threat arising from the introduction of an Internet channel is that while disintermediation gives a company the opportunity to sell direct and increase profitability on products, it can also threaten distribution arrangements with existing partners. Such channel conflicts are described by Frazier (1999), and need to be carefully managed. Frazier (1999) identifies some situations when the Internet should only be used as a communications channel.

This is particularly the case where manufacturers offer an exclusive, or highly selective, distribution approach. To take an example, a company manufacturing expensive watches costing thousands of pounds will not in the past have sold direct, but will have used a wholesaler to distribute watches via retailers. If this wholesaler is a major player in watch distribution, then it is powerful, and will react against the watch manufacturer selling direct. The wholesaler may even refuse to act as distributor and may threaten to distribute only a competitor’s watches, which are not available over the Internet. Furthermore, direct sales may damage the product’s brand or change its price positioning.

Further channel conflicts involve other stakeholders including sales representatives and customers. Sales representatives may see the Internet as a direct threat to their livelihood. In some cases such as Avon cosmetics and Encyclopaedia Britannica this has proved to be the case with this sales model being partly or completely replaced by the Internet. For many B2B purchases, sales representatives remain an essential method of reaching the customer to support them in the purchase decision. Here, following training of sales staff, the Internet can be used as a sales support and customer education tool. Customers who do not use the online channels may also respond negatively if lower prices are available to their online counterparts. This is less serious than other types of channel conflict.

To assess channel conflicts it is necessary to consider the different forms of channel the Internet can take. These are:

- a communication channel only,

- a distribution channel to intermediaries,

- a direct sales channel to customers,

- any combination of the above.

To avoid channel conflicts, the appropriate combination of channels must be arrived at. For example, Frazier (1999) notes that using the Internet as a direct sales channel may not be wise when a product’s price varies considerably across global markets. In the watch manufacturer example, it may be best to use the Internet as a communication channel only.

Internet channel strategy will, of course, depend on the existing arrangements for the market. If a geographical market is new and there are no existing agents or distributors, there is unlikely to be channel conflict, in that there is a choice of distribution through the Internet only or appointments of new agents to support Internet sales, or a combination of the two. Often SMEs will attempt to use the Internet to sell products without appointing agents, but this strategy will only be possible for retail products that need limited pre-sales and after-sales support. For higher-value products such as engineering equipment, which will require skilled sales staff to support the sale and after-sales servicing, agents will have to be appointed.

For existing geographical markets in which a company already has a mechanism for distribution in the form of agents and distributors, the situation is more complex, and there is the threat of channel conflict.

3.4. Virtual organizations

The concept of virtual organizations was introduced in Chapter 6. From an e-marketing perspective, the Internet provides new options for forming partnerships to mutually benefit all parties.

Referring to small and medium businesses, Azumah et al. (2005) indicate three levels of development towards what they term an e-organization:

- Half-fusion organizations (minimum use of the Internet and network technologies);

- Fusion organization (committed and intensive use of the Internet and network technologies).

- E-organization (uses technologies as the core of the business for managing the entire business processes, from the point of receiving a customer order, to processing the order and parts, and supplying and delivery).

Place tactics will have to review all the types of opportunities and threats described above and decide which are appropriate. In a B2B context they may vary on a case-by-case basis, for example special links may be set up to sell on a large customer’s own procurement site. Issues in distribution and fulfilment are described in Chapter 6.

4. Promotion

Specification of the Promotion is usually part of a communications strategy. This will include selection of target markets, positioning and integration of different communications tools. The Internet offers a new, additional marketing communications channel to inform customers of the benefits of a product and assist in the buying decision. The main elements of the promotional or communications mix and their online equivalents summarized by Chaffey and Smith (2008) are shown in Table 8.8:

One approach for developing promotion tactics is to specify the communications techniques required for different stages of the buying process (see Online marketing communications, Chapter 9 p. 503). Another approach is to look at how the Internet can supplement the range of promotional activities such as advertising, sales promotions, PR and direct marketing. How these techniques can be used to drive customer traffic to a web site is described in more detail in Focus on marketing communications for customer acquisition (Chapter 9). In Chapter 9 we also look at how customers can be persuaded to return to a site for future purchases.

The Promotion element of the marketing plan also requires three important decisions about investment for the online promotion or the online communications mix:

- Investment in promotion compared to site creation and maintenance. Since there is often a fixed budget for site creation, maintenance and promotion, the e-marketing plan should specify the budget for each to ensure there is a sensible balance and the promotion of the site is not underfunded.

- Investment in online promotion techniques in comparison to offline promotion. A balance must be struck between these techniques. Figure 8.22 summarizes the tactical options that

companies have. Which do you think would be the best option for an established company as compared to a dot-com company? It seems that in both cases, offline promotion investment often exceeds that for online promotion investment. For existing companies traditional media such as print are used to advertise the sites, while print and TV will also be widely used by dot-com companies to drive traffic to their sites.

There will naturally be a variation in spend on online marketing tools depending upon level of adoption of e-commerce by a company and its customers. Factors that will affect the proportion of online media spend in any organization include:

-

- Proportion of customers in a segment that can be reached through traditional or digital media.

- Proportion of customers in target market in researching and purchasing products online.

- Propensity of customers to purchase products using traditional channels such as phone or in-store.

- The relative cost-effectiveness of different online media such as search engine marketing, affiliate marketing and online advertising (see Chapter 9 for explanations) in comparison with traditional media such as TV and print.

There is a delicate balance to be struck between driving visitors to a web site where they may be less likely to convert, but the cost of sale will be lower. With any medium there is a point of diminishing returns where more spend on that medium will not result in improved results. It seems that many companies are following a strategy of gradually increasing their digital spend since they want to find this inflection point without overstepping it too far since traditional media buys such as those for TV and print are a known quantity.

- Investment in different online promotion techniques. For example, how much to pay for banner advertising as against online PR about online presence; how much to pay for search engine registration. These and other traffic building techniques are described in Chapter 9.

As introduced in Chapter 1, Evans and Wurster (1999) have argued that there are three aspects of online promotion that are key to achieving competitive advantage online. These are:

-

- Reach. This is the potential audience of the e-commerce site. Reach can be increased by moving from a single site to representation with a large number of different intermediaries. Allen and Fjermestad (2001) suggest that niche suppliers can readily reach a much wider market due to search-engine marketing.

- Richness. This is the depth or detail of information which is both collected about the customer and provided to the customer. It is related to the Product element of the mix.

- Reach. This refers to whose interest the selling organization represents – consumers or suppliers. This particularly applies to retailers. It suggests that customers will favour retailers who provide them with the richest information on comparing competitive products.

5. People, Process and Physical evidence

People, Process and Physical evidence are particularly important for service delivery. Since service delivery is an important aspect of e-commerce sites this is referred to in the Focus on excelling in e-commerce service quality in Chapter 9; managing organizational change is the focus of Chapter 10; and user-centred design is in Chapter 11. Enhancing service is also an important element of online branding which is described in the next Focus on section. Physical evidence could be applied to site design or the accompanying packaging when products are delivered. Alternatively, these could be interpreted as part of the extended product.

Smith and Chaffey (2001) suggest that online, part of the consideration for the People element of the mix is the consideration of the tactics by which people can be replaced or their work automated. These are some of the options:

- Autoresponders. These automatically generate a response when a company e-mails an organization, or submits an online form.

- E-mail notification. Automatically generated by a company’s systems to update customers on the status of their order, for example, order received, item now in stock, order dispatched.

- Callback facility. Customers fill in their phone number on a form and specify a convenient time to be contacted. Dialling from a representative in the call centre occurs automatically at the appointed time and the company pays, which is popular.

- Frequently asked questions (FAQs). For these, the art is in compiling and categorizing the questions so customers can easily find (a) the question and (b) a helpful answer.

- On-site search engines. These help customers find what they are looking for quickly and are popular when available. Site maps are a related feature.

- Virtual assistants come in varying degrees of sophistication and usually help to guide the customer through a maze of choices

Organizations can test actions needed at each stage for different types of scenario, e.g. enquiry from a new or existing customer, enquiry about the web site or e-mails from different stages in the buying process such as pre-sales, sales or post-sales.

What comprises a successful online brand? Is it an e-commerce site with high levels of traffic? Is it a brand with good name recognition? Is it a profitable brand? Or is it a site with more modest sales levels, but one that customers perceive as providing good service? Although sites meeting only some of these criteria are often described as successful brands, we will see that a successful brand is dependent on a wide range of factors.

Source: Dave Chaffey (2010), E-Business and E-Commerce Management: Strategy, Implementation and Practice, Prentice Hall (4th Edition).

This really answered my downside, thanks!