External growth strategies rely on establishing relationships with third parties. Mergers, acquisitions, strategic alliances, joint ventures, licensing, and franchis- ing are examples of external growth strategies. Each of these strategic options is discussed in the following sections, with the exception of franchising, which we consider separately in Chapter 15.

An emphasis on external growth strategies typically results in a more fast- paced, collaborative approach toward growth than the slower-paced internal strategies, such as new product development and expanding to foreign mar- kets. External growth strategies level the playing field between smaller firms

and larger companies.14 For example, Pixar, the small animation studio that

produced the animated hits Toy Story, Finding Nemo, and Up, had a number of key strategic alliances with Disney, before Disney acquired Pixar in 2006. By partnering with Disney, Pixar effectively co-opted a portion of Disney’s man- agement savvy, technical expertise, and access to distribution channels. The relationship with Disney helped Pixar grow and enhance its ability to effec- tively compete in the marketplace, to the point where it became an attractive acquisition target.

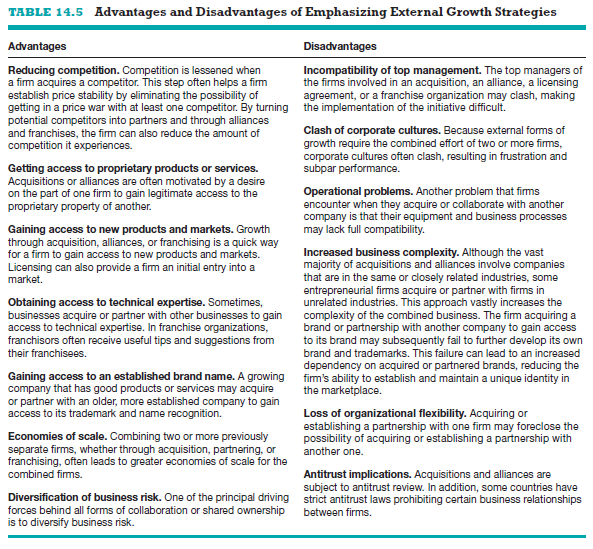

There are distinct advantages and disadvantages to emphasizing external growth strategies, as shown in Table 14.5.

1. Mergers and acquisitions

Many entrepreneurial firms grow through mergers and acquisitions. A merger is the pooling of interests to combine two or more firms into one. An acquisi- tion is the outright purchase of one firm by another. In an acquisition, the surviving firm is called the acquirer, and the firm that is acquired is called the target. This section focuses on acquisitions rather than mergers because entrepreneurial firms are more commonly involved with acquisitions than mergers.

Acquiring another business can fulfill several of a company’s needs, such as expanding its product line, gaining access to distribution channels, achiev- ing economies of scale, gaining access to technology that will enhance its current offerings, or gaining access to talented employees. In most cases, a firm acquires a competitor or a company that has a product line or core com- petence that it needs. For example, in 2012 Facebook acquired Instagram as a way of enhancing its photo sharing capabilities. Similarly, in 2014 Twitter acquired a company called TapCommerce to bolster its capabilities in mobile advertising.

Although it can be advantageous, the decision to grow the entrepreneurial firm through acquisitions should be approached with caution.15 Many firms have found that the process of assimilating another company into their cur- rent operation is not easy and can stretch finances to the brink.

Finding an appropriate acquisition Candidate If a firm decides to grow through acquisition, it is very important for it to exercise extreme care in finding acquisition candidates. Many acquisitions fail not because the compa- nies involved lack resolve, but because they were a poor match to begin with. There are typically two steps involved in finding an appropriate target firm. The first step is to survey the marketplace and make a “short list” of promising candidates. The second is to carefully screen each candidate to determine its suitability for acquisition. The key areas to focus on in accomplishing these two steps are as follows:

■ The target firm’s openness to the idea of being acquired and its ability to receive consent for its acquisition from key third parties. The third parties from whom consent may be required include bankers, investors, suppliers, employees, and key customers.

■ The strength of the target firm’s management team, its industry, and its physical proximity to the acquiring firm’s headquarters.

■ The perceived compatibility of the target company’s top management team and corporate culture with the acquiring firm’s top management team and corporate culture.

■ The target firm’s past and projected financial performance.

■ The likelihood the target firm will retain its key employees and customers if acquired.

■ The identification of any legal complications that might impede the purchase of the target firm and the extent to which patents, trademarks, and copyrights protect the firm’s intellectual property.

■ The extent to which the acquiring firm understands the business and industry of the target firm.

The screening should be as comprehensive as possible to provide the acquiring firm sufficient data to determine realistic offering prices for the firms under con- sideration. A common mistake among acquiring firms is to pay too much for the businesses they purchase. Firms can avoid this mistake by basing their bids on hard data rather than on guesses or intuition.

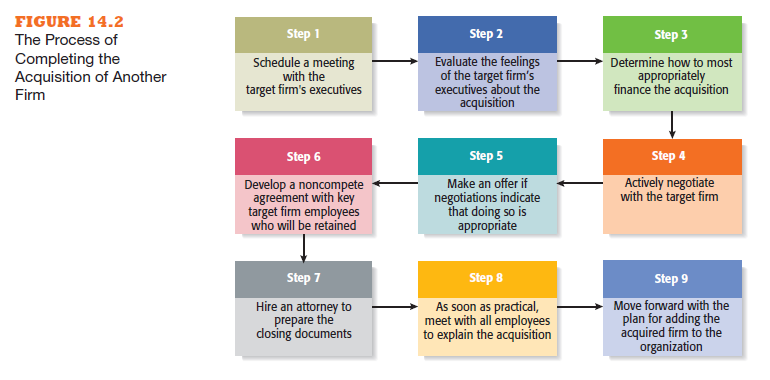

Steps involved in an acquisition Completing an acquisition is a nine-step process, as illustrated in Figure 14.2.

Step 1 Schedule a meeting with the target firm’s executives: The acquir- ing firm should have legal representation at this point to help structure the initial negotiations and help settle any legal issues. The acquiring firm should also have a good idea of what it thinks the acquisition tar- get is worth.

Step 2 Evaluate the feelings of the target firm’s executives about the acquisition: If the target is in a “hurry to sell,” it works to the acquir- ing firm’s advantage. If the target starts to get cold feet, the negotia- tions may become more difficult.

Step 3 Determine how to most appropriately finance the acquisition: The acquiring firm should be financially prepared to complete the transac- tion if the terms are favorable.

Step 4 Actively negotiate with the target firm: If a purchase is imminent, ob- tain all necessary shareholder and third-party consents and approvals.

Step 5 Make an offer if negotiations indicate that doing so is appropriate: Both parties should have the offer reviewed by attorneys and certified public accountants (CPAs) that represent their interests. Determine how payment will be structured.

Step 6 Develop a noncompete agreement with key target firm employees who will be retained: This agreement, as explained in Chapter 7, limits the rights of the key employees of the acquired firm to start the same type of business in the acquiring firm’s trade area for a specific amount of time.

Step 7 Hire an attorney to prepare the closing documents: Complete the transaction.

Step 8 As soon as practical, meet with all employees to explain the acqui- sition: A meeting should be held as soon as possible with the employ- ees of both the acquiring firm and the target firm. Articulate a vision for the combined firm and ease employee anxiety where possible.

Step 9 Move forward with the plan for adding the acquired firm to the organization: In some cases, the acquired firm is immediately as- similated into the operations of the acquiring firm. In other cases, the acquired firm is allowed to operate in a relatively autonomous manner.

Along with acquiring other firms to accelerate their growth, entrepreneurial firms are often the targets of larger firms that are looking to enter a new mar- ket or acquire proprietary technology. Selling to a large firm is often the goal of an investor-backed company, as a way of creating a liquidity event to allow investors to monetize their investment. Some entrepreneurs allow their com- panies to be bought by larger firms as a way of accelerating their growth. For example, in 2008 Honest Tea sold a large stake of itself to Coca-Cola, primarily as a means of integrating itself into Coke’s worldwide distribution channels. Coke is now providing Honest Tea access to markets it could have never pen- etrated on its own.

2. Licensing

Licensing is the granting of permission by one company to another company to use a specific form of its intellectual property under clearly defined condi- tions. Virtually any intellectual property a company owns that is protected by a patent, trademark, or copyright can be licensed to a third party. Licensing also works well for firms that create novel products but do not have the resources to build manufacturing capabilities or distribution networks, which other firms may already have in place.

Entrepreneurial firms can also benefit by licensing technology from larger companies. For example Mint.com, the subject of Case 14.2, licenses technol- ogy from Yodlee, a larger firm. Yodlee’s technology enables Mint.com to access its members’ account information, such as credit card balances and payment due dates. A firm named Wesabe, the subject of the “What Went Wrong?” fea- ture in Chapter 13, tried to build a personal financial management website similar to Mint.com and decided to build its own capabilities for scraping bank websites rather than license the technology from Yodlee. Marc Hedlund, one of Wesabe’s co-founders, identified this decision as one of the reasons Wesabe failed.

The terms of a license are spelled out through a licensing agreement, which is a formal contract between a licensor and a licensee. The licensor is the company that owns the intellectual property; the licensee is the company purchasing the right to use it. A license can be exclusive, nonexclusive, for a specific purpose, and for a specific geographic area.16 In almost all cases, the licensee pays the licensor an initial payment plus an ongoing royalty for the right to use the intellectual property. There is no set formula for determining the amount of the initial payment or the royalties—these are issues that are part of the process of negotiating a licensing agreement.17 Entrepreneurial firms often press for a relatively large initial payment as a way of generating immediate cash to fund their operations.

There are two principal types of licensing: technology licensing and merchan- dise and character licensing.

Technology licensing Technology licensing is the licensing of pro- prietary technology that the licensor typically controls by virtue of a utility patent.18 This type of licensing agreement commonly involves one of two sce- narios. First, firms develop technologies to enhance their own products and then find noncompetitors to license the technology to spread out the costs and risks involved. Second, companies that are tightly focused on developing new products pass on their new products through licensing agreements to compa- nies that are more marketing oriented and that have the resources to bring the products to market.

Striking a licensing agreement with a large firm can involve tough negotia- tions. An entrepreneur should carefully investigate potential licensees to make sure they have a track record of paying licensing fees on time and are easy to work with. To obtain this information, it is appropriate to ask a potential licensee for references. It is also important that an entrepreneur not give away too much in regard to the nature of the proprietary technology in an initial meeting with a potential licensee. This challenge means finding the right balance of piquing a potential licensee’s interest without revealing too much. Nondisclosure agree- ments, described in Chapter 7, should be used in discussing proprietary tech- nologies with a potential licensee.

Merchandise and Character licensing Merchandise and character licensing is the licensing of a recognized trademark or brand that the licensor typically controls through a registered trademark or copyright. For example, Harley-Davidson licenses its trademark to multiple companies that place the Harley trademark on T -shirts, jackets, collectibles, gift items, jewelry, watches, bike accessories, and so on. By doing this, Harley not only generates licensing income but also promotes the sale of Harley-Davidson motorcycles. Similarly, entrepreneurial firms such as eBay and Starbucks license their trademarks not only to earn licensing income, but also to promote their products or services to a host of current and potential customers.

The key to merchandise and character licensing is to resist the temptation to license a trademark too widely and to restrict licensing to product categories that have relevance and that appeal to a company’s customers. If a company licenses its trademark too broadly, it can lose control of the quality of the products with which its trademark is identified. This outcome can diminish the strength of a company’s brand. For example, a company such as ModCloth, which is a U.S. based online retailer specializing in vintage and vintage-inspired clothing, acces- sories, and décor, might license its trademark to a watch manufacturer that is interested in producing a line of ModCloth women’s watches. ModCloth would want to make sure that the watches bearing its trademark were fashionable, were of similar quality to its clothing and other products, and were appealing to its clientele. ModCloth can enforce these standards through the terms of its licensing agreements.

3. Strategic alliances and Joint ventures

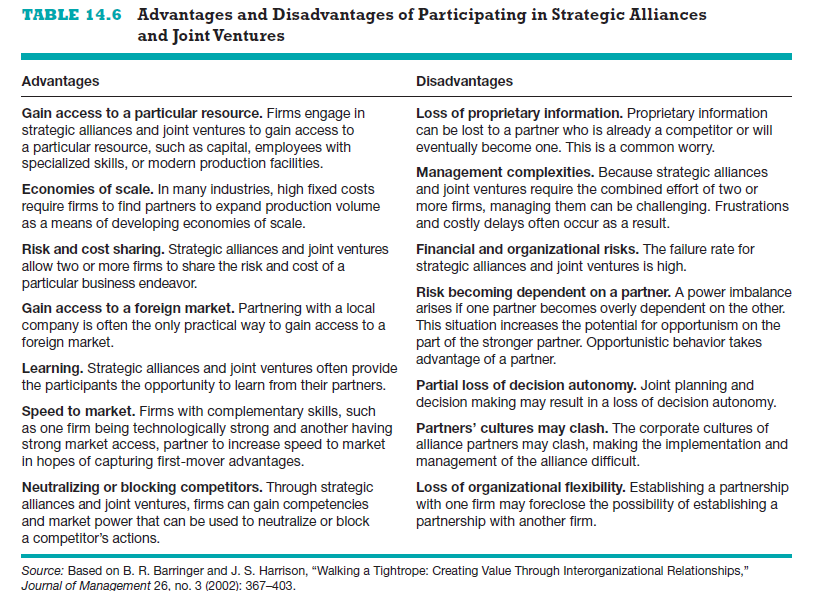

The increase in the popularity of strategic alliances and joint ventures has been driven largely by a growing awareness that firms can’t “go it alone” and suc- ceed.19 As with all forms of firm growth, strategic alliances and joint ventures have advantages and disadvantages. We present these points in Table 14.6.

Strategic alliances A strategic alliance is a partnership between two or more firms that is developed to achieve a specific goal. Various studies show that participation in alliances can boost a firm’s rate of patenting,20 product innovation,21 and foreign sales.22 Alliances tend to be informal and do not involve the creation of a new entity (such as in a joint venture). Although en- gaging in alliances can be tremendously helpful for an entrepreneurial firm, setting up an alliance and making it work can be tricky. This dimension of alli- ances is highlighted in this chapter’s “Partnering for Success” feature.

Technological alliances and marketing alliances are two of the most com- mon forms of alliances.23 Technological alliances feature cooperation in research and development, engineering, and manufacturing. Research-and- development alliances often bring together entrepreneurial firms with specific technical skills and larger, more mature firms with experience in development and marketing. By pooling their complementary assets, these firms can typically produce a product and bring it to market faster and cheaper than either firm could alone.24 Pfizer’s blockbuster drug Celebrex, for example, was created via a technological alliance. Celebrex is a prescription arthritis medicine. Marketing alliances typically match a company that has a distribution system with a com- pany that has a product to sell in order to increase sales of a product or service. For example, an American food company may initiate an alliance with Nestlé (a Swiss food company) to gain access to Nestlé’s distribution channels in Europe. The strategic logic of this type of alliance for both partners is simple. By finding more outlets for its products, the partner that is supplying the product can in- crease economies of scale and reduce per-unit cost. The partner that supplies the distribution channel benefits by adding products to its product line, increas- ing its attractiveness to those wanting to purchase a wide array of products from a single supplier.

Both technological and marketing alliances allow firms to focus on their specific area of expertise and partner with others to fill their expertise gaps. This approach is particularly attractive to entrepreneurial firms, which often lack the financial resources or time to develop all the competencies they need to bring final products to market quickly. Michael Dell describes the early years of Dell Inc.:

As a small start-up, we didn’t have the money to build the components [used to make up a PC] ourselves. But we also asked, “Why should we want to?” Unlike many of our competitors, we actually had an option: to buy components from the specialists, leveraging the investments they had already made and allowing us to focus on what we did best—designing and delivering solutions and systems directly to customers. In forging these early alliances with suppliers, we created exactly the right strategy for a fast-growing company.25

Joint Ventures A joint venture is an entity created when two or more firms pool a portion of their resources to create a separate, jointly owned organiza- tion.26 An example is Beverage Partners Worldwide, which is a joint venture between Coca-Cola and Nestlé. Formed in 1991, the joint venture markets ready-to-drink chilled teas based on green tea and black tea in more than 50 countries worldwide.

Gaining access to a foreign market is a common reason to form a joint ven- ture.27 In these cases, the joint venture typically consists of the firm trying to reach a foreign market and one or more local partners. Joint ventures created for reasons other than foreign market entry are typically described as either scale or link joint ventures.28 In a scale joint venture, the partners collaborate at a single point in the value chain to gain economies of scale in production or distribution. This type of joint venture can be a good vehicle for developing new products or services. In a link joint venture, the position of the parties is not symmetrical, and the objectives of the partners may diverge. For example, many of the joint ventures between American and Canadian food companies provide the American partner with access to Canadian markets and distribution chan- nels and the Canadian partner with the opportunity to add to its product line.

A hybrid form of joint venture that some larger firms utilize is to take small equity stakes in promising young companies. In these instances, the large companies act in the role of corporate venture capitalists, as explained in Chapter 10. Google established a venture capital program in 2009, named Google Ventures. Investing in private companies, this program seeks to help start-up ventures grow from their initial stages to a point of either issuing an initial public offering or being acquired. Notable investments include Nest Labs, Rocker Lawyer, HomeAway, Uber, 23andMe, and Namo Media.29 Firms typically make investments of this nature in companies with the potential to be suppliers, customers, or acquisition targets in the future. The equity stake provides the large company a “say” in the development of the smaller firm. On occasion, the larger firm that has a small equity stake will acquire the smaller firm. These transactions are called spin-ins. The opposite of a spin-in is a spin-out, which occurs when a larger company divests itself of one of its smaller divisions and the division becomes an independent company. Hewlett- Packard, for example, spun off its test-and-measurement equipment division as Agilent Technologies, which advertises itself as the “world’s premiere mea- surement company.”

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

This website is my inspiration , very excellent design and style and perfect content material.