As the foreign business develops successfully, the firm may consider enlarging its engagement in its target markets abroad through foreign direct investments (FDI), which has several forms (Rugman & Hodgetts 2003: 41). The establishment of a sales branch represents the lowest form of financial involvement in the category of foreign direct investment. The institutional character of an FDI is mirrored by constant interaction and personal contact with actors in the host country in the course of day-to-day business activities. Aside from necessary resource transfers, such as financial, the issue of staff mobility and corresponding expatriate training arises in this context. The extent to which local and expatriate personnel are employed in the host country depends on the target market business volume, the size of the facilities, and the degree to which the foreign branches are embedded in a sales and distribution network (Duelfer & Joestingmeier 2011).

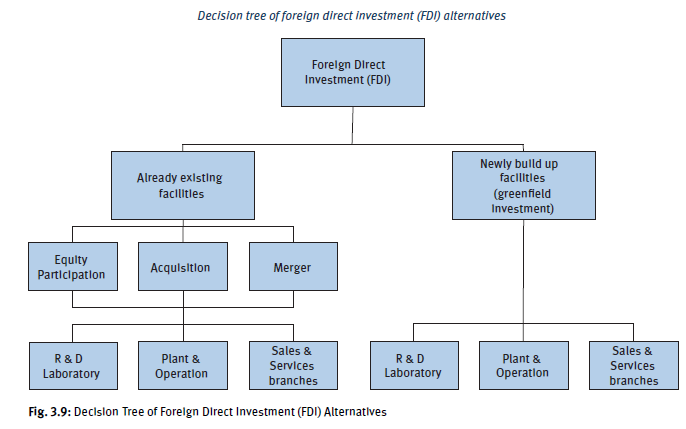

A firm investing abroad combines firm-specific advantages developed at home with other assets available in the foreign country (Jean-Francois Hennart & Park 1993). The term wholly owned subsidiary describes an enterprise that owns all of the capital invested abroad, such as, for example, research and development, sales, and/or manufacturing facilities. The firm either sets up an entirely new operation (start-up or greenfield) or it acquires partial share (equity participation) or completely takes over an established firm in the target foreign country (Hitt et al. 2015). The firm’s resource availability and the firm-specific objectives determine whether the market entry will be either through firm-specific resources or external, through acquisitions. Firm-specific resources may consist of superior organizational ability, market knowledge, or technological expertise. Acquisitions come along with the advantage that the firm can combine its own resource advantages with those of an acquired foreign firm. The firm can acquire technological knowledge, foreign market knowledge, and a skilled labor force. A valuable brand reputation can be obtained, which might have taken years to build up; and, thus, immediate pressure from competition may be substantially reduced (Penrose 1995).

There are two different types of acquisitions: An international horizontal acquisition is made in order to realize the firm’s growth strategy through expanding in foreign markets. A firm acquires another organization positioned in the same location of the industry chain abroad. Horizontal acquisitions provide prerequisites to increase the overall market share of the firm and usually provide potential for cost reduction because of larger operational capacities resulting in economies of scale effects. In the case of an international vertical acquisition, a firm either acquires a foreign supplier (backward integration) or a distributor (forward integration) in the target market abroad (Hitt et al. 2015). The new external knowledge from the acquired firm needs to be integrated and combined with the existing internal knowledge. By assimilating the acquisition partner’s knowledge and best practices, acquiring firms can enlarge their knowledge base, which helps a firm to adapt itself to the foreign market environment. The absorptive capacity of the acquiring firm influences the performance and effectiveness of its business operations in the foreign market (Zou & Ghauri 2008).

Nevertheless, in spite of all the advantages, an acquisition is by no means a universally available strategy for international market entry, nor does it allow a firm automatically to escape from limited resources. More autonomy for the acquired business organization may provoke the risk of conflicts with the acquiring company’s policies and activities and result in increased difficulties of working out an appropriate subsidiary- headquarters relationship. In consequence, there is a limit to the rate of expansion by acquisitions because consistent general policies have to be worked out and integrated between the acquired firm and its new headquarters. Operations, marketing, and accounting procedures need to be coordinated; and personnel policies and numerous other challenges need to be managed. For example, talented and highly skilled employees may leave the acquired firm. These challenges may offset the benefits derived from the acquisition of an established operation (Hill 2012). Therefore, financial, managerial, and organizational resource limits on the rate of expansion imply that no company can acquire every likely firm in sight in any given period of time. A firm has to choose carefully; and since mistakes may be costly and not always reparable, those target firms should be selected that seem most likely to complement or supplement existing resources. Acquisition decisions are influenced by the predilections and experience of the management and the expected profitability input of the acquired firm, which depends on the price paid compared with the expected contribution to the earnings of the acquiring firm (Penrose 1995).

An alternative to an acquisition is a greenfield investment, where the firm newly develops and builds up facilities. Necessary resources to start up a new business in the target foreign market have to be make available by the internal efforts of the firm (Brouthers, Brouthers, & Wilson 2001). In contrast to an acquisition, the establishment of a firm through a greenfield investment (foreign start-up) entails building an entirely new organization. Companies often establish start-ups by sending expatriates, who select and hire local employees and gradually build up the business. Through its expatriates, the parent firm can train the new labor force, which makes it possible to better incorporate the company culture compared to with an acquisition, particularly in the case of a hostile takeover (Barkema & Vermeulen 1998). Brouthers and Brouthers (2000) claim that firms that have developed strong capabilities, especially in the areas of technology and international operations, tend to favor greenfield investments instead of acquiring existing facilities.

Another entry mode through an FDI, called a merger, is where two firms amalgamate their resources to form a new company. International mergers typically involve firms of similar size with different national origins. Mergers are sometimes preferred to an acquisition in order to minimize the mental reservations of the national governments that may be involved, depending on the strategic importance to the local economy (Grant 2013). Figure 3.9 provides an overview of FDI alternatives.

The main advantage of market entry through the establishment of a wholly owned subsidiary is hierarchical control over decision making, which is important, for example, regarding quality assurance and the protection of intellectual property rights. Further advantages of FDI derive from the closeness to the market and its customers. This proximity improves the local product development and increases cultural sensitivity in marketing communication. A wholly owned subsidiary can be integrated (and controlled) in the firm’s overall strategy when approaching diverse regional foreign markets (Deresky 2014). Additionally, some nations – for example, central and eastern European countries that joined the European Union in 2004 – support foreign investments with tax benefits and infrastructure developments in the case of greenfield projects. Assuming that quality and production efficiency are equal relative to the home country, the firm may enjoy additional cost savings due to low labor expenses.

Challenges that come up with the establishment of wholly owned subsidiaries arise from the increased planning and coordination complexity of foreign and local operations. The firm may underestimate culturally biased differences reflected in work ethics, quality consciousness of the employees, and loyalty toward the enterprise. Subsidiary operations have to be prepared to accept centrally determined decisions concerning production output, product portfolio, service mission, human resources, and price policy for the incoming and outgoing units (Hill 2012). The wholly owned subsidiary in a foreign country entails, among all market entry concepts, the highest uncertainty and investment risk (Hitt et al. 2015).

Arora and Fosfuri (2000) concluded from their research that managerial learning curve effects influence the choice of the firm’s foreign operations. Prior experience in the host country increases the odds that the project will be carried out through a wholly owned operation rather than through, for example, licensing. Similarly, Barkema et al. (1996) argue that firms entering foreign markets face cultural adjustment costs. The management takes advantage of the learning curve, especially when it chooses the expansion path in such a way that it can exploit previous experience in the same country or other nations with similar cultural characteristics.

Source: Glowik Mario (2020), Market entry strategies: Internationalization theories, concepts and cases, De Gruyter Oldenbourg; 3rd edition.

I am constantly looking online for ideas that can help me. Thx!