1. The importance of getting Financing or Funding

Few people deal with the process of raising investment capital until they need to raise capital for their own firm. As a result, many entrepreneurs go about the task of raising capital haphazardly, because they lack experience in this area and because they don’t know much about their choices.1 This shortfall may cause a business owner to place too much reliance on some sources of capital and not enough on others.2 Entrepreneurs need to have as full an understanding as possible of the alternatives that are available in regard to raising money. And raising money is a balancing act. Although a venture may need to raise money to survive, its founders usually don’t want to deal with people who don’t understand or care about their long-term goals.

The need to raise money surprises a number of entrepreneurs, in that many of them launch their firms with the intention of funding all their needs internally. Commonly, though, entrepreneurs discover that operating without investment capital or borrowed money is more difficult than they anticipated. Because of this, it is important for entrepreneurs to understand the role of in- vestment capital in the survival and subsequent success of a new firm.

2. Why Most new ventures need Funding

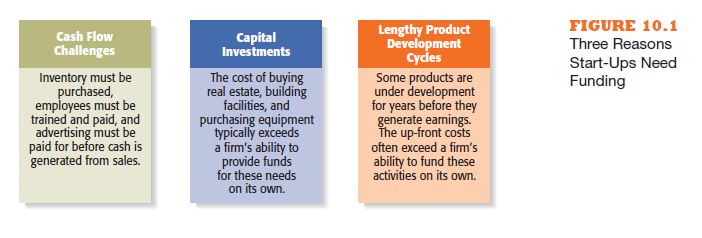

There are three reasons that most entrepreneurial ventures need to raise money during their early life: cash flow challenges, capital investments, and lengthy product development cycles. These reasons are laid out in Figure 10.1. Let’s look at each reason so we can better understand their importance.

2.1. Cash flow challenges

As a firm grows, it requires an increasing amount of cash to operate as the foundation for serving its customers. Often, equipment must be purchased and new employees hired and trained before the increased customer base generates additional income. The lag between spending to generate revenue and earning income from the firm’s operations creates cash flow challenges, particularly for new, often small, ventures, as well as for ventures that are growing rapidly.

If a firm operates in the red, its negative real-time cash flow, usually com- puted monthly, is called its burn rate. A company’s burn rate is the rate at which it is spending its capital until it reaches profitability. Although a nega- tive cash flow is sometimes justified early in a firm’s life—to build plants and buy equipment, train employees, and establish its brand—it can cause severe complications. A firm usually fails if it burns through all its capital before it becomes profitable. This is why inadequate financial resources is a primary reason new firms fail.3 A firm can simply run out of money even if it has good products and satisfied customers.

To prevent their firms from running out of money, most entrepreneurs need investment capital or a line of credit from a bank to cover cash flow short- falls until their firms can begin making money. It is usually difficult for a new firm to get a line of credit from a bank (for reasons discussed later). Because of this, new ventures often look for investment capital, bootstrap their opera- tions, or try to arrange some type of creative financing.

2.2. Capital investments

Firms often need to raise money early on to fund capital investments. Although it may be possible for the venture’s founders to fund its initial activities, it becomes increasingly difficult for them to do so when it comes to buying property, con- structing buildings, purchasing equipment, or investing in other capital projects. Many entrepreneurial ventures are able to delay or avoid these types of expendi- tures by leasing space or co-opting the resources of alliance partners. However, at some point in its growth cycle, the firm’s needs may become specialized enough that it makes sense to purchase capital assets rather than rent or lease them.

2.3. Lengthy product Development cycles

In some industries, firms need to raise money to pay the up-front costs of lengthy product development cycles. For example, it typically takes between one and a half and two years to develop an electronic game. In the biotech industry, the path to commercial licensing takes approximately eight years.4

This tortoise-like pace of product development requires substantial up-front investment before the anticipated payoff is realized. While the biotech industry is an extreme example, lengthy product development cycles are the realities ventures face in many industries.

To meet these challenges, and others described in the chapter and throughout the book, many entrepreneurs like to partner with others to launch their ventures. A fertile place for young entrepreneurs to find potential busi- ness partners is to attend a Startup Weekend. A description of what Startup Weekend is and why it represents a fertile place to find a business partner is describe in the “Partnering for Success” feature nearby.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

7 May 2021

7 May 2021

6 May 2021

7 May 2021

6 May 2021

6 May 2021