Companies often need to cut or raise prices.

1. INITIATING PRICE CUTS

Several circumstances might lead a firm to cut prices. One is excess plant capacity: The firm needs additional business and cannot generate it through increased sales effort, product improvement, or other measures. Companies sometimes initiate price cuts in a drive to dominate the market through lower costs. Either the company starts with lower costs than its competitors, or it initiates price cuts in the hope of gaining market share and lower costs.

Cutting prices to keep customers or beat competitors often encourages customers to demand price concessions, however, and trains salespeople to offer them.81 A price-cutting strategy can lead to other possible traps:

- Low-quality trap. Consumers assume quality is low.

- Fragile-market-share trap. A low price buys market share but not market loyalty. The same customers will shift to any lower-priced firm that comes along.

- Shallow-pockets trap. Higher-priced competitors match the lower prices but have longer staying power because of deeper cash reserves.

- Price-war trap. Competitors respond by lowering their prices even more, triggering a price war.82

Customers often question the motivation behind price changes.83 They may assume the item is about to be replaced by a new model, the item is faulty and is not selling well, the firm is in financial trouble, the price will come down even further, or the quality has been reduced. The firm must monitor these attributions carefully.

2. INITIATING PRICE INCREASES

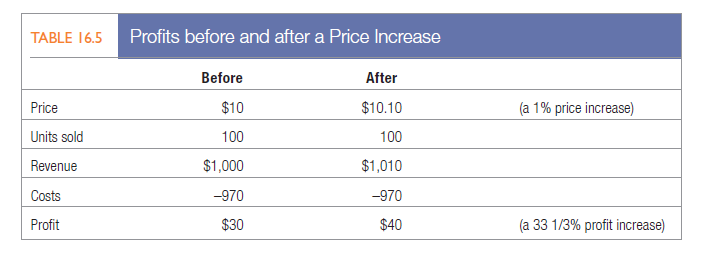

A successful price increase can raise profits considerably. If the company’s profit margin is 3 percent of sales, a 1 percent price increase will increase profits by 33 percent if sales volume is unaffected. This situation is illustrated in Table 16.5. The assumption is that a company charged $10 and sold 100 units and had costs of $970, leaving a profit of $30, or 3 percent on sales. By raising its price by 10 cents (a 1 percent price increase), it boosted its profits by 33 percent, assuming the same sales volume.

A major circumstance provoking price increases is cost inflation. Rising costs unmatched by productivity gains squeeze profit margins and lead companies to regular rounds of price increases. Companies often raise their prices by more than the cost increase, in anticipation of further inflation or government price controls, in a practice called anticipatory pricing.

Another factor leading to price increases is overdemand. When a company cannot supply all its customers, it can raise its prices, ration supplies, or both. It can increase price in the following ways, each of which has a different impact on buyers.

- Delayed quotation pricing. The company does not set a final price until the product is finished or delivered. This pricing is prevalent in industries with long production lead times, such as industrial construction and heavy equipment.

- Escalator clauses. The company requires the customer to pay today’s price plus all or part of any inflation increase that takes place before delivery. Escalator clauses base price increases on some specified price index. They are found in contracts for major industrial projects, such as aircraft construction and bridge building.

- Unbundling. The company maintains its price but removes or prices separately one or more elements that were formerly part of the offer, such as delivery or installation. Car companies sometimes add higher-end audio entertainment systems or GPS navigation systems to their vehicles as separately priced extras.

- Reduction of discounts. The company instructs its sales force not to offer its normal cash and quantity discounts.

Although there is always a chance a price increase can carry some positive meanings to customers—for example, that the item is “hot” and represents an unusually good value—consumers generally dislike higher prices. In passing price increases on to them, the company must avoid looking like a price gouger.84 Coca-Cola’s proposed smart vending machines that would raise prices as temperatures rose and Amazon.com’s dynamic pricing experiment that varied prices by purchase occasion both became front-page news. The more similar the products or offerings from a company, the more likely consumers are to interpret any pricing differences as unfair. Product customization and differentiation and communications that clarify differences are thus critical.85

Several techniques help consumers avoid sticker shock and a hostile reaction when prices rise: One is maintaining their sense of fairness, such as by giving them advance notice so they can do forward buying or shop around. Sharp price increases also need to be explained in understandable terms. Making low-visibility price moves first is also a good technique: Eliminating discounts, increasing minimum order sizes, and curtailing production of low- margin products are examples, and contracts or bids for long-term projects should contain escalator clauses based on such factors as increases in recognized national price indexes.86

3. ANTICIPATING COMPETITIVE RESPONSES

The introduction or change of any price can provoke a response from customers, competitors, distributors, suppliers, and even government. Competitors are most likely to react when the number of firms is few, the product is homogeneous, and buyers are highly informed.

How can a firm anticipate a competitor’s reactions? One way is to assume the competitor reacts in the standard way to a price being set or changed. Another is to assume the competitor treats each price difference or change as a fresh challenge and reacts according to self-interest at the time. Now the company will need to research the competitor’s current financial situation, recent sales, customer loyalty, and corporate objectives. If the competitor has a market share objective, it is likely to match price differences or changes.87 If it has a profit-maximization objective, it may react by increasing its advertising budget or improving product quality.

The problem is complicated because the competitor can put different interpretations on lowered prices or a price cut: that the company is trying to steal the market, that it is doing poorly and trying to boost its sales, or that it wants the whole industry to reduce prices to stimulate total demand. When Walmart began to run ads claiming lower prices than Publix, the regional supermarket chain dropped its prices below Walmart’s on roughly 500 essential items and began its own advertising campaign in retaliation.88

4. RESPONDING TO COMPETITORS’ PRICE CHANGES

How should a firm respond to a competitor’s price cut? It depends on the situation. The company must consider the product’s stage in the life cycle, its importance in the company’s portfolio, the competitor’s intentions and resources, the market’s price and quality sensitivity, the behavior of costs with volume, and the company’s alternative opportunities.

In markets characterized by high product homogeneity, the firm can search for ways to enhance its augmented product. If it cannot find any, it may need to meet the price reduction. If the competitor raises its price in a homogeneous product market, other firms might not match it if the increase will not benefit the industry as a whole. Then the leader will need to roll back the increase.

In nonhomogeneous product markets, a firm has more latitude. It needs to consider the following: (1) Why did the competitor change the price? To steal the market, to utilize excess capacity, to meet changing cost conditions, or to lead an industry-wide price change? (2) Does the competitor plan to make the price change temporary or permanent? (3) What will happen to the company’s market share and profits if it does not respond? Are other companies going to respond? (4) What are the competitors’ and other firms’ likely responses to each possible reaction?

Market leaders often face aggressive price cutting by smaller firms trying to build market share. Using price, Fuji has attacked Kodak, Schick has attacked Gillette, and AMD has attacked Intel. Brand leaders also face lower- priced store brands. Three possible responses to low-cost competitors are: (1) further differentiate the product or service, (2) introduce a low-cost venture, or (3) reinvent as a low-cost player.89 The right strategy depends on the ability of the firm to generate more demand or cut costs.

An extended analysis of alternatives may not always be feasible when the attack occurs. The company may have to react decisively within hours or days, especially where prices change with some frequency and it is important to react quickly, such as in the meatpacking, lumber, or oil industries. It would make better sense to anticipate possible competitors’ price changes and prepare contingent responses.

Source: Kotler Philip T., Keller Kevin Lane (2015), Marketing Management, Pearson; 15th Edition.

I like this weblog very much so much excellent info .